One Plus One Always Equals Two

By Colin Twiggs

February 21, 2008 9:00 p.m. ET (1:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

The Fed

The Fed has cut the fed funds rate by two and a quarter percent

since September 2007 and futures markets are anticipating a

further half percent rate cut at the next FOMC meeting, on

March 18. Financial markets are also being flooded with

liquidity via the Fed's new term auction facility, in order to

avert a decline in bank credit growth — which would

plunge the economy into a recession.

Unfortunately, one plus one always equals two. For every action

taken, expect an equal and opposite reaction in the future.

January consumer price figures already show an up-tick in

measured inflation, with annual headline CPI growth of 4.3% and

core CPI up 2.5%. The Fed is likely to face pressure later this

year to raise rates in order to head off inflation. Financial

markets may not be stable enough to absorb this — risking

high inflation and low growth (commonly referred to as stagflation)

last faced in the 1970s.

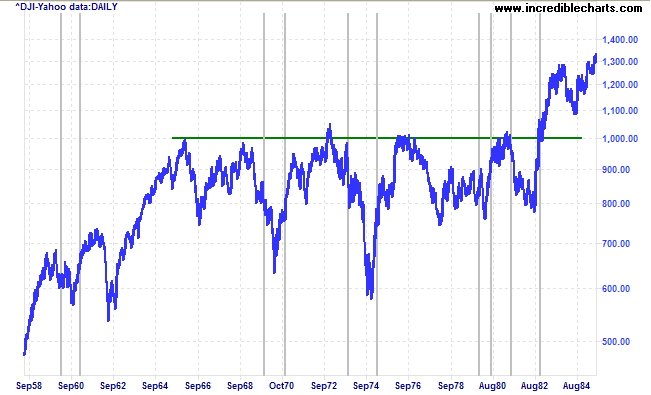

The above chart shows how the Dow Jones Industrial Average failed to advance (above 1000) for 17 years, from 1965 to 1982. Vertical lines mark the start and end date of consecutive recessions. A further recession was recorded in 1966, but later revised by the NBER.

Treasury Yields

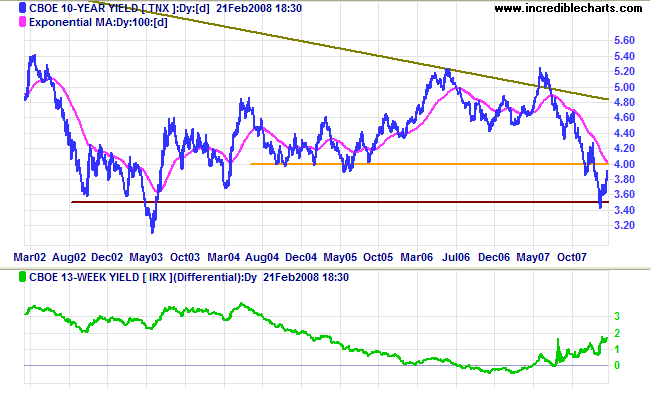

Ten-year treasury yields found support at 3.50 percent and rebounded to test resistance at 4.0%. The rising yield differential is simply a factor of short-term rates falling faster than t-bonds.

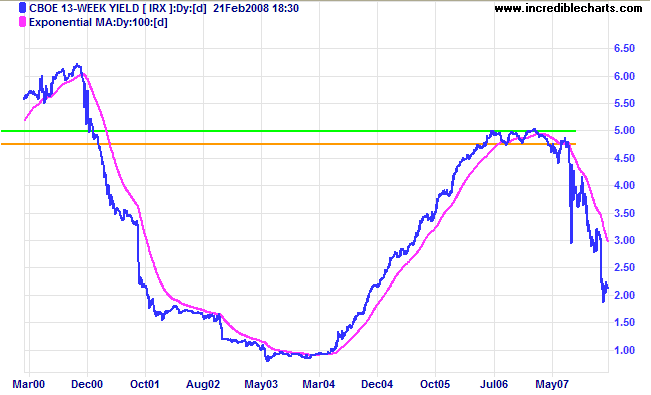

Short-term yields are testing support at 2.0%, but remain in the steep part of the down-trend, well below the 100-day moving average.

Financial Markets

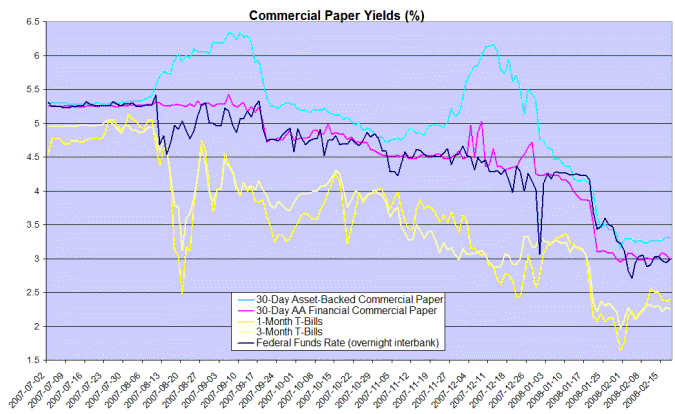

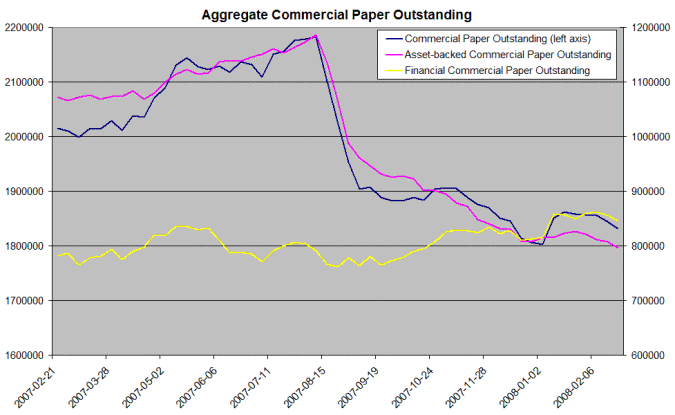

Narrowing of the spread between commercial paper and treasury bill rates indicates the return of some degree of stability to financial markets. Further dips of the fed funds rate below its 3.0% target, however, would increase the likelihood of another rate cut.

Total commercial paper issued is once again shrinking, increasing the pressure on banks to tighten credit.

Commercial Mortgages

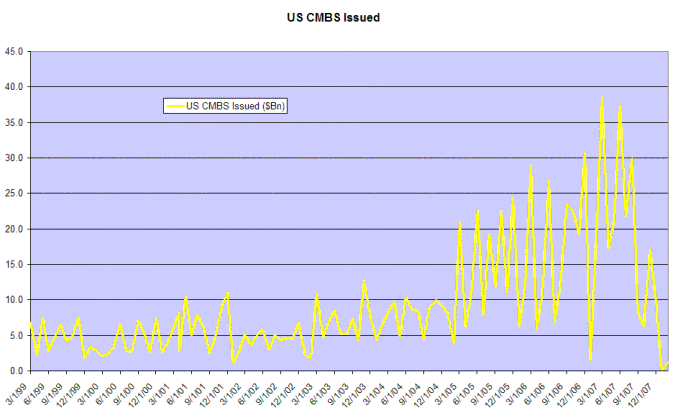

New issues of commercial mortgage-backed securities have dwindled to almost zero, compared $20 to $35 billion per month in 2007.

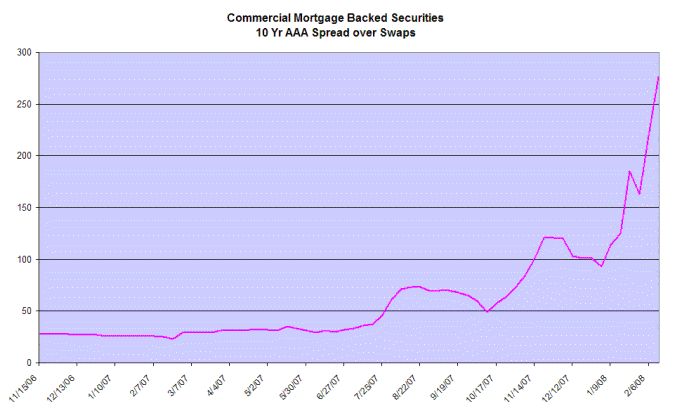

Spreads for Aaa rated (10-year) commercial mortgage-backed securities have also ballooned from as low as 25 points in early 2007 to more than 270 points above the swap rate. Contraction of the commercial property market has the potential to further de-stabilize financial markets.

Bank Credit

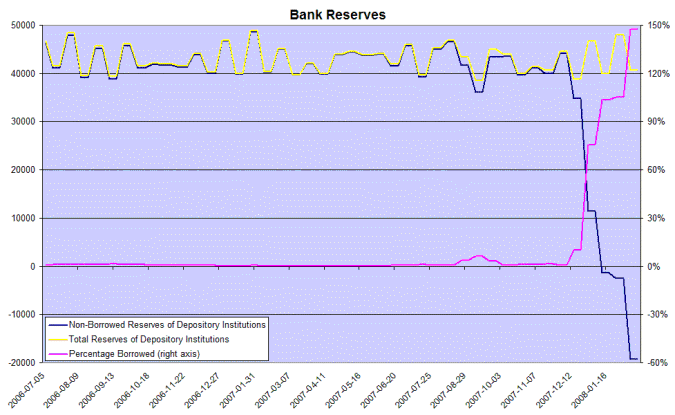

Bank credit growth is being maintained by record levels of borrowings from the Fed, mainly through the recently introduced Term Auction Facility. My data goes back to 1960 and the previously recorded percentage high for borrowed reserves was 32% in 1984.

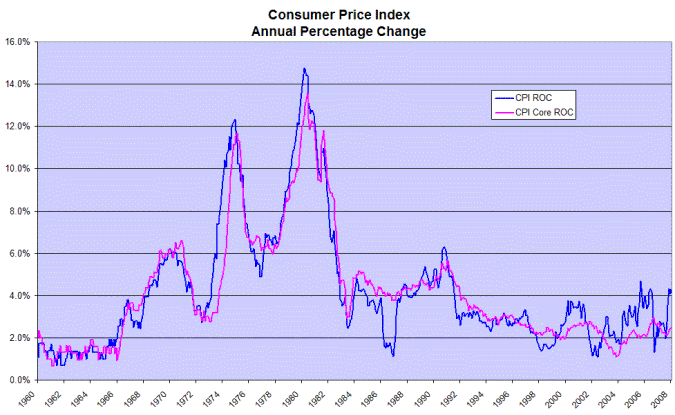

Consumer Price Index

I do not place as much reliance on CPI as the Fed does. There is too much of a lag, between increases in the money supply and the knock-on effect on consumer prices, for it to be an effective monitoring tool. The index also significantly understates the loss of purchasing power of the dollar. Nevertheless, core CPI gives a good indication of future Fed actions.

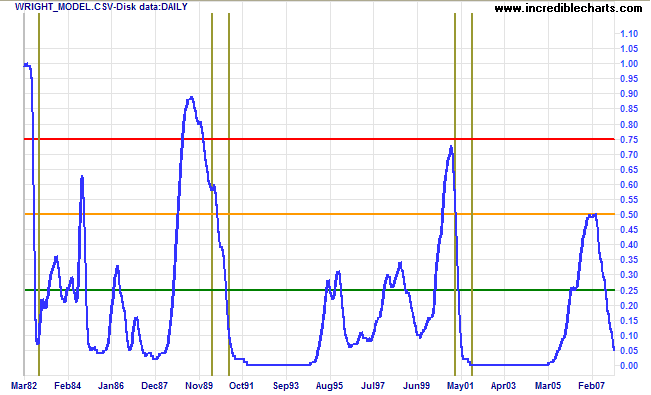

Jonathan Wright's recession prediction model shows probability of a recession (in the next four quarters) fell to 5 per cent. My criticism of the model is that it underestimated the probality of recession at the end of 2006. The recent peak should have been a lot higher — around 70 to 80 percent.

I have never seen more senators express discontent with their

jobs.... I think the major cause is that, deep down in our

hearts, we have been accomplices to doing something terrible

and unforgivable to this wonderful country. Deep down in our

hearts, we know that we have bankrupted America and that we

have given our children a legacy of bankruptcy... We have

defrauded our country to get ourselves elected.

~ John Danforth, Republican senator from Missouri (1992).

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.