Bear Pause

By Colin Twiggs

February 14, 2008 4:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

Bond Insurers

Warren Buffett's offer to bond insurers does not solve the problem facing them: they would still be left with their exposure to sub-prime mortgages. Collapse of a major bond insurer, or even down-grading to junk status, would send shudders through the already besieged financial markets and cannot be contemplated. Expect further intervention (by the Fed/Treasury) in the next few months.

Stock Markets

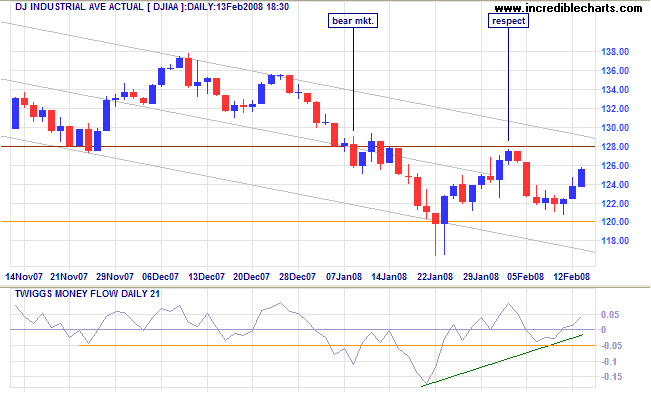

The Dow is headed for another test of resistance at 12800, the former primary support level. I normally consider this to be an ideal entry point for shorts, but first want to see signs of strong selling or a false breakout above the 12800 level. Upward breakout remains a reasonable possibility until then, given the higher low (trough) on the index and Twiggs Money Flow — and would indicate continuation of the market top.

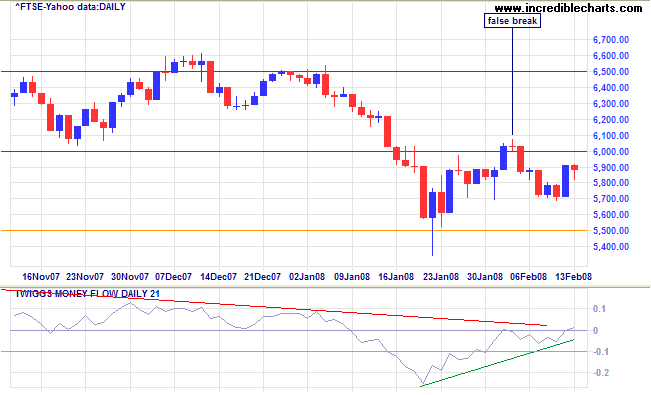

The FTSE 100 shows similar signs of short-term accumulation and is expected to test the former primary support level of 6000.

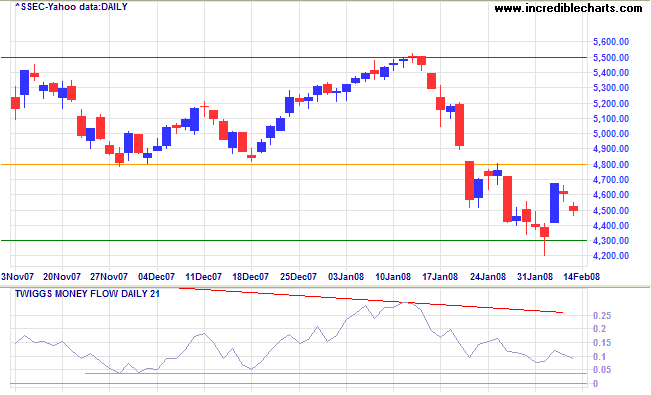

The Shanghai Composite index is weaker, retracing to test support at 4300 after the Chinese New Year holidays.

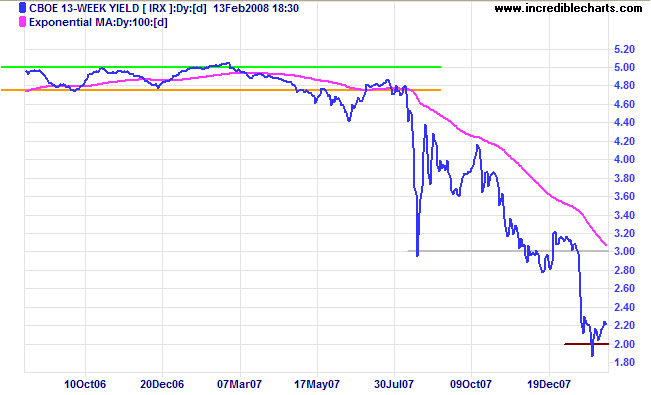

Treasury Yields

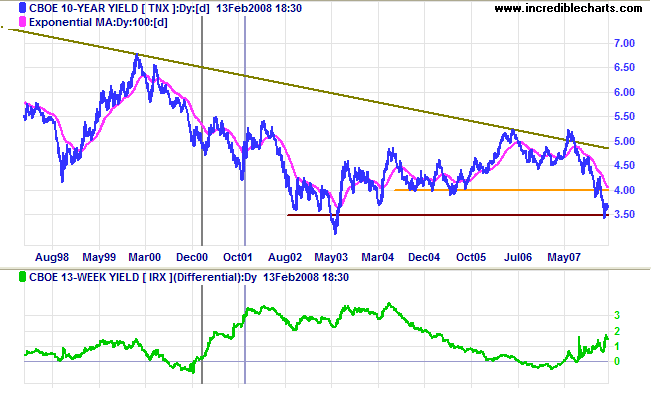

Ten-year treasury yields are testing support at 3.50 percent — last reached when short-term rates were at 40-year lows.

The yield differential continues to rise, as short-term yields test support at 2.0%.

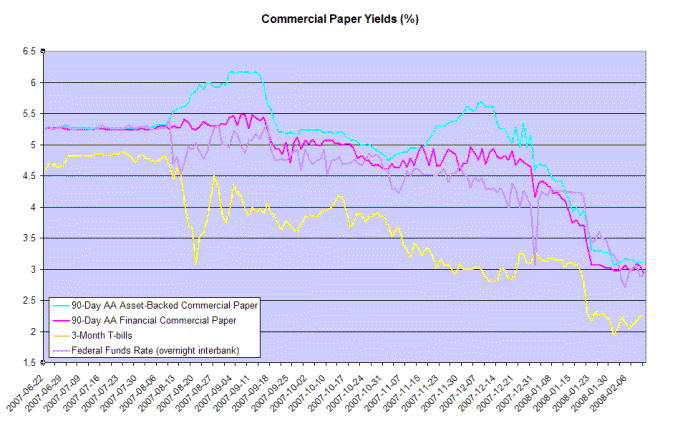

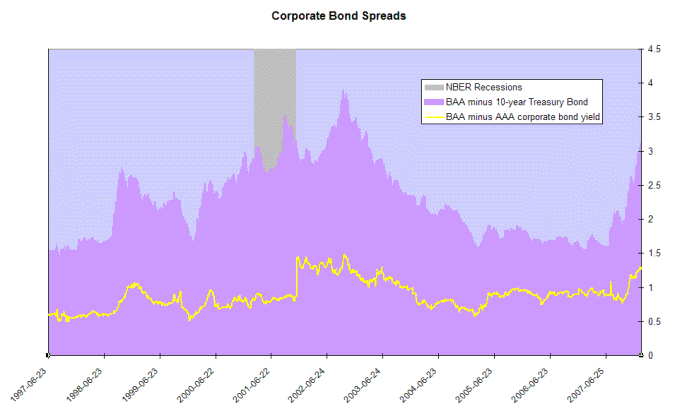

Financial Markets

Commercial paper rates show some semblance of normality, closely shadowing the fed funds rate at 3.0%. The continued wide spread with 3-month treasury bills, however, warns that investors remain wary of financial markets.

Corporate bond spreads, especially Baa minus 10-year treasury yields, are approaching levels last seen during the 2001 recession and illustrate how risk-averse the market has become.

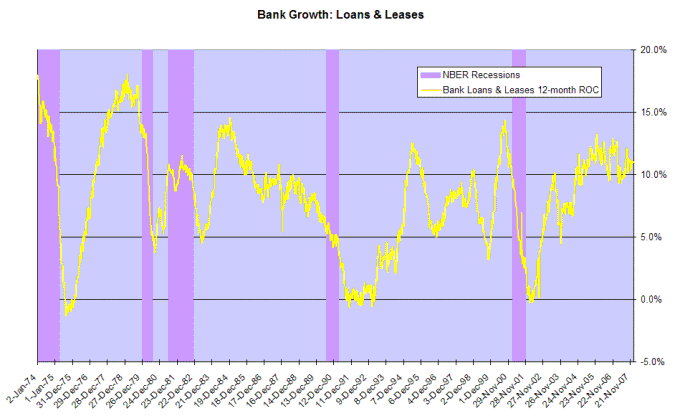

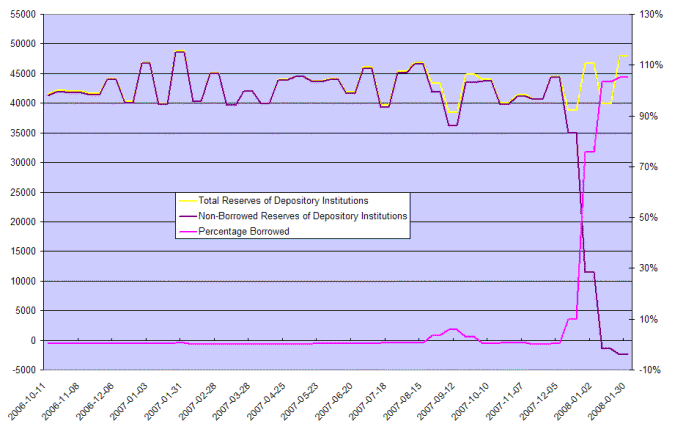

Bank Credit

Declining bank credit would increase the likelihood of a full-blown recession, but so far credit growth is maintaining above 10%.

Credit growth is being maintained by record levels of borrowings from the Fed, mainly through the recently introduced Term Auction Facility. My data goes back to 1960 and the previously recorded high for borrowed reserves was 32% in 1984.

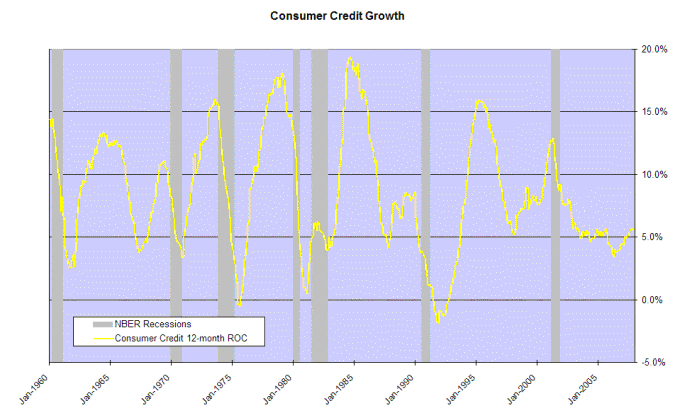

Consumer Credit

A downturn in consumer credit would again warn of a recession, but credit growth is holding fairly steady at 5%.

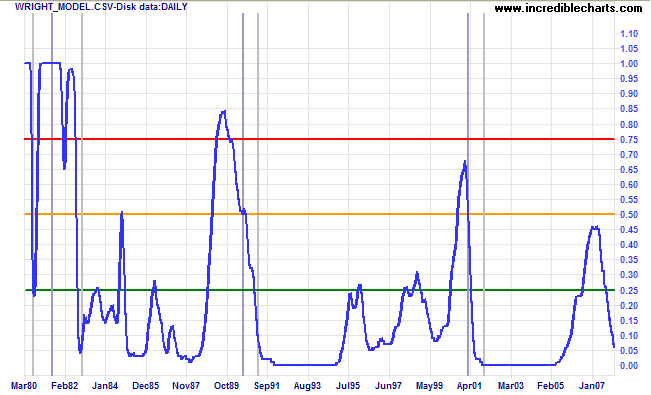

Jonathan Wright's recession prediction model shows probability of a recession (in the next four quarters) at a low 6 per cent. My criticism of the model is that it underestimated the probality of recession at the end of 2006 because of low short-term rates. The recent peak should have been a lot higher — around 70 to 80 percent.

Whosoever controls the volume of money in any country is

absolute master of all industry and commerce... And when you

realise that the entire system is very easily controlled, one

way or another, by a few powerful men at the top, you will not

have to be told how periods of inflation and depression

originate.

~ President James A. Garfield (1881).

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.