Gold & Euro Await Another Cut

By Colin Twiggs

January 29, 2008 10:00 p.m. ET (2:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

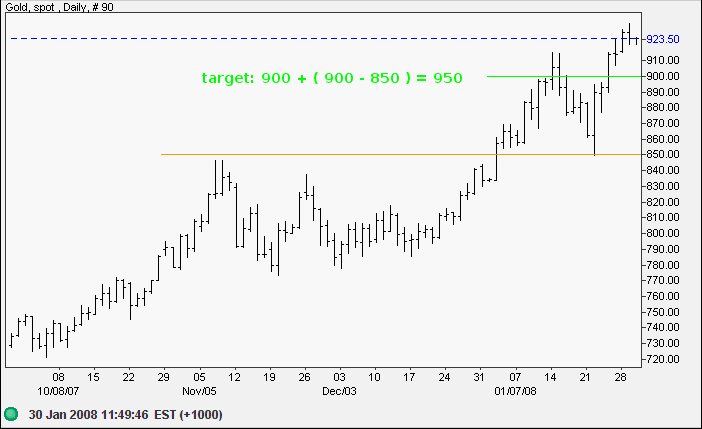

Gold

Gold, the euro, and crude all rallied after the Fed cut the funds rate to 3.5% on January 22. Expect further demand if the January 30/31 FOMC meeting makes additional cuts.

Spot gold rallied off support at $850 and is likely to reach a target of $950. Any (short/medium-term) retracement is likely to find support at $900. Primary support remains at $775 and is unlikely to be tested.

Source: Netdania

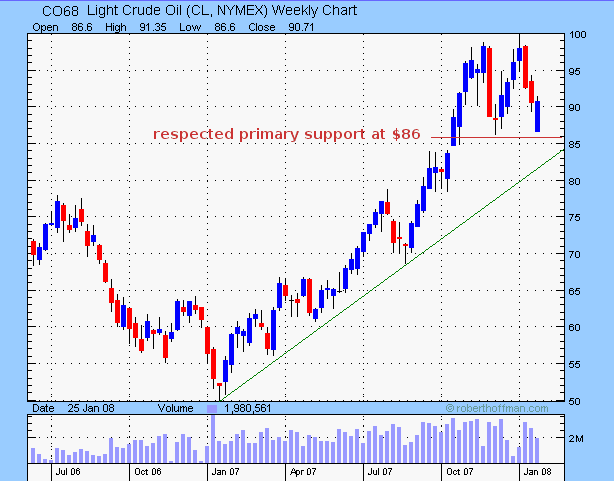

Crude Oil

June 2008 Light Crude responded to the stimulatory measures announced by the Fed and the government, respecting primary support at $86/barrel and advancing towards another test of $100. Failure of support at $86 is not expected — and would warn that crude has started a primary down-trend.

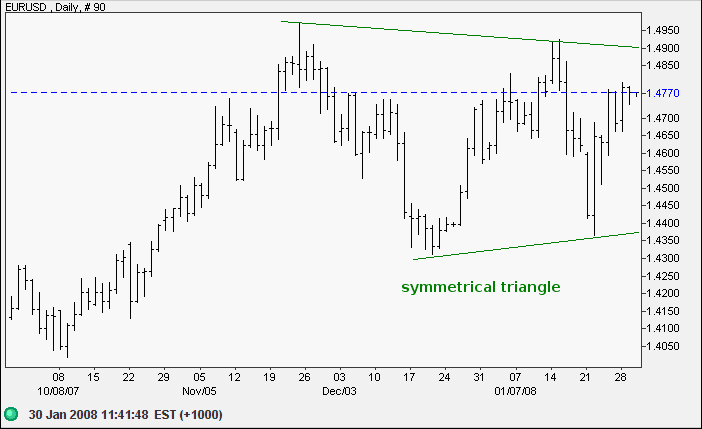

Currencies

The euro is consolidating in a large symmetrical triangle below resistance at $1.50. Downward breakout, below $1.4350, would warn of a primary down-trend; while a rise above $1.49 would mean another test of the key psychogical level of $1.50. In the long term, breakout above $1.50 would offer a target of $1.57, but there may be a few false breaks (feints) ahead of the real breakout.

Source: Netdania

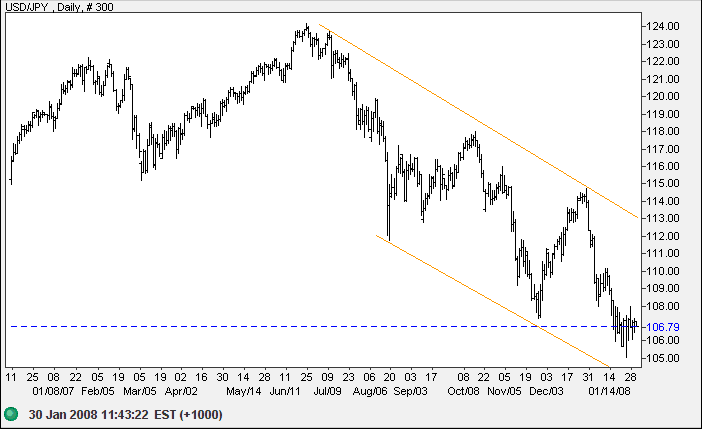

The dollar continues in a downward trend against the yen. Consolidation near the lower border suggests another bear rally; so watch for a rise above 108. The long term target for the down-trend remains at 100.

Source: Netdania

The Australian dollar is struggling with resistance at

$0.8900 against the greenback. We have already seen one false

break, so breakouts are not to be trusted unless confirmed by a

retracement (that respects support at $0.8900). A rate rise by

the RBA would boost demand for the Aussie.

The Australian dollar also successfully tested long-term

support at 90/86 (the intra-day low was 86) against the yen.

Failure of this level would warn of unwinding carry trades and

offer a target of 90 - (107 - 90) = 73.

Source: Netdania

The history of fiat money is little more than a register of

monetary follies and inflations. Our present age merely affords

another entry in this dismal register.

~ Hans F. Sennholz

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.