Hair Of The Dog

By Colin Twiggs

January 24, 2008 8:00 p.m. ET (12:00 a.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

Government Response

The Fed cut the fed funds to 3.5% and the Bush administration announced agreement on an economic stimulus package including tax rebates for individuals and business incentives for investment in new equipment. With Federal Government debt already at $9 trillion they will have to borrow the money. That fixes the underlying problem about as effectively as three fingers of scotch fix a hangover — or mailing your bank manager a check to settle your overdrawn bank account.

Stock Markets

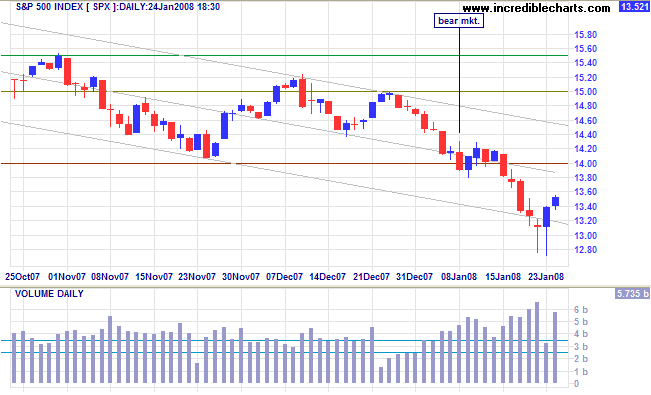

The rally on the S&P 500 and the Dow is typical of a bear market rally: a sharp reaction accompanied by heavy volume. Volume reflects the number of stockholders taking the opportunity to sell down their positions. Be careful of confusing hope with probability: the index is likely to meet resistance at 1400 followed by a sharp reversal.

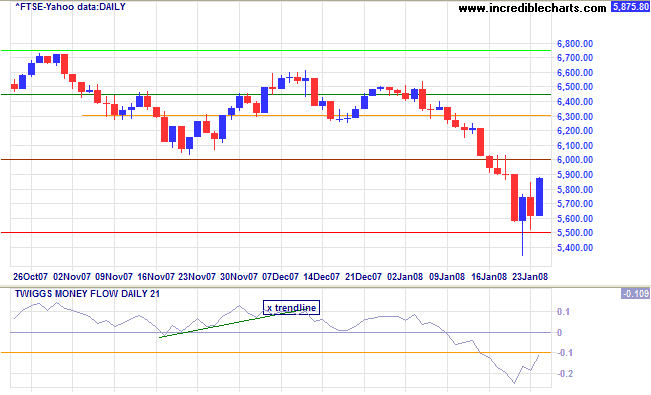

The FTSE 100 similarly, is likely to test the former primary support level of 6000.

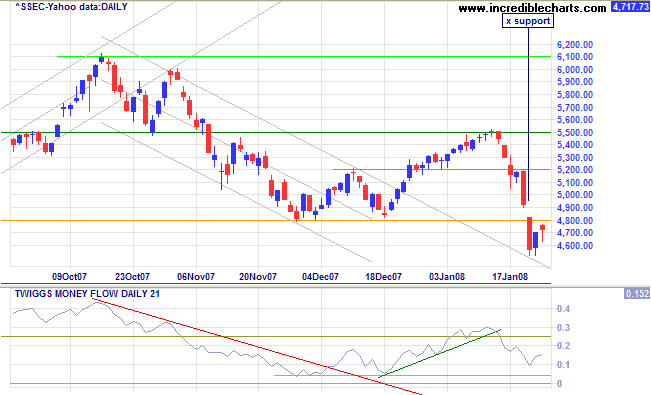

The Shanghai Composite index broke through support at 4800 to join other markets in a primary down-trend.

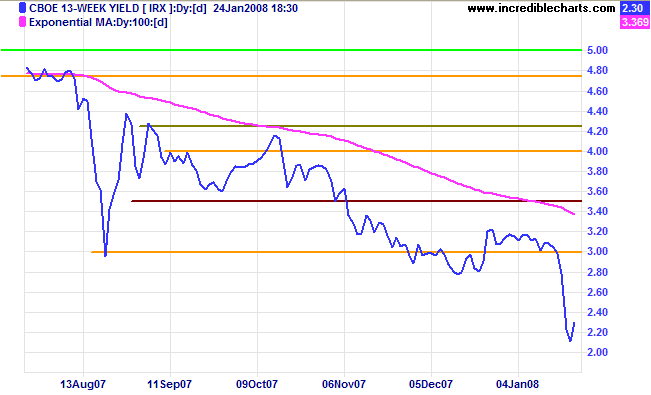

Treasury Yields

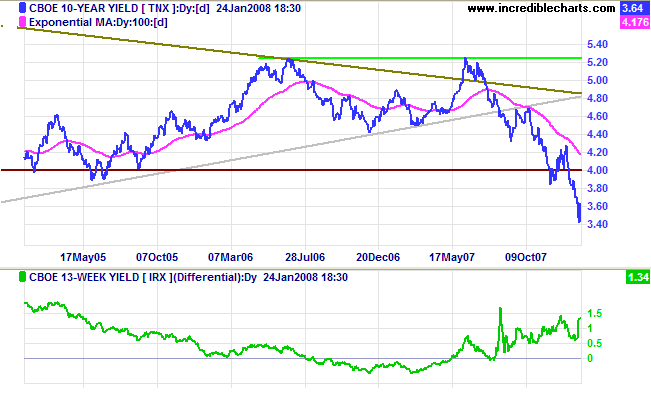

Ten-year treasury yields have fallen sharply as funds flow from stocks into bonds.

The yield differential recovered as short-term yields fell even faster.

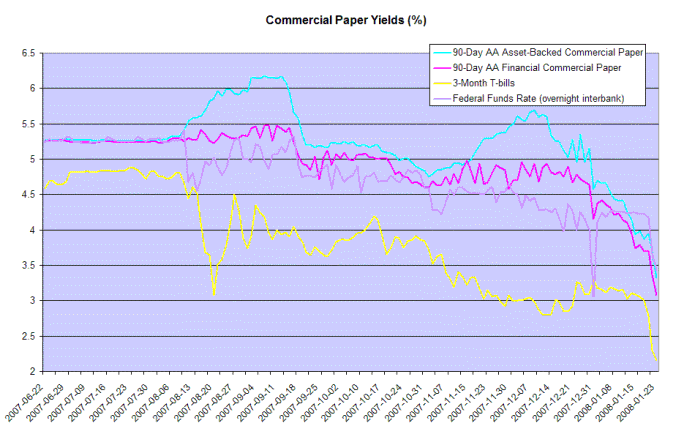

Financial Markets

Commercial paper rates fell sharply in response to the rate cut by the Fed. The fall below the new fed funds rate of 3.5% shows that further rate cuts are expected. Three-month treasury bill yields also fell sharply, the continued wide spread warning of further instability in financial markets.

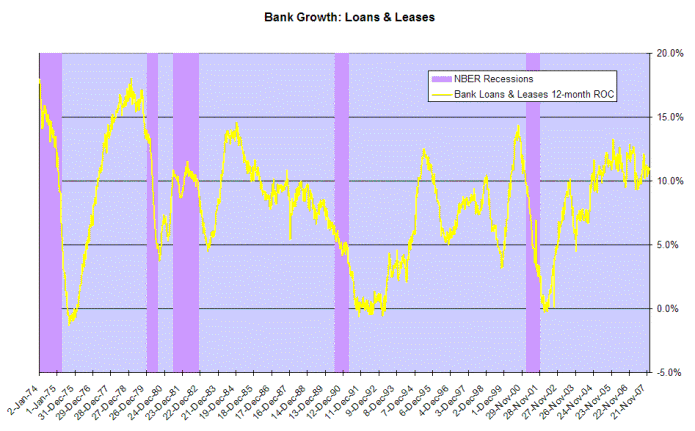

Bank Credit

One (short-term) positive aspect is that bank credit continues to grow at above 10 per cent.

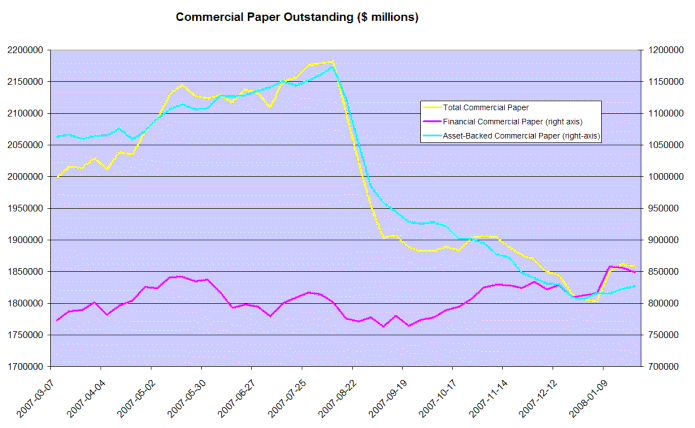

Commercial paper markets found some support, with the level stabilizing around $1.8 trillion. Further contraction would squeeze bank credit.

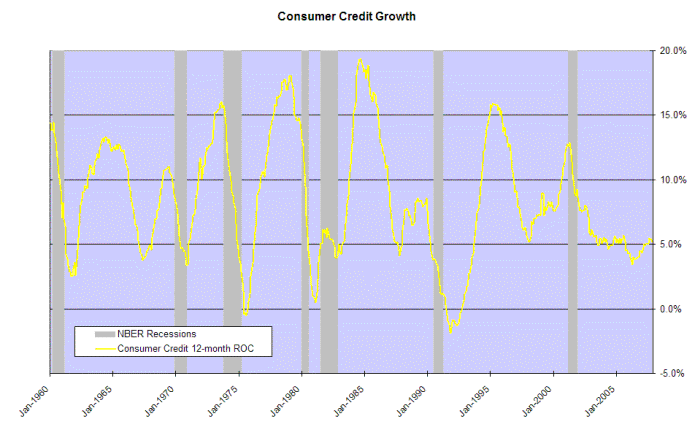

Consumer Credit

Consumer credit growth remains at a precarious 5 per cent. Further falls would sound a recession warning.

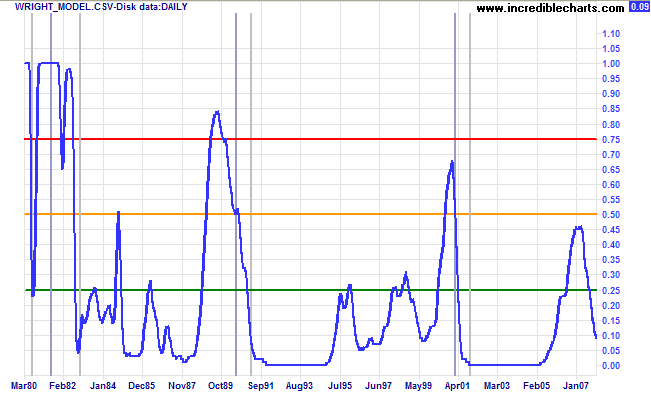

Jonathan Wright's recession prediction model is displayed for academic interest only, having failed to account for the damage caused by a negative yield curve in a low interest rate environment. The model shows probability of a recession (in the next four quarters) as a low 9 percent.

If the government is really bent on protecting the public's

earnings, it should begin at home with the purchasing power of

the dollar............ If any company listed on the Stock

Exchange had engaged in equivalent financial practices, its

directors would be facing prosecution by the SEC.

~ Bernard Baruch:

My Own Story.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.