The Bear Contagion Spreads

By Colin Twiggs

January 19, 1:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA

Another casualty of the property crisis are bond insurers, who guarantee $2.4 trillion of debt including municipal bonds and mortgage securities according to Bloomberg. Ambac Financial Group is the first to lose its AAA rating but others may follow. Insurers who lose their investment grade status would force a sell-off of affected bonds, driving down values.

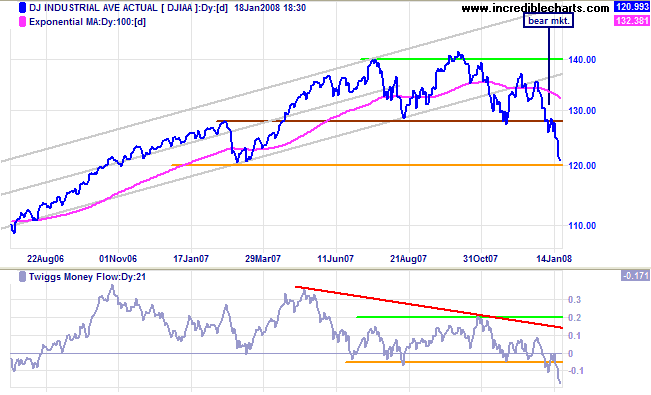

Dow Jones Industrial Average

The Dow is in a bear market after breaking primary support at 12800. Twiggs Money Flow confirms with a fall below its August 2007 low.

Short Term: Expect support at 12000, possibly even a retracement to test the new resistance level of 12800.

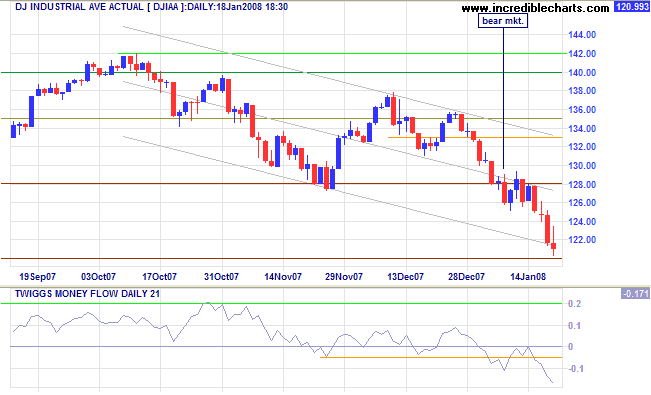

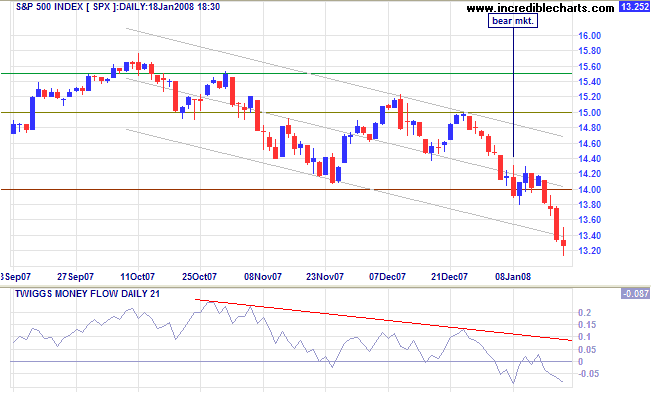

S&P 500

The S&P 500 confirms the Dow signal, with a similar fall through primary support at 1400.

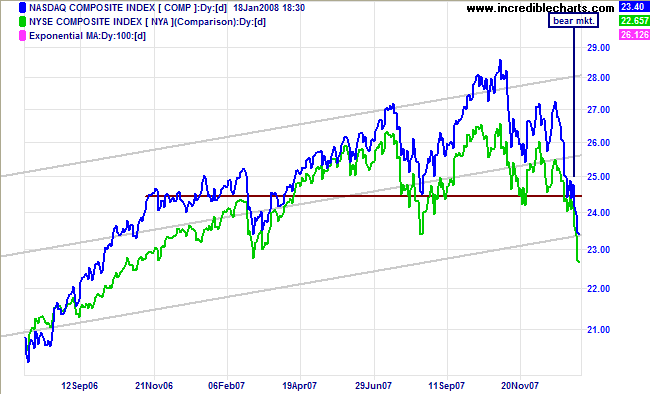

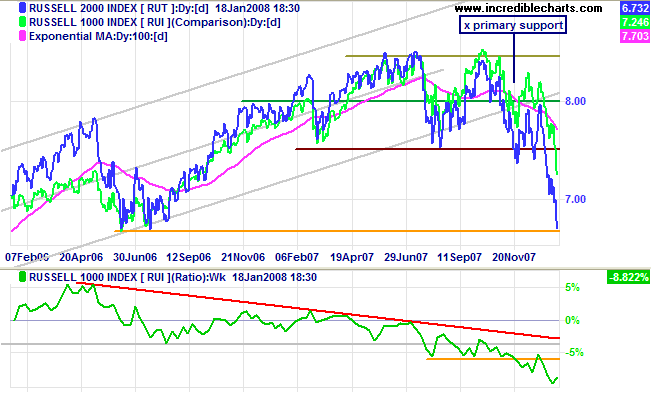

Small Caps & Technology

If any further confirmation (of a bear market) was necessary, the Nasdaq Composite and NYSE Composite both broke through primary support to commence a down-trend.

The Russell 2000 shows a similar pattern with the break below 750 confirming a primary down-trend. Declining price ratio (to the large cap Russell 1000) reflects the expected migration to relative safety of large cap stocks.

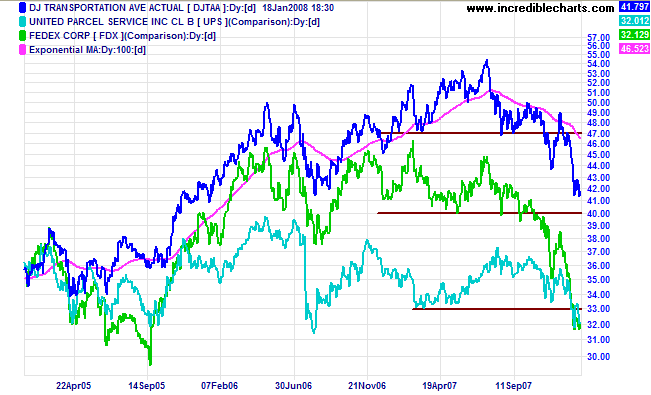

Transport

The Dow Jones Transportation Average and lead indicators Fedex & UPS all display primary down-trends, signaling a broad economic down-turn.

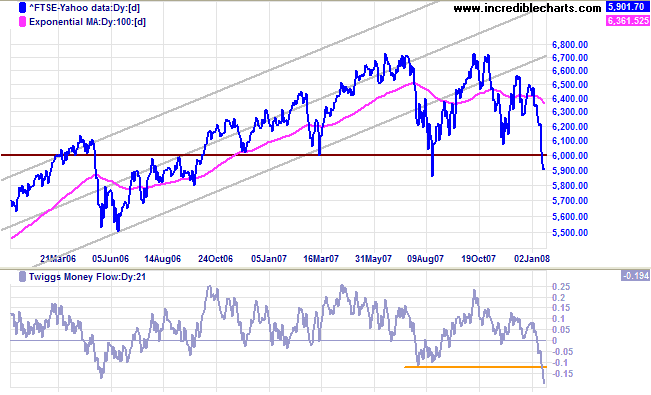

United Kingdom: FTSE

The FTSE 100 broke through primary support at 6000, signaling a primary down-trend. Twiggs Money Flow confirms the signal with a fall below the August 2007 low. Expect a test of support at 5500.

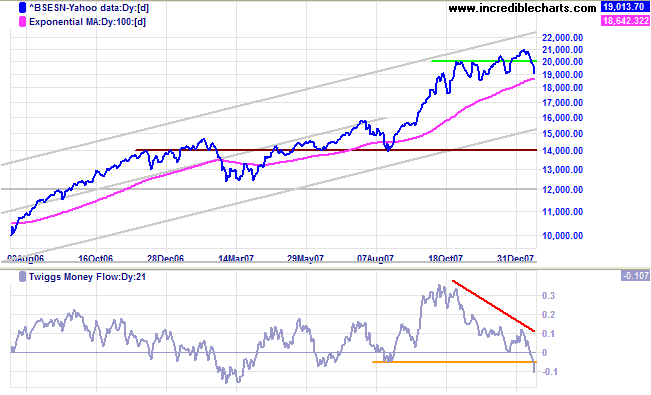

India: Sensex

The Sensex made two false breaks above 20000 before retracing to test support at 19000. Twiggs Money Flow signals strong distribution with a fall below its August 2007 low. Failure of support is expected and would indicate a test of the lower trend channel. Reversal below support at 14000 would signal a primary down-trend.

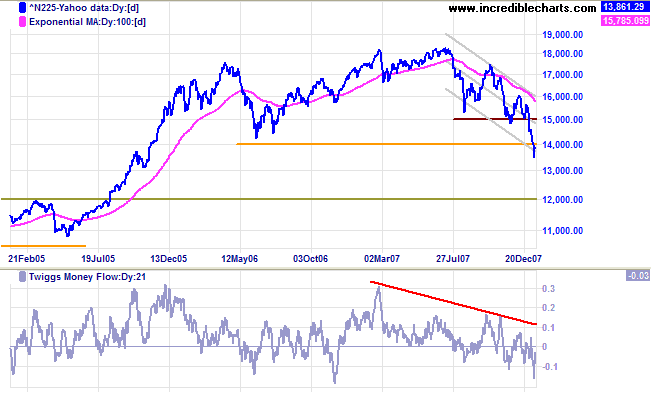

Japan: Nikkei

The Nikkei 225 is in a primary down-trend and Twiggs Money Flow shows no signs of recovery. Support at 14000 was weak and the next key level is 12000. The index is at the lower trend channel, however, so there could be some retracement first.

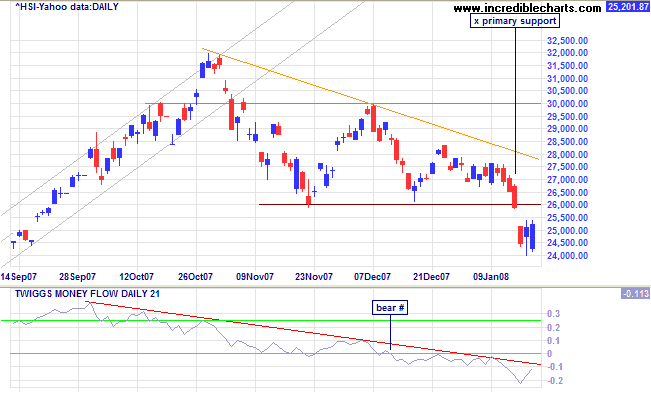

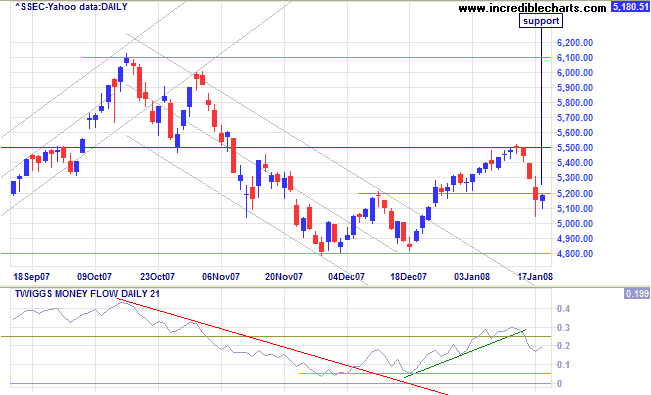

China: Hang Seng & Shanghai

The Hang Seng broke through primary support at 26000. Subsequent consolidation indicates a retracement to test the new resistance level, but a fall below 24000 would negate this.

The Shanghai Composite found short-term support around 5200, but given the bearish state of other equity markets, expect a test of primary support at 4800. A Twiggs Money Flow fall below 0.05 would warn of a primary trend change.

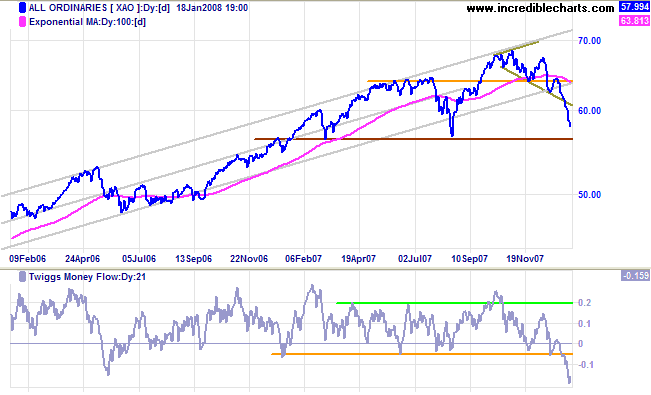

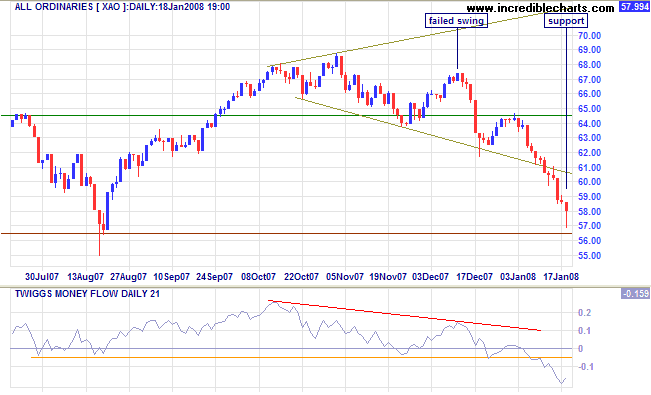

Australia: ASX

The All Ordinaries is headed for a test of primary support at 5650 after breaking out of the broadening top pattern (and the trend channel). Twiggs Money Flow warns of strong distribution, having fallen to a 3-year low.

Short Term: Expect some support at 5650, but given the bearish state of other equity markets (and TMF), this is not expected to hold.

We hold the distinction of being the only nation in the history

of the world that went to the poor-house in an

automobile.

~ Will Rogers, cowboy humorist (1879 - 1935).

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.