Further Bear Market Signals

By Colin Twiggs

January 17, 2008 3:00 a.m. ET (7:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

Stock Markets

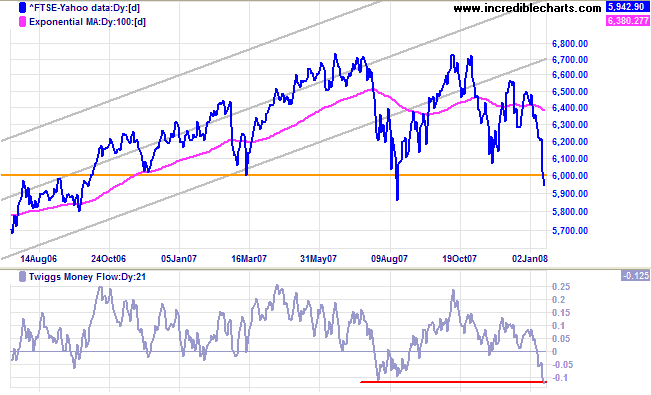

The FTSE 100 crossed below primary support at 6000, joining the Dow and S&P 500 in a primary down-trend — further confirmation of a bear market.

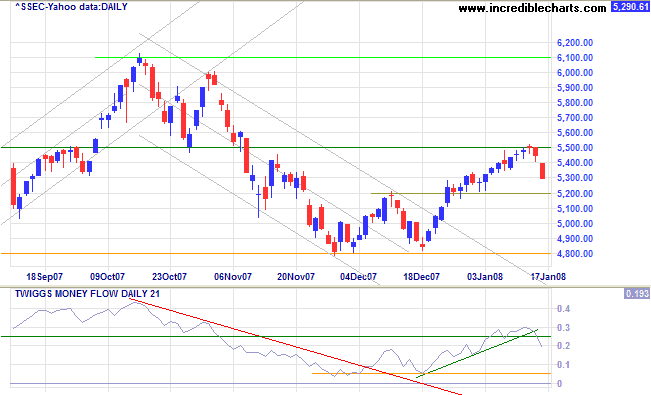

The Shanghai Composite index recovered from a secondary correction, but has now encountered resistance at 5500. A fall below 5200 would be bearish, while reversal below 4800 would signal the start of a primary down-trend.

Treasury Yields

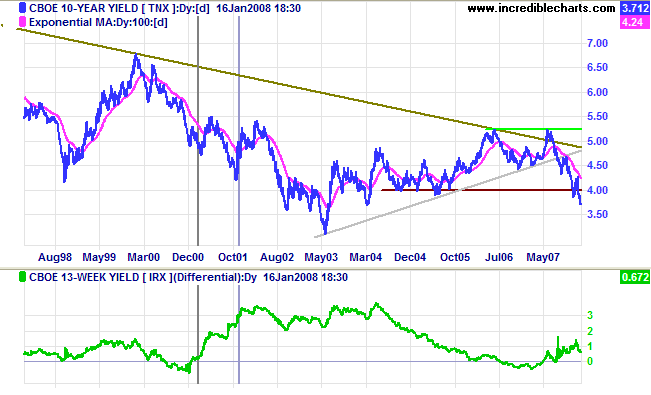

Ten-year treasury yields broke support at 4.0% in anticipation

of further rate cuts.

Vertical lines in 2000/2001 mark the last official recession

and follow shortly after the yield differential (10-year minus

3-month treasury yields) dipped below zero. There is a

significant lag after the negative yield curve in 2007,

however, as banks resorted to off-balance sheet SIVs to avoid

the credit squeeze — creating a greater lag and, quite

likely, a more severe backlash.

Financial Markets

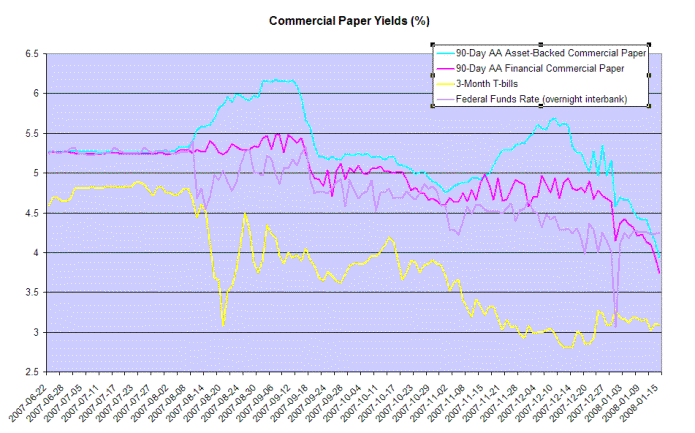

Commercial paper rates are falling sharply in anticipation of further rate cuts by the Fed. Three-month treasury bill yields have found support at 3.00%, indicating return of a measure of stability to financial markets.

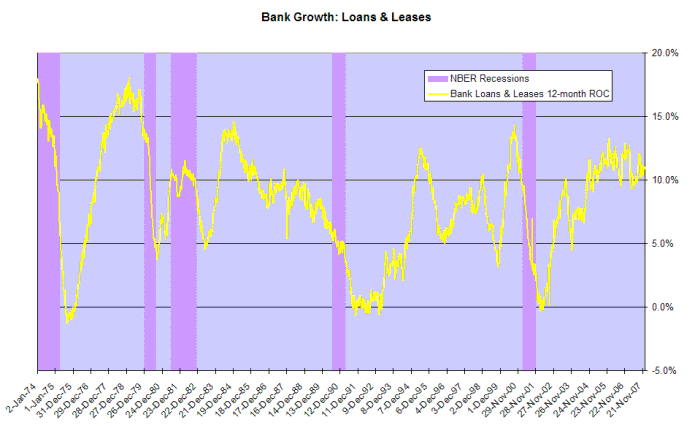

Bank Credit

Bank credit growth is maintaining at above 10 percent, with commercial & industrial finance compensating for the slow-down in real estate.

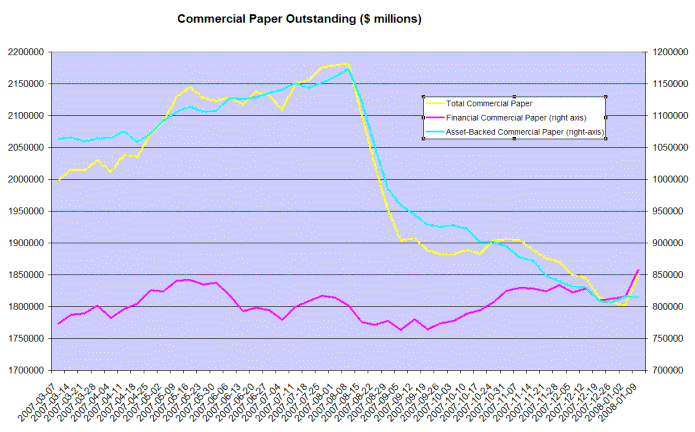

In the gray market, asset-backed paper remains out of favor and a surge in financial sector issues has been necessary to make up the shortfall. Further contraction would squeeze bank credit.

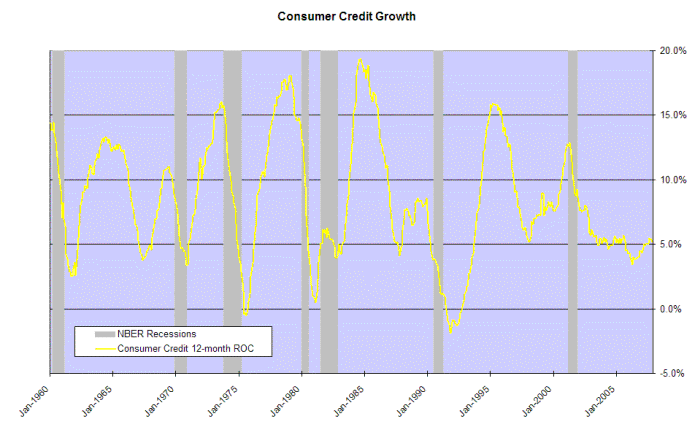

Consumer Credit

Consumer credit growth remains at a precarious 5 per cent. Further falls would sound a recession warning.

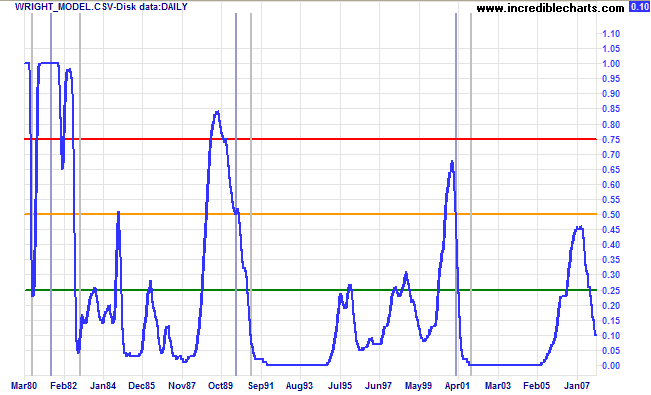

I believe that Jonathan Wright's recession prediction model is discredited, having failed to account for the damage caused by a negative yield curve in a low interest rate environment. The model is displayed for academic interest only and shows probability of a recession (in the next four quarters) at a low 10 percent.

During my eighty-seven years I have witnessed a whole

succession of technological revolutions. But none of them have

done away with the need for character in the individual or the

ability to think.

~ Bernard Baruch:

My Own Story.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.