Fed Rate Cut Likely

By Colin Twiggs

November 29, 2007 2:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

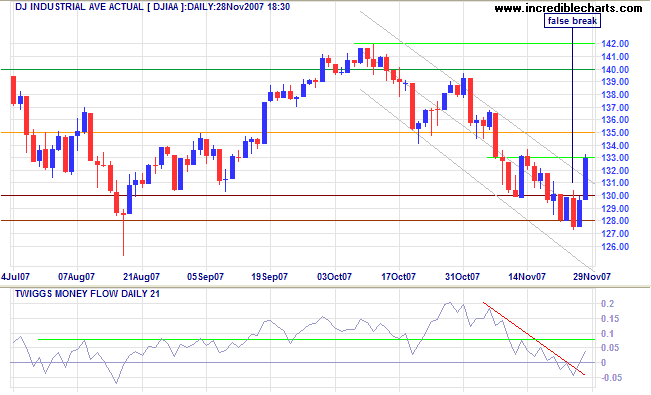

Dow Failed Breakout

The Dow reversed, penetrating the upper trend channel, after a failed break below primary support at 12800. One of the biggest mistakes analysts/traders can make is gathering evidence to support their existing position rather than opening their mind to new possibilities. Another common mistake, however, is to shift your position back and forth in response to each new piece of evidence — before their is clear proof that you are on the wrong track.

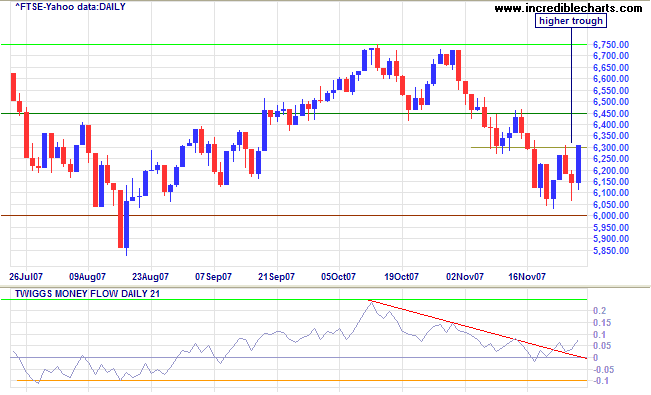

Probability may have shifted slightly with Wednesday's strong blue candle, from say 80 per cent to 75 per cent, but remains firmly in favor of a bear market. A higher trough, as with the FTSE below, would increase the contrary evidence, while reversal below 12800 would push the probability back above 80 per cent.

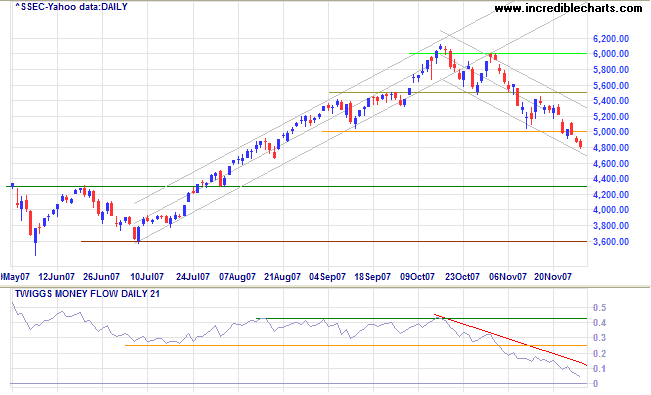

The Shanghai Composite index broke through support at 5000, indicating that the secondary correction is likely to test support at 4300.

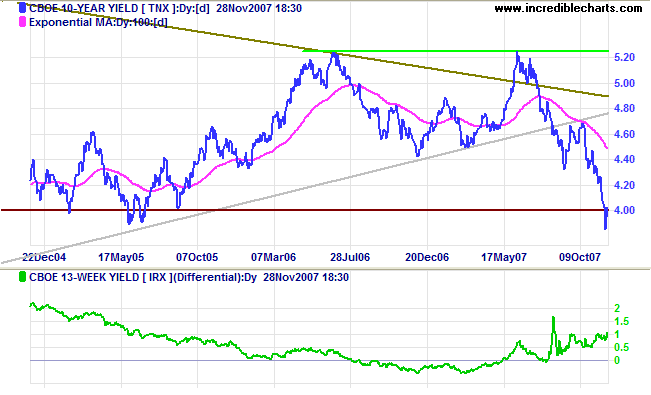

Treasury Yields

Ten-year treasury yields recovered above support at 4.0%, after a sharp fall in anticipation of further rate cuts from the Fed. The yield differential (10-year minus 3-month treasury yields) is above 1 per cent, but damage to the economy was done 6 months ago, when the spread fell below zero.

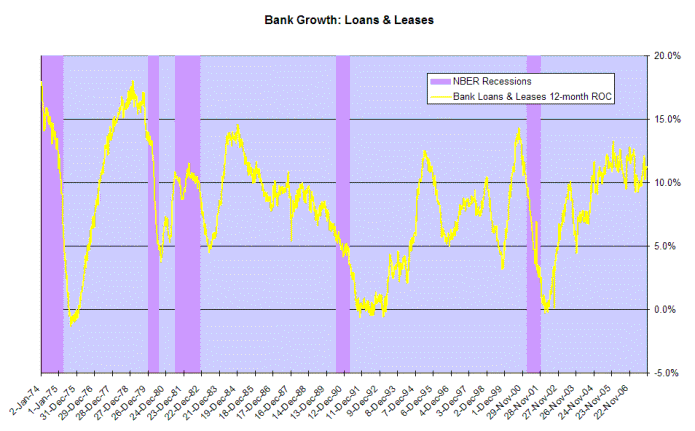

Bank Lending

Bank credit continues to grow at above 10 per cent a year.

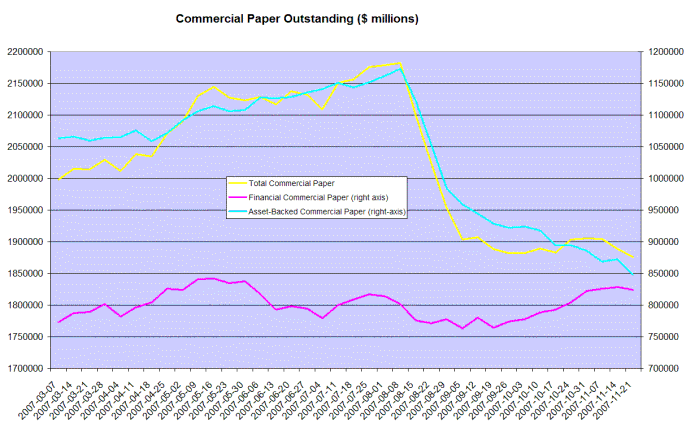

The real contraction is taking place off-balance sheet, however, as shown by the sharp decline in asset-backed commercial paper.

Citigroup is the first banking group to show the effects of subprime write-downs on its capital base, being forced to secure a $7.5 billion infusion of Tier 1 capital from Abu Dhabi Investment Authority, in order to maintain its capital adequacy ratios. Expect other banks to follow before the housing collapse is over.

Financial Markets

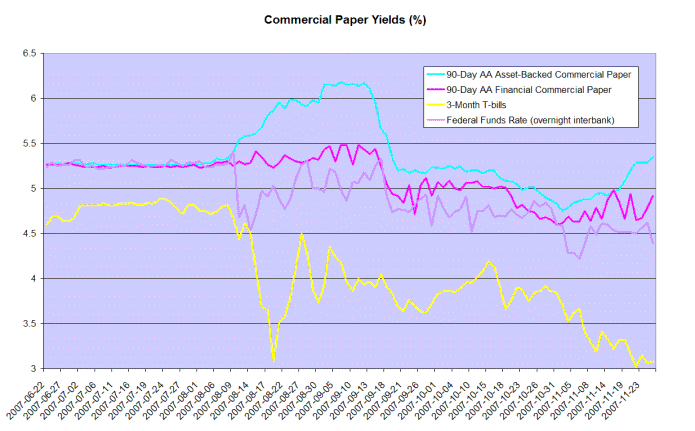

Treasury bill (3-month) yields are testing support at 3.00%, while rates on asset-backed securities and financial paper continue rising. The widening spread warns of further upheaval in financial markets.

The effective federal funds rate fell below the Fed target of 4.5% for a second time, indicating that further rate cuts are likely.

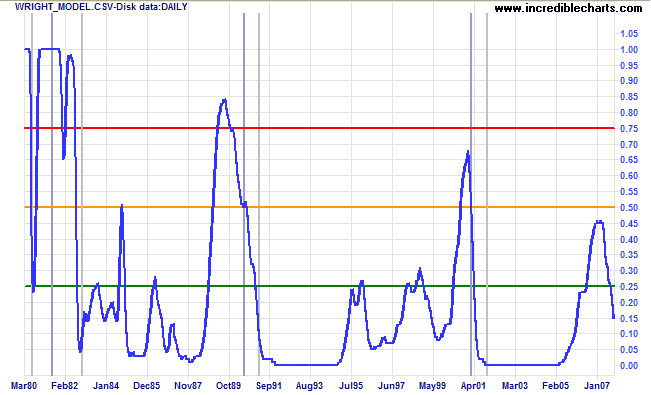

I believe that Jonathan Wright's recession prediction model has failed to adequately address the damage caused by a negative yield curve in a low interest rate environment. The model currently shows a slight up-tick in the probability of a recession in the next four quarters, to 16 percent.

Its not whether you are right or wrong that matters, but how

much money you make when your right and how much you don't lose

when your wrong.

~ George Soros

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.