Gold Breaks Rising Trendline

By Colin Twiggs

November 20, 2007 2:00 a.m. ET (6:00 p.m. AET)

In an attempt to make our newsletters more readable we will

trial splitting the weekly coverage in two: gold, oil and forex

on Tuesdays; the economy and interest rates on Thursdays.

Please give us your feedback when we survey readers after a few

weeks.

These extracts from my trading diary are for educational

purposes and should not be interpreted as investment advice.

Full terms and conditions can be found at

Terms of Use.

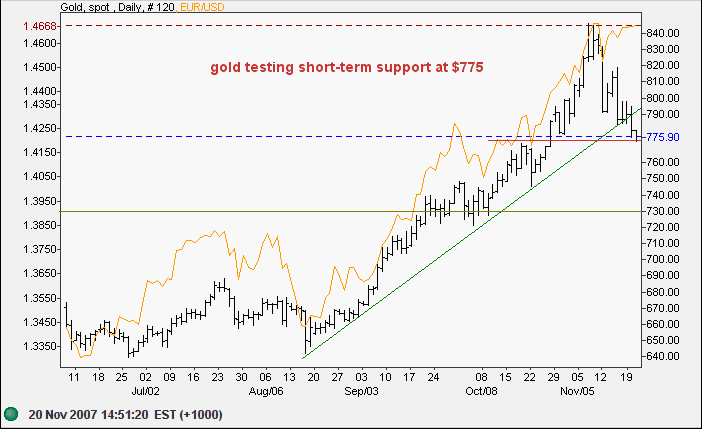

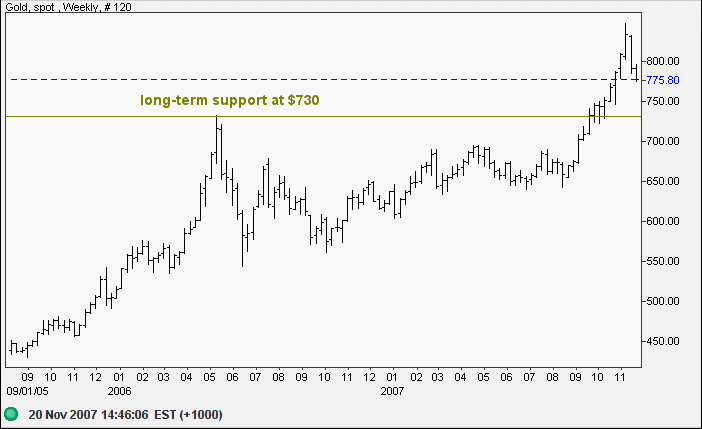

Gold

Gold broke through the rising (green) trendline, warning of a

secondary correction. Penetration of short-term support at $775

would confirm the signal.

The euro remains bullish against the dollar and we can expect

gold to recover and follow this in the medium-term.

The primary up-trend is strong, and the long-term target of $900 [725+(725-550)] remains. A secondary correction is likely to find support at the 2006 high of $730/$725.

Source: Netdania

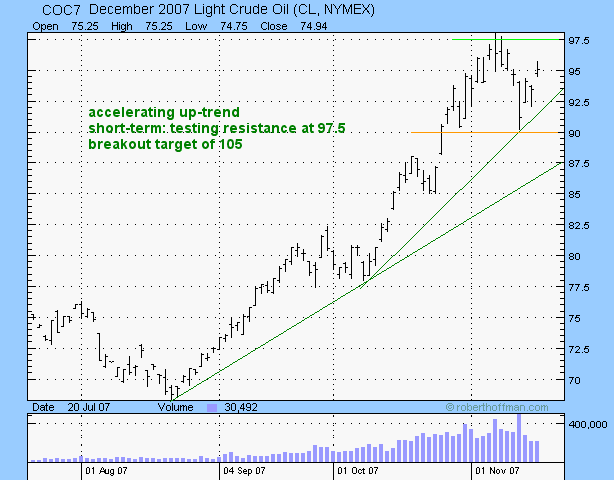

Crude Oil

December Light Crude respected support at $90/barrel and is headed for a test of resistance at $97.50. Breakout would present a short-term target of $105, but the $100 barrier is likely to intercede. While not expected, reversal below $90 would warn of a secondary correction.

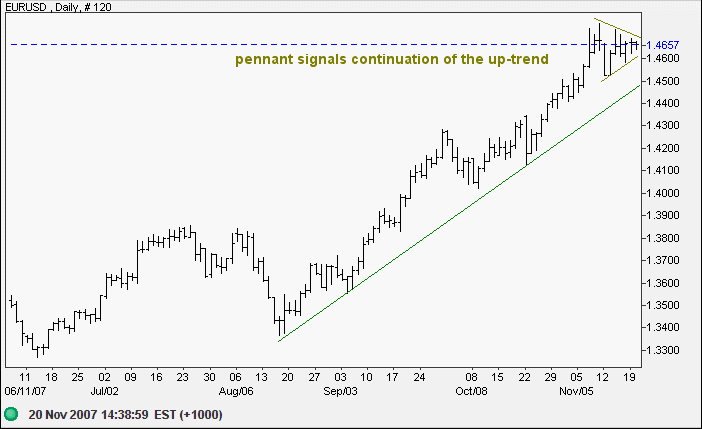

Currencies

The euro formed a pennant, signaling continuation of the up-trend. Upward breakout would offer a target of $1.50 [1.4650+(1.4700-1.4350)]. Breakout below the rising (green) trendline is not expected — and would warn of a secondary correction.

Source: Netdania

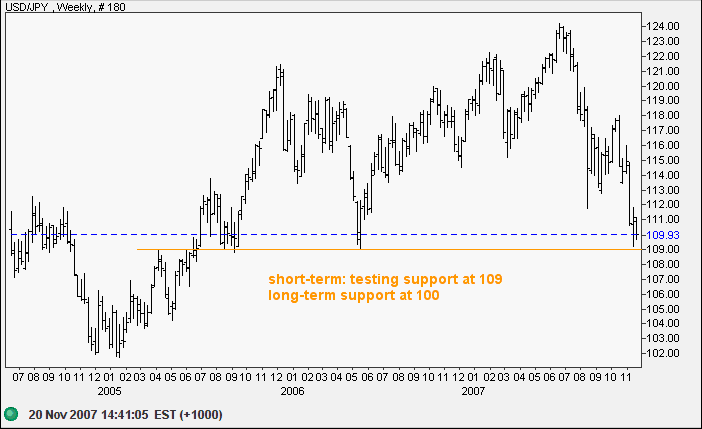

The dollar is testing support at 109 against the yen — from the 2006 low. Failure would signal a test of long-term support at 100.

Source: Netdania

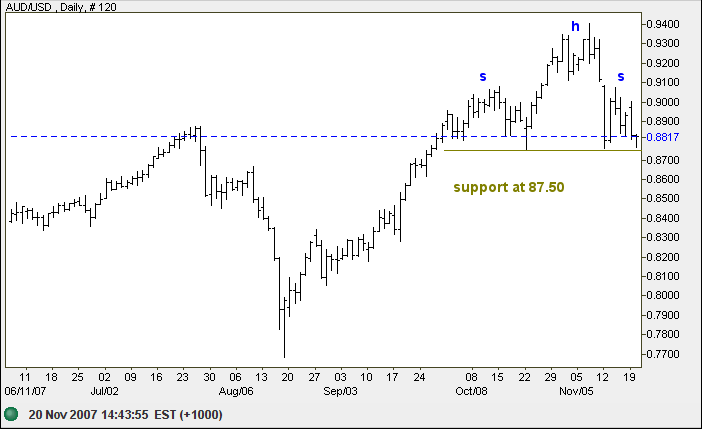

The Australian dollar is testing support at $0.8750. Failure would complete a head and shoulders pattern with a target of $0.8100 [0.8750-(0.9400-0.8750)], while recovery above $0.9100 would indicate another test of resistance at $0.9400. The long-term target of parity now appears remote and would only be revived by a rise above $0.9400.

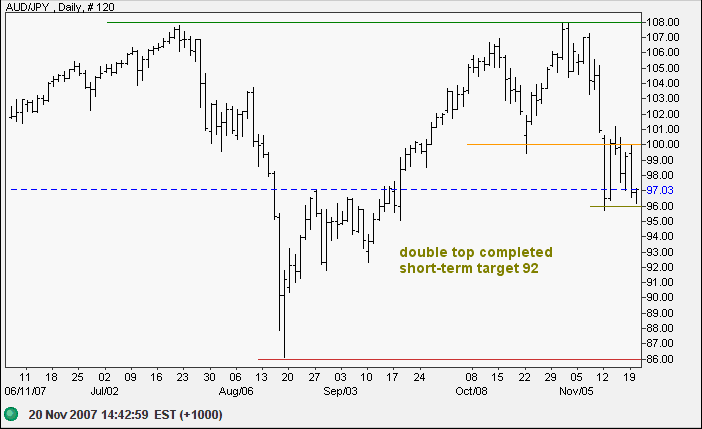

Weakness of the Aussie dollar is attributable to the unwinding of large carry trades. The cross-rate with the yen shows the full effect, with hedge funds effectively buying the yen and selling high-yielding currencies such as the Australian dollar to cancel their exposure. Failure of short-term support at 96 would offer a target of 92 [96-(100-96)] which coincides with the target for the completed double top pattern [100-(108-100)]. It would also mean that support at 87.50 against the USD is unlikely to hold.

Source: Netdania

Until government administrators can so identify the interests

of government with those of the people and refrain from

defrauding the masses through the device of currency

depreciation for the sake of remaining in office, the wiser

ones will prefer to keep as much of their wealth in the most

stable and marketable forms possible - forms which only the

precious metals provide.

~ Elgin Groseclose.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.