Gold Up-Trend Remains

By Colin Twiggs

November 13, 2007 3:00 a.m. ET (7:00 p.m. AET)

In an attempt to make our newsletters more readable we will

trial splitting the weekly coverage in two: gold, oil and forex

on Tuesdays; the economy and interest rates on Thursdays.

Please give us your feedback when we survey readers after a few

weeks.

These extracts from my trading diary are for educational

purposes and should not be interpreted as investment advice.

Full terms and conditions can be found at

Terms of Use.

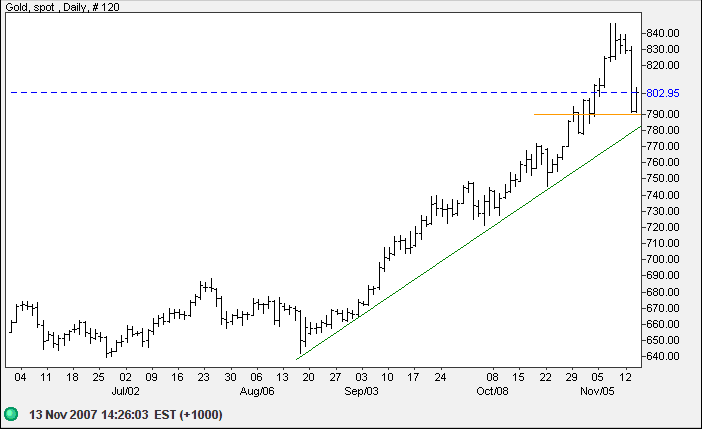

Gold

Gold retraced sharply before finding support at $790. The metal remains above the rising (green) trendline, signaling that the up-trend is intact and the long-term target of $900 [725+(725-550)] remains. Breakout below the trendline would warn of a larger, secondary correction.

Source: Netdania

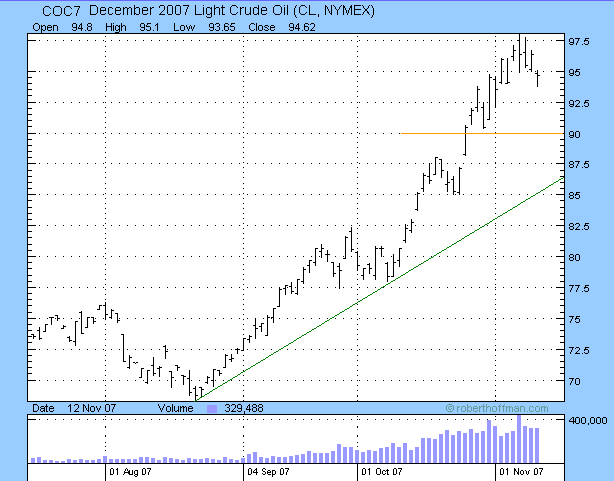

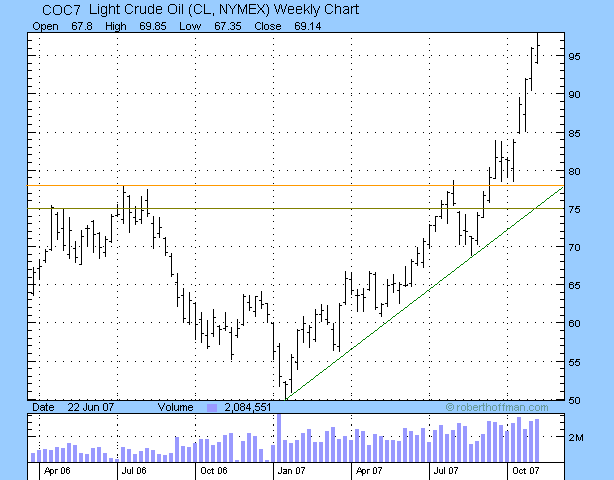

Crude Oil

December Light Crude is retracing, in line with gold, as the dollar strengthens. Expect a test of support at $90/barrel. Breakout below the rising (green) trendline is not expected and would warn of a secondary correction.

The weekly chart shows a strong band of support between $75 and $78/barrel, coinciding with the rising long-term trendline.

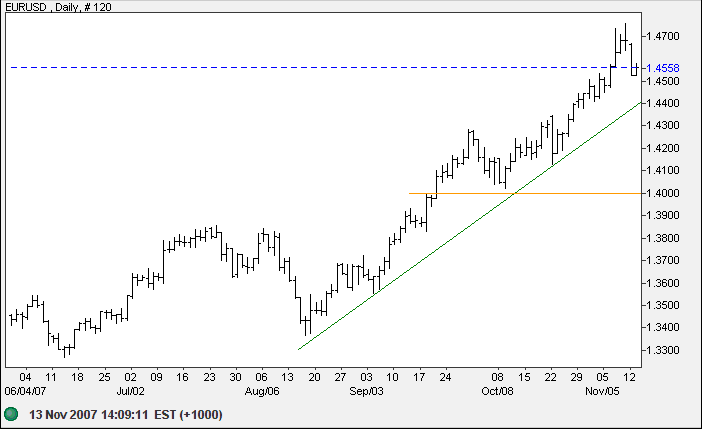

Currencies

The euro is retracing to test the rising (green) trendline. Respect would signal an advance to test the next target of $1.50 [1.47+(1.47-1.44)]. Breakout below the trendline is not expected — and would warn of a secondary correction.

Source: Netdania

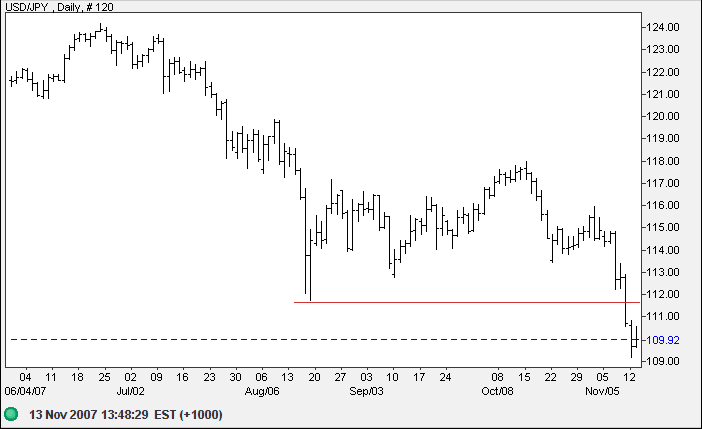

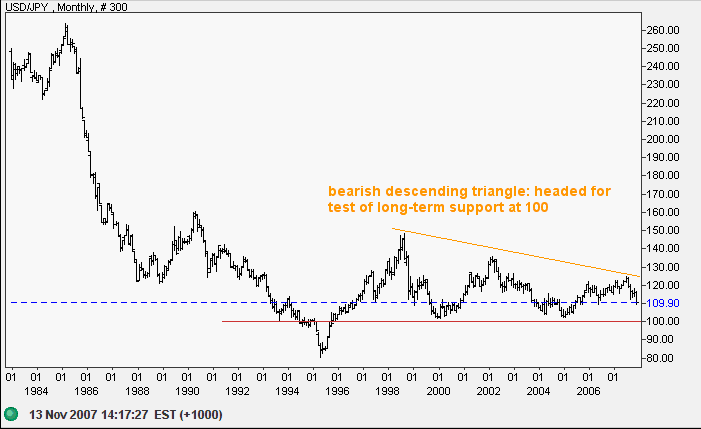

The dollar broke through support at 112 against the yen, signaling a further decline with a target of 100 [112-(124-112)].

The sharp rise of the yen can be attributed to the unwinding of large carry trades, effectively buying the yen and selling high-yielding currencies such as the Australian dollar. The monthly chart shows a large bearish descending triangle with support at 100. Failure would signal strong long-term appreciation of the yen.

Source: Netdania

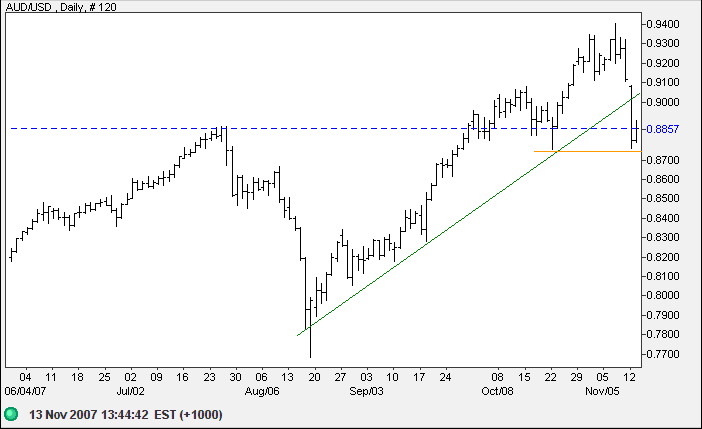

The Australian dollar reflects a corresponding sharp fall, with penetration of the rising (green) trendline warning of a secondary correction. Failure of support at $0.8750 would confirm this. The long-term target of parity [0.8900+(0.8900-0.7800)] now appears remote and would only be revived by a rise above $0.9400.

Source: Netdania

We need only take our heads out of the sand to see clearly that

interventionism not only has failed to provide the promised

something-for-nothing, but has led to all sorts of undesirable

consequences. Indeed, many are just beginning to realize that

we are moving towards disaster even though we have been on a

wrong heading for decades.

~ Leonard Read.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.