Primary Support Faces A Stern Test

By Colin Twiggs

November 10, 2:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

Learning From Others' Mistakes

Chuck Prince and Stan O'Neal are clever, talented business

leaders. You don't get appointed as CEO of Citigroup or Merrill

Lynch if you are an idiot. They also had loads of experience.

If either of them had been approached ten years ago with a

scheme to expose their organization to billions of dollars of

subprime mortgages, they would most likely have baulked at the

idea.

So how did they fail?

First of all, securitizing loans and selling them off via SIVs

provides a huge boost to current earnings, with profits

recognized up front rather than over the life of the loan.

Securitizing probably started in a small way, but once started

it is hard to stop. You become blinded by the results and a

self-congratulatory culture of invulnerability takes hold. Any

employee who questions the wisdom of the strategy is likely to

receive the Jerry Maguire treatment.

Secondly, if you need to justify your course of action, just

look around and you will find everyone else doing the same

thing; so it must be right. The herd instinct offers a false

sense of security.

As traders we should be aware of both these pitfalls. When we are at our most successful, we are also at the greatest risk. Failing to maintain strict discipline can sow the seeds of our later destruction. Further, try not to follow what everyone else is doing: remain detached. Shut out as much of the external noise as you can. Do not seek reassurance from others. Make your own decisions. Essentially you are on your own. All that you have to protect yourself is self-discipline.

USA

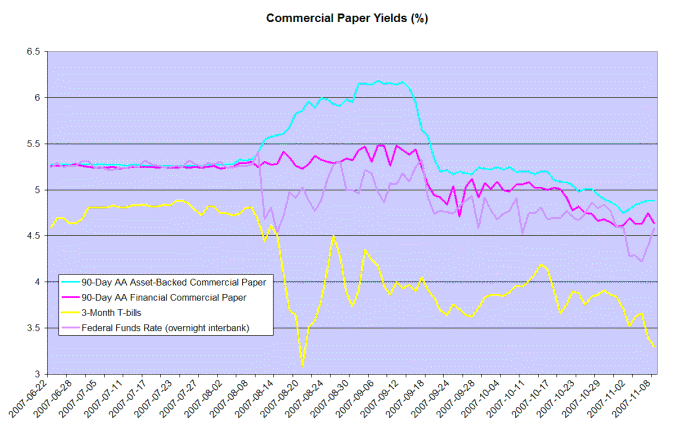

The yield on 3-month treasury bills is testing 3.00% on intra-day lows. The widening margin with commercial paper rates warns of further financial instability ahead; and the effective fed funds rate dip below 4.50% increases the likelihood of further rate cuts.

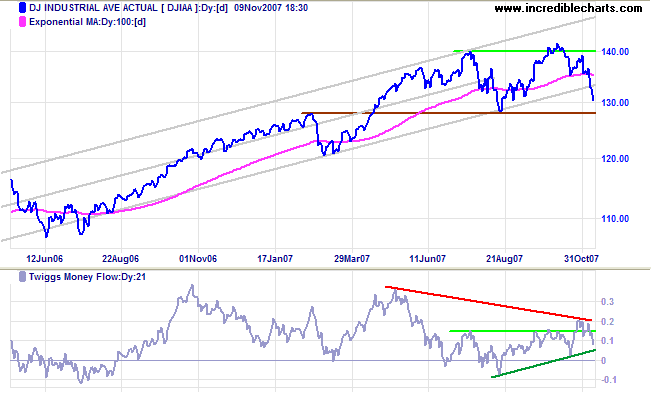

Dow Jones Industrial Average

The Dow Jones Industrial Average started another secondary correction, after breaking 13500, and is headed for a test of primary support at 12800. The double top has no great significance unless primary support is penetrated, which would then signal reversal of the primary trend.

Twiggs Money Flow shows a long-term bearish divergence (red), but medium-term accumulation (green trendline) suggests that primary support may hold.

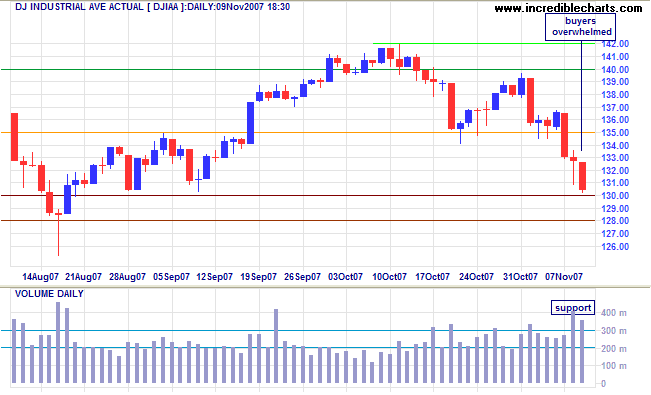

Short Term: Thursday's long tail and large volume indicate strong buying support. Bargain hunters were overwhelmed on Friday, but may reappear between 13000 and 12800.

Transport

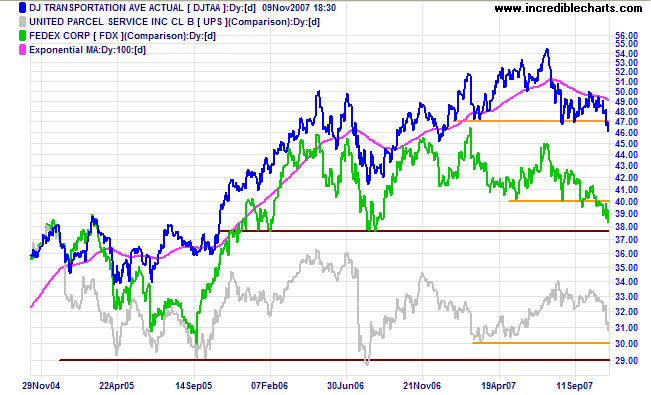

The Dow Jones Transportation Average reverted to a primary down-trend after breaking support at 4700. Fedex, already in a primary down-trend, is now testing the base ($100/$98) of the 2006/2007 ranging market. UPS is also headed for a test of primary support; the declining transport indicators warning of an expected slow-down in the broader economy.

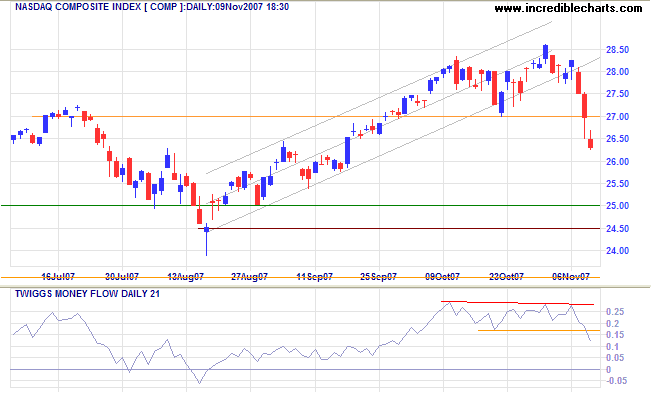

Small Caps & Technology

The Nasdaq Composite also started a secondary correction after breaking 2700 and is now headed for a test of primary support at 2450.

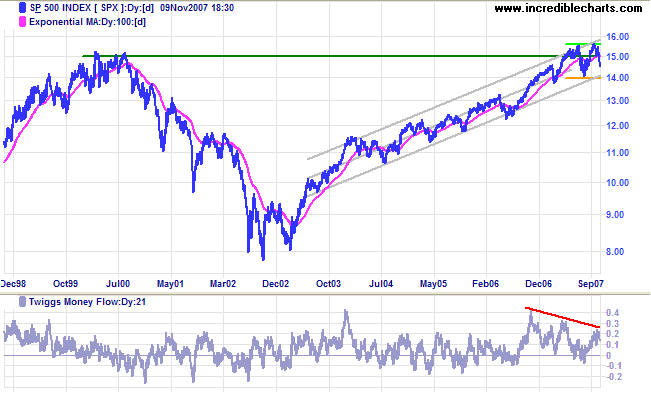

S&P 500

Current market instability can be attributed to the subprime

collapse, but we should not lose sight of the technical

explanation: at least major important indices, the S&P 500,

FTSE 100 and the DAX, have all encountered key resistance

levels.

The S&P 500 is finding it difficult to overcome the

1500 resistance level, from its year 2000 highs, and is now

headed for a test of primary support at 1400. Failure of

support would signal that the primary trend has reversed.

Twiggs Money Flow shows a similar pattern to the Dow, with

medium-term accumulation conflicting with a long-term bearish

divergence, suggesting that there is a reasonable chance that

support will hold.

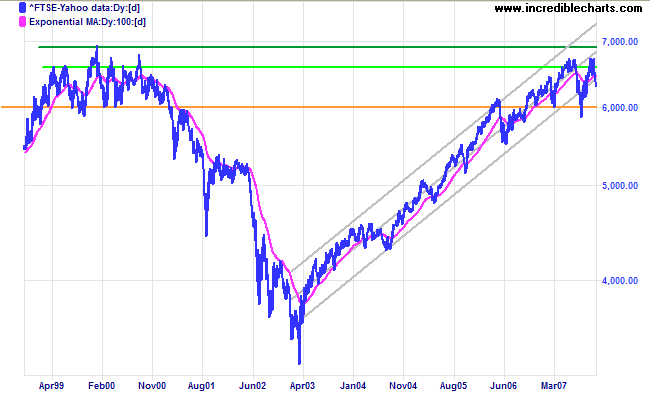

United Kingdom: FTSE

The FTSE 100 has also started a secondary correction after encountering resistance at the year 2000 highs of 6600/6900. Failure of primary support at 6000 would signal a primary down-trend.

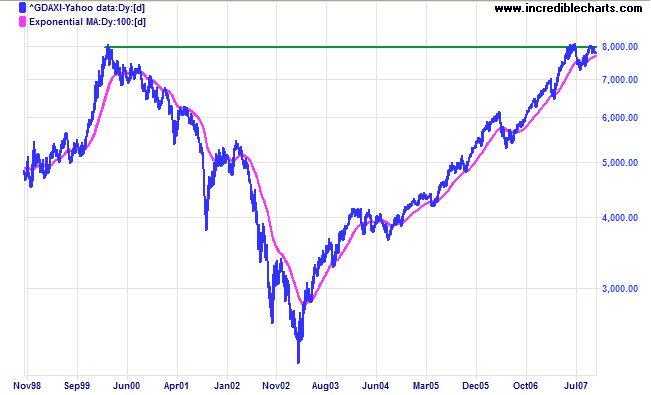

The German Dax is in a similar stuation, starting a secondary correction after encountering resistance at the year 2000 high of 8000. A fall below 7200 (or close below 7270) would signal a primary down-trend.

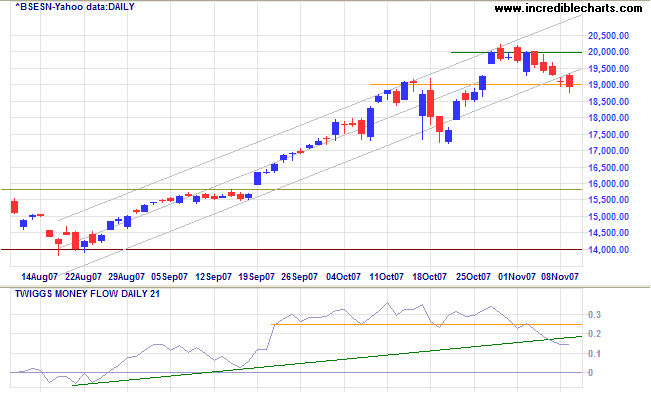

India: Sensex

The Sensex is testing support at 19000 after encountering resistance at 20000. A clear breakout below the trend channel, with say another close below 19000, would warn of a secondary correction. Twiggs Money Flow broke the rising (green) trendline, warning of distribution. Primary support remains a long way below at 14000.

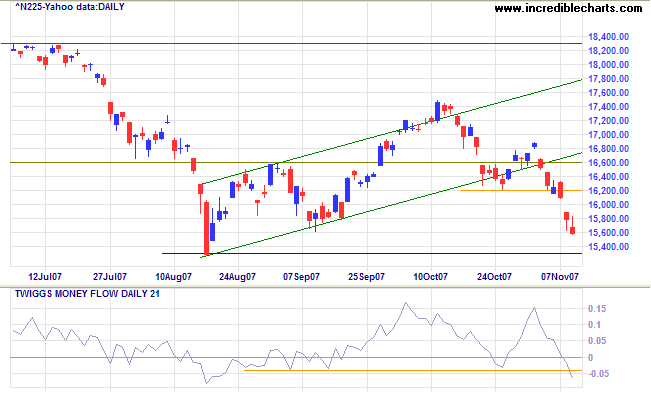

Japan: Nikkei

The Nikkei 225 is now in a clear primary down-trend and headed for a test of support at 15300 after breaking out of the trend channel. A close below 15300 would warn of another (primary) decline. Twiggs Money Flow signals distribution.

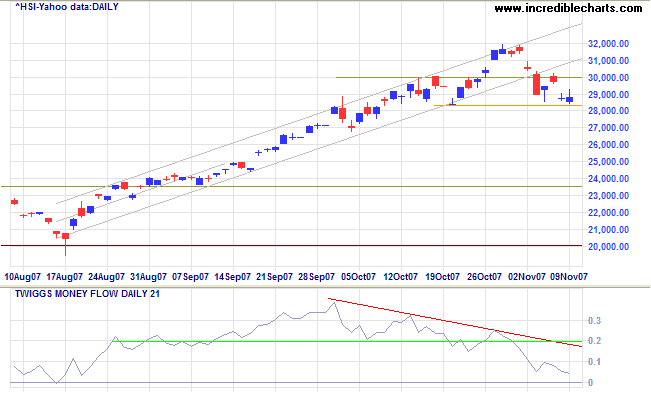

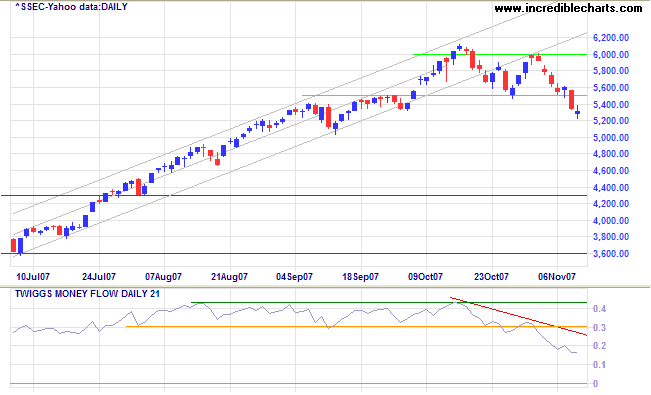

China: Hang Seng & Shanghai

The Hang Seng warns of a secondary correction after breaking below the trend channel, confirmed if there is a close below 28300. Twiggs Money Flow displays a strong bearish divergence, signaling distribution. The index remains a long way above primary support at 20000.

The Shanghai Composite broke through support at 5500, signaling the start of a secondary correction. Twiggs Money Flow breakout below support at 0.3 confirms strong distribution. With the final phase of a bull market and primary support a long way below at 3600, the index may be prone to a sharp fall.

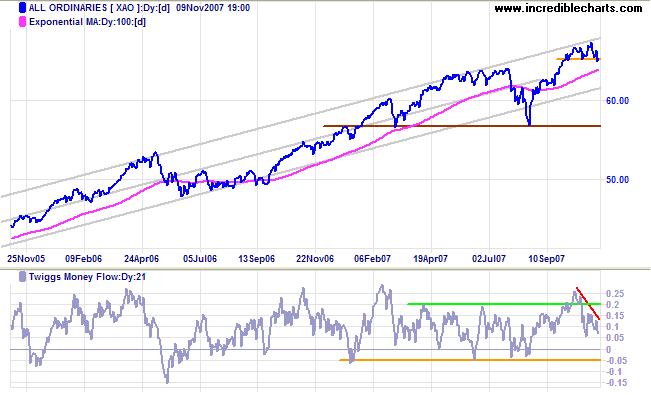

Australia: ASX

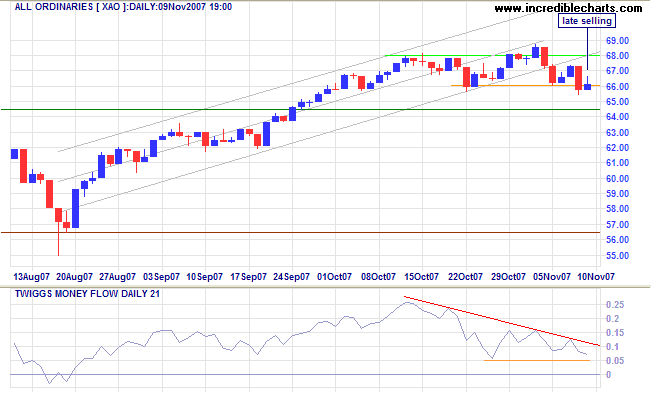

The All Ordinaries broke support at 6600, signaling the start of a secondary correction. Expect a test of the lower trend channel border, while failure of support at 5650 would signal reversal to a primary down-trend. Twiggs Money Flow is falling, but still some way above support at -0.05, penetration of which would warn of a trend reversal.

Short Term: Friday shows a partial recovery, but the long shadow signals late selling. Expect the week to start with a sharp fall, given the bearish performance of both its major influences: the US and China.

If you wish to remain the slaves of bankers and pay the cost of

your own slavery, let them continue to create deposits.

~ Josiah Stamp, Governor of the Bank of England in the 1920's.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.