Dow Breaks Key Support Level

By Colin Twiggs

November 8, 2007 12:00 a.m. ET (4:00 p.m. AET)

In an attempt to make our newsletters more readable we will

trial splitting the weekly coverage in two: gold, oil and forex

on Tuesdays; the economy and interest rates on Thursdays.

Please give us your feedback when we survey readers after a few

weeks.

These extracts from my trading diary are for educational

purposes and should not be interpreted as investment advice.

Full terms and conditions can be found at

Terms of Use.

Stock Markets

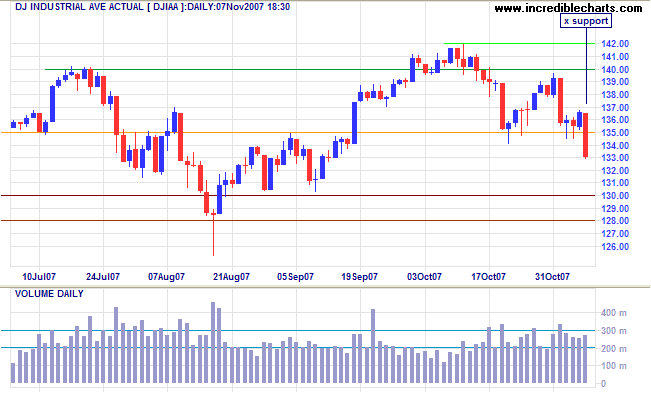

The Dow closed below support at 13500, signaling another secondary correction. The earlier failed breakout above 14000 is a bearish sign, warning that primary support at 12800 faces a stern test.

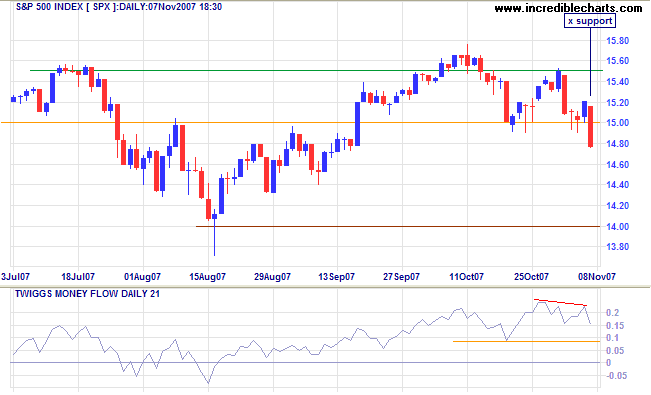

The S&P 500 shows an almost identical pattern: breaking through the key 1500 support level and headed for a test of primary support at 1400.

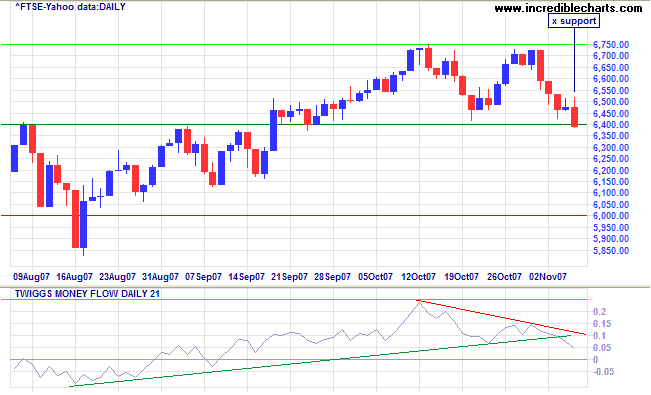

The FTSE 100 earlier closed below support at 6400, warning of a test of primary support at 6000.

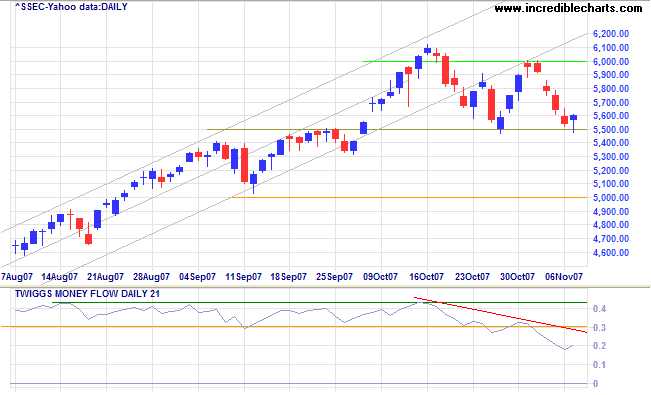

While support at 5500 has so far held, the Shanghai Composite is below its trend channel, signaling a loss of momentum, and Twiggs Money Flow warns of distribution.

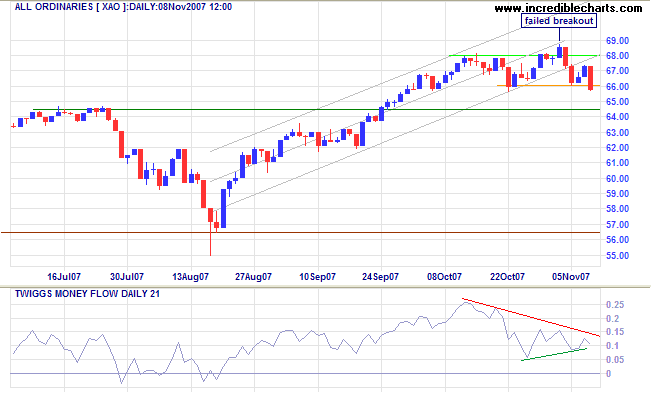

The Australian All Ordinaries also warns of a secondary correction after breaking below the trend channel and (intra-day) penetrating support at 6600.

Financial Markets

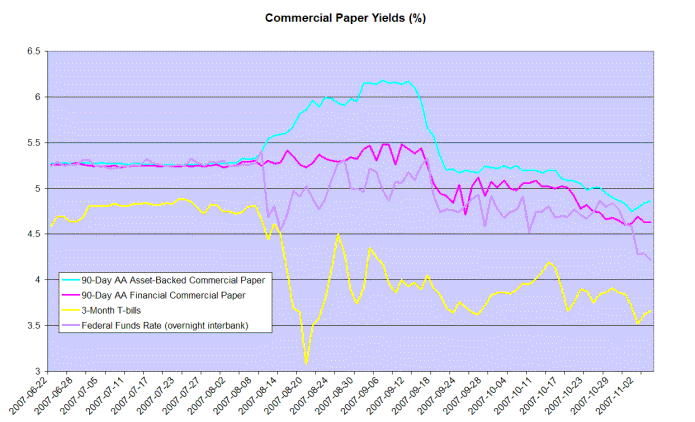

The federal funds rate has fallen sharply below the target rate of 4.50%, warning that the Fed may have difficulty avoiding further rate cuts. The wide spread between commercial paper and treaury bills signals investors' continued mistrust of the financial markets.

The Yield Curve

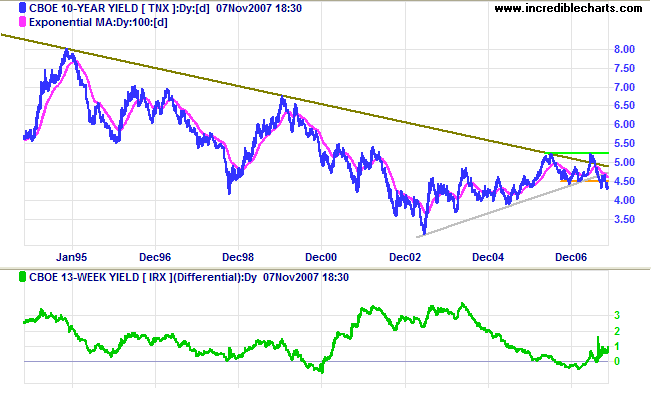

Ten year treasury yields have broken through support at 4.50%,

signaling that the super-cycle down-trend in long bond yields

is intact.

The yield differential is above zero, but for all the wrong

reasons: low short-term yields are due the flight from

financial markets.

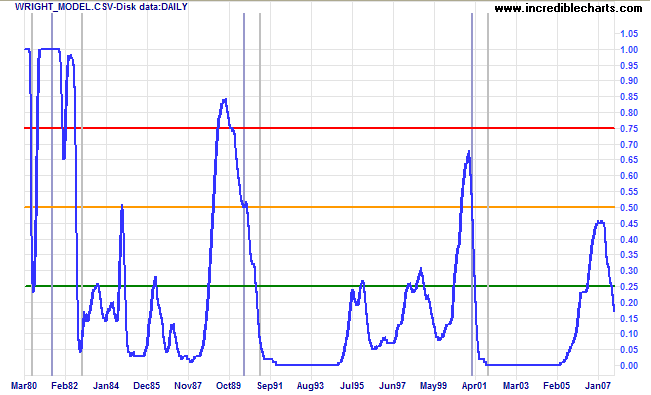

Jonathan Wright's recession prediction model indicates the probability of a recession in the next four quaters has fallen to a low 17 percent. The model is based on the nominal level of the fed funds rate and the yield differential between 10-year and 3-month treasuries. As such it fairly accurately predicts a decline in the availability of credit caused by a narrowing of bank interest margins. However, it will not reflect a decline in availability of credit caused by other factors, such as a collapse of the commercial paper market. Not all recessions are atypical, as I pointed out earlier. While the model remains a useful tool, I believe that it underestimates the risk of recession in the present environment.

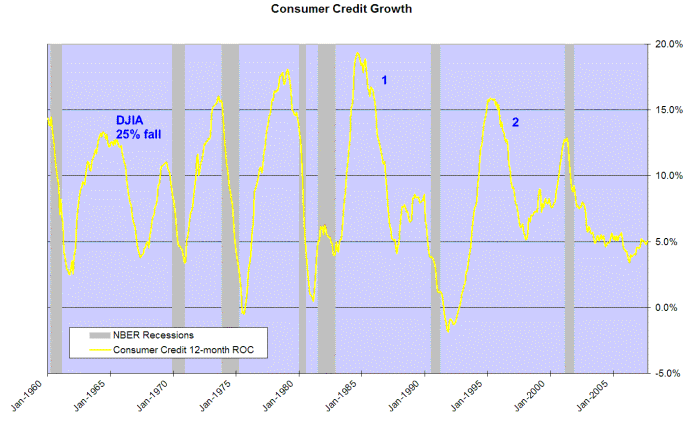

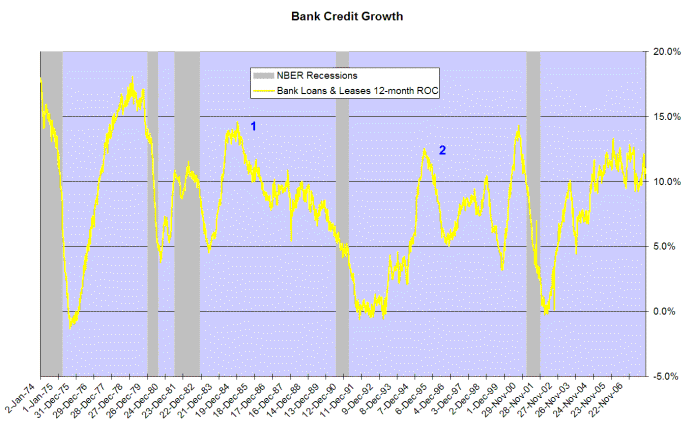

Bank Credit & Consumer Credit

A sharp fall in consumer credit growth would be the final nail in the coffin (#1 and #2 indicate previous occurrences where this signal has failed), but CC has been growing at a relatively low level of 5.0% for some time.

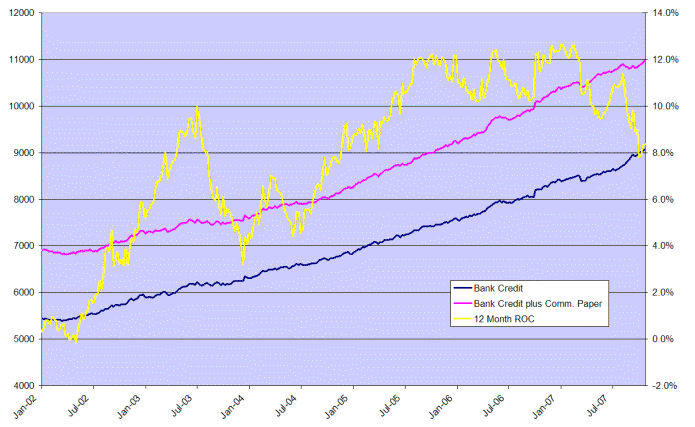

Consumer credit growth may have been low, but most of us are aware of what has been happening with real estate lending. Even the consistent 10 per cent growth in overall bank credit over the last two years does not tell the full story.

If we take commercial paper into account, annual credit growth was closer to 12 per cent throughout 2006. We can see the start of a down-trend in mid-2007 and further falls would indicate that the housing market contagion is spreading to other parts of the economy.

If a nation expects to be ignorant and free, it expects what

never was

and never will be.

~ Thomas Jefferson

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.