Euro Within Reach Of $1.50

By Colin Twiggs

November 6, 2007 2:00 a.m. ET (6:00 p.m. AET)

In an attempt to make this newsletter more readable, I will

trial splitting the coverage in two: gold, oil and forex on

Tuesdays; the economy and interest rates on Thursdays. We will

conduct a survey, after a few weeks, to obtain your

feedback.

These extracts from my trading diary are for educational

purposes and should not be interpreted as investment advice.

Full terms and conditions can be found at

Terms of Use.

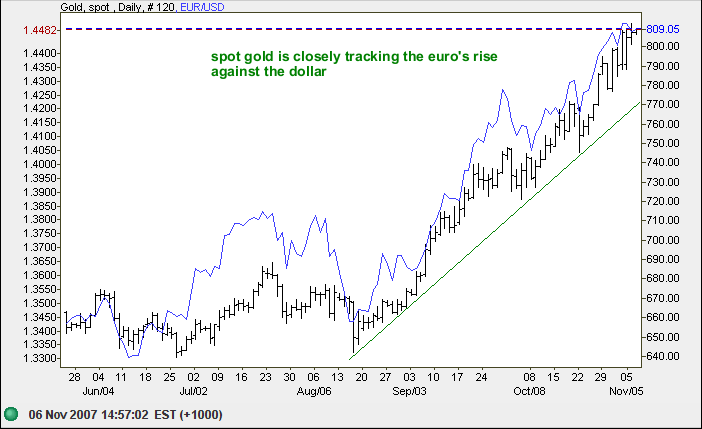

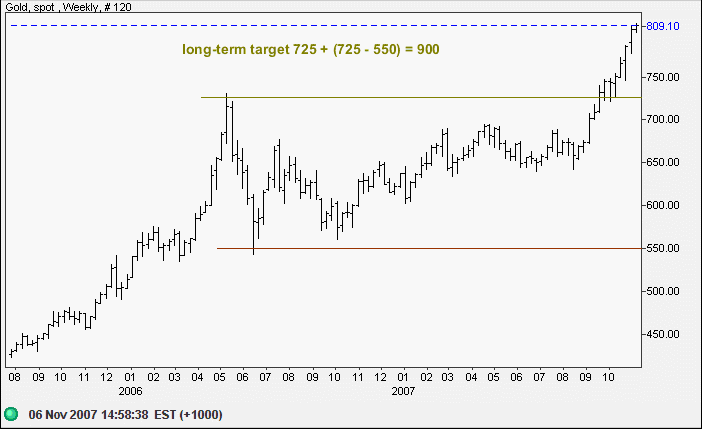

Gold

Gold broke through $800 and is likely to retrace to test support at the former resistance level. The metal shows similar appreciation to the euro against the dollar following recent rate cuts by the Fed. Reversal below $770/ounce is now unlikely and would warn of another correction.

The long-term target remains at $900 [725+(725-550)].

Source: Netdania

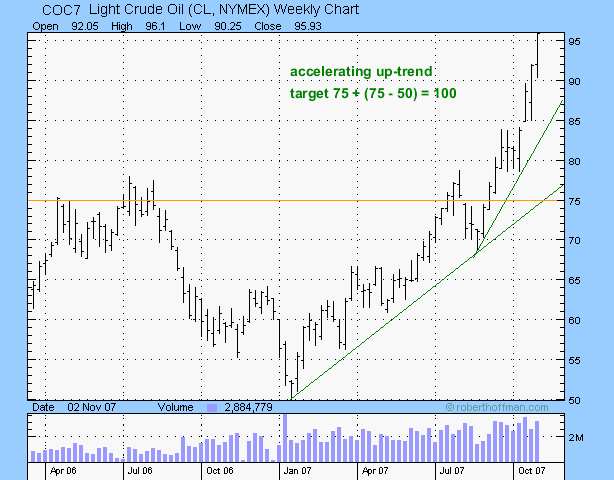

Crude Oil

December Light Crude is also advancing rapidly as the dollar weakens. The target of $100/barrel is likely to be tested in the next few weeks, but the accelerating up-trend is in danger of heading into a blow-off, with sharp gains followed by an equally sharp fall. Reversal below $90 is not expected in the short-term — and would warn of a correction.

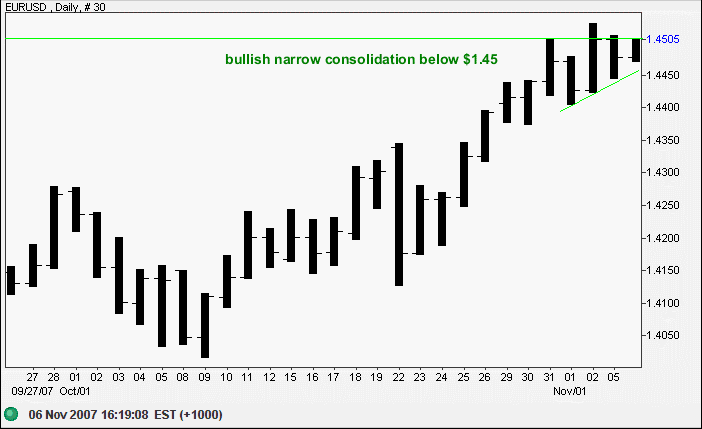

Currencies

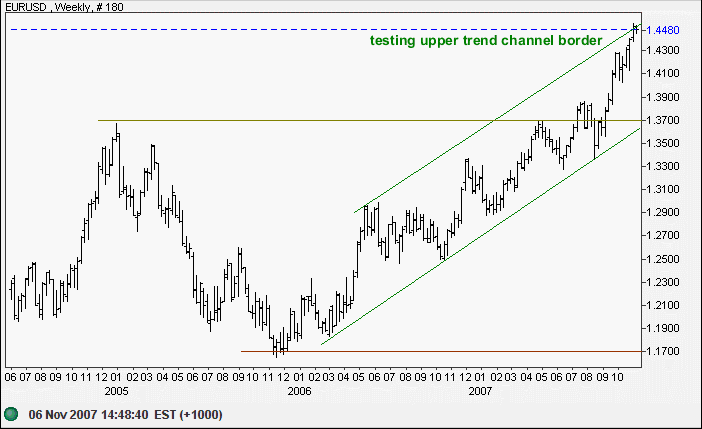

The euro is consolidating in a bullish narrow formation below resistance at $1.45. Breakout would offer a short-term target of $1.50 [1.45+(1.45-1.40)].

In the long-term the euro continues to test the upper border of the trend channel. Reversal below $1.40 would warn of a correction to the lower channel border, while a breakout above $1.45 would indicate that the up-trend is accelerating. It may be prudent to use the more conservative long-term target of $1.50 [1.35+(1.35-1.20)] which coincides with the short-term target.

Source: Netdania

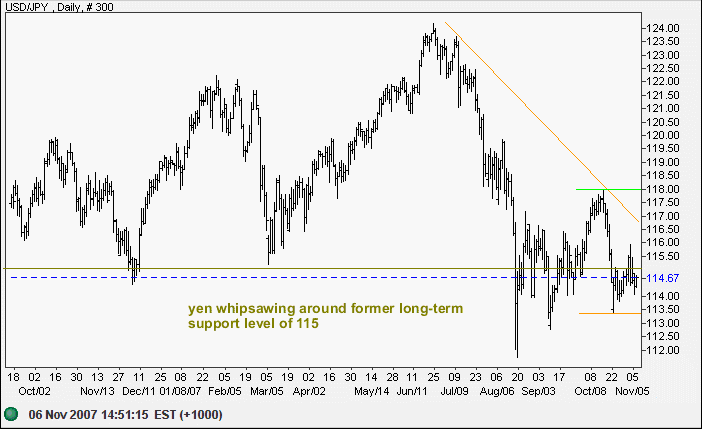

The dollar is whipsawing around the former long-term support level of 115 against the yen, indicating uncertainty. Any sign that the yen is strengthening could result in a sharp move as there are a large number of carry trades reliant on the currency. A fall below 113.25 may be sufficient to precipitate this, while failure of support at 112 would signal a test of the key 100 support level (from 2005).

Source: Netdania

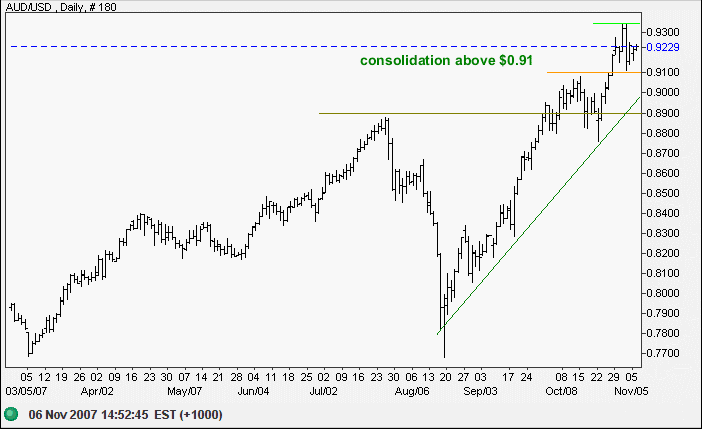

The Australian dollar respected the new support level of $0.9100 on retracement and is now consolidating between $0.9100 and $0.9350. Expect an upward breakout with a short-term target of $0.9600 [0.9350+(0.9350-0.9100)]. Reversal below the rising (green) trendline is unlikely — and would warn of a secondary correction. The long-term target remains parity [0.8900+(0.8900-0.7800)].

Source: Netdania

It is the greenback which is unstable, and not bullion.

~ Dr. Franz Pick

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.