Banks Under Pressure

By Colin Twiggs

November 3, 2:00 a.m. ET (5:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA

A better than expected jobs report, with 166,000 new jobs created in October, failed to boost stocks after the Federal Reserve reported that it had injected $41 billion of temporary funding into financial markets on Thursday. This is the highest single day total since September 19, 2001 and a sign that banks are feeling the credit squeeze.

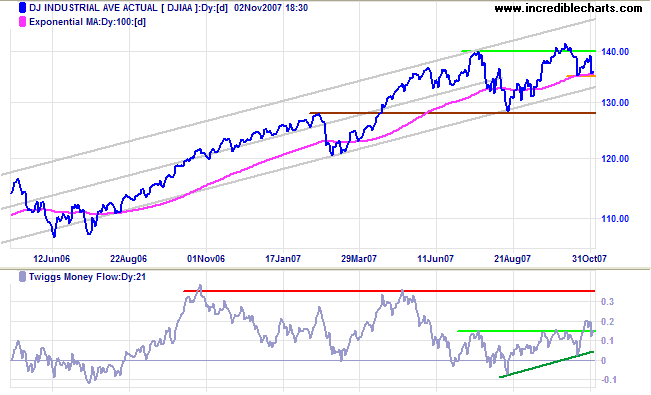

Dow Jones Industrial Average

The Dow Jones Industrial Average is again testing support at 13500 after a failed attempt at 14000. Breakout above the all-time high (14200) would confirm the next target of 15000 [14000+(14000-13000)], while a close below 13500 would indicate another secondary correction.

Twiggs Money Flow adds to the uncertainty, offering conflicting signals for the three time frames: short-term distribution; medium-term accumulation (green trendline); and a long-term bearish divergence (red).

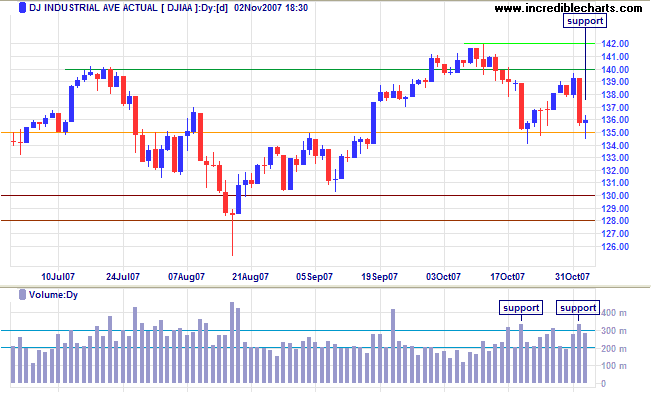

Short Term: Long tails and higher volumes indicate buying support at 13500. Expect further consolidation between 13500 and 14000, with future direction indicated by a breakout.

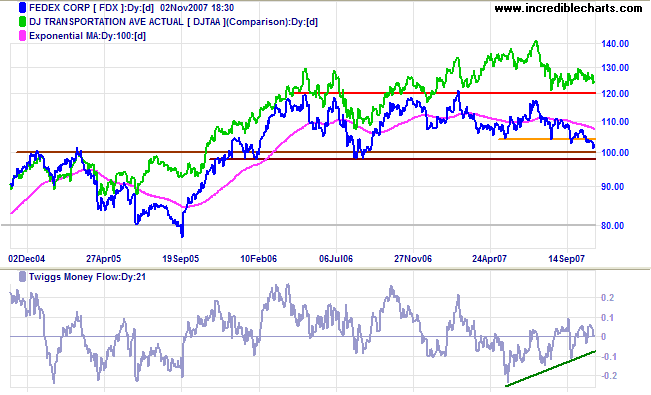

Transport

Fedex remains headed for a test of support at $100 and is dragging the Dow Jones Transportation Average towards a test of its primary support level of 4700. Reversal of Twiggs Money Flow below the rising (green) trendline would indicate that support at $100 is unlikely to hold (a bear signal for the broader economy), while a rise above the recent high of 0.1 would signal buying support.

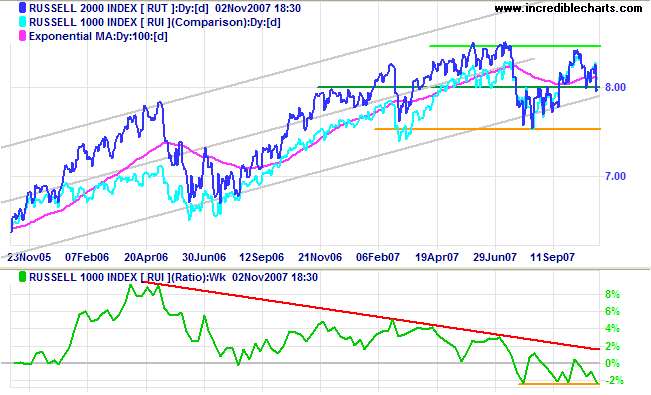

Small Caps & Technology

The Russell 2000 closed below 800, signaling another test of primary support at 750. The declining Price Ratio highlights the shift from small caps to safer, large cap stocks.

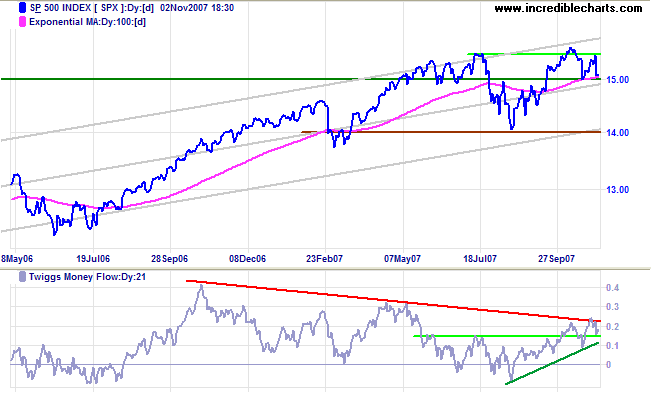

S&P 500

The S&P 500 encountered resistance at 1550 and is now testing support at the key 1500 level. Expect further consolidation between 1500 and 1550 with future direction indicated by a breakout. A close below 1500 would signal another test of primary support at 1400; while a close above 1550 would indicate a primary advance with a target of 1700 [1550+(1550-1400)], confirmed if there is a rise above 1575. Twiggs Money Flow signals strong medium-term accumulation, but the long-term bearish divergence remains.

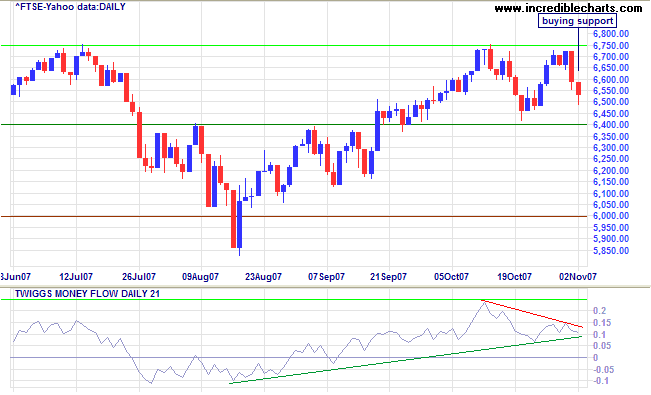

United Kingdom: FTSE

The FTSE 100 is headed for another test of support at 6400 after respecting resistance at 6750. Long tails on Thursday and Friday signal buying support, but Twiggs Money Flow continues to display a bearish decline, although the (green) medium-term signal remains positive. A close below 6400 would warn of a secondary correction to test primary support at 6000, but breakout above 6750 remains equally likely — and would signal a test of the all-time high of 6930.

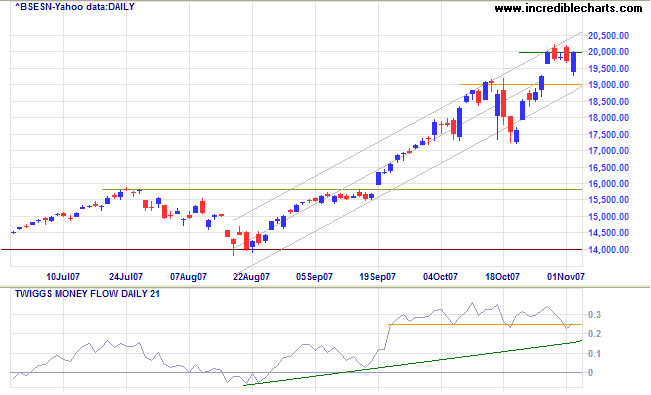

India: Sensex

After breaking through 19000, the Sensex is testing resistance at 20000, at the upper trend channel. Twiggs Money Flow continues to signal accumulation, while primary support remains a long way below at 14000.

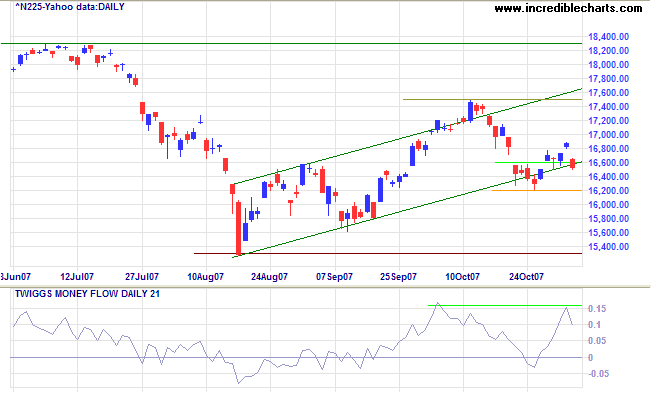

Japan: Nikkei

The Nikkei 225 is testing the lower border of the trend channel, whipsawing around the former primary support level of 16600. A rise above 16900 would signal a swing to the upper channel border, while failure of support at 16200 would test primary support at 15300. Twiggs Money Flow displays strong short-term accumulation.

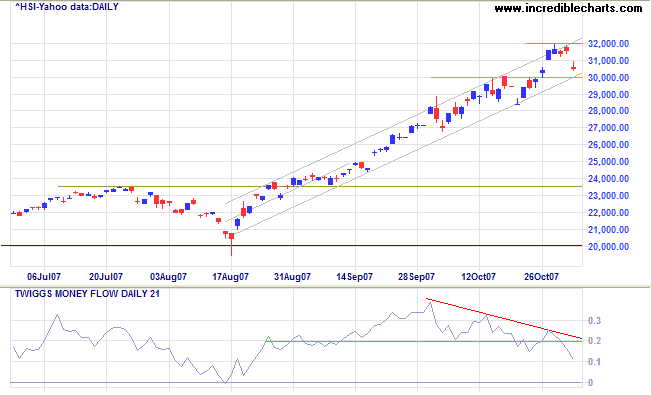

China: Hang Seng & Shanghai

The Hang Seng index continues to follow the trend channel, retracing to test support at 30000 after finding resistance at 32000. Twiggs Money Flow, however, shows a strong bearish divergence, warning of significant profit-taking. A break below 30000 (and the trend channel) would signal a secondary correction, while respect of support would indicate another test of the upper trend channel. The index remains a long way above primary support at 20000.

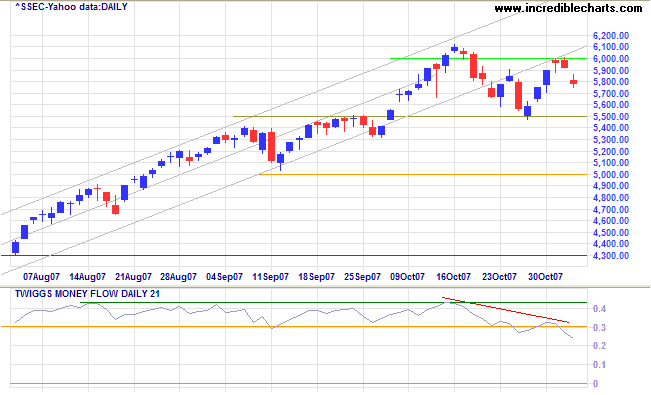

The Shanghai Composite Index failed to recover after breaking below the trend channel, the latest rally respecting resistance at 6000. Expect another test of support at 5500. Failure (of 5500) would signal a secondary correction; while recovery above 6000, though less likely at present, would indicate another primary advance. Twiggs Money Flow warns of (medium-term) distribution after breaking through support at 0.3.

Shanghai remains in the final phase of a bull market and, with primary support a long way below at 3600, may be prone to a sharp fall.

Australia: ASX

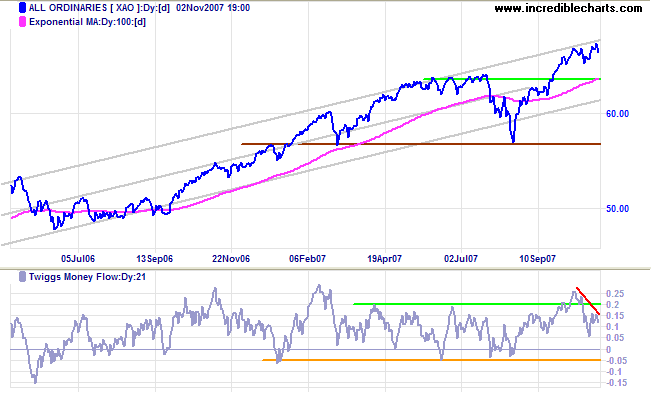

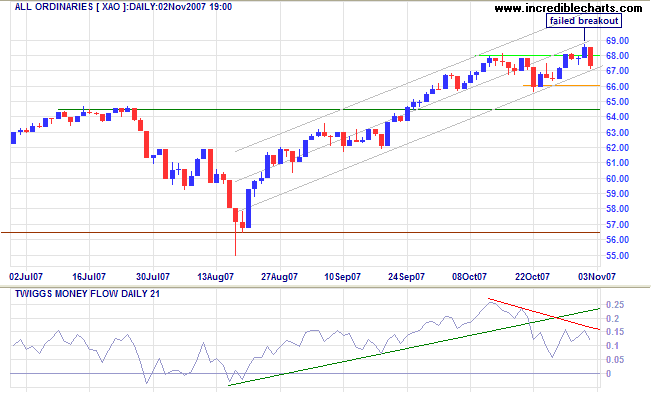

The All Ordinaries is consolidating at the upper border of the trend channel, while Twiggs Money Flow has fallen sharply, suggesting a down-swing to the lower channel border. Recovery above 6800, while less likely at present, would present a target of 7250 [6450+(6450-5650)].

Short Term: The failed breakout above 6800 warns of a test of support at 6600. A close below 6600 would warn of a secondary correction, while reversal above 6800 would indicate another advance.

Whosoever controls the volume of money in any country is

absolute master of all industry and commerce... And when you

realise that the entire system is very easily controlled, one

way or another, by a few powerful men at the top, you will not

have to be told how periods of inflation and depression

originate.

~ Pres. James Garfield (1881)

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.