The Liquidity Squeeze Continues

By Colin Twiggs

October 25, 2007 5:00 a.m. ET (7:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

Economy

No amount of financial engineering or SIVs will turn a bad loan into a good one. Sooner or later banks (or ABS investors) will have to recognize the loss — unless they can get the taxpayer to foot the bill. There are no appeals for a bailout yet, but do not be surprised to see this idea floated over the next year. The precedent was established in the 1970s and 1980s of the government stepping in to guarantee the liabilities of large entities in financial difficulty — "in the interests of preserving the stability of the financial markets and to protect the taxpayer". All losses are thereafter borne by the taxpayer (some protection!) and the banks end up making a profit where they stood to lose billions of dollars. The S&L debacle of the 1980s and 1990s, for example, cost the US taxpayer more than $500 billion according to some estimates. Ask any parent what happens if you reward bad behavior: you end up with an uncontrollable child. Little wonder that the history of financial debacles keeps on repeating itself.

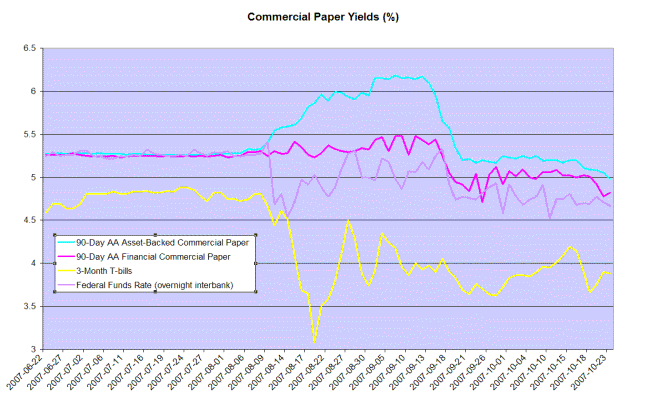

The Fed keeps pumping liquidity into financial markets and commercial paper rates are settling back towards the fed funds rate. This is not the full story, however, with the 3-month treasury yield below 4.0%, signaling investors continued aversion to risk.

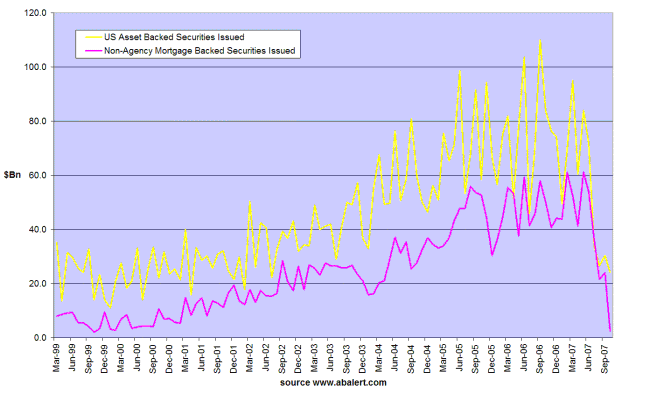

New issues of asset-backed and mortgage-backed securities (up to October 18) have dried up almost completely and concerned investors are unlikely to roll-over existing short-term and medium-term notes as they mature. The scramble to set up a $100 billion SIV is aimed at averting the immediate threat of banks having to take a large chunk of existing ABS funding onto their balance sheets.

The Fed will be forced to maintain a high level of liquidity over the next few months and another rate cut is likely, causing a further decline in the dollar and boosting gold and oil prices.

Gold

Gold successfully tested support at $750, confirming the long-term target of $900 [730+(730-550)]. A rise above $770 would signal another (medium-term) advance. Reversal below $725/ounce is unlikely — and would warn of another correction. Gold is expected to appreciate as the US dollar weakens.

Source: Netdania

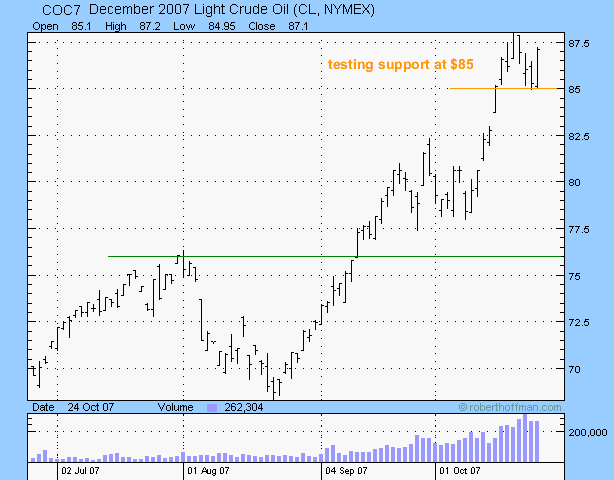

Crude Oil

December Light Crude respected support at $85 per barrel. A rise above $88 would signal another (medium-term) advance, in line with gold. Reversal below $82.50 is unlikely — and would signal a secondary correction. Expect crude to appreciate as the dollar weakens.

Currencies

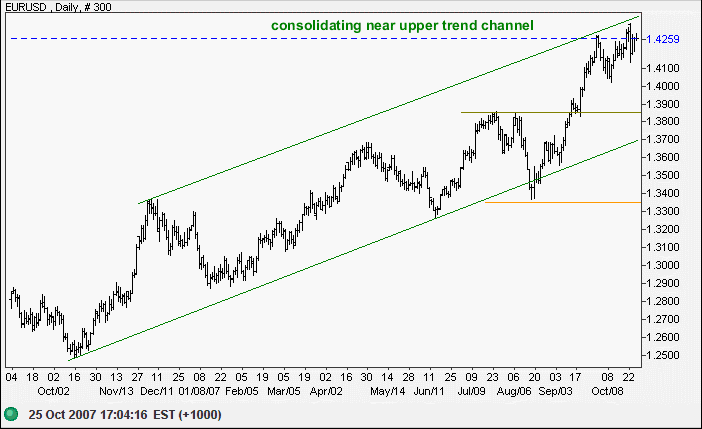

The euro is consolidating against the dollar at the

upper trend channel. A fall below the week's low would signal a

test of the lower channel border, while a new high would

indicate an accelerating up-trend — which could lead to a

blowoff.

The long-term target is $1.57 [1.37+(1.37-1.17)].

Source: Netdania

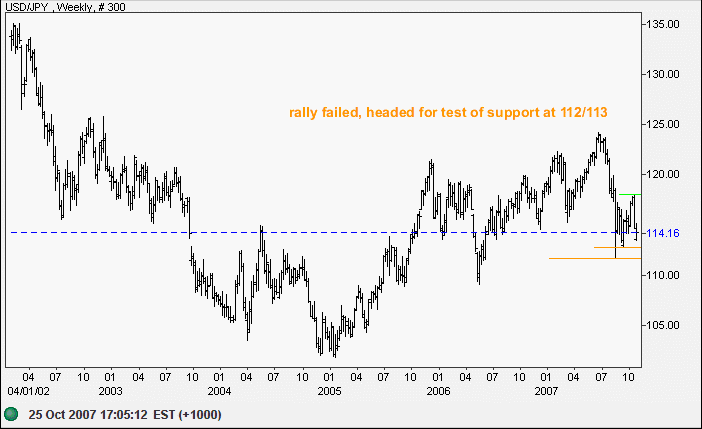

The dollar's rally against the yen failed and we are now headed for a test of support at 112. Failure would signal a test of the key 100 support level (from 2005).

Source: Netdania

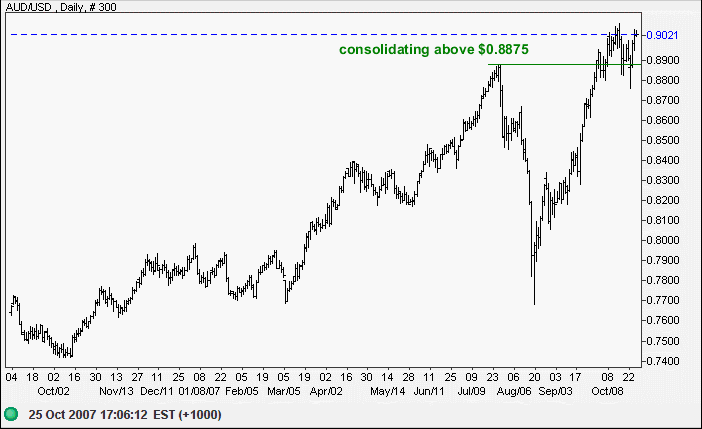

The Australian dollar is consolidating between 0.8875 and $0.9100. Expect an upward breakout, which would confirm the long-term target of parity with the greenback. Failure of support is unlikely (despite several false breaks) — and would warn of a correction.

Source: Netdania

Treasury Yields

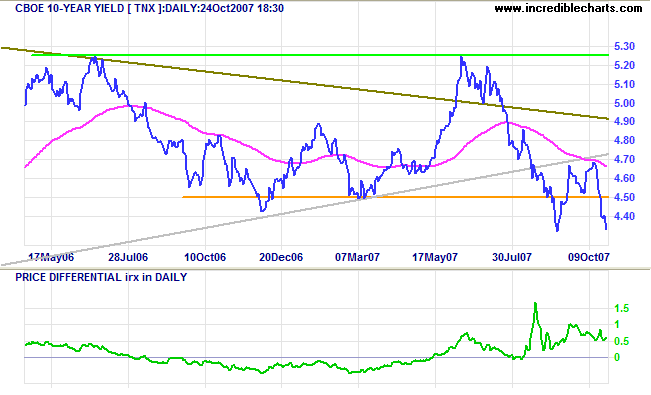

Ten-year treasury yields are falling despite the weakening

dollar, reflecting investors flight to safety.

The yield differential (10-year minus 13-week treasury yields)

remains low, indicating a flat yield curve and added pressure

on bank margins.

Stock Markets

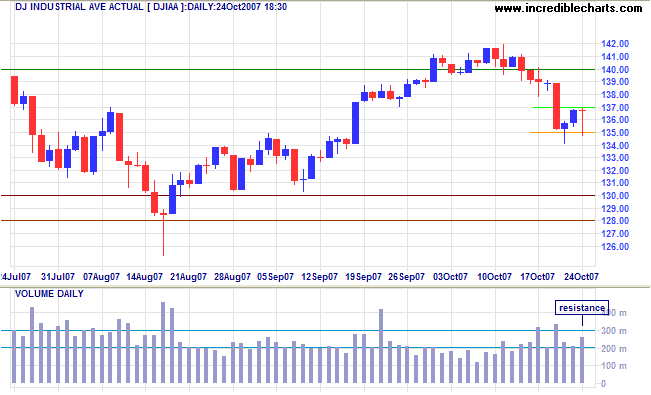

The Dow encountered resistance at 13700 and reversal below 13500 would signal a test of primary support (at 12800).

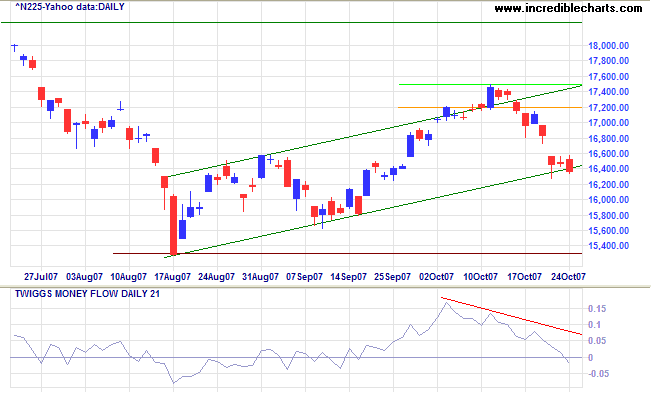

The Nikkei is headed for a test of primary support at 15300 after breaking below the trend channel. Twiggs Money Flow signals strong distribution.

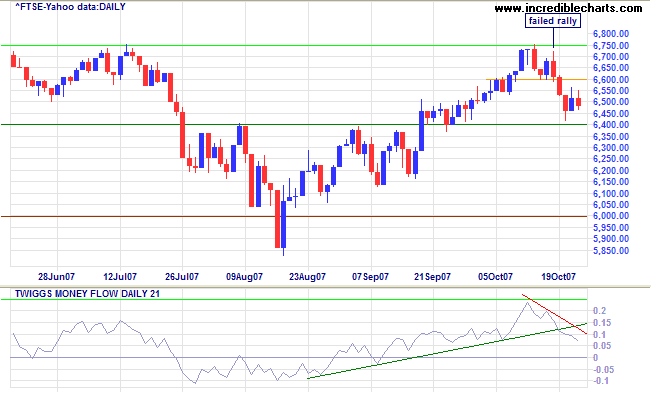

An FTSE 100 fall below 6400 would signal a test of primary support at 6000/5850. Twiggs Money Flow signals distribution. Recovery above 6600 is not expected and would signal a test of 6750.

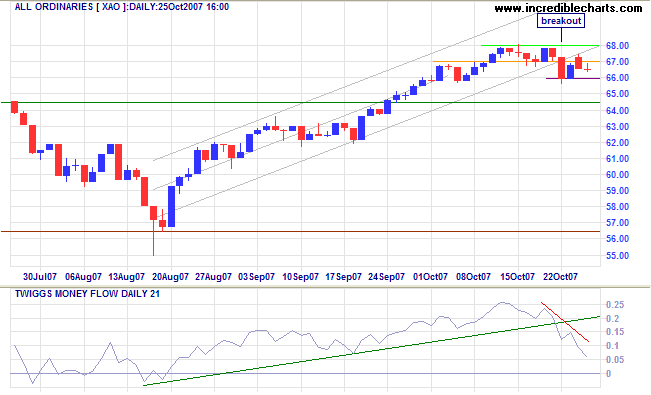

The Australian All Ordinaries broke below its trend channel and Twiggs Money Flow signals strong distribution, warning of a secondary correction.

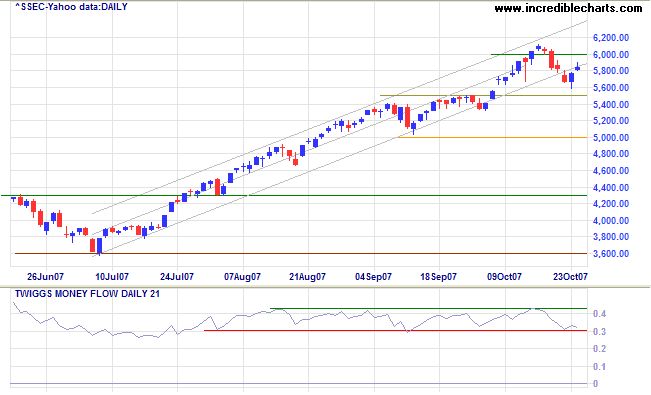

The Shanghai Composite is the only ray of sunshine: testing resistance at 6000. A breakout would signal a test of the upper trend channel, but reversal is as likely, considering bearish sentiment in other markets, and a fall below 5600 would warn of a secondary correction.

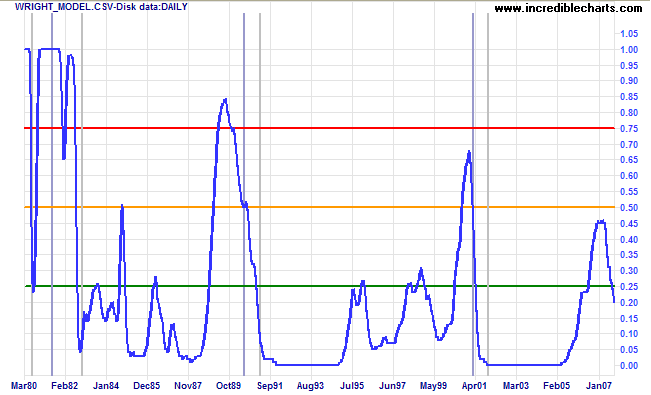

Wright Model

Probability of recession in the next four quarters eased to 20 per cent according to the Wright Model. The model fairly accurately predicts recessions caused by contraction of the money supply, but I suspect that it may way off the mark in identifying mischief caused by excess liquidity and artificially low interest rates.

With market and credit risk, you could lose a fortune.

With liquidity risk, you could lose the bank!

~ Bruce McLean Forrest, UBS Treasury Group

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.