Market Consolidates Ahead Of September 30th

By Colin Twiggs

September 29, 2007 4:00 a.m. ET (6:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA

The extent of stock-pumping by fund managers to improve their quarter-end results is difficult to gauge, but all should become clear as positions are unwound over the next few days.

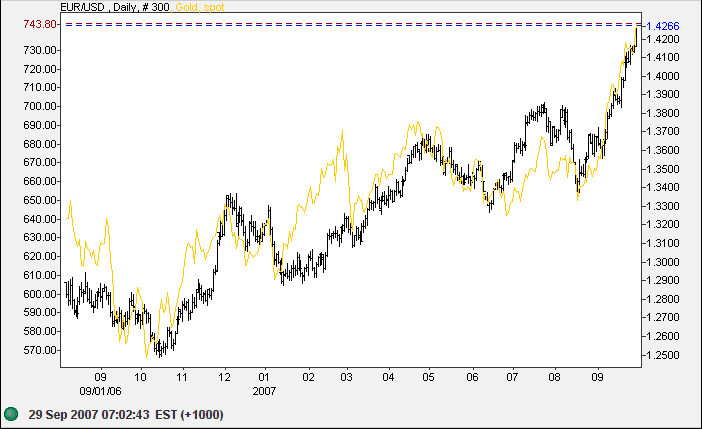

The dollar has fallen to new lows against the euro and gold and oil have responded accordingly, with gold rising to $743.80/ounce and December light crude at $80.48/barrel. There may yet be another retracement to test support at $730/ounce, but the long-term target for gold is $900 [730+(730-565)].

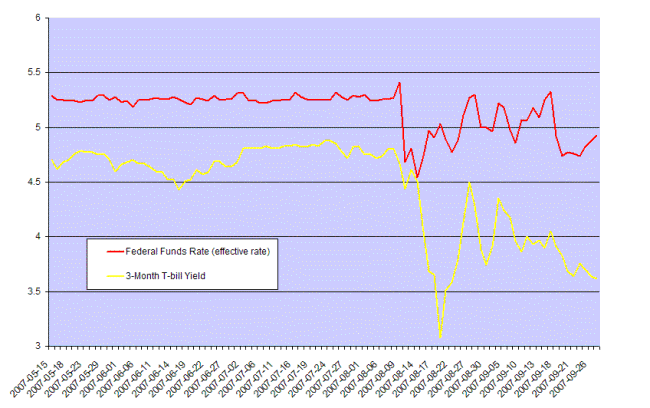

A falling dollar may stimulate exports, but the subprime credit squeeze is likely to endure for some time. Declining yields on 3-month treasury bills reflect ongoing concern with all but the best borrowers in the financial markets: investors are prepared to accept a discount of 140 basis points over the equivalent rate on AA financial paper. The surge in the effective federal funds rate is larger than at previous month-ends, indicating that banks are feeling the credit squeeze, even with extra liquidity injected by the Fed.

Dow Jones Industrial Average

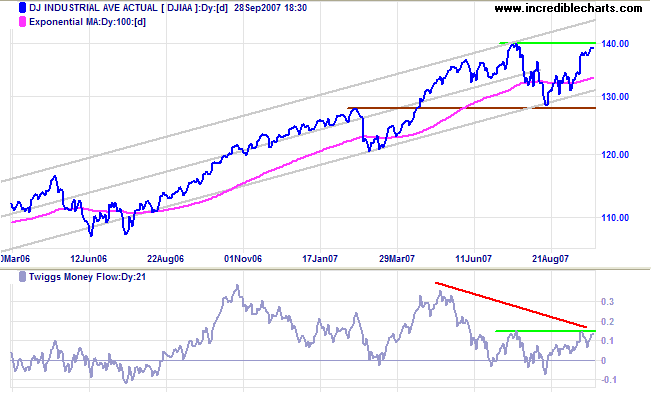

Despite the credit squeeze the Dow Jones Industrial Average is close to its all-time high of 14000. Breakout above 14000 would signal a test of the upper trend channel and a target of 15000 [14000+(14000-13000)]. Respect of resistance (at 14000) would warn of a test of primary support at 12800/13000.

Twiggs Money Flow signals short-term accumulation, but long-term distribution. A rise above the July high, however, would indicate buying strength.

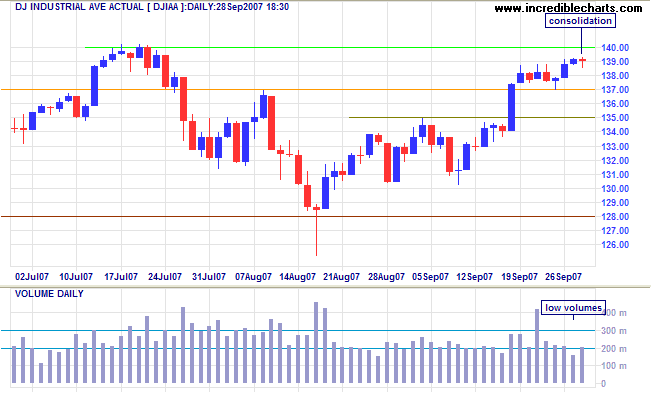

Short Term: The index is consolidating between 13700 and 14000. Expect a test of support after the quarter-end. Respect would be a bull signal, while failure would warn of another correction.

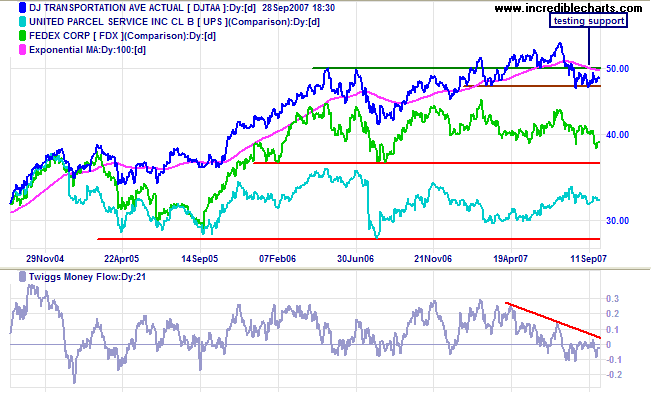

Transport

Dow Jones Transportation Average continues to consolidate between 4700 and 5000, reflecting uncertainty over the economy. Breakout will signal future direction. Fedex and UPS have been ranging for the past 18 months and penetration of support at $100 and $67 respectively would be bearish signs.

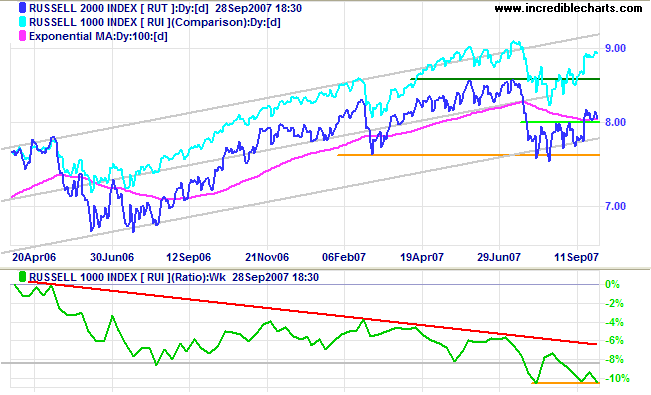

Small Caps

The Russell 2000 has under-performed relative to the large cap Russell 1000 index over the past 18 months. Price Ratio confirms long-term migration to the safety of large cap stocks.

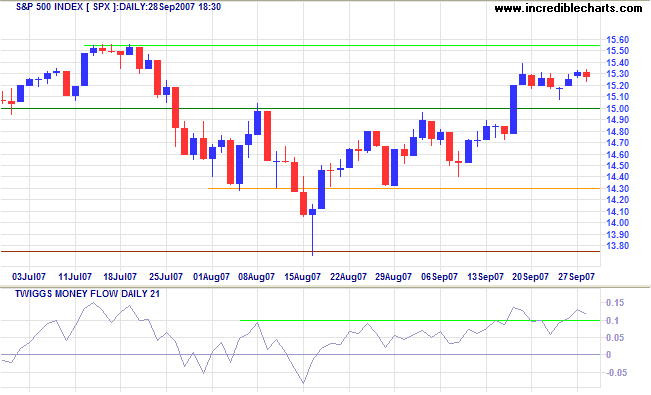

S&P 500

The S&P 500 is also consolidating ahead of the quarter end. Expect a test of support at 1500. Respect would be a bullish signal, while failure would warn of a test of primary support at 1400. Twiggs Money Flow signals short-term accumulation.

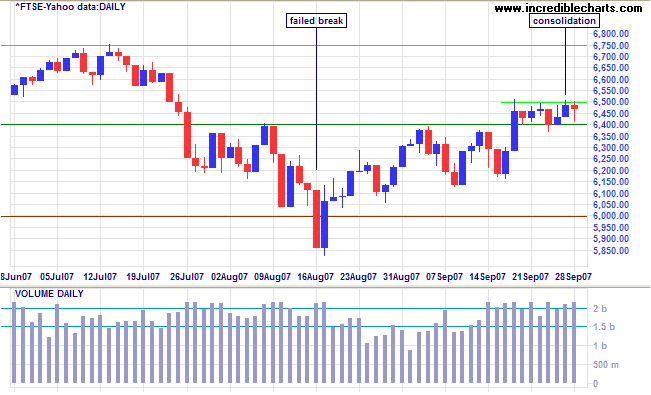

United Kingdom: FTSE

The FTSE 100 is consolidating in a narrow band between 6400 and 6500. Strong volume over the past week warns of distribution. Breakout will signal future direction: either a test of resistance at 6750 or of primary support at 6000/5850.

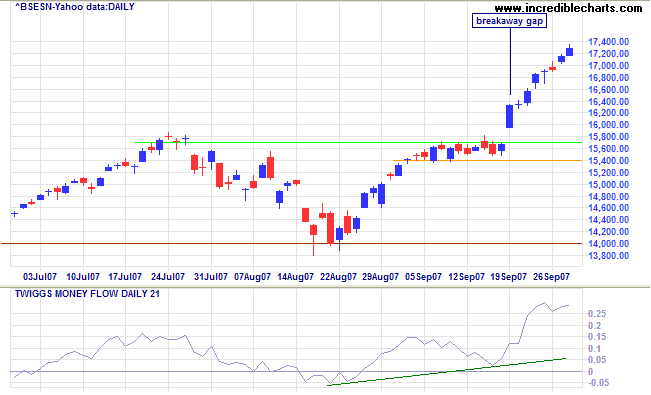

India: Sensex

The Sensex has been rising sharply since the breakaway gap on September 19. The calculated target is 17400 [15700+(15700-14000)], but I suspect that the index will reach 18000 [16000+(16000-14000)] as the Sensex tends to advance in steps of 2000. Rising Twiggs Money Flow signals strong medium-term accumulation. Primary support remains at 14000.

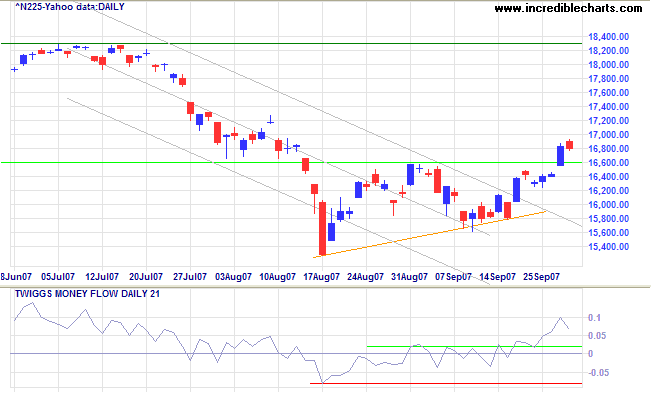

Japan: Nikkei

The Nikkei 225 broke through resistance at 16600 after an ascending triangle formation, indicating weakness in the primary down-trend. Twiggs Money Flow is rising, signaling short-term accumulation. Expect retracement to test the new support level. This is a bear market rally and the outcome remains unpredictable: slow steady gains would be reassuring while a sharp rally will often reverse just as quickly.

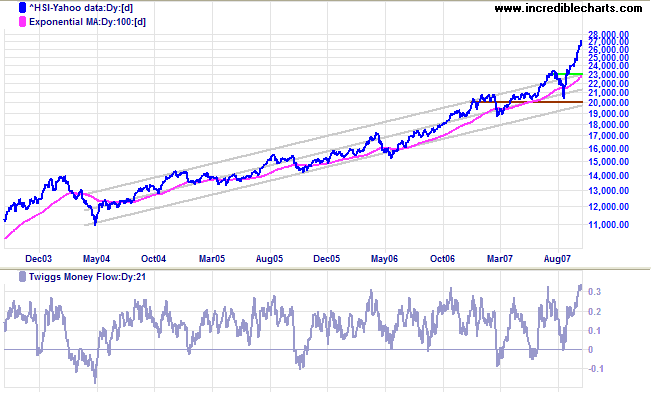

China: Hang Seng & Shanghai

The Hang Seng is accelerating in a strong up-trend, while Twiggs Money Flow reflects exceptional long-term accumulation, with only a few small dips below the zero line since mid-2004. The Hang Seng trades at a lower Price Earnings multiple than the Shanghai Composite (19 v. 26 according to Forbes Global Market Scorecard) and the two now appear to be converging.

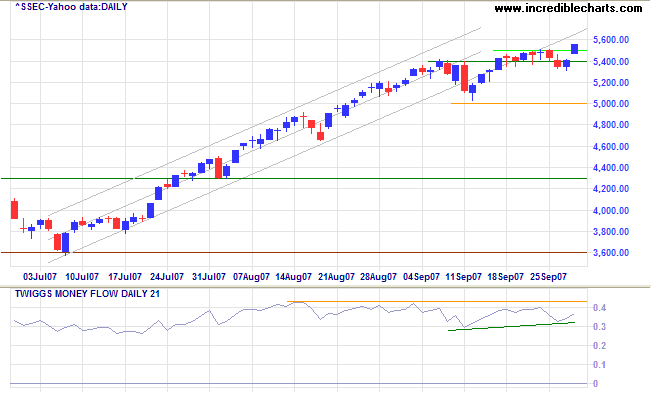

The Shanghai Composite broke through resistance at 5500 after consolidating in a narrow band. Mild bearish divergence remains visible on Twiggs Money Flow, but rising lows now signal short-term accumulation. The next target is 6000 [5500+(5500-5000)], but we need to remain cautious as the index has slowed to below its trend channel. Reversal below 5000 would warn of a secondary correction. The primary trend is in the final stage of a bull market, where advances are more likely to be based on expectations of further price rises rather than actual results.

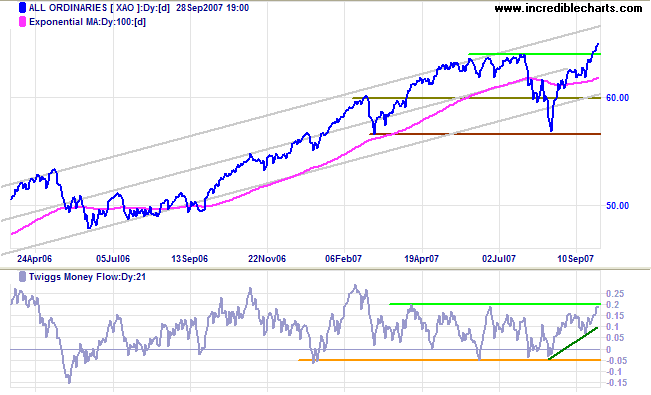

Australia: ASX

The All Ordinaries broke through its previous high of 6460, ahead of the Dow and S&P 500, signaling a test of the upper trend channel and offering a target of 7300 [6500+(6500-5700)]. After an initial overshoot, the index tends to correct to confirm support at each thousand marker (the same pattern has occurred at 4000, 5000 and 6000). Twiggs Money Flow, signals strong medium- and long-term accumulation and a rise above 0.2 would be a further bull signal.

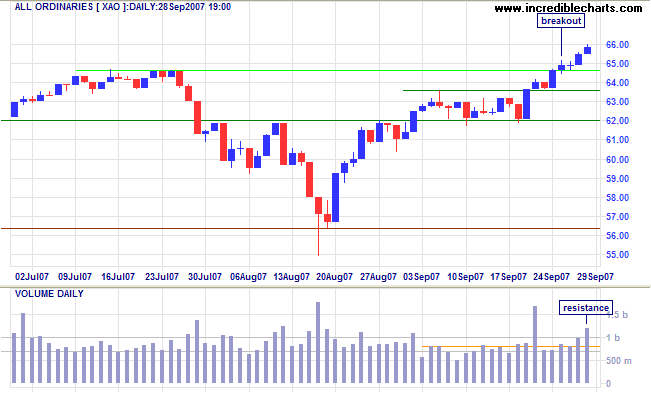

Short Term: Strong volume over the last two days and a weaker close on Friday signal resistance. Expect retracement to test the new support level of 6460 in the next week. Respect of support would be a bull signal, while failure would warn of another correction — confirmed if there is a close below 6200.

It is part of the unceasing human endeavour to prove that the

spirit of man can transcend the flaws of his nature.

~ Aung

San Suu Kyi: 1991 Nobel Peace Prize Winner and political

detainee in Myanmar (Burma) for the past 17 years.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.