Fundamentals v. Technicals

By Colin Twiggs

September 14, 2007 3:30 a.m. EST (5:30 p.m. AEST)

The Saturday newsletter is a day early &mdash I am taking a short break over the weekend. These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA

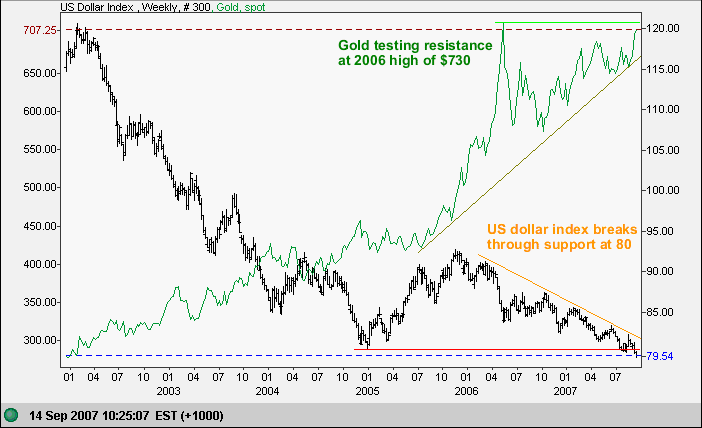

Anticipation of a Fed rate cut is weakening the US Dollar, with the Dollar Index breaking support at 80 to find a new 10-year low. This is likely to have a positive effect on export industries and reduce the trade deficit. Spot gold, as a consequence of the declining dollar, is headed for a test of the 2006 high of $730.

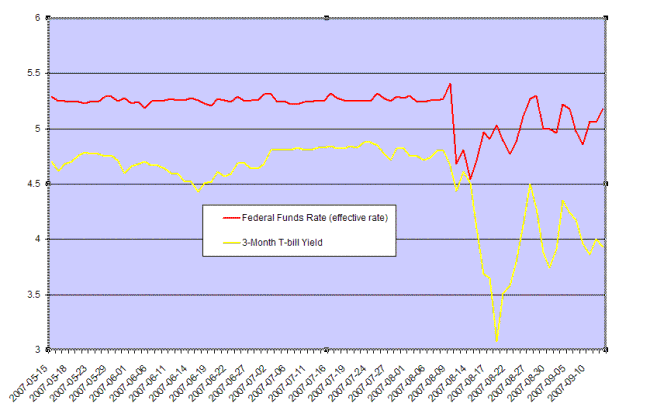

Offsetting the export boost is the credit squeeze in financial markets, the full impact of which will only be apparent after earnings are released for the current quarter. The Fed continues to boost liquidity, with the effective federal funds rate oscillating below the target rate of 5.25%. Treasury bill yields below 4.0% show that investors are prepared to pay a substantial premium for the safety of T-bills over commercial paper.

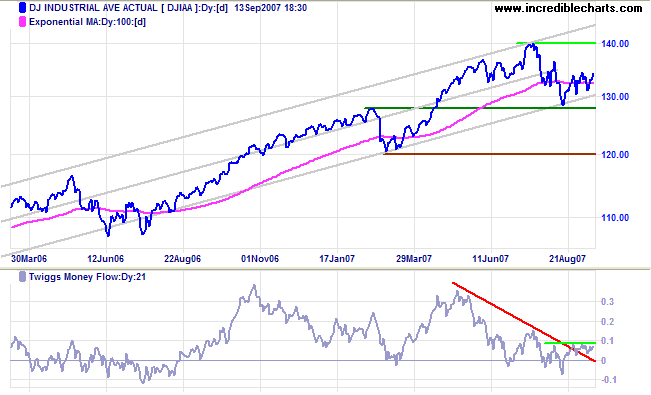

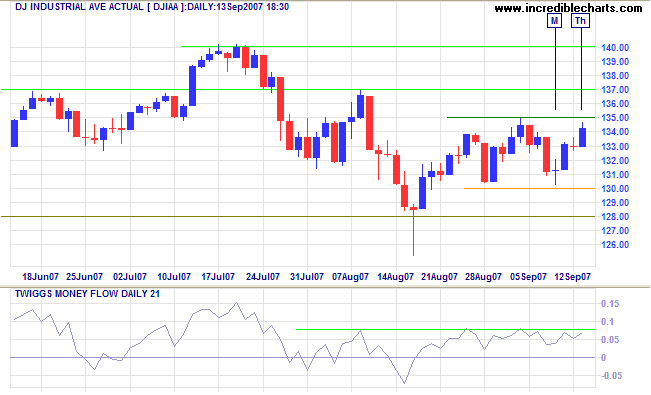

Dow Jones Industrial Average

The Dow Jones Industrial Average is consolidating above 13000, at the lower border of the trend channel, and Twiggs Money Flow ranging above zero signals short-term accumulation. The primary trend is up and, despite the economic uncertainty, an advance to test the upper border of the channel is more likely. Breakout below 13000, however, would warn of a test of primary support at 12000.

Short Term: Volatility remains high, signaling uncertainty, so further consolidation may be required before the market shows real direction. A rise above 13500 would signal a primary advance, while a fall below 13000 would warn that the secondary correction will continue. A Twiggs Money Flow (21-day) rise above 0.08 would be a bullish sign.

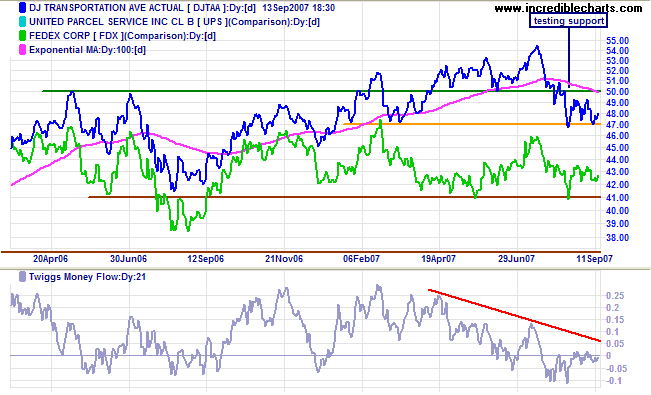

Transport

Dow Jones Transportation Average is testing support at 4700. Downward breakout would signal the start of a primary down-trend, while a close above 4950 would indicate recovery. Fedex continues to range long-term in a narrow band, reflecting uncertainty over the economy.

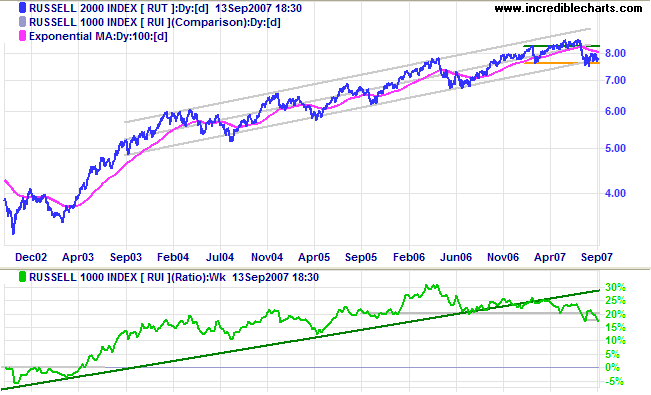

Small Caps

The Russell 2000 is declining faster than the large cap Russell 1000 index. The Price Ratio (Russell 2000/1000) decline (below the August low) confirms a long-term swing towards the safety of large cap stocks.

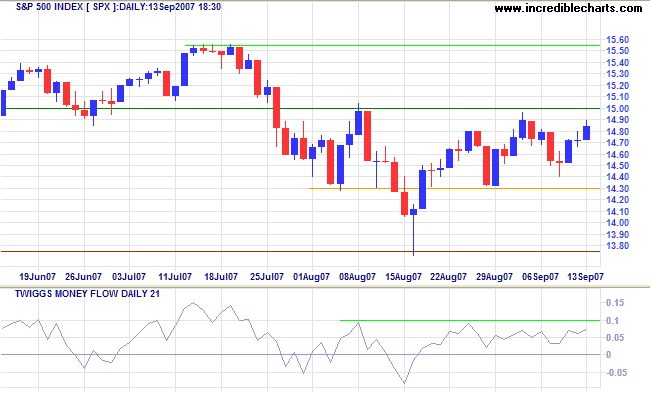

S&P 500

The S&P 500 is ranging in a narrow band between 1430 and 1500. Twiggs Money Flow consolidating above zero indicates short-term accumulation and a rise above 0.1 would be a bullish sign. The primary up-trend means that breakout above 1500 is more likely, and would signal another primary advance, while a fall below 1430 would warn of a test of primary support at 1370.

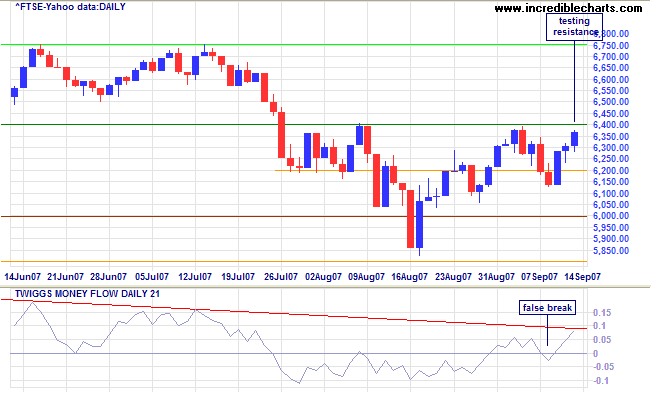

United Kingdom: FTSE

The FTSE 100 is testing resistance at 6400; the failed break below 6200 signaling short-term accumulation. Breakout above 6400 is more likely, and would signal continuation of the primary up-trend, while reversal below Monday's low would mean another test of primary support at 6000.

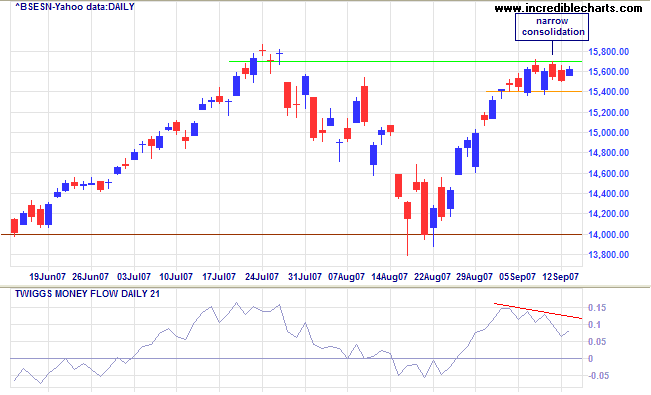

India: Sensex

The Sensex displays a bullish narrow consolidation below resistance at 15700. An upward breakout is likely and would signal an advance with a target of 17400 [15700+(15700-14000)]. Bearish divergence on Twiggs Money Flow, however, warns of distribution and a close below 15400/15350, while not as likely, would warn of another correction.

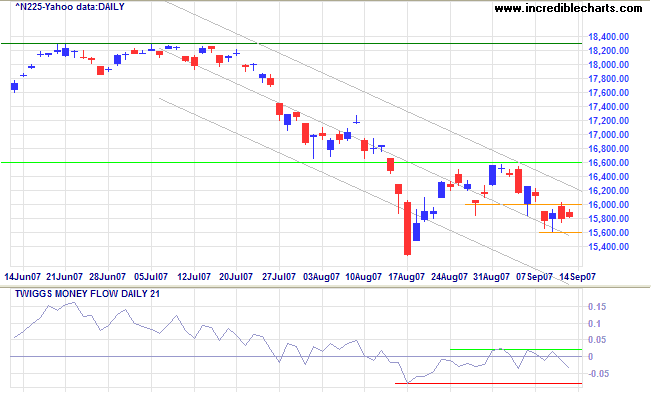

Japan: Nikkei

The Nikkei 225 is consolidating below short-term support at 16000, while Twiggs Money Flow whipsaws around zero, signaling uncertainty. The primary trend is down and breakout below 15600 would warn of a swing to test the lower border of the trend channel.

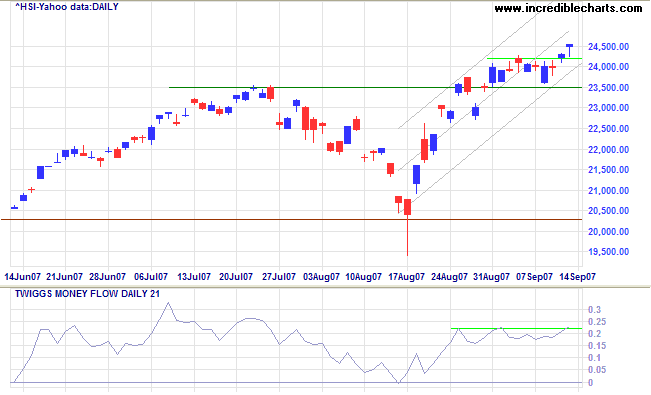

China: Hang Seng & Shanghai

The Hang Seng continues to advance in a strong primary up-trend with a target of 26700 [23500+(23500-20300)]. Breakout above the recent consolidation signals a rally to test the upper border of the trend channel. Twiggs Money Flow shows strong accumulation.

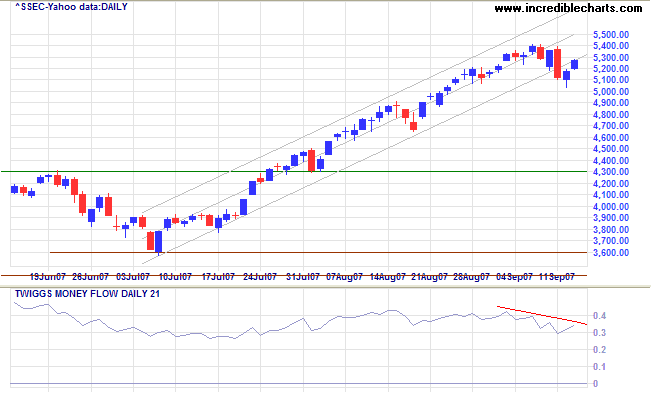

The Shanghai Composite breached the lower border of its trend channel, while bearish divergence on Twiggs Money Flow indicates short-term distribution. A rise above 5400 would signal continuation of the advance, while reversal below 5000 would warn of a secondary correction. The primary up-trend has reached the final stage of a bull market — where speculation dominates and advances are based on hopes and expectations rather than actual results.

Australia: ASX

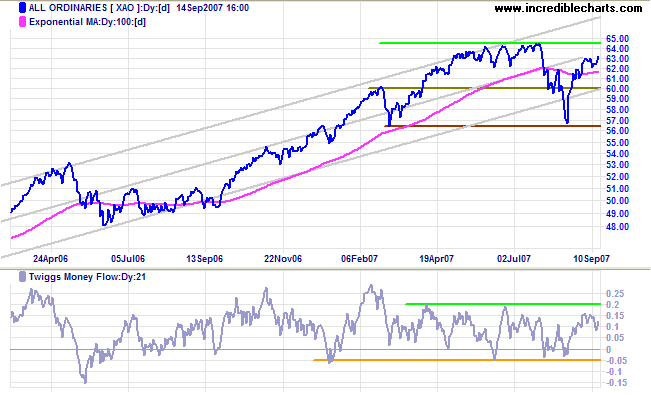

The All Ordinaries is cautiously advancing towards a test of the previous high at 6460. A Twiggs Money Flow (21-day) rise above 0.2 would be a strong bull signal and a new advance on the Dow or S&P 500 would add further impetus to the primary up-trend. Reversal below 6000 is now unlikely and would indicate another test of primary support at 5650.

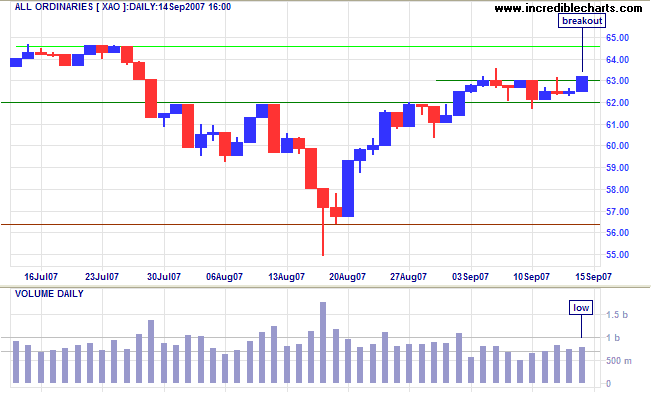

Short Term: Breakout above the narrow consolidation between 6200 and 6300 signals a test of the previous high from July 2007. Reversal below 6200 is now considered unlikely — and would signal a test of 6000.

I never argue with the tape.

~ Jesse Livermore in Reminiscences of a Stock Operator by Edwin Lefevre.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.