Gold, Oil, Currencies & Interest Rates

By Colin Twiggs

September 11, 2007 4:30 a.m. EST (6:30 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

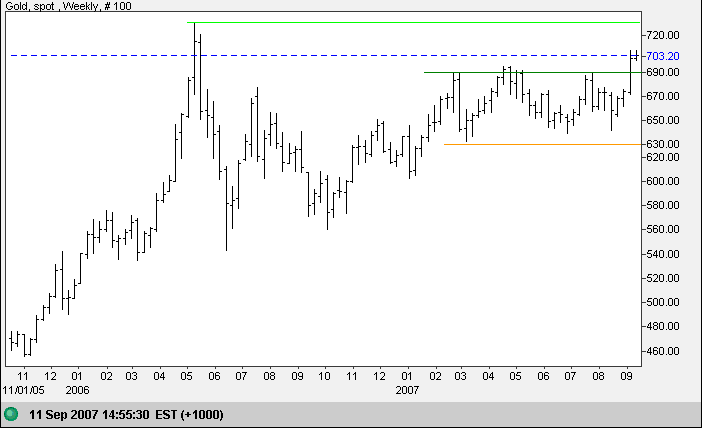

Gold

Spot gold broke through resistance at $690 and is now consolidating above the new support level — a bullish sign. Expect a test of resistance at the 2006 high of $730 as investors seek safety from turbulent financial markets.

Source: Netdania

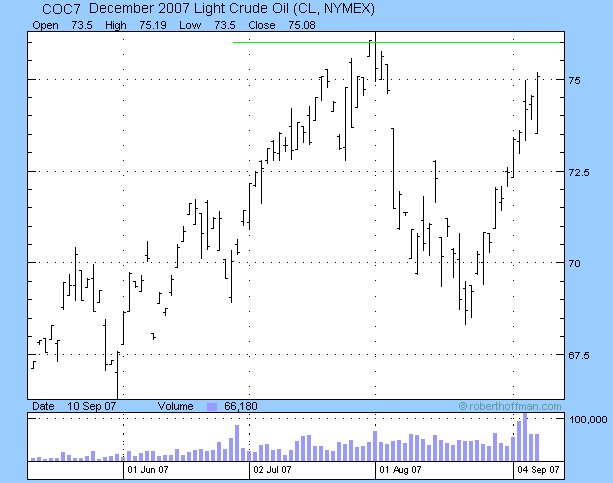

Crude Oil

December Light Crude is headed for a test of resistance at $76/barrel. Narrow consolidation below the resistance level would be a strong bull signal.

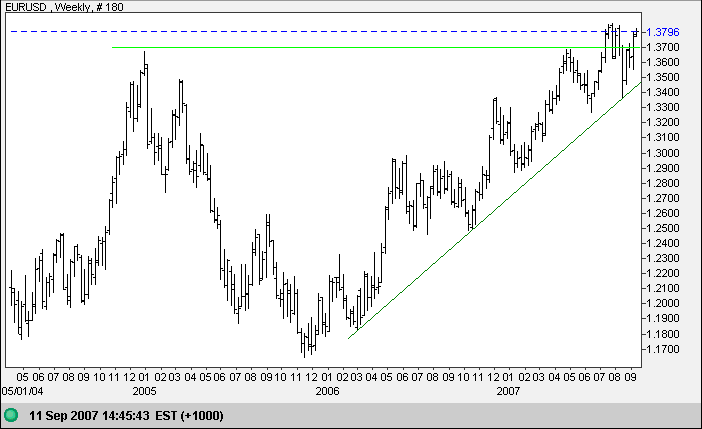

Currencies

The euro again broke through resistance at $1.37, indicating that the long-term up-trend will continue.

Source: Netdania

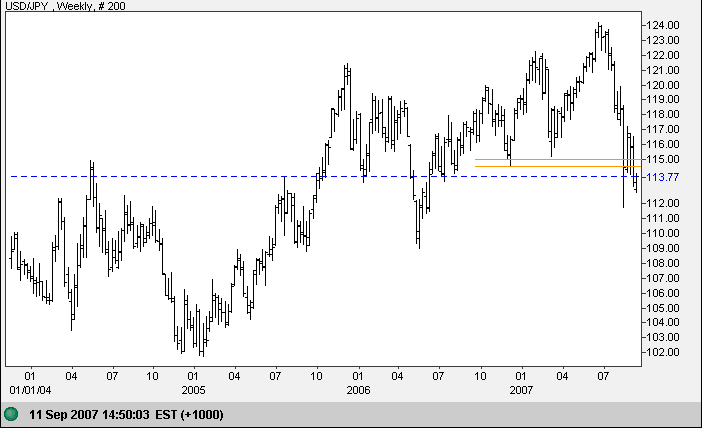

Carry trades are the next area of vulnerability in financial markets. Expect more to unwind as the dollar weakens against the yen. The fall below 114 signals continuation of the primary down-trend.

Source: Netdania

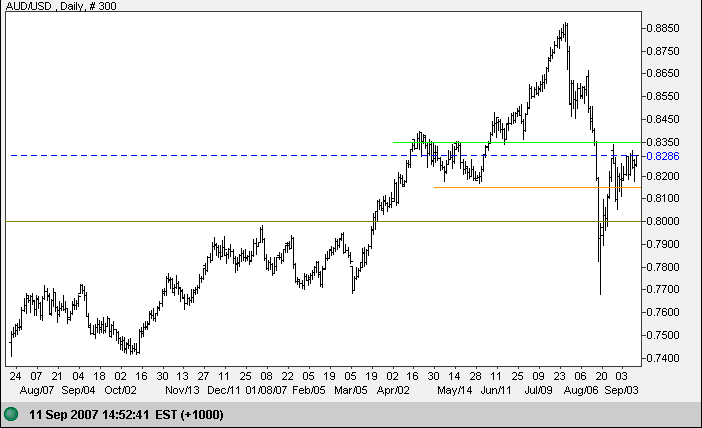

The Australian dollar is consolidating between 0.8150 and 0.8350. Breakout above 0.8350 would place the primary down-trend in question, while a downward breakout would confirm the down-trend.

Source: Netdania

Treasury Yields

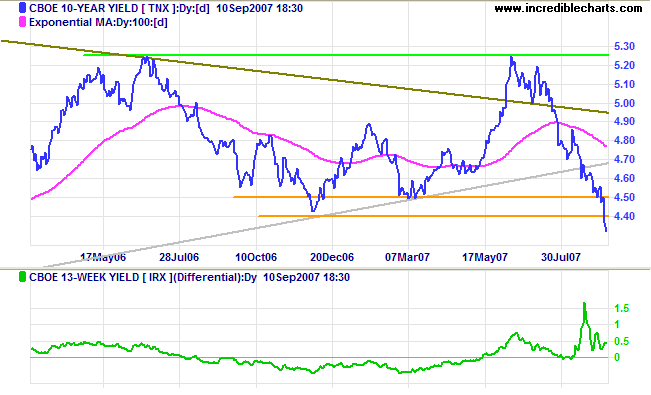

Ten-year treasury yields broke through support at 4.50%/4.40%,

indicating that the downward trend from the 20-year super-cycle

will continue; while recovery above 4.50% would signal a false

break.

The yield differential (10-year minus 13-week treasury yields)

remains close to zero, signaling pressure on bank margins.

Concern over tightening bank credit and the non-bank commercial

paper market continues.

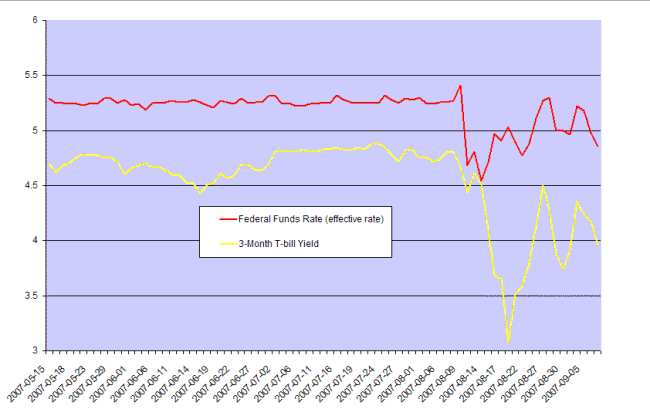

The fall in short-term (3-month) treasury yields indicates that investors remain highly risk-averse, while an effective federal funds rate below 5.0% reveals that the Fed continues to assist the banking system with additional liquidity. Whether the official target is reduced or not is largely academic as rates have already been effectively lowered.

The real impact of the sub-prime crisis will not be visible until results for the September quarter are available.

Stock Markets

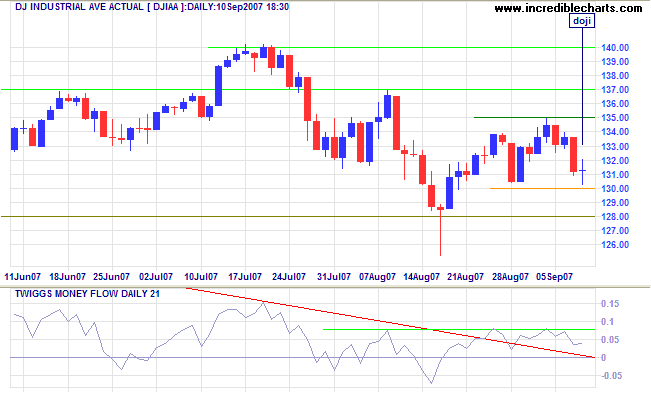

The Dow Jones Industrial Average is consolidating between 13000 and 13500 on low volume — a positive sign. And Twiggs Money Flow holding above zero remains bullish. Monday's doji, however, indicates uncertainty and reversal below 13000 would warn that the correction is likely to continue.

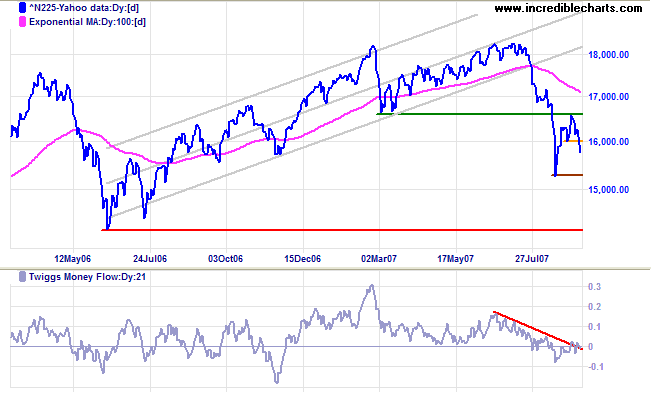

The Nikkei broke through short-term support at 16000 confirming the primary down-trend.

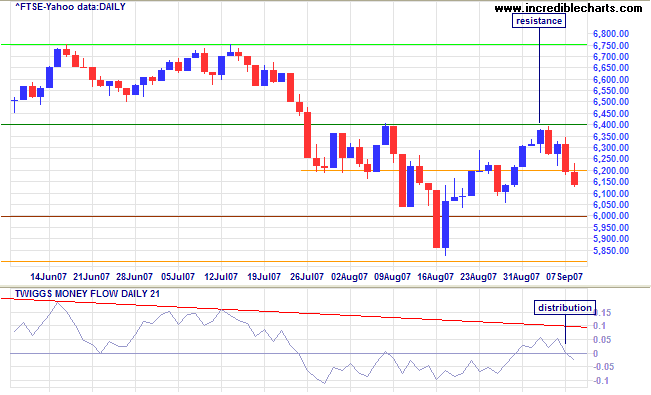

The FTSE 100 is headed for another test of primary support at 6000, while Twiggs Money Flow signals distribution. A close below 6000 would confirm the primary down-trend.

The Hang Seng and Shanghai Composite remain bullish (some would say irrationally exhuberant), while the ASX All Ordinaries advances tentatively on low volume.

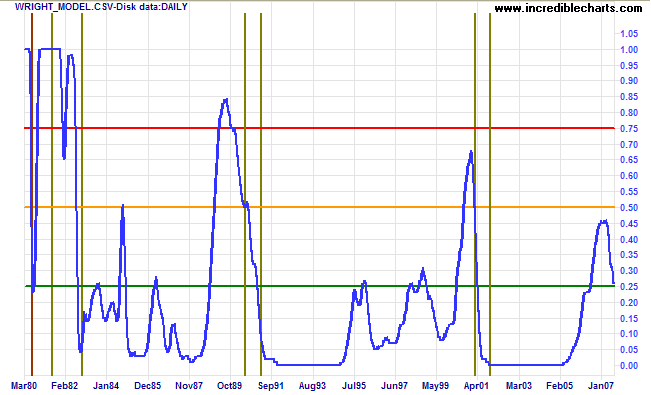

Wright Model

Probability of recession in the next four quarters remains at a low 26 per cent according to the Wright Model. From past recessions (indicated by pairs of vertical lines) we can see that the model fairly accurately predicts recessions caused by a contraction of the money supply, but I suspect I suspect that it may not be as accurate in identifying the mischief caused by maintaining artificially low interest rates.

.....where Fortune is concerned: she shows her force where

there is no organized strength to resist her; and she directs

her impact there where she knows that no dikes and embankments

are constructed to hold her.

~ Niccolo Machiavelli, The Prince (1532)

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.