Gold, Oil, Currencies & Interest Rates

By Colin Twiggs

August 21, 2007 9:30 p.m. EST (11:30 a.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

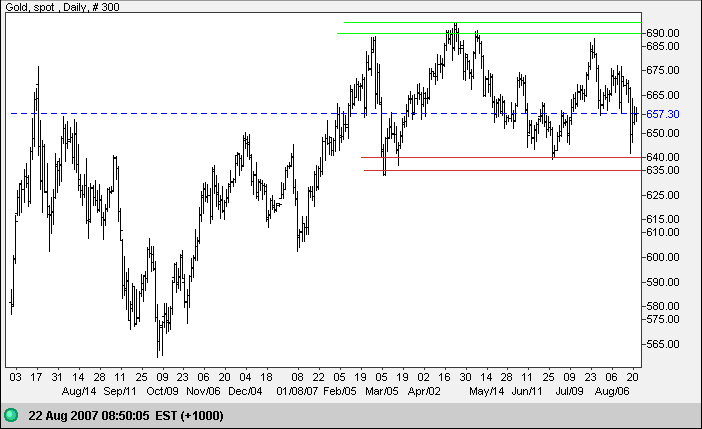

Gold

Spot gold continues to oscillate between resistance at $690 and support at $640. Wait for a breakout to indicate future direction.

Source: Netdania

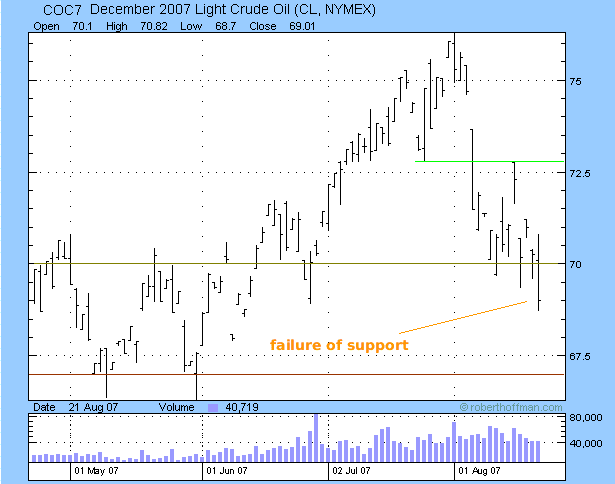

Crude Oil

December Light Crude broke through support at $70, signaling a test of support at $67. Failure would warn of a test of the January 2007 low of $55. Recovery above last week's high (just below $73), on the other hand, would indicate that the primary up-trend is intact.

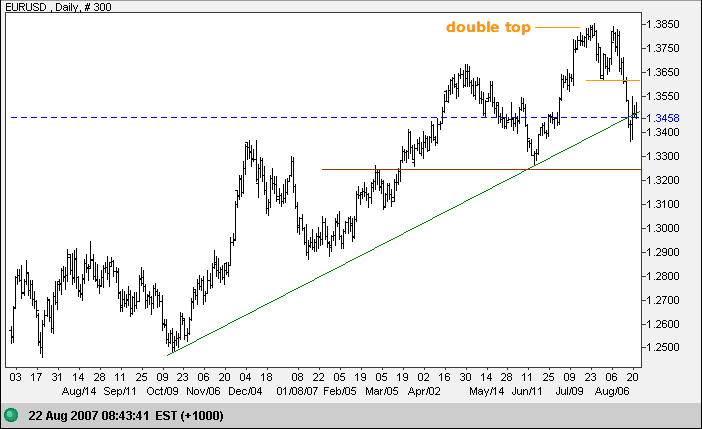

Currencies

The euro penetrated the rising long-term trendline, signaling weakness, but the primary trend remains intact unless support at $1.3250 is broken.

Source: Netdania

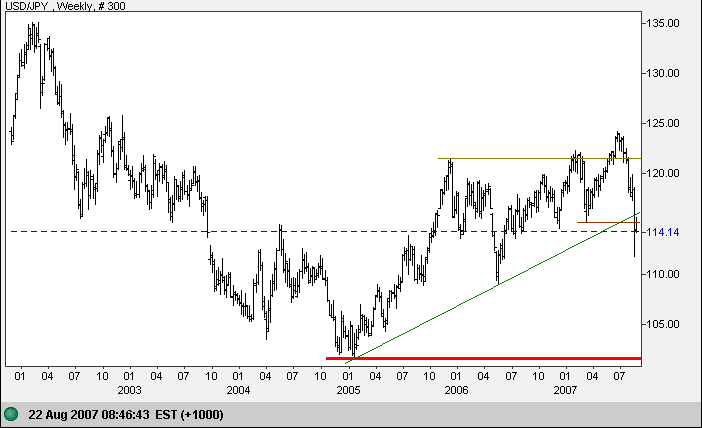

On the weekly chart we can see that the dollar has penetrated the rising trendline and primary support at 115/114.50 against the yen. Expect a primary down-trend to test long-term support at 100 as carry trades are unwound.

Source: Netdania

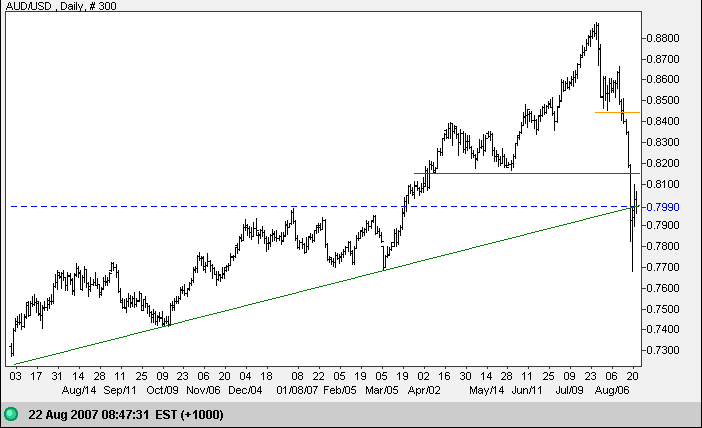

The Australian dollar has also been affected by unwinding carry trades. The long-term rising trendline has been penetrated together with primary support at 0.8150 (and 0.8000). Expect a primary down-trend - though a rally above 0.8000 and subsequent retracements that respect this level would indicate that the signal is false.

Source: Netdania

Treasury Yields

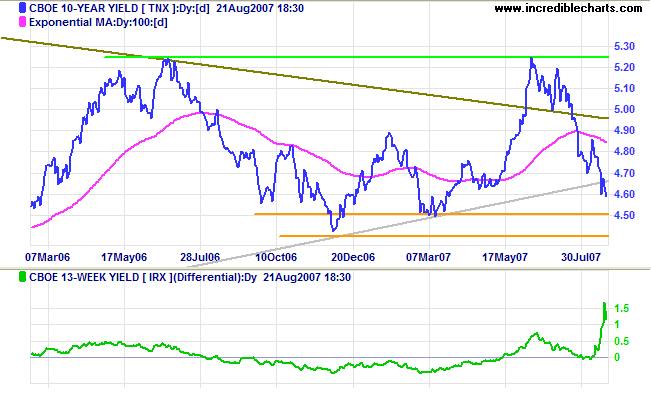

Ten-year treasury yields are headed for a test of support at

4.50%. We can expect further consolidation between 4.50% and

5.25% as the 2003 - 2007 up-trend converges with the downward

trendline from the 20-year super-cycle.

The yield differential (10-year minus 13-week treasury yields)

rose sharply because of the sharp fall in T-Bill yields, but

concern over tightening bank credit is increasing.

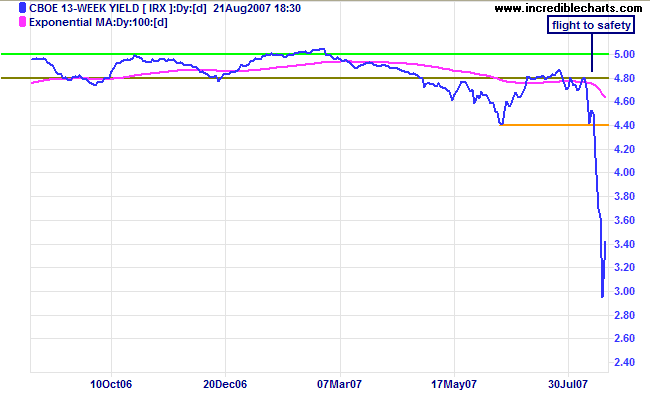

Short-term (13-week) treasury yields clearly depict the flight to safety as money poured into short-term treasuries.

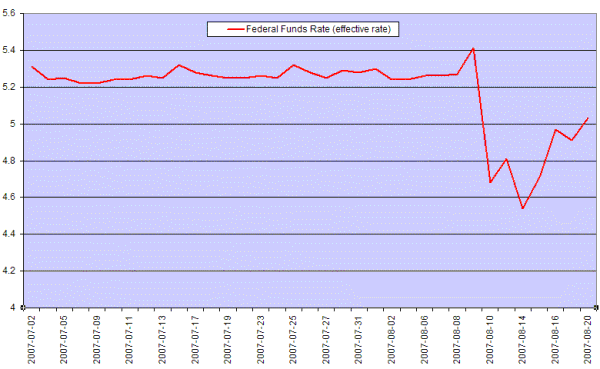

We can see how the federal funds rate (the rate at which banks lend to each other in the overnight market) spiked above 5.40% on August 9, reflecting the liquidity squeeze. The Fed responded by pumping new money into the financial system, driving rates as low as 4.60% before they recovered to 5.0%. Reducing the discount rate (the overnight rate at which the Fed lends to banks) last week is largely symbolic. Banks only use the discount window as a last resort, preferring to borrow at lower rates from each other. The impact of the last two weeks is that banks are likely to be more risk averse, concentrating on improving their balance sheets rather than pursuing growth. Tighter credit is likely to translate into lower sales and lower earnings in the equity market.

Stock Markets

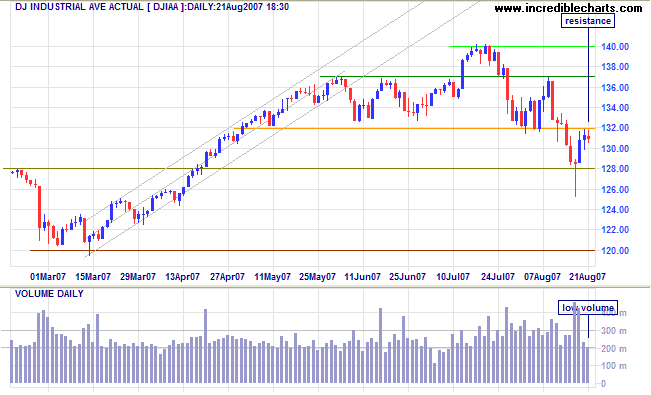

The Dow Jones Industrial Average recovered from the wild fall below 12800 last week, but the attempted rally is faltering at resistance at 13200, with low volume indicating little interest from buyers. The primary trend remains up, with support at 12000.

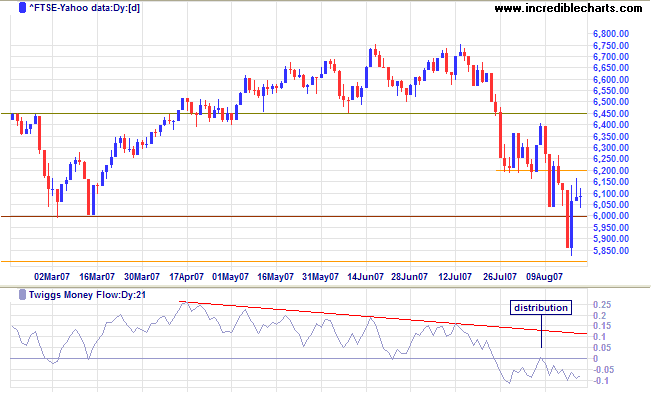

The Nikkei reversed to a primary down-trend after breaking support at 16600. The FTSE 100 gave a weak signal, penetrating primary support at 6000 before recovering the next day. The attempted rally is faltering, however, and retreat below 6000 would confirm the trend reversal. The Shanghai Composite index, on the other hand, continues to charge towards its target of 5000 - seemingly oblivious to the uncertainty elsewhere - but we should expect some retracement in sympathy with other markets.

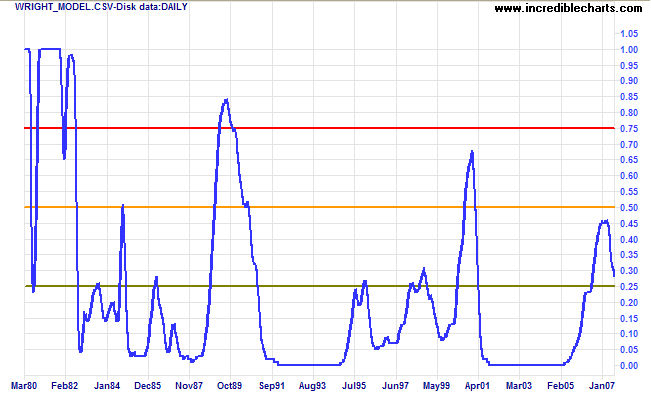

Wright Model

Probability of recession in the next four quarters fell to 28 per cent according to the Wright Model.

The professional concerns himself with doing the right thing

rather than with making money, knowing that the profit takes

care of itself if the other things are attended to.

~ Jesse Livermore in Reminiscences of a Stock Operator by Edwin Lefevre.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.