Gold, Oil, Currencies & Interest Rates

By Colin Twiggs

August 14, 2007 8:30 p.m. EST (10:30 a.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

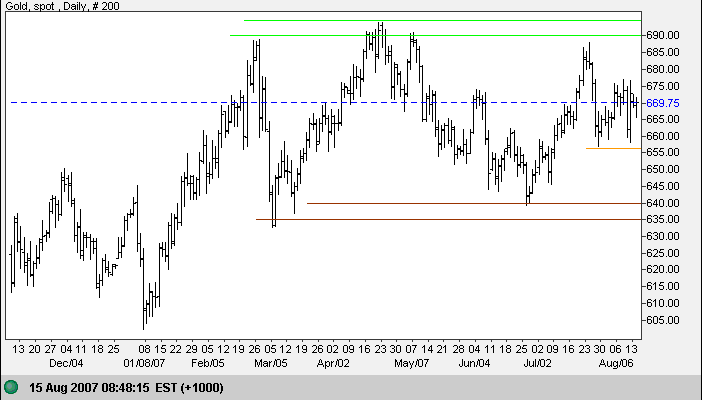

Gold

Spot gold is consolidating between resistance at $690 and support at $640. Respect of short-term support would be a bullish sign - otherwise we must wait for a breakout to indicate future direction.

Source: Netdania

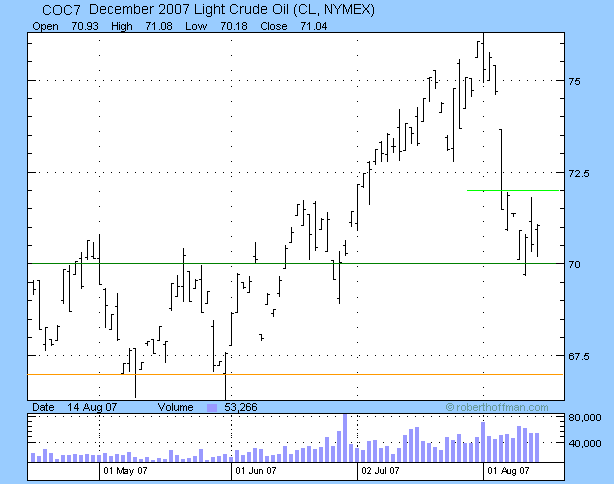

Crude Oil

December Light Crude is testing support at $70. Failure would signal trend weakness and a test of $67. Failure of support at $67 would be more serious - signaling a test of the January 2007 low of $55. A rise above $72, on the other hand, would indicate that the up-trend is intact.

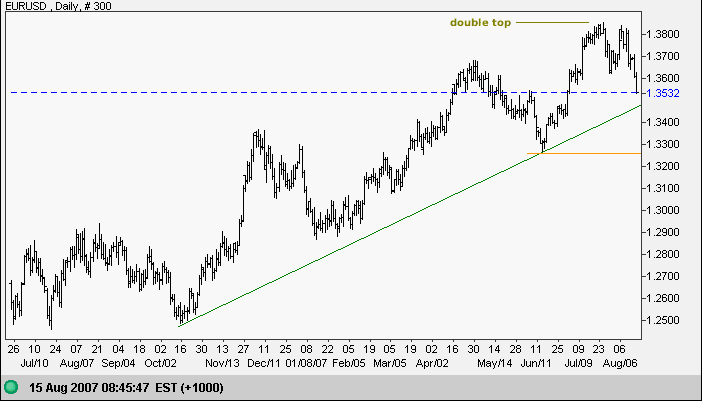

Currencies

The euro is headed for a test of the rising trendline after completing a double top at $1.3850. Respect of the trendline would signal another rally, while failure would indicate trend weakness and a test of primary support at $1.3250.

Source: Netdania

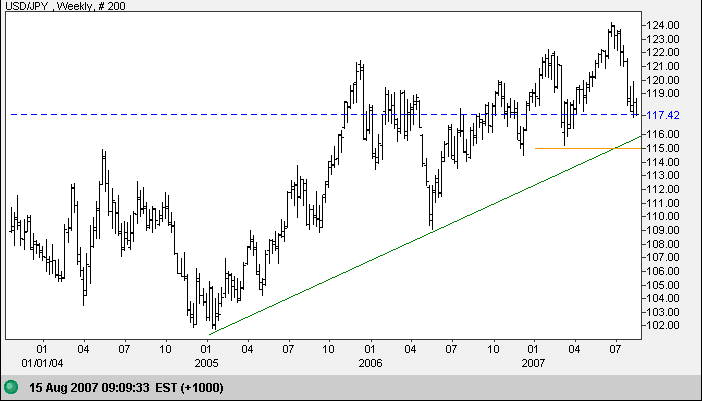

The dollar is headed for a test of the long-term rising trendline against the yen as carry trades are unwound. Failure of primary support at 115/114.50 would signal reversal to a down-trend.

Source: Netdania

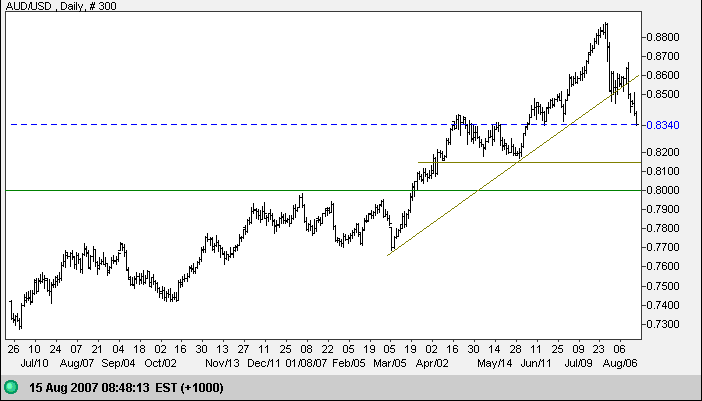

Contrary to the yen, the Australian dollar is losing ground as investors grow more risk-averse and unwind carry trades. Penetration of the rising trendline signals trend weakness. Expect some support at 0.8150, but I suspect that the key support level of 0.8000 may be tested.

Source: Netdania

Treasury Yields

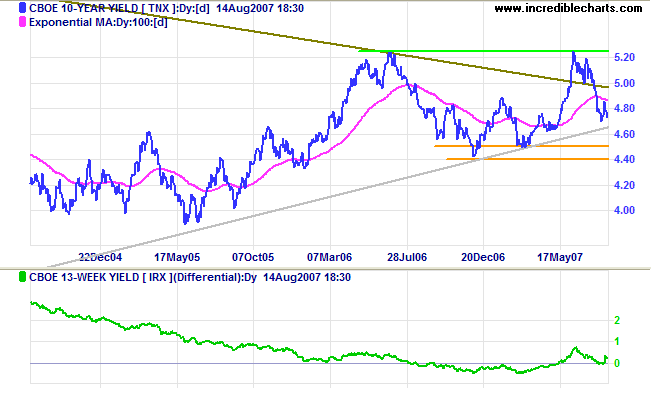

Ten-year treasury yields continue to soften. We can expect

further consolidation between 4.40% and 5.25% as the 2003 -

2007 up-trend converges with the downward trendline from the

20-year super-cycle.

The yield differential (10-year minus 13-week treasury yields)

benefited from the sharp fall in T-Bill yields, but tightening

of bank credit remains cause for concern.

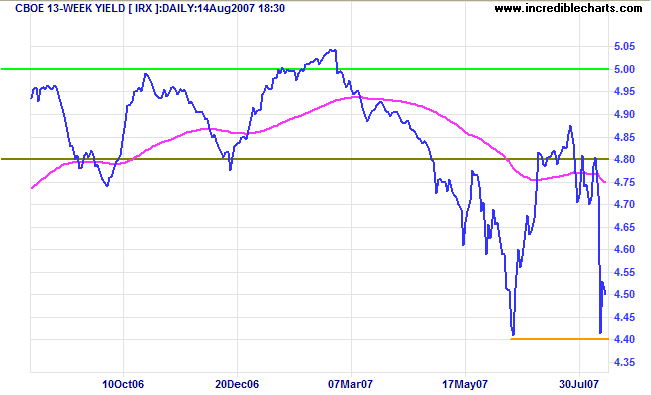

Short-term (13-week) treasury yields fell sharply, reflecting the outflow from banks - which is why the Fed and other central banks had to inject funds into the market.

Stock Markets

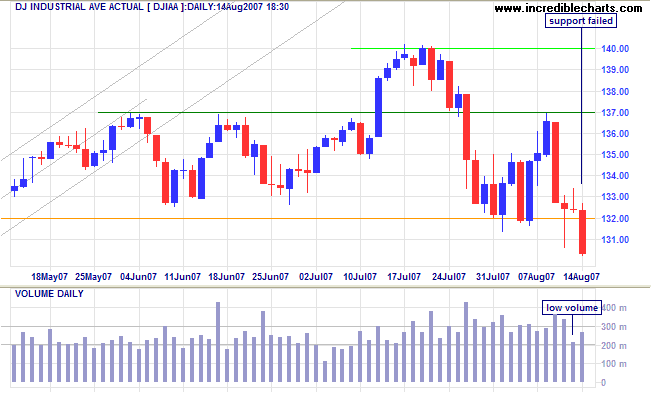

The Dow Jones Industrial Average broke through support at 13200 after several previous failed attempts. This remains only a secondary correction, but it is stronger than many investors suspected. The next support level is 12800 from the February 2007 peak, but the primary trend is not threatened until there is a test of 12000.

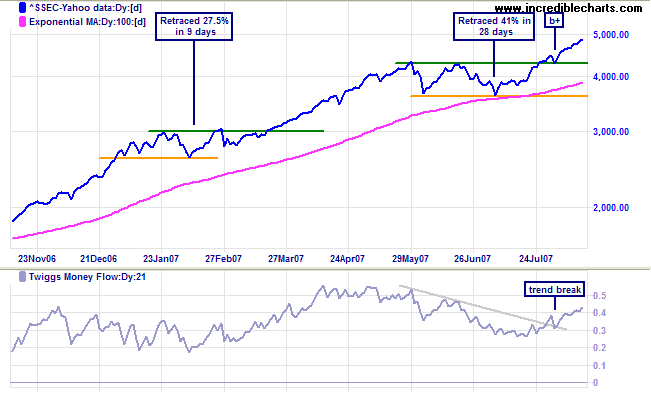

Expect negative sentiment on the Dow to flow through to the ASX, Nikkei, LSE and the DAX. The Nikkei is the most precarious as it is testing primary support at 16600. The Shanghai Composite index, on the other hand, remains headed for its target of 5000 (4300+[4300-3600]) - though we should expect some retracement over the next week in sympathy with other markets.

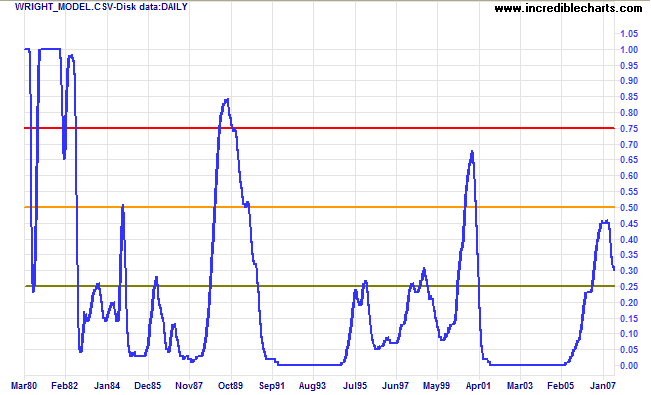

Wright Model

Probability of recession in the next four quarters eased to 30 per cent according to the Wright Model.

One of the most helpful things that anybody can learn is to

give up trying to catch the last eighth - or the first. These

two are the most expensive eigths in the world.

~ Jesse Livermore in Reminiscences of a Stock Operator by Edwin Lefevre.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.