The Fed Steps In

By Colin Twiggs

August 11, 2007 4:30 a.m. EST (6:30 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

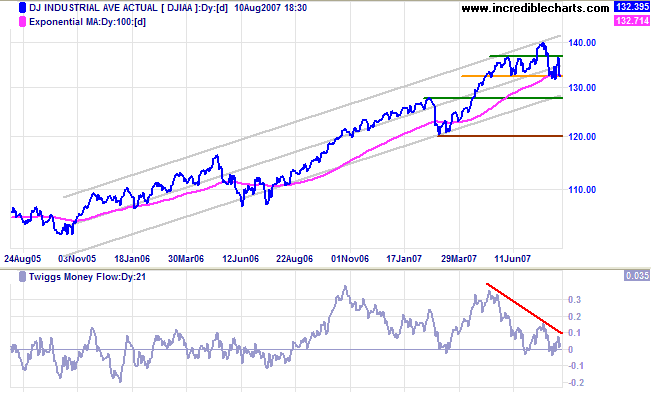

USA: Dow, Nasdaq and S&P500

Concern over banks' exposure to the subprime mortgage market

drove short-term treasury yields lower - the outflow from the

banking system creating a liquidity squeeze. Central banks

responded by injecting new money into the banking system, with

the Fed entering into more than $40 billion of repurchase

agreements on Thursday/Friday. The Fed buys mortgage-backed

securities known as "repos" in the market and deposits payment

with the seller's commercial bank - restoring the level of

deposits available to the banking system.

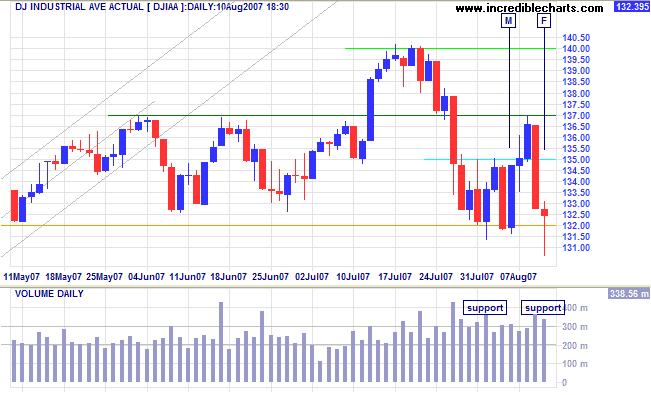

Confidence has at least temporarily recovered, with the Dow

Jones Industrial Average retreating above support at 13200

after a sharp fall early Friday. I have been expecting a swing

to test the first line of primary support at 12800, but further

intervention from the Fed could prevent this.

Twiggs Money Flow continues with a large bearish

divergence.

Long Term: The primary trend remains up, with support at 12800 and 12000.

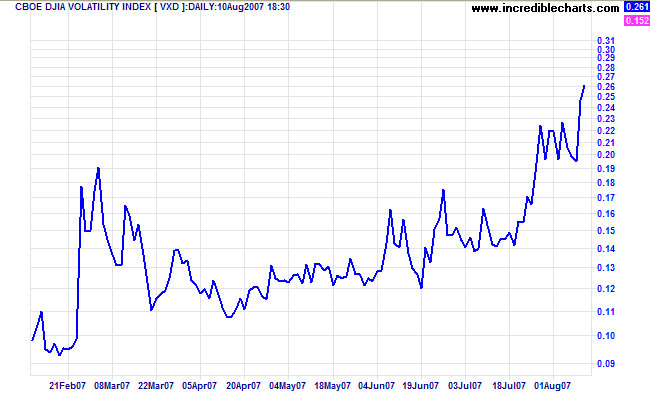

Short Term: With volatility at record levels we can expect a very treacherous ride over the next few weeks. Further oscillation between resistance at 13700 and support at 13200 is likely, while breakout outside the band would signal future direction. Normally an intra-day breakout would be sufficient, but several false breaks on the downside caution us to wait for a close below 13200 - or an intra-day fall below 13000.

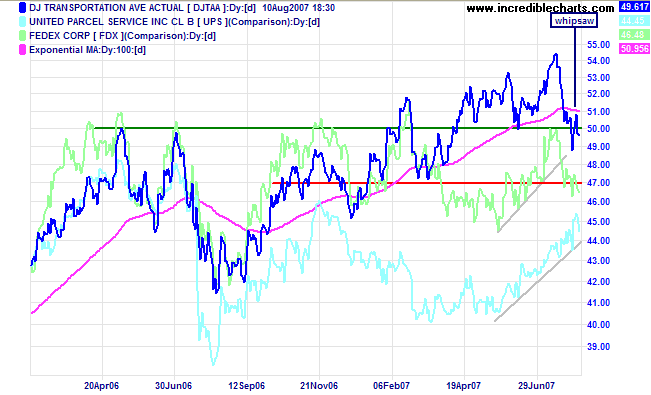

The Dow Jones Transportation Average is whipsawing around 5000, indicating that the down-swing may not reach primary support at 4700 and the primary trend remains positive. Fedex continues to look bearish - headed for a test of primary support - while UPS respects its rising trendline (while not expected, reversal of these two stocks below their 2007 lows would be a bear signal for the economy).

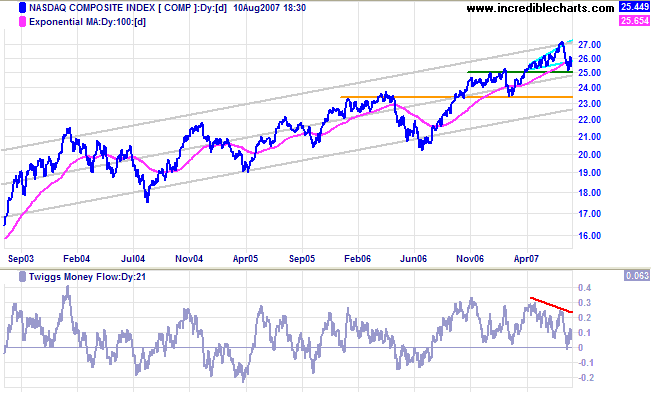

The Nasdaq Composite is testing support at 2500. A break

below this level would warn of a test of primary support at

2340.

Long Term: The primary trend is up.

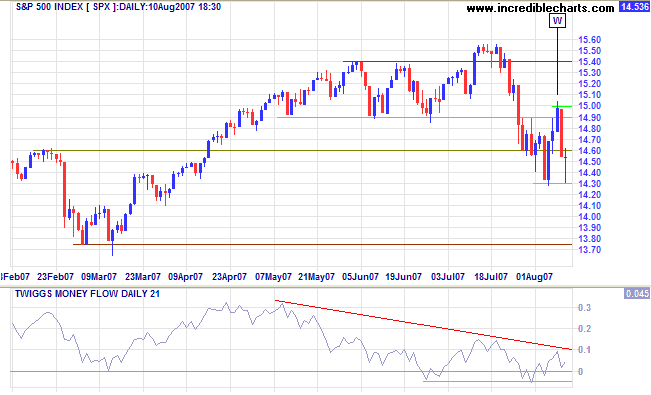

The S&P 500 also made a miraculous recovery on

Friday, respecting support at 1430 before closing near the

day's high. Expect a test of resistance at 1500. A fall below

1430 is less likely - and would signal a test of primary

support at 1375. A Twiggs Money Flow fall below last week's low

would signal weakness, while a rise above Wednesday's high

would be bullish.

Long Term: The primary trend remains up.

LSE: United Kingdom

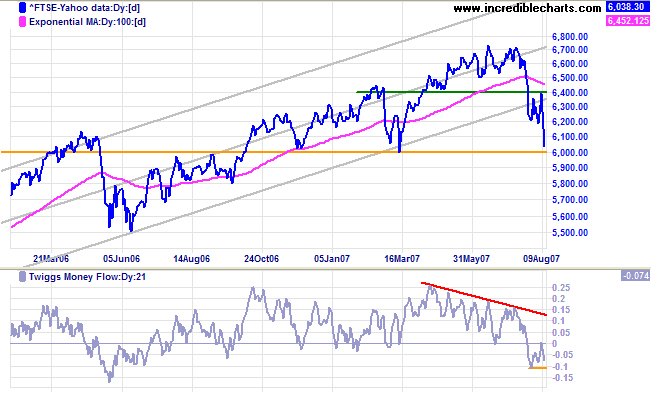

The FTSE 100 is testing primary support at 6000.

Positive influence from US markets means the level is likely to

hold in the short term. A Twiggs Money Flow fall below -0.1

would signal strong distribution, while a rise above zero would

indicate recovery.

Long Term: The primary trend remains up.

Japan: Nikkei

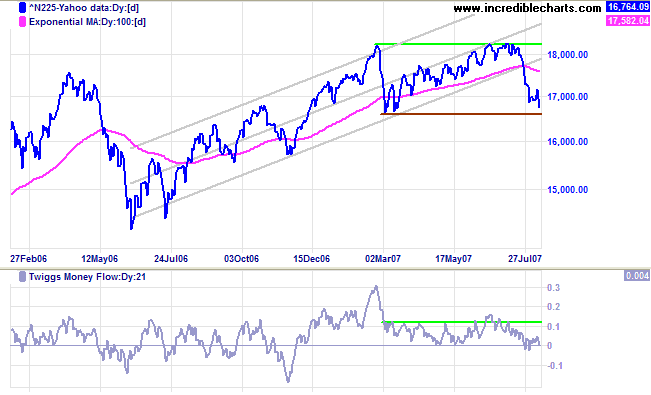

The Nikkei 225 is testing primary support at 16600.

Twiggs Money Flow whipsawing around zero indicates

uncertainty, but expect some positive influence from the

US.

Long Term: The primary trend continues up.

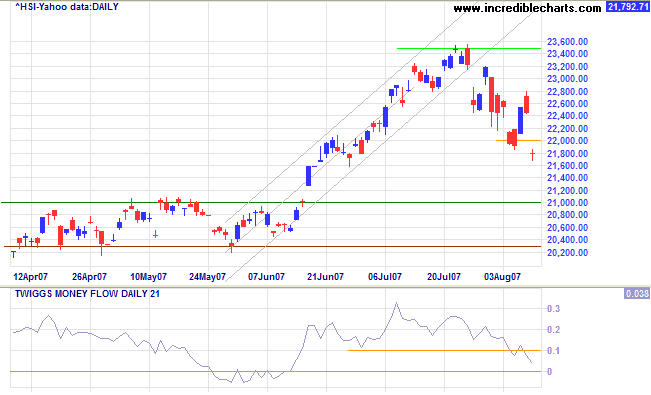

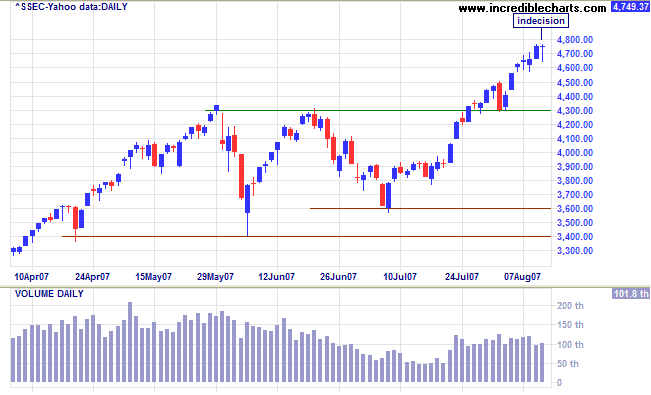

China: Hang Seng & Shanghai

The Hang Seng broke through support at 22000, with Twiggs Money Flow falling below 0.1, signaling a test of support at 21000. However, we have to bear in mind that Friday's positive performance in the US may ease selling pressure. Reversal above 22800 would be a bullish sign.

The Shanghai Composite index hesitated on Friday, with a hanging man candle signaling indecision. The target remains at 5000 (4300+[4300-3600]), but we may see a short retracement before then.

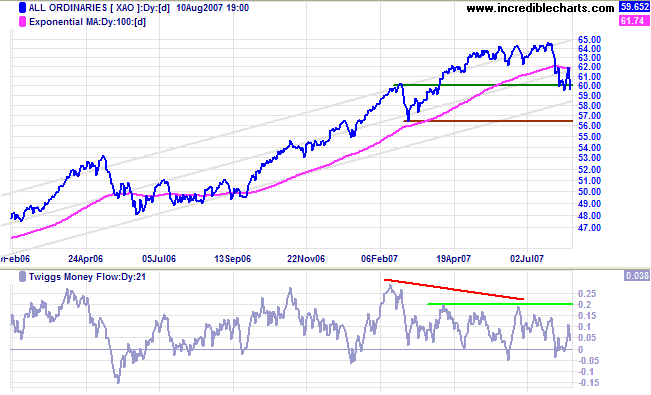

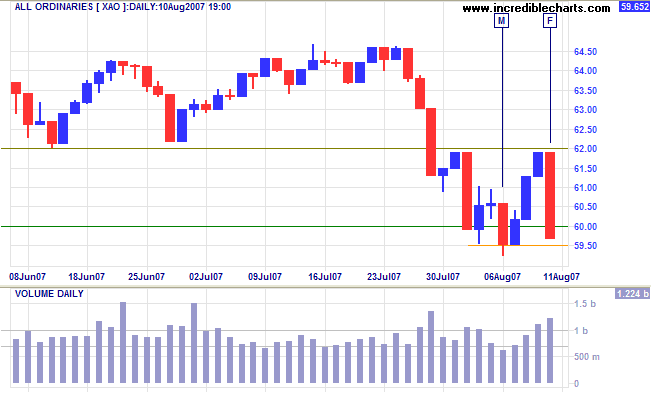

ASX: Australia

The All Ordinaries is testing support at 6000/5950,

while

Twiggs Money Flow (21-day) is improving. Failure of support

would test the lower border of the trend channel and possibly

primary support at 5650, while a rise above 6200 would signal a

rally to 6450.

Long Term: The primary trend remains up.

Short Term: A close below 5950 or an intra-day fall below Monday's low would warn of another down-swing. Considering Friday's positive close in US markets, a test of resistance at 6200 is equally likely.

The show ain't over till the fat lady sings

(we could say that the Fed is the fat lady of the financial

markets).

~ often attributed to New York Yankees catcher Yogi Berra, the

phrase may first have been used by San Antonio sports

broadcaster Dan Cook.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.