Markets Warn Of A Secondary Correction

By Colin Twiggs

July 28, 2007 5:30 a.m. EST (7:30 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA: Dow, Nasdaq and S&P500

Markets reflected concern over the impact of the housing

down-turn on the rest of the economy, in some cases retreating

below the line of accumulation of the past few months. A

secondary correction is likely, but reversal of the primary

trend is not - we have not yet reached stage 3 of a bull

market, where prices have outrun values.

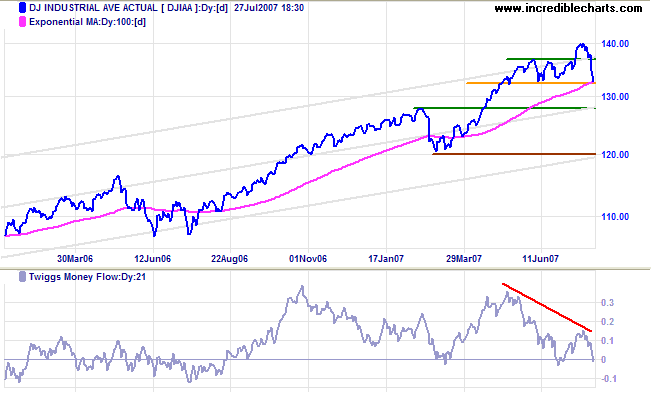

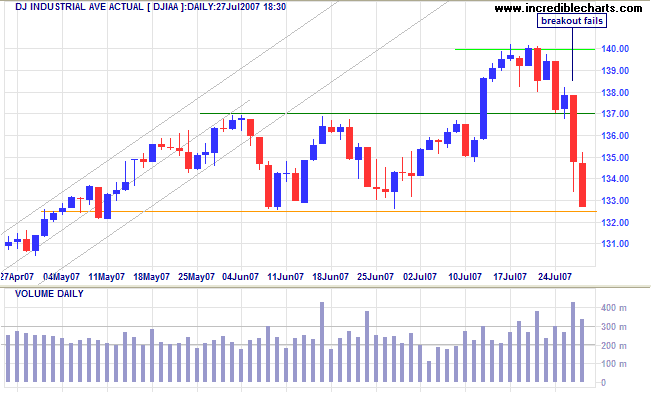

The Dow Jones Industrial Average retreated through 13700

and is now testing support at the base of the recent months

consolidation. Breakout below 13250 would warn of a secondary

correction.

Twiggs Money Flow below zero signals distribution.

Long Term: The primary trend remains up, with support at 12800 and 12000.

Short Term: The index is testing support at 13250. Strong volume indicates support, but behavior of the S&P 500 indicates that this is likely to be overrun.

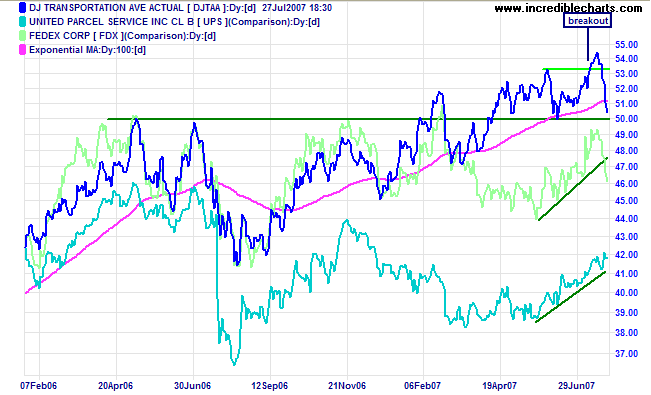

The Dow Jones Transportation Average retreated below 5300 and is now testing support at the base of the past few months line of accumulation. Breakout below 5000 would warn of a secondary correction. The two major component stocks reflect uncertainty: Fedex penetrated its rising trendline while UPS remains positive.

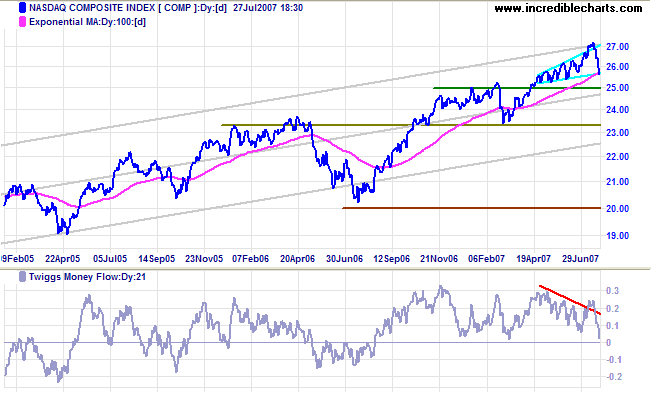

The Nasdaq Composite is testing the lower border of the

ascending broadening wedge pattern. Downward breakout would

warn of a secondary correction.

Long Term: The primary trend remains upwards, with

support at 2340 and 2500.

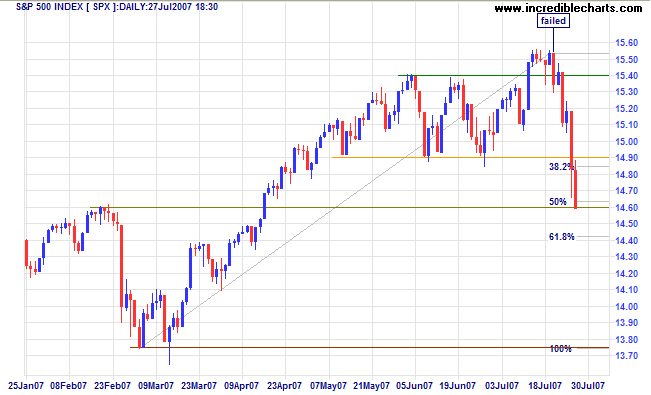

The S&P 500 fell below 1490, the base of the

consolidation of recent months, warning of a secondary

correction. The index has already fallen to the 50% Fibonacci

level, testing support at 1460. If that fails, expect further

support at 61.8% followed by primary support at 1375 (100%).

Twiggs Money Flow is below zero, signaling distribution.

Long Term: The primary trend remains up.

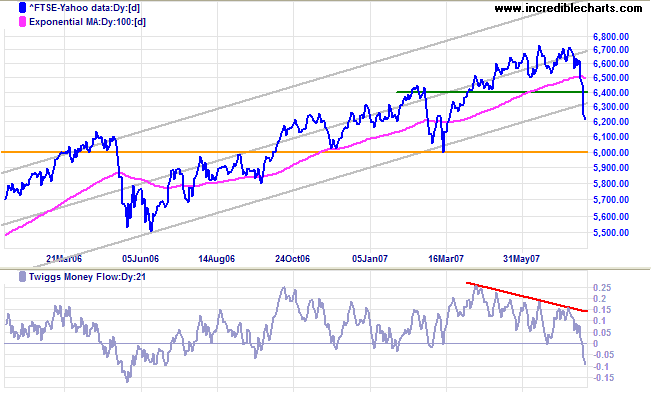

LSE: United Kingdom

The FTSE 100 is undergoing a secondary correction after

breaking through support at 6500. Twiggs Money Flow signals

strong distribution, warning that a test of primary support at

6000 is likely.

Long Term: The primary trend remains up.

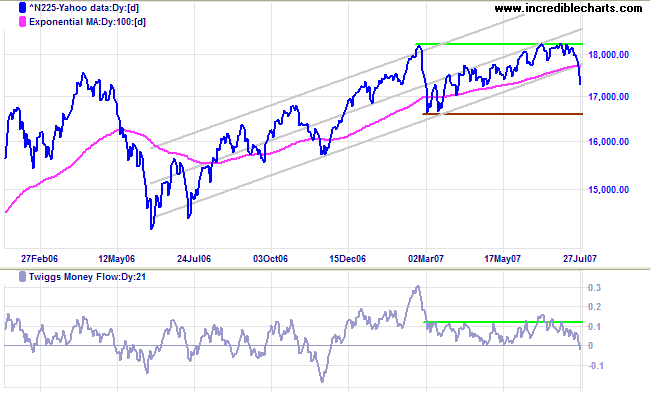

Japan: Nikkei

The Nikkei 225 broke below the trend channel, warning of

a test of primary support at 16600.

Twiggs Money Flow crossed below zero, signaling

distribution.

Long Term: The primary up-trend continues.

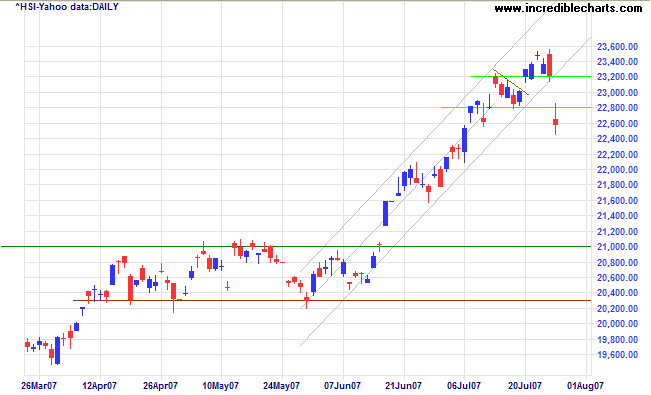

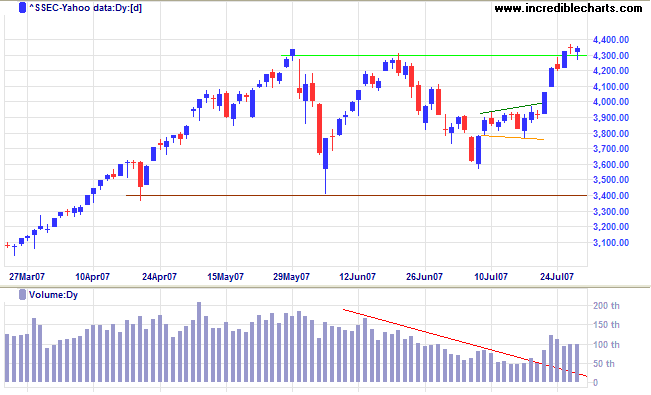

China: Hang Seng & Shanghai

The Hang Seng gapped below support at 22800 to signal the start of a secondary correction. Twiggs Money Flow signals short-term distribution, but long-term accumulation. Expect a test of 21000.

By contrast, the Shanghai Composite index held steady at 4350. Following bearish sentiment in other markets, we can expect support at 4300 to come under pressure. Failure would warn of a test of support at 3600.

ASX: Australia

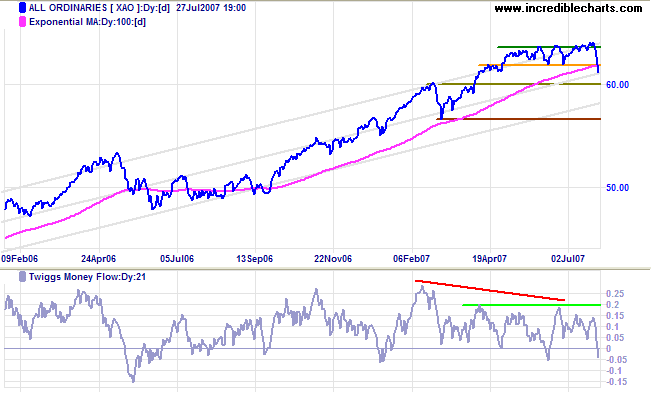

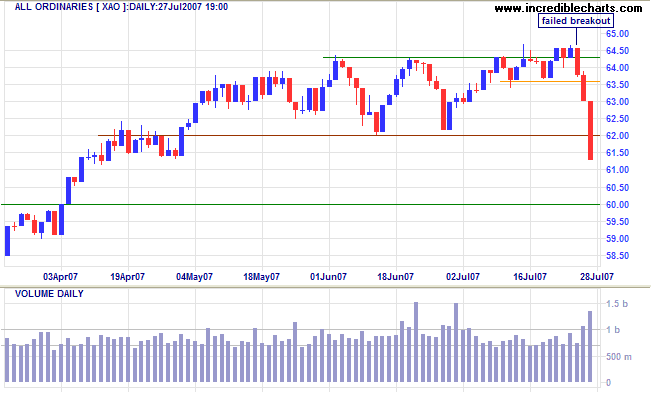

The All Ordinaries turned down from its consolidation of

recent months, warning of a secondary correction.

Twiggs Money Flow (21-day) below zero signals

distribution.

Long Term: The primary trend remains up, with support at

6000 and 5650.

Short Term: Wednesday's failed breakout followed by Friday's fall through support at 6200 displays a classic bull trap, signaling the start of a secondary correction.

A primary movement in the market will generally have a

secondary movement in the opposite direction of at least

three-eighths of the primary movement...... The law seems to

hold good no matter how far the advance goes.

~ Charles Dow, July 20th 1901.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.