Gold, Oil, Currencies & Interest Rates

By Colin Twiggs

July 24, 2007 4:30 a.m. EST (6:30 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

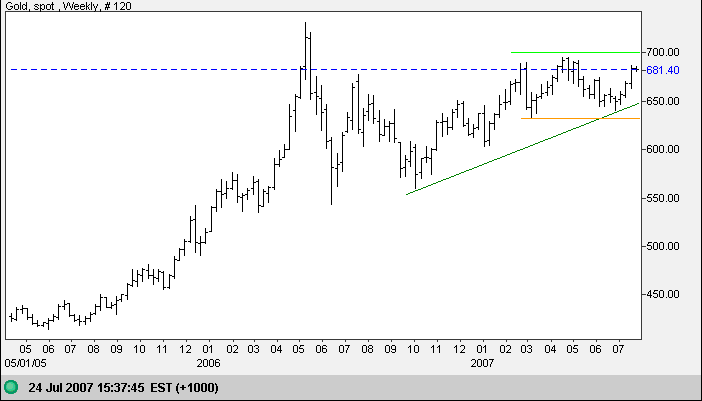

Gold

Spot gold is consolidating between $680 and $685 in the short term. This is a continuation signal and we can expect a test of resistance at $695/$700 in the medium term. Breakout would signal a rally to $730, while reversal would test primary support at $635.

Source: Netdania

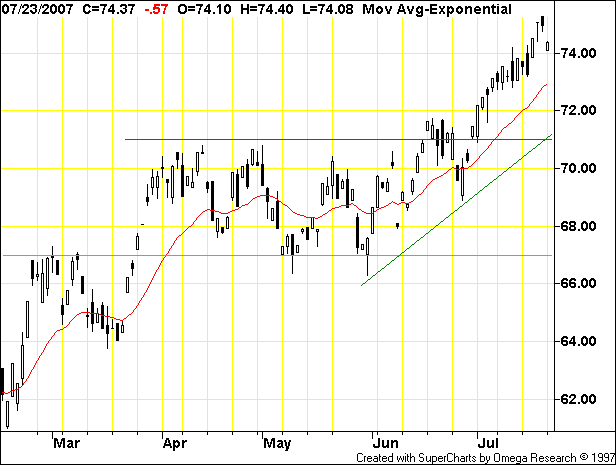

Crude Oil

December Light Crude reached its target of $75 after a strong rally. Consolidation below $75 is likely - or retracement to the rising trend line.

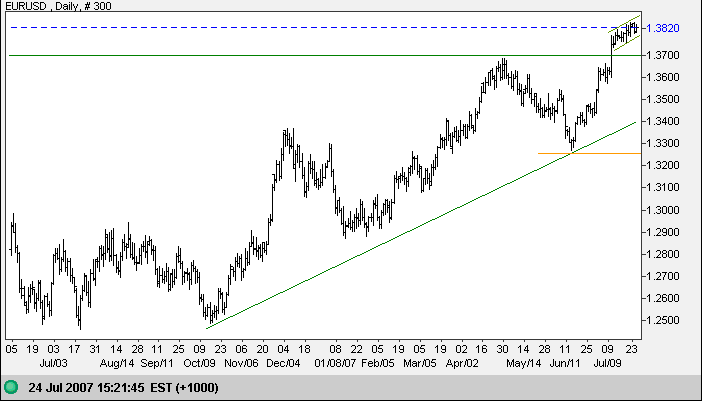

Currencies

The euro is consolidating in an upward flag above the new support level at $1.37. Expect a continuation of the rally, with a medium term target of $1.41 (1.37+[1.37-1.33]). Reversal below $1.37 is not expected - and would signal a test of the rising trendline.

Source: Netdania

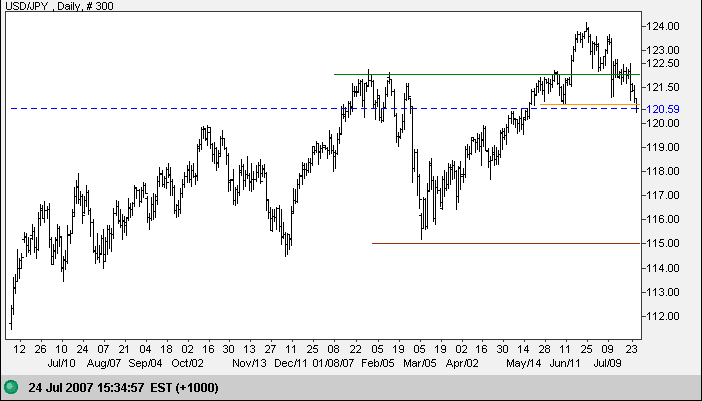

The dollar is also weakening against the yen. The fall below 121 warns of a correction to test primary support at 115. Retreat above 121 would signal uncertainty.

Source: Netdania

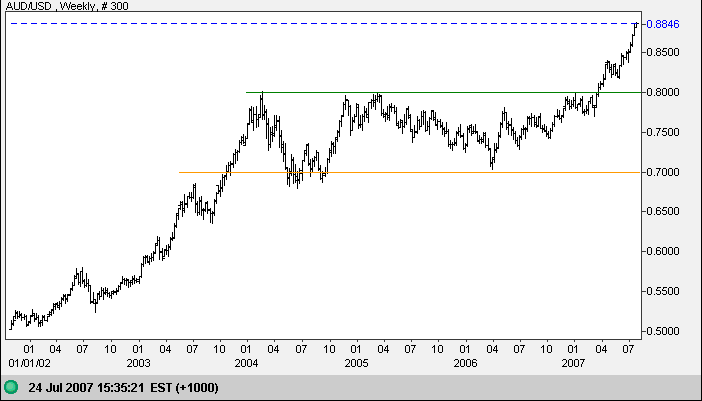

The Australian dollar is accelerating upwards against the greenback. I have revised the medium-term target to 0.90 (0.80+[0.80-0.70]).

Source: Netdania

Treasury Yields

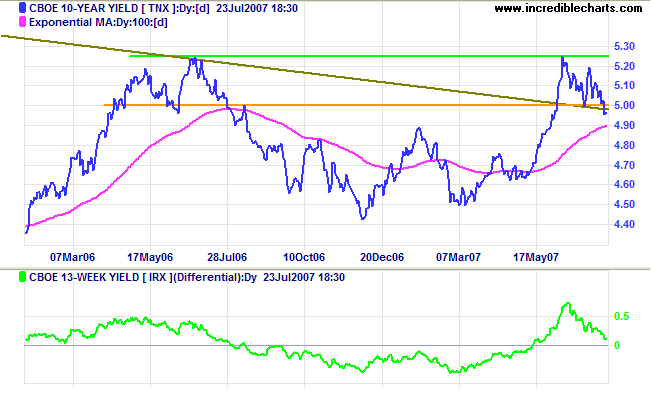

The ten-year treasury yield declined below 5.00%, signaling that expectations of future rates rises have dwindled. The yield differential (10-year minus 13-week treasury yields) is falling. Retracement below zero would be a negative sign.

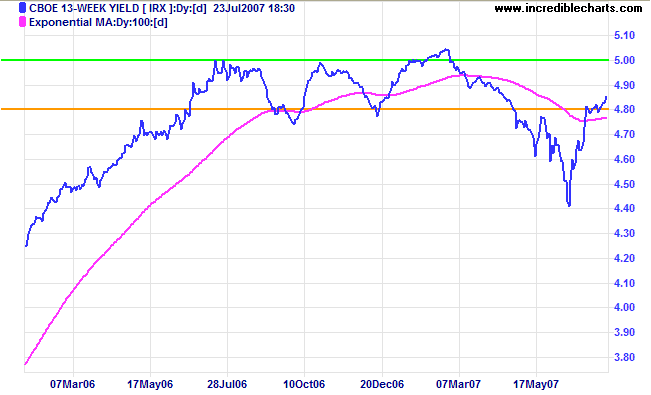

Conversely, short-term (13-week) treasury yields broke through resistance at 4.80% as expectations of rates rises diminish. The recent equilibrium is likely to be restored.

Stock Markets

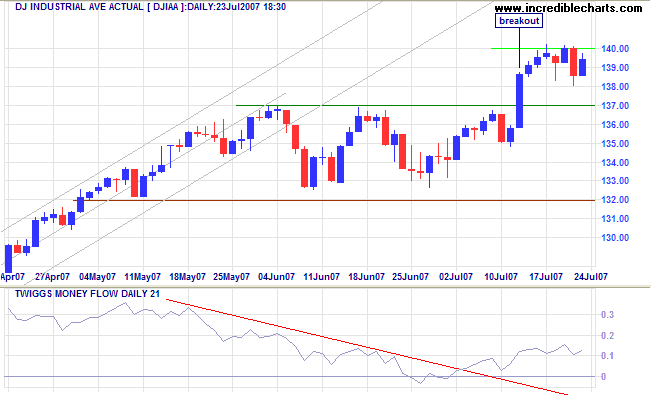

The Dow Jones Industrial average is consolidating between 13800 and 14000. This is a continuation signal, so expect an upward breakout. Reversal below 13500 is not expected - and would signal a test of primary support at 13200.

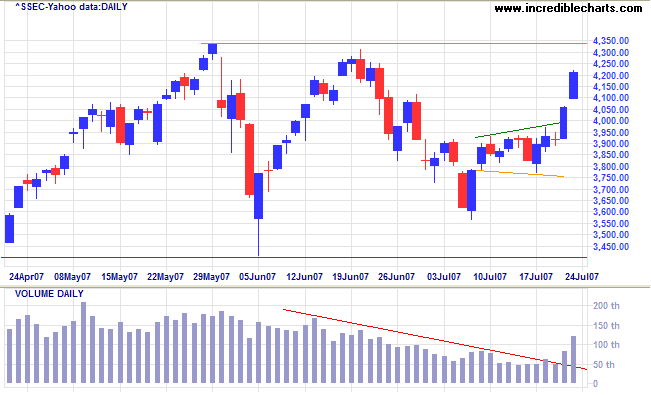

The Shanghai Composite index bounced back with a vengeance and is headed for a test of resistance at 4300. The target for a breakout would be 5000 (4300+[4300-3600]). Reversal at 4300 is not expected - and would re-test support at 3500.

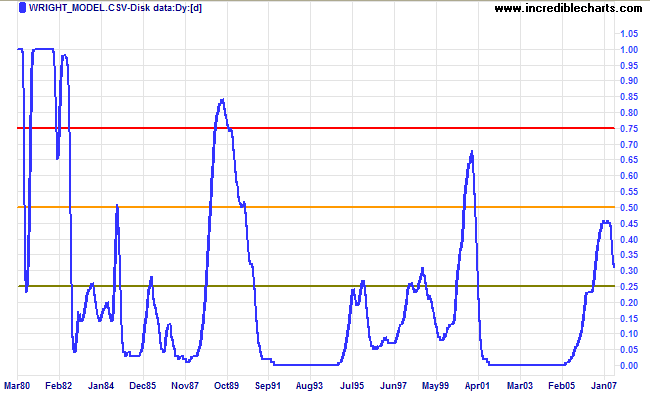

Wright Model

Probability of recession in the next four quarters eased to a modest 31 per cent according to the Wright Model.

I do not deny that many appear to have succeeded in a material

way by cutting corners and by manipulating associates, both in

their professional and in their personal lives. But material

success is possible in this world and far more satisfying when

it comes without exploiting others.

~ Alan Greenspan.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.