Dow Hesitates at 14000

By Colin Twiggs

July 21, 2007 3:30 a.m. EST (5:30 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA: Dow, Nasdaq and S&P500

Concerns over the subprime mortgage sector and its impact on

the economy drove down bond yields and the dollar. Earnings

disappointments from Google, Ericcson and Caterpillar further

weakened the stock market.

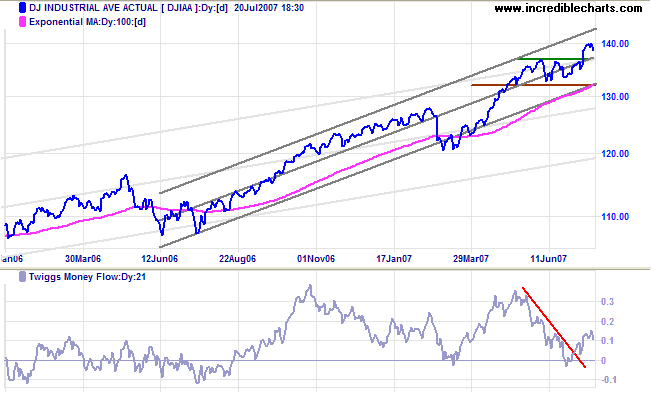

After briefly flirting with 14000, the Dow Jones Industrial

Average is retreating to test support at 13700.

Twiggs Money Flow continues to signal accumulation.

Long Term: The primary trend is up, with support at 13200.

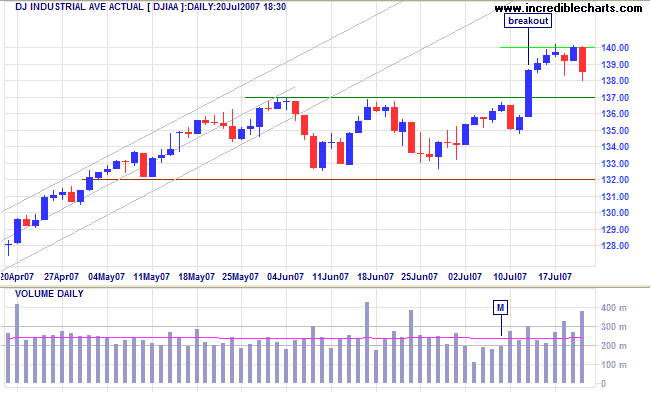

Short Term: Friday's strong volume is partly attributable to options expiry. Respect of the new support level at 13700 would be a bullish sign, while reversal below 13500 is not expected and would warn of a bull trap.

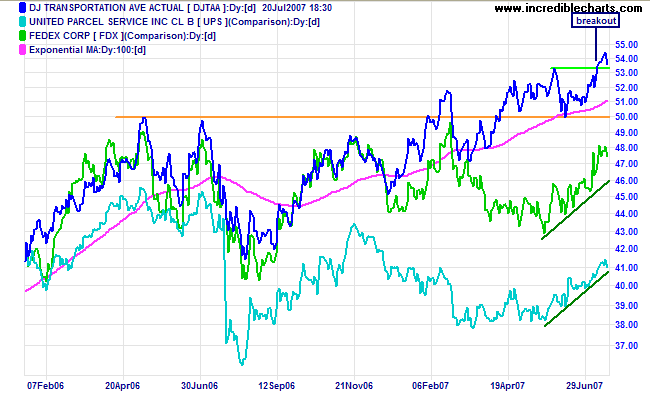

The Dow Jones Transportation Average is retreating to test support at 5300. Respect of support would be a bullish sign, while a fall below 5000 is not expected and would warn of another secondary correction. Both Fedex and UPS remain positive, supporting the index.

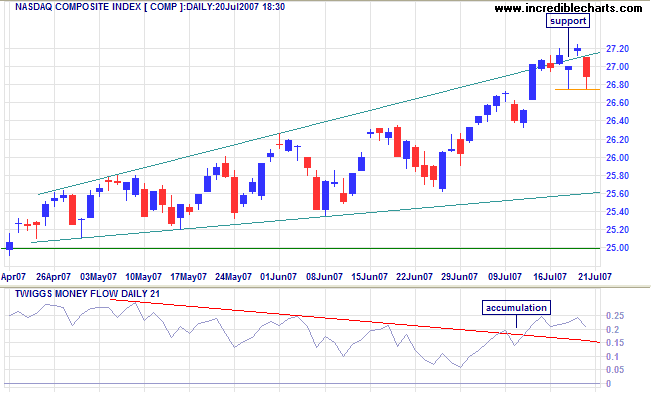

The Nasdaq Composite retreated to within the ascending

broadening wedge pattern, but Twiggs Money Flow continues to

signal accumulation. A fall below Wednesday's low would warn of

a test of the lower border of the pattern, while reversal above

Thursday's high would signal further gains.

Long Term: The primary trend remains upwards, with

support at 2340 and 2500 (from 2525).

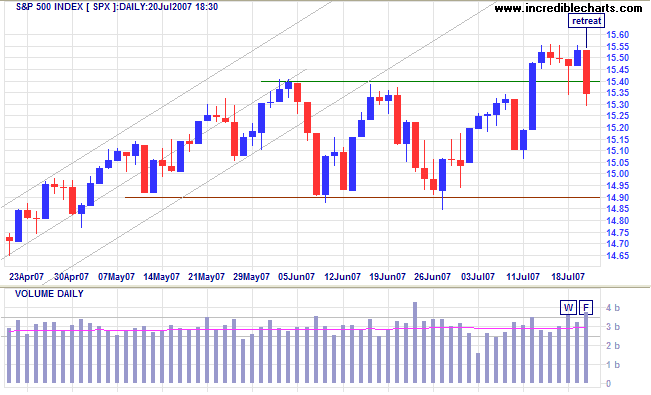

The S&P 500 retreated below the new support level of

1540, warning of a possible bull trap. A fall below Friday's

low (1530) would warn of a test of primary support at 1490.

Reversal above 1555, on the other hand, would herald another

advance.

Long Term: The primary trend continues upwards.

LSE: United Kingdom

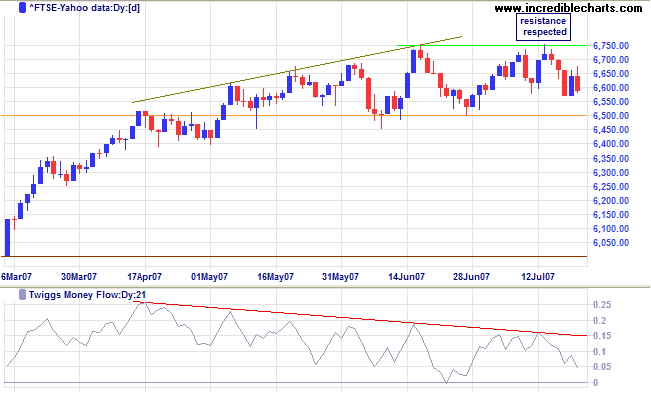

The FTSE 100 is consolidating between support at 6500

and resistance at 6750. Upward breakout would signal an advance

to test the all-time high of 6900/7000; downward breakout would

warn of a test of primary support at 6000. A Twiggs Money Flow

fall below zero would be bearish, while a break above the

downward trendline would be a bullish sign.

Long Term: The primary up-trend continues.

Japan: Nikkei

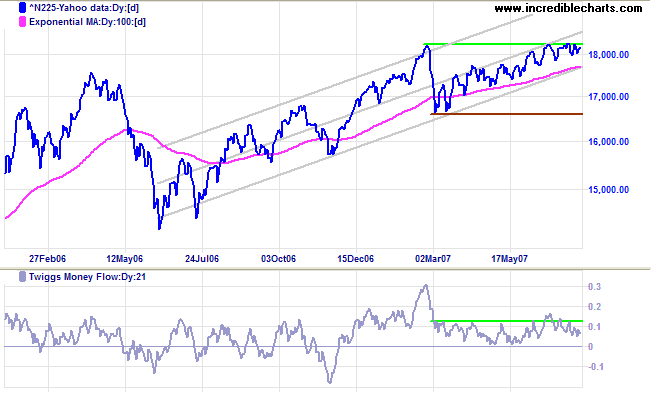

The Nikkei 225 displays a bullish narrow consolidation

below resistance at 18300.

Twiggs Money Flow signals short-term distribution but

longer term accumulation (by respecting zero). The target for

an upward breakout is 20000 (18300+[18300-16600]). A break

below the trend channel is not expected; and would warn of a

test of primary support at 16600.

Long Term: The primary trend is up.

China: Hang Seng & Shanghai

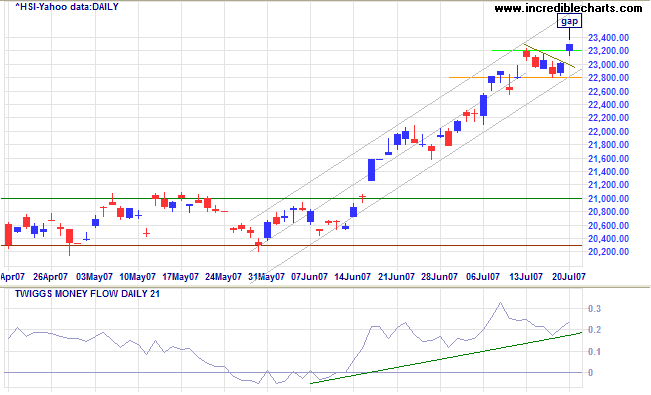

The Hang Seng gapped up strongly after a brief retracement to test support at the lower trend channel. Twiggs Money Flow signals strong accumulation. Expect another test of the upper trend channel.

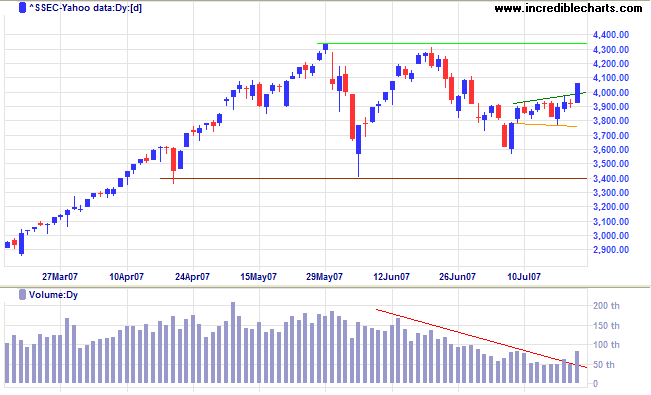

By contrast, the Shanghai Composite index is languishing in a broad consolidation between 3400 and 4350. Volume is recovering and we can expect another test of resistance after Friday's strong breakout from a broadening formation. Interesting that the recent pattern at first resembled a pennant, then a rectangle and finally a broadening formation. Provided it was narrow, the outcome was likely to be bullish.

ASX: Australia

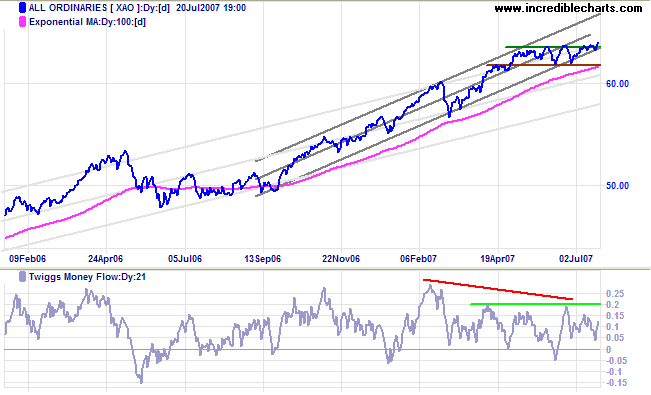

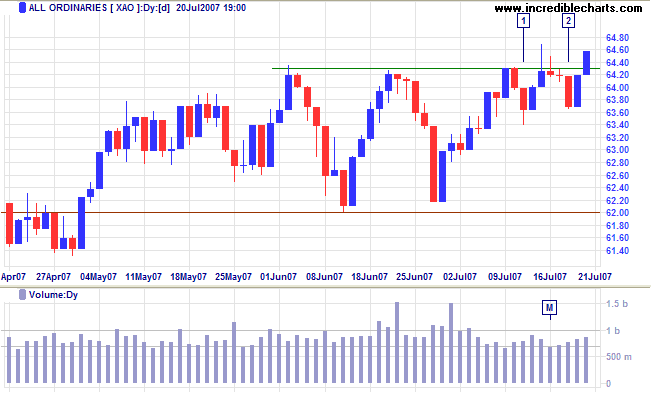

The All Ordinaries broke out from its recent

consolidation and is likely to test the upper border of the new

trend channel. Accelerating trends increase the risk of a

blow-off (a sharp rise followed by an equally sharp fall). A

Twiggs Money Flow (21-day) rise above 0.2 would confirm the

breakout.

Long Term: The primary trend remains up, with support at

6200.

Short Term: Monday's low volume [M] signaled weak resistance and a second short retracement indicated that an upward breakout was likely. Expect a test of the new support level, and possibly 6360, after Friday's weak showing in the US. As long as 6360 holds, we remain in bullish territory. A close below 6360, on the other hand, would warn of a test of support at 6200.

It has often been said that truth is the first casualty in war.

To which we should add: money (the currency) is the

second.

~ G. Edward Griffin:

The Creature From Jekyll Island - A Second Look at the Federal

Reserve

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.