Retail Sales In The Spotlight

By Colin Twiggs

July 14, 2007 3:30 a.m. EST (5:30 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA: Dow, Nasdaq and S&P500

Markets acquired new energy after improved sales reported by

some chain stores. With consumer confidence surging to a

6-month high, the market appeared set for a lift-off. But the

Commerce Department rained on the parade, releasing June retail

sales figures down a disappointing 0.9%.

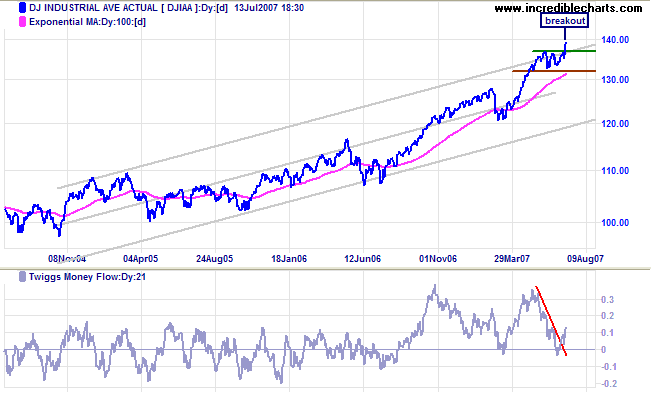

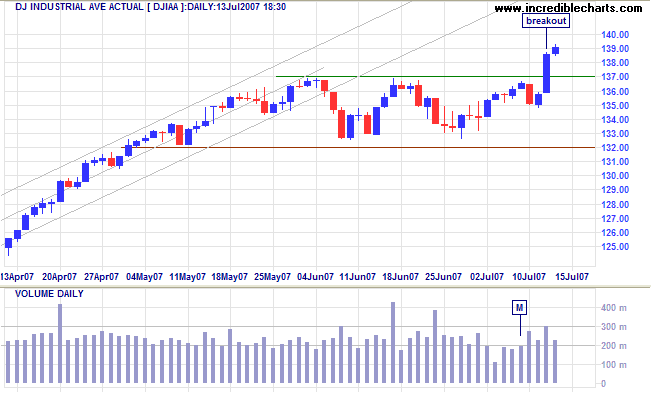

The Dow Jones Industrial Average broke out above its

10-week consolidation, signaling another primary advance and

establishing a new, steeper trend channel.

Twiggs Money Flow signals accumulation.

Long Term: The primary trend is up, with support at 13200.

Short Term: A retracement (or consolidation) to test new support at 13700 is expected. Reversal below 13500 is unlikely and would warn of a bull trap.

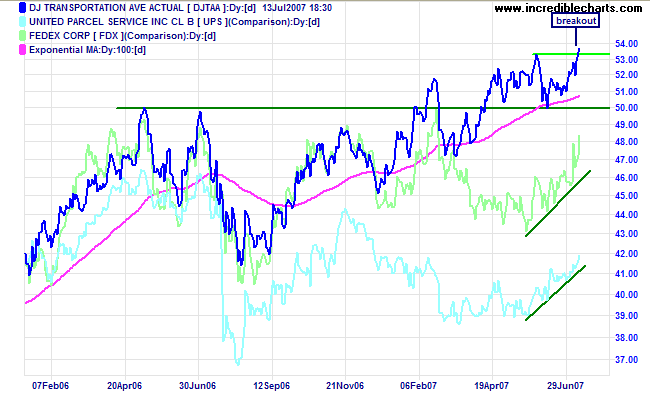

The Dow Jones Transportation Average made a bullish breakout above 5300 accompanied by strong rises in Fedex and UPS. Reversal below 5000 is not expected and would signal trend weakness.

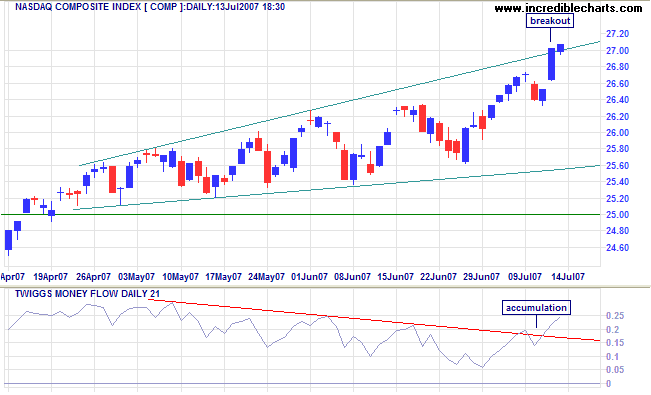

The Nasdaq Composite made an upward breakout from the

ascending broadening wedge pattern, while Twiggs Money Flow

signals accumulation. Expect further gains.

Long Term: The primary trend remains upwards, with

support at 2340 and 2500 (from 2525).

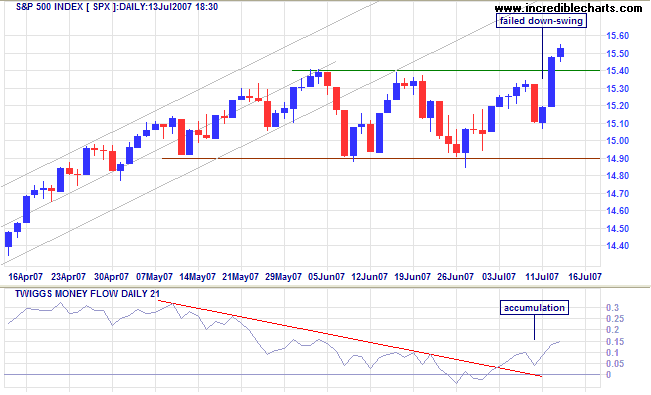

The S&P 500 broke through resistance at 1540, after

a bullish failed down-swing, signaling another primary advance.

Retracement (or consolidation) to test the new support level is

likely.

Long Term: The primary trend remains up, with support at

1490.

LSE: United Kingdom

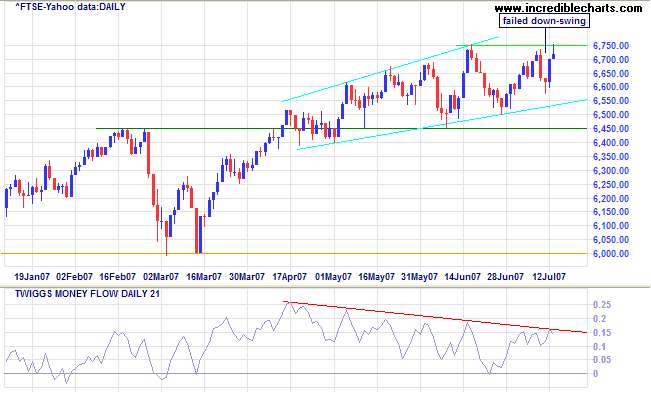

The FTSE 100 completed a bullish failed down-swing and

is testing resistance at 6750. Breakout would signal an advance

to the all-time high of 6900/7000. Twiggs Money Flow is

consolidating below the downward trendline and upward breakout

would be a bullish sign.

Long Term: The primary up-trend continues, with support

at 6000 and 6450.

Japan: Nikkei

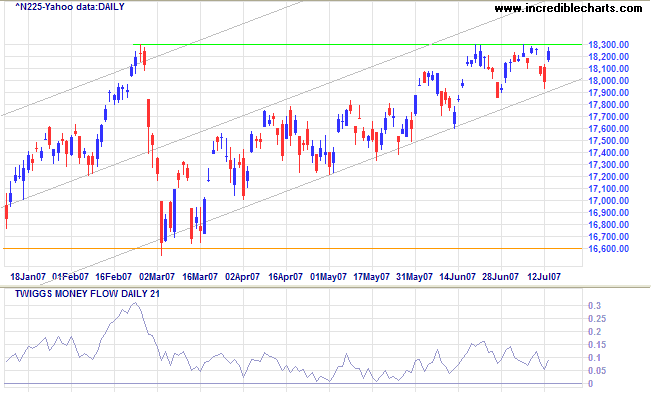

The Nikkei 225 shows a bullish consolidation below

resistance at 18300.

Twiggs Money Flow signals short-term distribution but

longer term accumulation (the indicator is respecting zero).

The target for an upward breakout is 19800

(18200+[18200-16600]). A fall below 17900/18000 is not expected

- and would warn of a test of primary support at 16600.

Long Term: The primary trend remains up.

China: Hang Seng & Shanghai

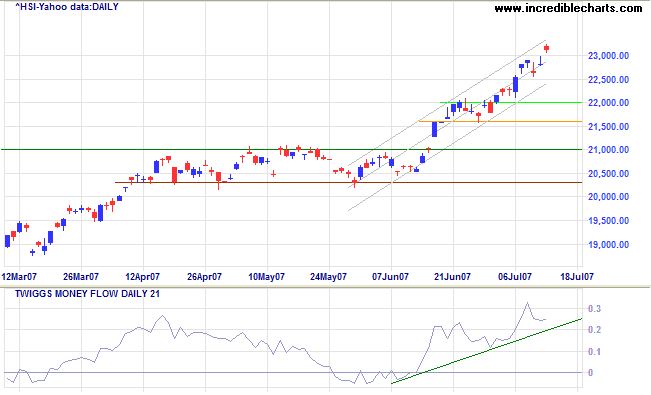

The Hang Seng index continues to accelerate, breaking through 23000 and converging with Shanghai which has been running ahead for some time. Twiggs Money Flow signals strong accumulation, having completed a trough high above zero.

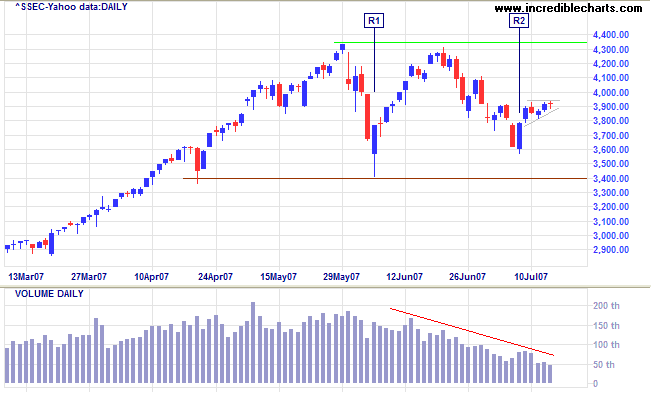

The Shanghai Composite index is consolidating above 3400, with declining volume indicating that the market is losing momentum. A small bullish pennant signals that a test of resistance at 4350 is likely.

ASX: Australia

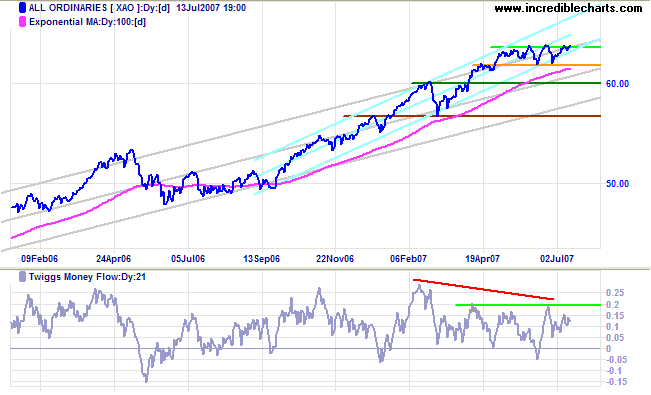

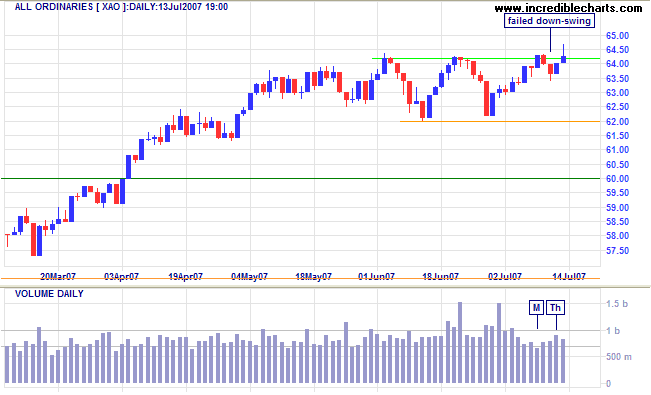

The All Ordinaries is testing resistance at the top of

the 10-week consolidation at the upper border of the trend

channel. Upward breakout is likely after similar breakouts in

US markets and would warn that the primary trend is

accelerating - establishing a new trend channel drawn in light

blue. Accelerating trends increase the risk of a blow-off (a

sharp rise followed by an equally sharp fall). A

Twiggs Money Flow (21-day) rise above 0.2 would signal

strong accumulation.

Long Term: The primary trend remains up, with support at

5650 and 6000. A clear upward breakout would shift primary

support to 6200.

Short Term: The failed down-swing is bullish, signaling continuation of the up-trend, but this has been countered by a bearish gravestone candle on Friday. A fall below 6350 would signal a test of support at 6200, while respect of 6350 (or a rise above Friday's high) would indicate another rally.

For a long time it had seemed to me that life was about to

begin - real life. But there was always some obstacle in the

way. Something to be got through first, some unfinished

business, time still to be served, a debt to be paid. Then life

would begin. At last it dawned on me that these obstacles were

my life.

~ Fr. Alfred D'Souza

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.