China Builds Up Steam

By Colin Twiggs

July 7, 2007 2:30 a.m. EST (4:30 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

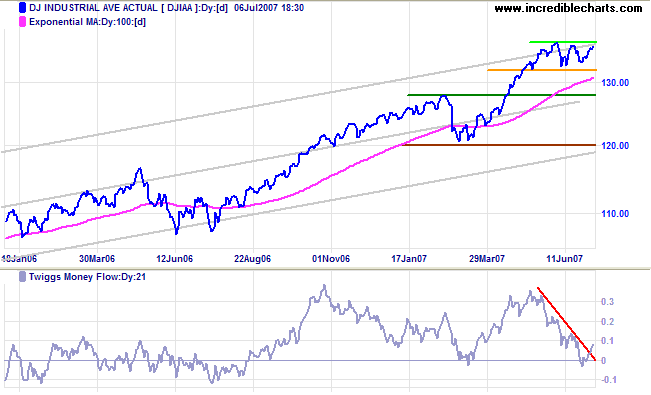

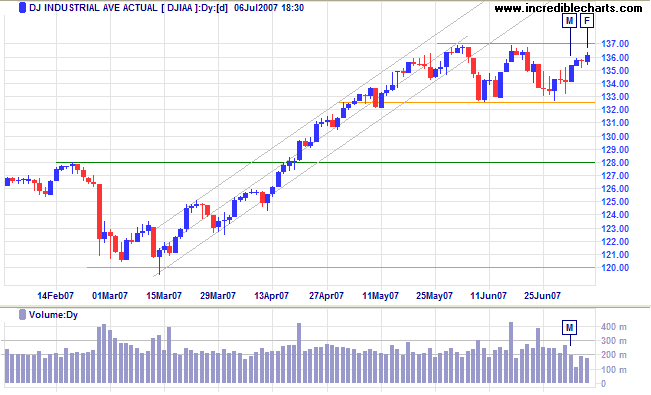

USA: Dow, Nasdaq and S&P500

Most markets took a breather this week and the Dow Jones Industrial Average was no exception, consolidating at the upper border of its 3-year trend channel. Twiggs Money Flow recovered sharply, signaling short-term accumulation.

Long Term: The primary trend is up, with support at 12000 and 12800.

Short Term: Breakout below 13250 would warn of a secondary correction, while a rise above 13700 would signal another primary advance - and possible acceleration into a blow-off. Low volumes are attributable to the Independence Day holiday.

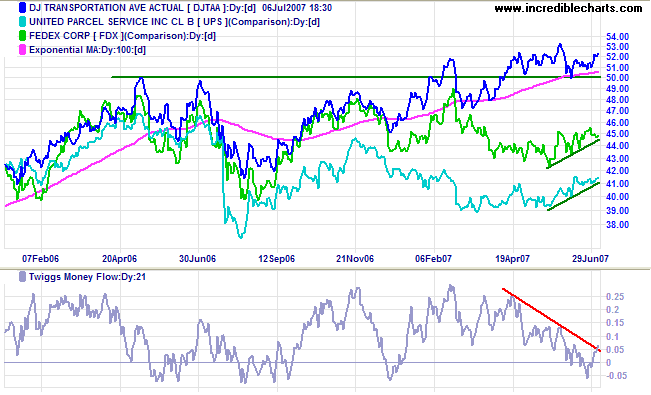

The Dow Jones Transportation Average respected support

at 5000 and is now rallying to test 5300. Breakout above this

level would be a bull signal. Twiggs Money Flow recovered

sharply to signal short-term accumulation. Reversal below 5000

is not expected and would signal trend weakness.

Fedex and UPS both appear bullish, echoing the index.

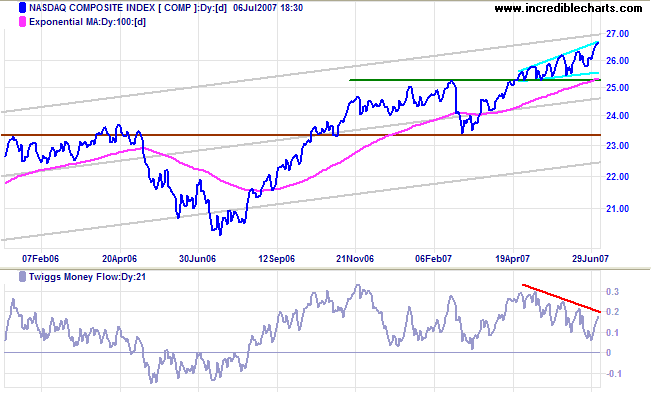

The Nasdaq Composite displays a failed down-swing in the

ascending broadening wedge pattern: signaling that an upward

breakout is likely. Twiggs Money Flow is edging lower, but

watch for a break of the downward trendline.

Long Term: The primary trend remains upwards, with

support at 2340 and 2500 (from 2525).

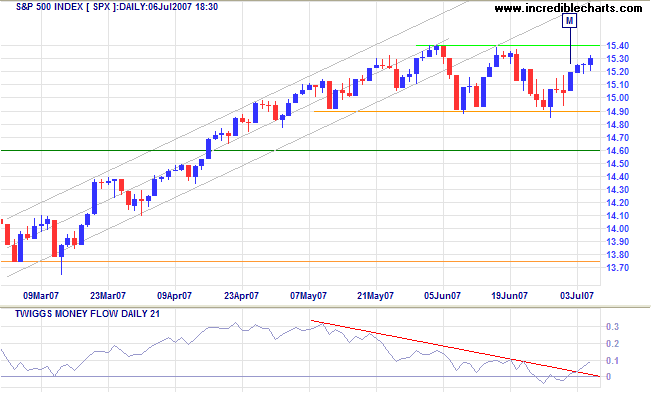

The S&P 500 continues with similar consolidation to

the Dow. A rise above 1540 would signal another primary

advance, while breakout below 1490 would warn of a secondary

correction. Twiggs Money Flow has recovered above zero,

signaling short-term accumulation.

Long Term: The primary trend remains up, with support

levels at 1460 and 1375.

LSE: United Kingdom

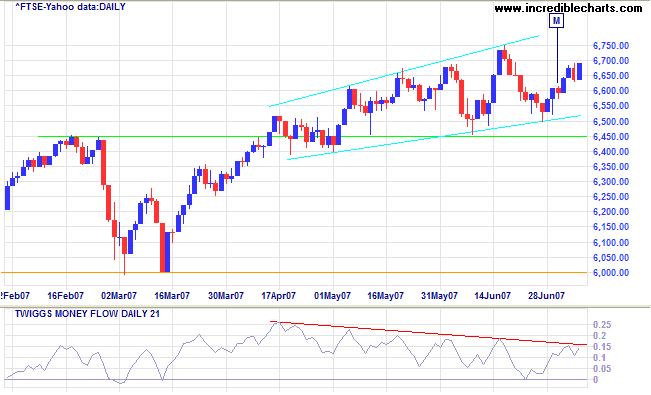

The FTSE 100 is rallying towards the upper border of an

ascending broadening wedge. A swing that fails to reach the

upper border would be bearish, while an upward breakout would

signal another primary advance - towards the all-time high of

6900/7000. Twiggs Money Flow threatens to break above the

downward trendline, which would be a bullish sign.

Long Term: The primary up-trend continues, with support

at 6000 and 6450.

Japan: Nikkei

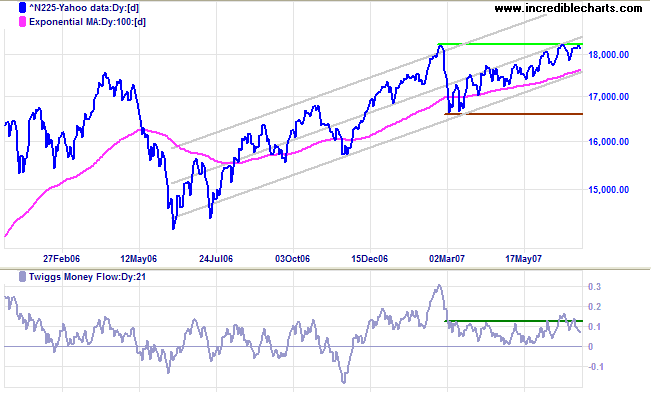

The Nikkei 225 shows short-term distribution on

Twiggs Money Flow, but narrow consolidation below

resistance at 18215 would be a bullish sign. The target for an

upward breakout is 19800 (18200+[18200-16600]). A fall below

the trend channel is not expected, but would signal another

test of primary support at 16600.

Long Term: The primary trend remains up.

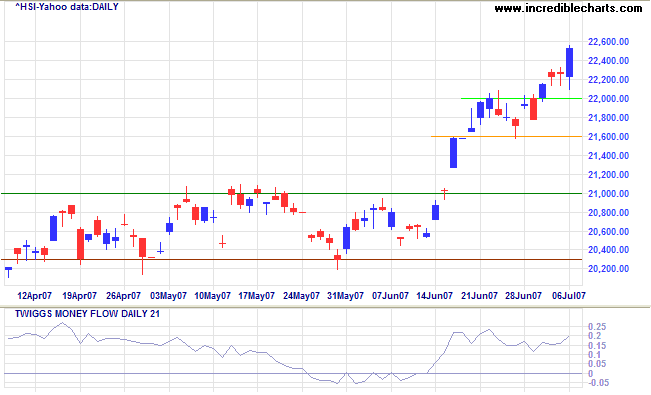

China: Hang Seng

China is going gangbusters, with the Hang Seng index powering through resistance at 22000 and now headed for a test of 23000. Twiggs Money Flow is close to completing a bullish trough above zero, signaling strong accumulation. Reversal below 21600 is not expected and would signal a test of the new support level at 21000.

ASX: Australia

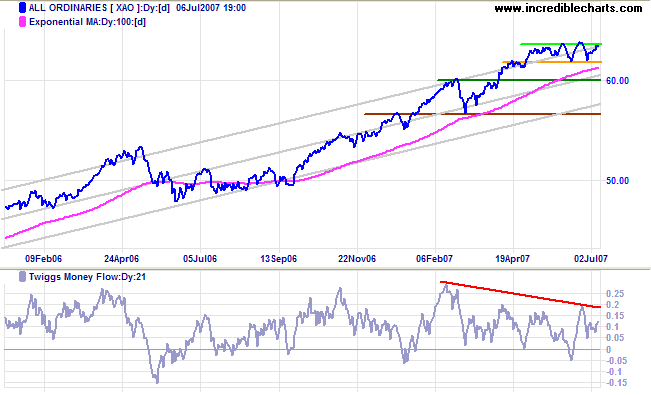

The All Ordinaries consolidates at the upper border of

the trend channel. Downward breakout would warn of a secondary

correction, while upward breakout would signal another advance

- and an accelerating up-trend, possibly leading to a blow-off.

Twiggs Money Flow (21-day) continues to display a long-term

bearish divergence, though a break of the downward trendline

would end this.

Long Term: The primary trend remains up, with support at

5650 and 6000.

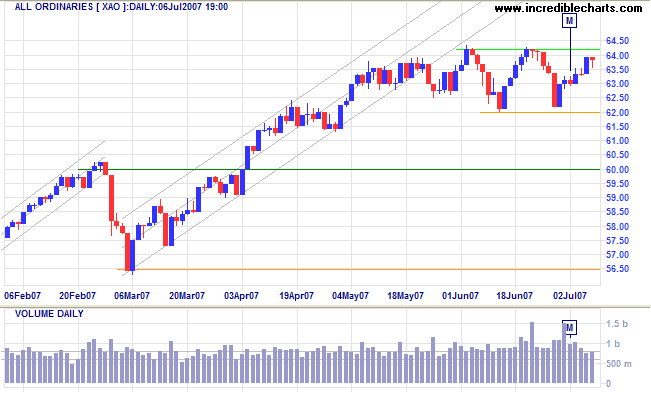

Short Term: The broadening top formation lost its shape and now resembles a regular rectangle, with support at 6200 and resistance at 6420. Look for a failed swing or breakout to indicate future direction. Higher volumes on Monday and Tuesday signal selling into the rally, but this has faded.

If you know the enemy and know yourself, you need not fear the

result of a hundred battles. If you know yourself but not the

enemy, for every victory gained you will also suffer a defeat.

If you know neither the enemy nor yourself, you will succumb in

every battle.

~ Sun Tzu

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.