Gold, Oil, Currencies & Interest Rates

By Colin Twiggs

July 03, 2007 3:00 a.m. EST (5:00 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

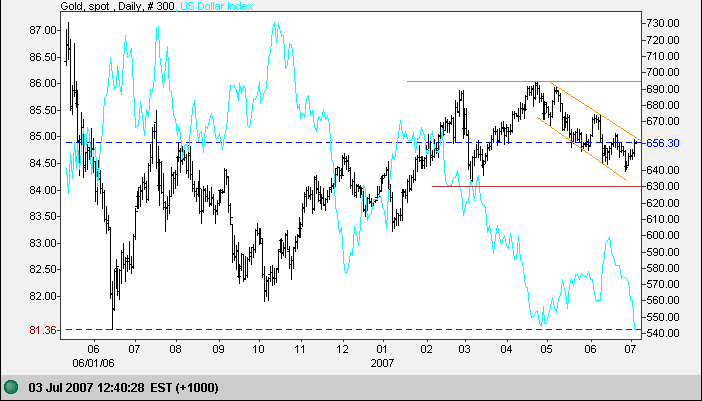

Gold

Spot gold is testing the upper border of the trend channel.

Upward breakout would indicate that the secondary correction

may be coming to an end - not confirmed until we see a higher

low followed by a higher high.

The falling US Dollar Index and rising crude prices should

increase demand for gold.

In the longer term, the primary trend remains up. A rise above

$695 would indicate another primary advance (with a target of

$760), while a fall below $630 would signal reversal.

Source: Netdania

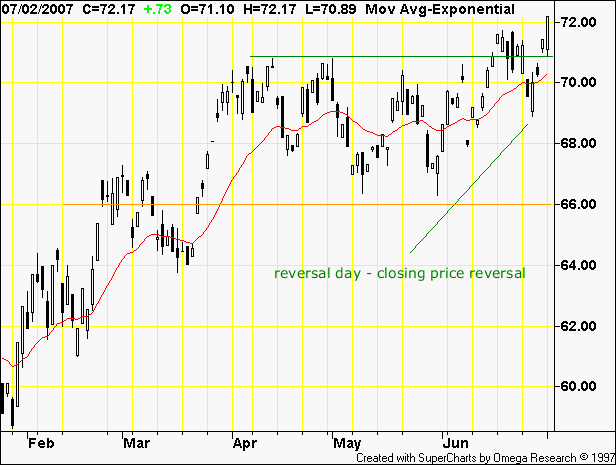

Crude Oil

December Light Crude threatened a bull trap, but quickly reversed direction after a closing price reversal. Respect of support at $71 would signal that the up-trend and target of $76 (71+[71-66]) is intact.

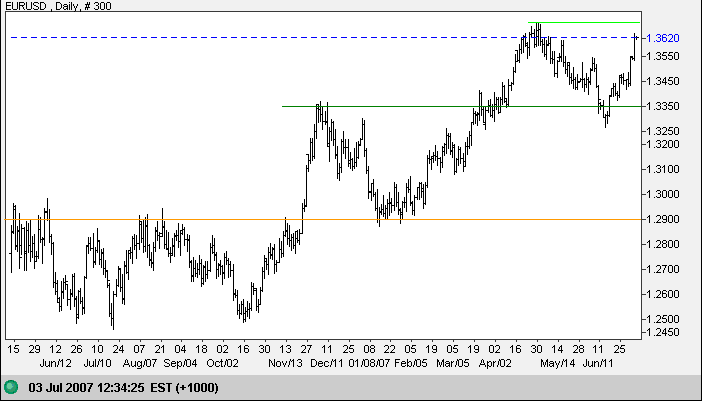

Currencies

The euro strengthened against the dollar, anticipating a widening rate spread between the two currencies. Breakout above $1.37 would give a medium term target of $1.41 (1.37+[1.37-1.33]), but the currency first has to overcome stern resistance at $1.37. Failure of support at $1.33 is unlikely and would warn of a test of primary support at $1.29.

Source: Netdania

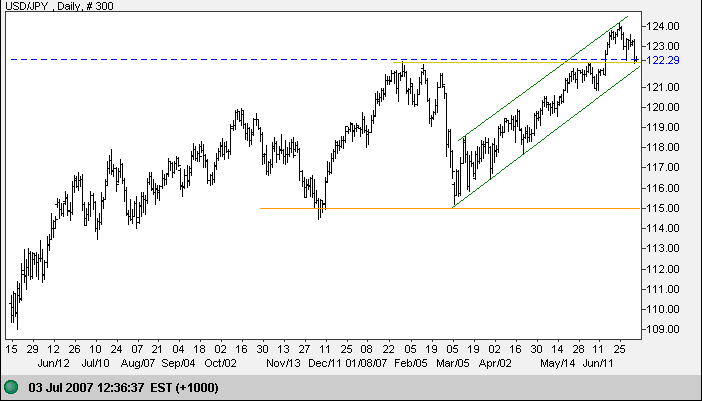

The dollar retraced to test support at 122 against the yen as Japanese business confidence rises, strengthening the argument for future rate hikes. Respect of support at 122 would be bullish, indicating a medium-term target of 129 (122+[122-115]). Downward breakout from the rising trend channel would signal weakness - and a possible re-test of primary support at 115.

Source: Netdania

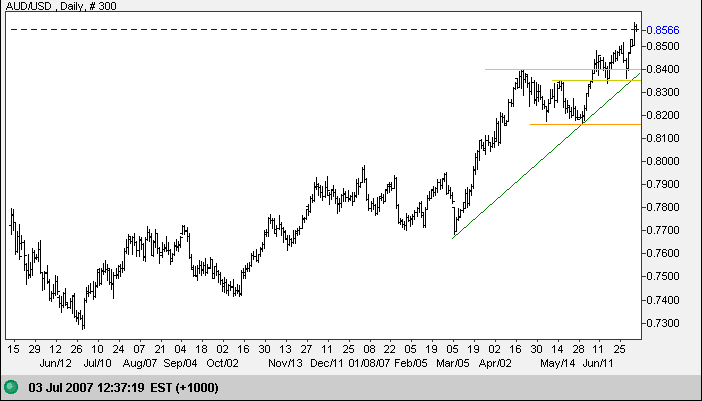

The Australian dollar rose sharply after respecting support at 0.8350. The medium term target is 0.8650 (0.8400+[0.8400-0.8150]).

Source: Netdania

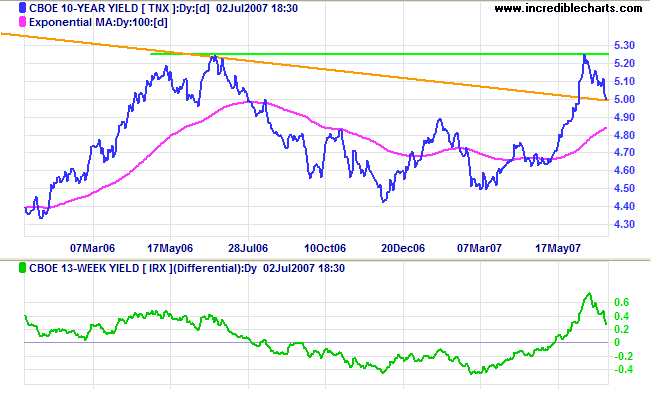

Treasury Yields

The ten-year treasury yield retraced to 5.00% as expectations of further rate hikes fade. The yield differential (10-year minus 13-week treasury yields) remains positive.

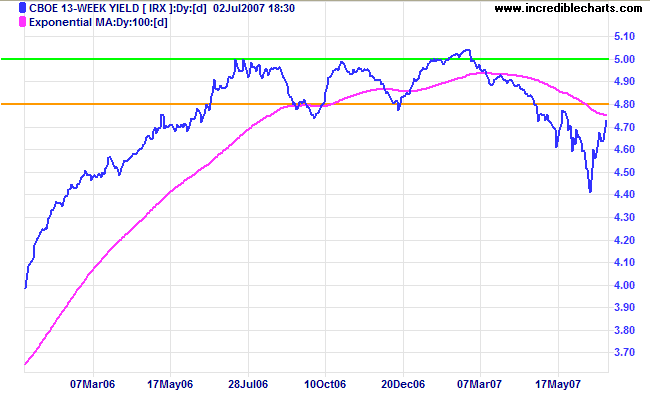

The recovery of short-term (13-week) treasury yields continues. Respect of resistance at 4.80% would warn that the down-trend is intact, while failure would signal that the recent equilibrium is restored.

Stock Markets

The Hang Seng is holding in a bullish consolidation below 22000

despite a rising yuan threatening to weaken dollar exports. The

Nikkei 225 remains bullish, headed for a test of the 2007 high

of 18300.

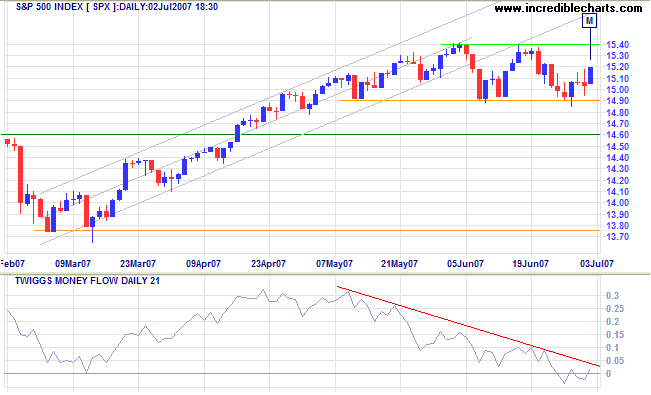

The S&P 500 is consolidating between resistance at the

all-time high of 1540 and support at 1490. The index appears

headed for a test of the upper border, but there is no clear

indication of the likely breakout direction. Failure of support

at 1490 would warn of a secondary correction, while breakout

above 1540 would signal another primary advance with a

short-term target of 1590 (1540+[1540-1490]).

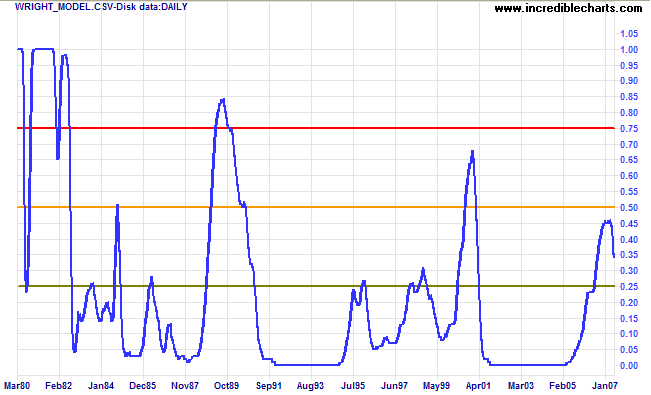

Wright Model

Probability of recession in the next four quarters fell to a low 34 per cent according to the Wright Model.

The good fighters of old first put themselves beyond the

possibility of defeat, and then waited for an opportunity of

defeating the enemy

~ Sun Tzu

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.