Dow Hesitant, Nikkei Marches On

By Colin Twiggs

June 30, 2007 4:00 a.m. EST (6:00 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

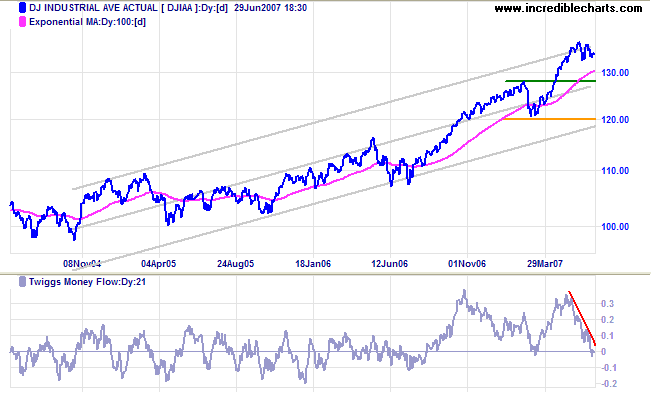

USA: Dow, Nasdaq and S&P500

The Dow Jones Industrial Average is consolidating at the upper border of its 3-year trend channel while Twiggs Money Flow fell to below zero, signaling distribution.

Long Term: The primary trend is up, with support at 12000 and 12800.

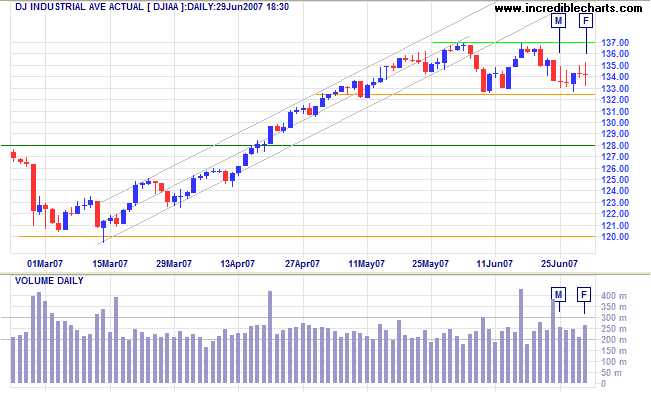

Short Term: Downward breakout below 13250 would warn of a secondary correction. On the other hand, a rise above 13700 would signal another primary advance - which could accelerate into a blow-off.

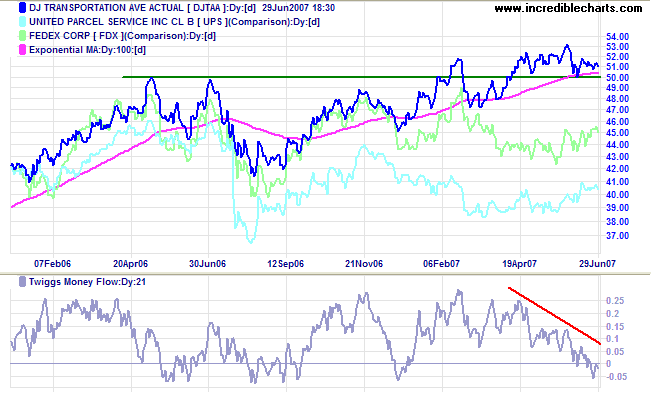

Both UPS and Fedex are edging upwards, but the Dow Jones Transportation Average is retreating toward another test of support at 5000. Twiggs Money Flow signals distribution and a (DJTA) close below 5000 would signal weakness.

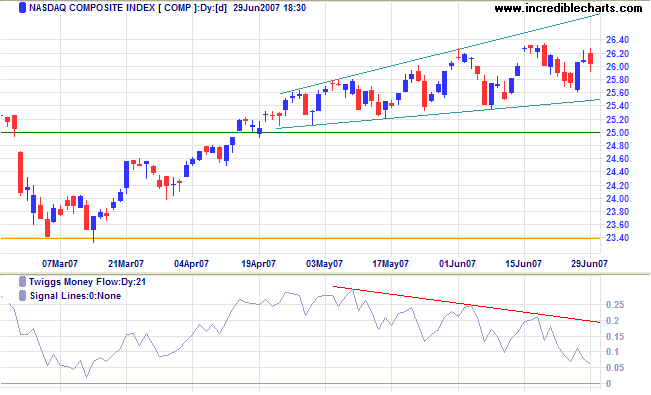

The Nasdaq Composite is consolidating in an ascending

broadening wedge; a failed up-swing would warn of a downward

breakout and secondary correction.

Long Term: The primary trend remains upwards, with

support at 2340 and 2500 (from 2525).

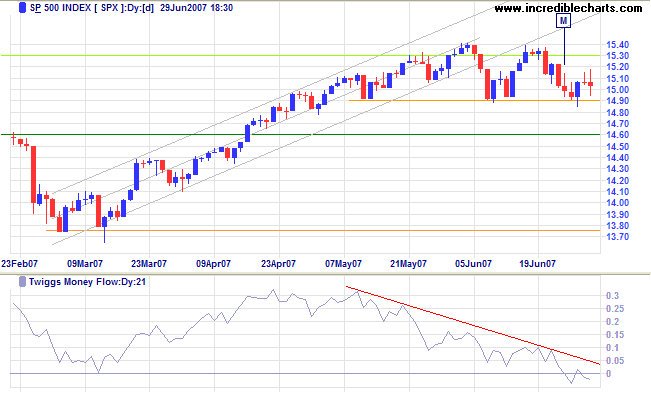

The S&P 500 shows similar consolidation to the Dow,

with

Twiggs Money Flow (21-day) signaling distribution. Breakout

below 1490 would warn of a secondary correction; while a rise

above 1540, though unlikely in the present circumstances, would

signal a further primary advance.

Long Term: The primary trend remains up, with support

levels at 1460 and 1375.

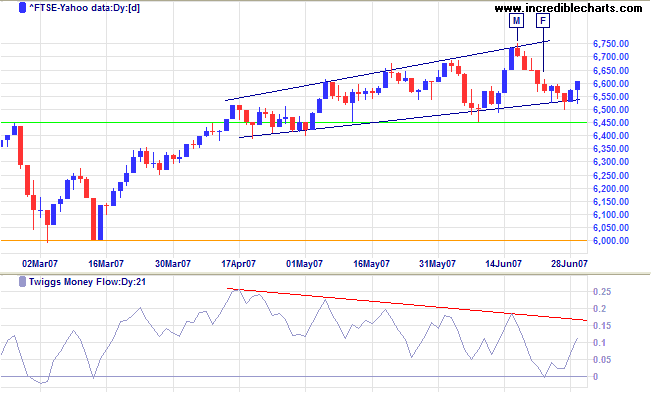

LSE: United Kingdom

The FTSE 100 appears stronger than US markets, rallying

off the lower border of an ascending broadening wedge, while

Twiggs Money Flow is recovering. Expect a swing to test the

upper border of the formation. Breakout from the wedge, or a

failed swing, will indicate future direction.

Long Term: The primary up-trend continues, with support

at 6000 and 6450.

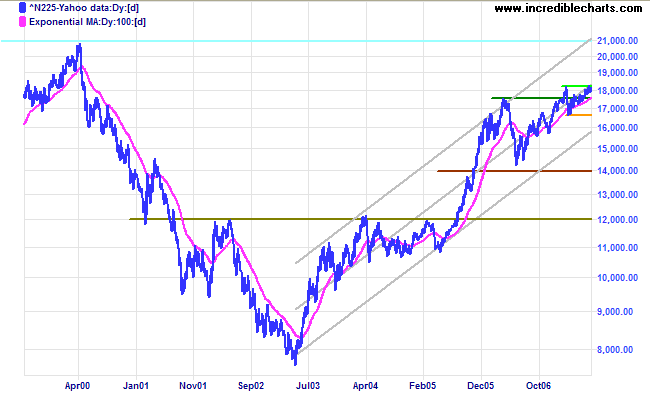

Japan: Nikkei

The Nikkei 225 is testing resistance at the February

2007 high of 18215, while

Twiggs Money Flow signals accumulation. The medium-term

target for an upward breakout is 19800

(18200+[18200-16600]).

Long Term: The primary trend remains up, with primary

support at 16600. The long-term target is 21000

(17500+[17500-14000]).

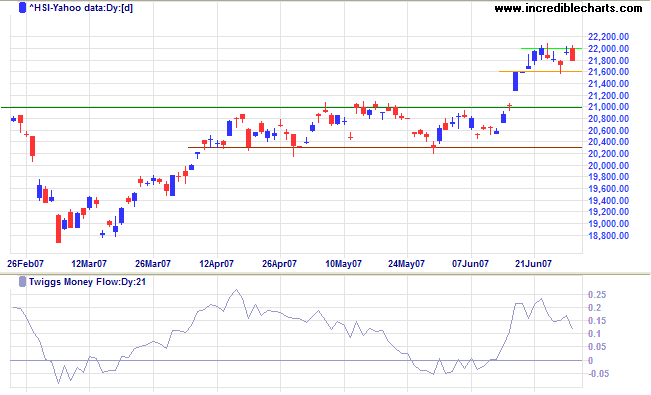

China: Hang Seng

The Hang Seng is consolidating below resistance at 22000, while Twiggs Money Flow signals short-term distribution. The calculated target for an upward breakout is 23300 (21000+[21000-18700]). Downward breakout is less likely and would signal a test of the new support level at 21000; reversal below 21000 is not expected.

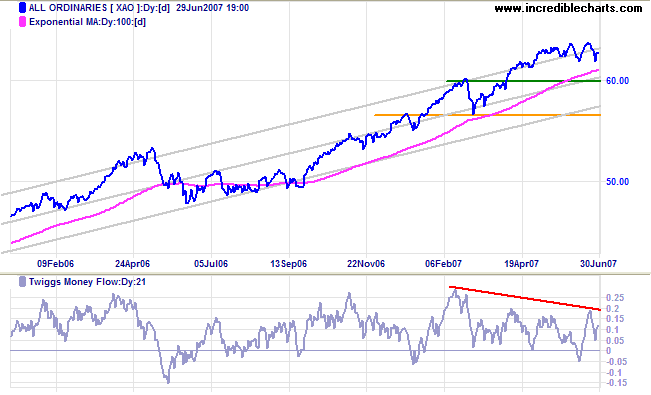

ASX: Australia

The All Ordinaries is consolidating at the upper border

of the trend channel. Downward breakout would warn of a

secondary correction, while upward breakout would signal a

further primary advance.

Twiggs Money Flow (21-day) displays a short-term bull, but

long-term bear signal.

Long Term: The primary trend remains up, with support at

5650 and 6000.

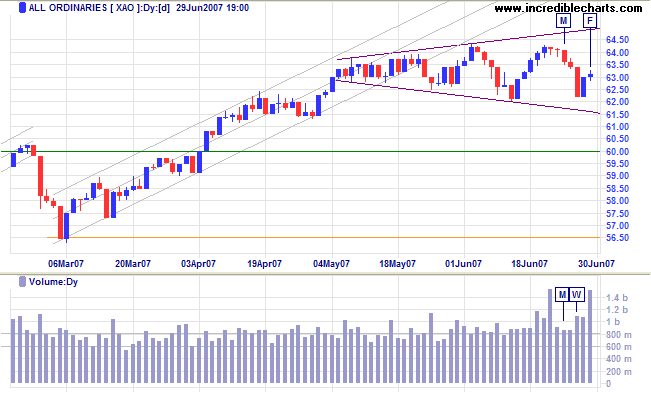

Short Term: The index continues in a broadening top formation. Look for a failed swing or breakout to indicate future direction. Respect of 6200 would be a bullish sign. Large volume on Friday is most likely attributable to profit-taking (or loss-taking) at the tax year-end, so we should not read too much into this.

On the occasion of every accident that befalls you, remember to

turn to yourself and inquire what power you have for turning it

to use.

~ Epictetus

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.