Western Bears, Eastern Tigers

By Colin Twiggs

June 23, 2007 4:00 a.m. EST (6:00 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA: Dow, Nasdaq and S&P500

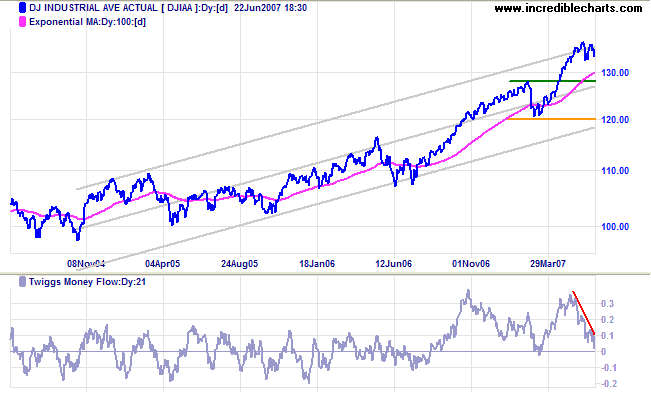

The Dow Jones Industrial Average is at the upper border of its 3-year trend channel while Twiggs Money Flow is falling rapidly, warning of another secondary correction.

Long Term: The primary trend is up, with support at 12000 and 12800.

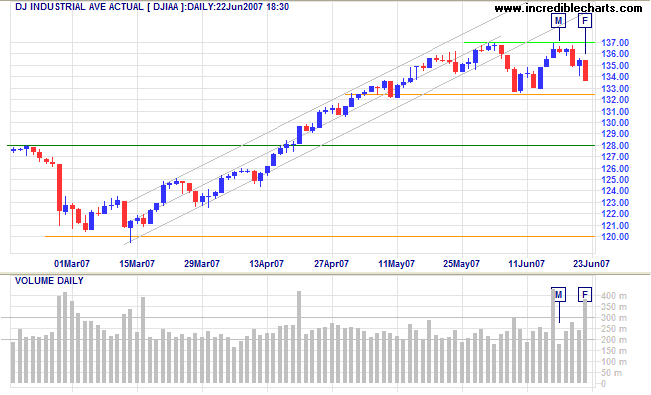

Short Term: Friday's strong red candle and large volume depict an attempted rally overwhelmed by sellers, with the index retracing towards a test of support at 13250. Penetration of support would warn of a secondary correction. Reversal above 13700, signaling resumption of the primary advance, is unlikely.

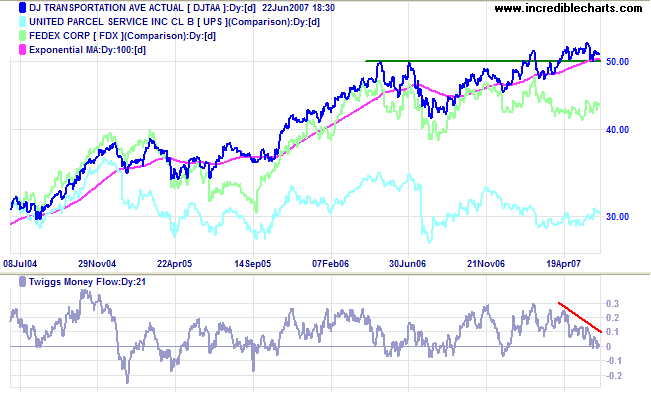

The Dow Jones Transportation Average continues to consolidate above support at 5000, normally a bullish sign, but Twiggs Money Flow has fallen sharply. A close below 5000 would signal weakness. Both UPS and Fedex display uncertainty.

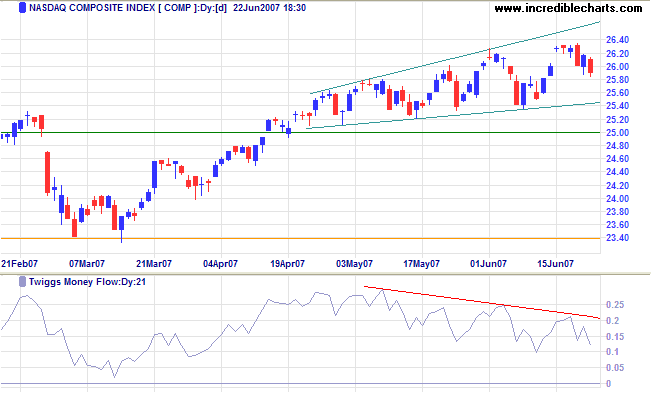

The Nasdaq Composite closed the gap from last week's

doji star; the failed up-swing in an ascending broadening

wedge formation suggests that a downward breakout is

likely.

Long Term: The primary trend remains upwards, with

support at 2340 and 2500 (from 2525).

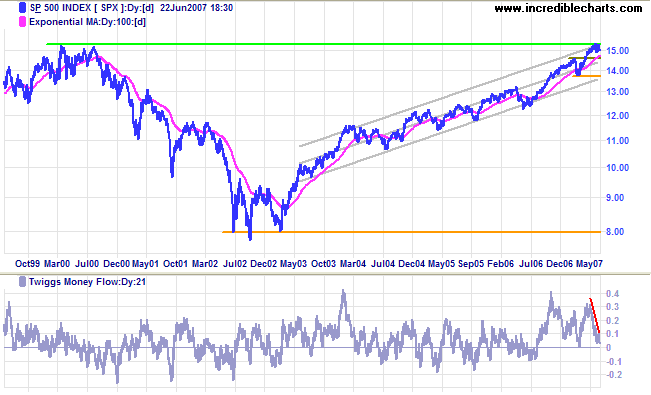

The S&P 500 is consolidating below resistance at

1530 while

Twiggs Money Flow (21-day) is falling sharply. Reversal

below last week's low of 1490 would warn of a secondary

correction. Continued consolidation would be bullish; and a

rise above 1540, though unlikely in the present circumstances,

would signal resumption of the primary advance.

Long Term: The primary trend remains up, with support

levels at 1460 and 1375.

LSE: United Kingdom

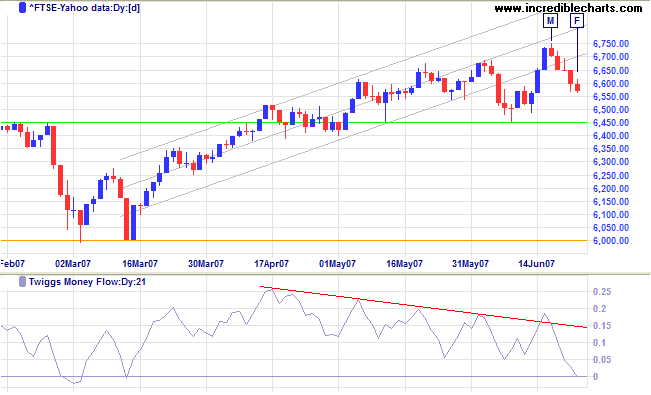

The FTSE 100 is losing momentum, having failed to test

the upper trend channel, and is headed for a test of support at

6450. Twiggs Money Flow is falling sharply and failure of

support would warn of a secondary correction to test primary

support at 6000. Recovery above 6750, signaling resumption of a

strong up-trend, remains equally likely.

Long Term: The primary up-trend continues.

Japan: Nikkei

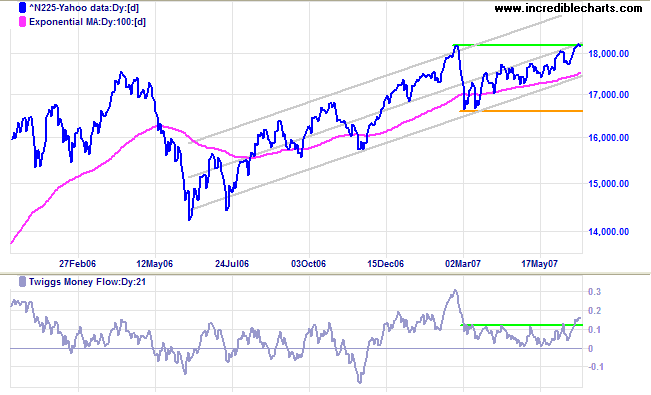

The Nikkei 225 is testing resistance at the February

2007 high of 18215.

Twiggs Money Flow breakout above the previous 3 month high

signals accumulation and increases the likelihood of an upward

breakout.

Long Term: The primary trend remains up, with primary

support at 16600.

China: Hang Seng

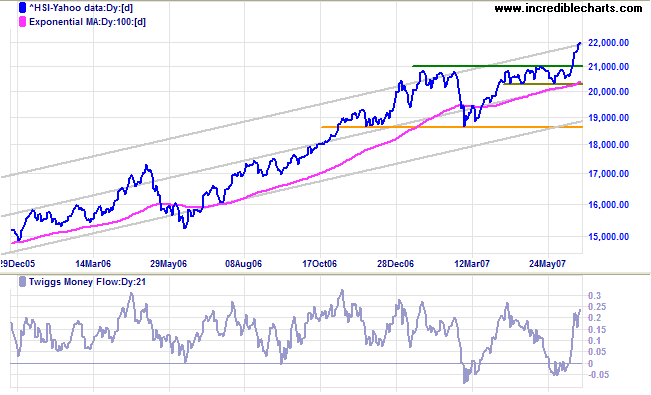

The Hang Seng broke through 21000 and is now testing resistance at 22000. Twiggs Money Flow rising steeply signals strong accumulation. The calculated target is 23300 (21000+[21000-18700]). Retracement to test the new support level at 21000 remains a possibility, but reversal below this level is unlikely.

ASX: Australia

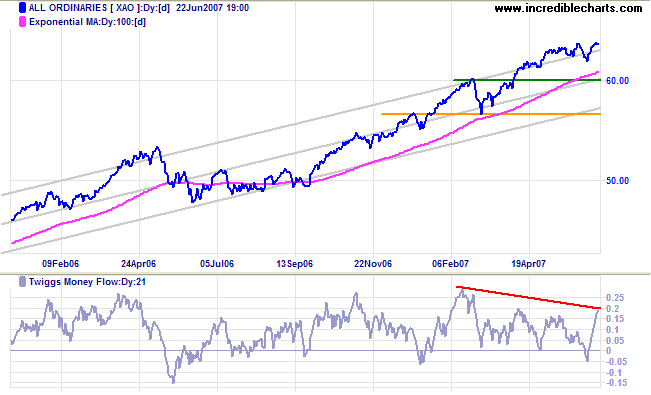

The All Ordinaries displays a broadening top formation

at the upper border of the trend channel. The sharp rise in

Twiggs Money Flow (21-day) may overstate accumulation - see

Short Term below. Downward breakout would warn of a

secondary correction. Upward breakout, indicating that the

trend may be accelerating into a blow-off, is not as

likely.

Long Term: The primary trend remains up, with support at

5650 and 6000.

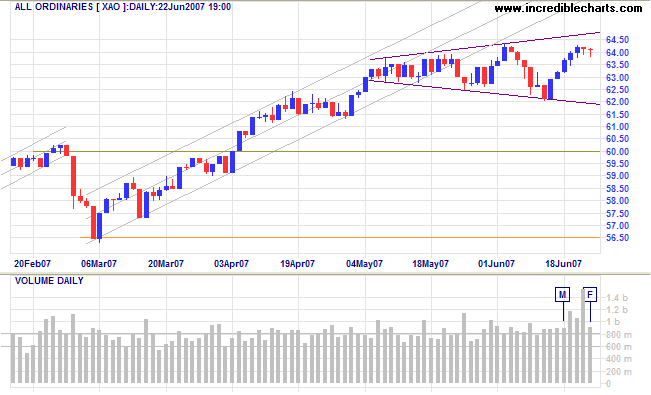

Short Term: Long tails in the recent rally signal distribution and large volumes warn of significant resistance at 6400. Watch for a failed up-swing in the broadening top formation which would signal that a downward breakout is likely.

No sane man is unafraid in battle, but discipline produces in

him a form of vicarious courage.

There is only one type of discipline, perfect discipline.

~ General George S. Patton Jnr.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.