Gold, Oil, Currencies & Interest Rates

By Colin Twiggs

May 29, 2007 6:00 a.m. EST (8:00 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

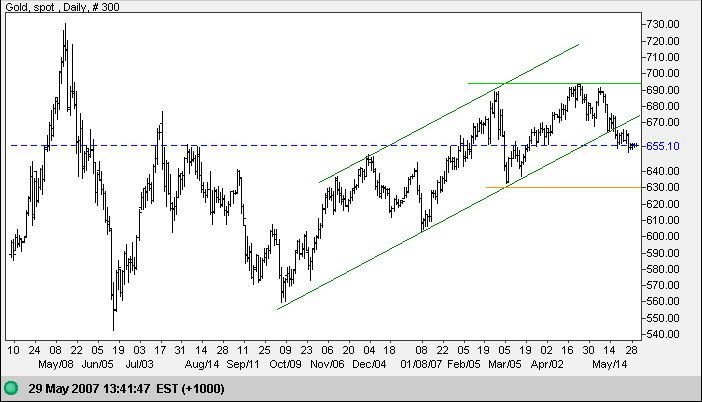

Gold

Spot gold broke down from the trend channel, warning that the trend is weakening. The small pennant over the last four days is likely to resolve in a downward direction, signaling a test of primary support at $630. The primary trend remains up. In the longer term, a rise above the April high would signal a test of the upper trend channel; while a fall below $630 would warn that the trend has reversed. Probabilities remain about even, considering that strong crude prices should support demand for gold.

Source: Netdania

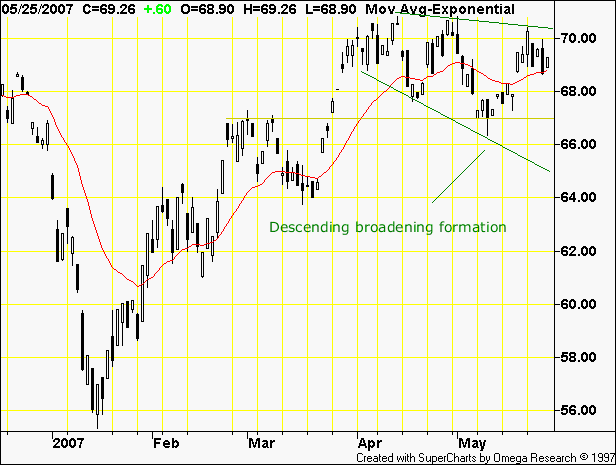

Crude Oil

December Light Crude respected the upper border of the descending broadening formation and has pulled back slightly. Upward breakout would be positive, but the pattern is prone to pull-backs and only a rise above $71 would be a reliable signal.

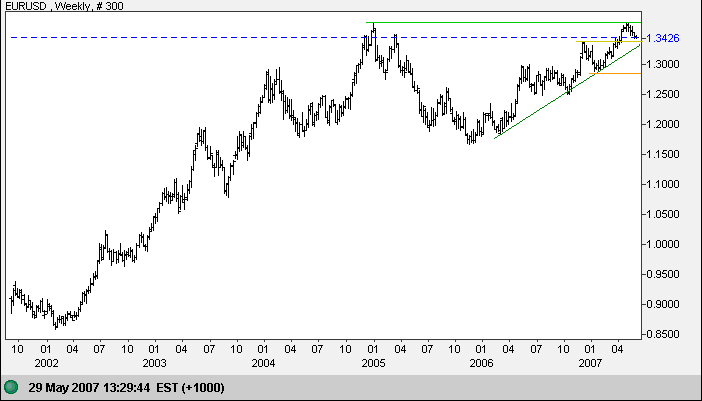

Currencies

The euro is retracing towards the first line of primary support at $1.34. Failure of support would break the long-term trendline and signal trend weakness. In the longer term, a fall below primary support at $1.29 would signal reversal; while a rise above the 2005 high of $1.37 would signal continuation of the primary advance.

Source: Netdania

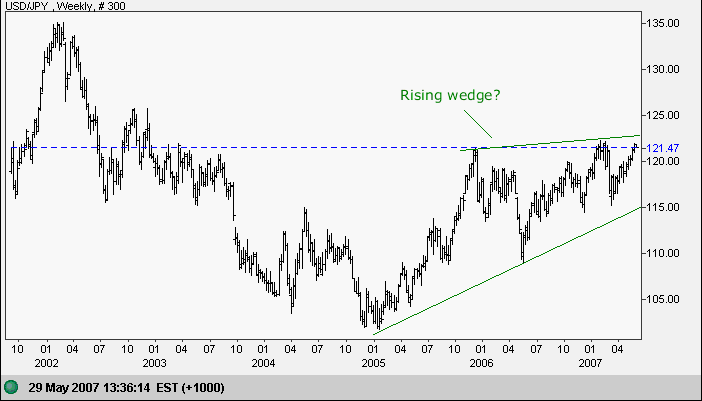

The dollar continues in a bearish rising wedge against the yen on the weekly chart. This is a reversal pattern, but breakout above the upper border would signal pattern failure and continuation of the up-trend.

Source: Netdania

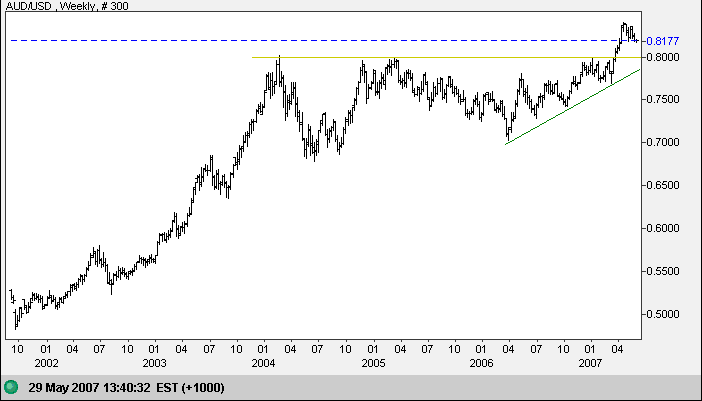

The Australian dollar's continues to retrace and is likely to test the first line of primary support at 0.80. Respect of support remains likely and would be a bull signal, while failure would signal trend weakness.

Source: Netdania

Treasury Yields

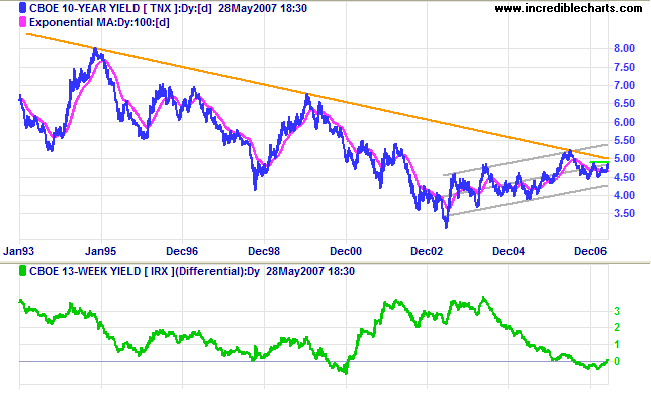

Thirty-year treasury yields [TYX] have broken above their 15-year (downward) trendline, signaling weakness in the super-cycle bear-trend, but this is yet to be confirmed by ten-year treasury notes [TNX] below. A TNX rise above 4.90% would signal a primary up-trend. However, only a rise above 5.25% (and 5.30% for TYX) would signal a trend change in the super-cycle. The yield differential (10-year minus 13-week treasury yields) remains above zero, suggesting a more positive outlook for the economy.

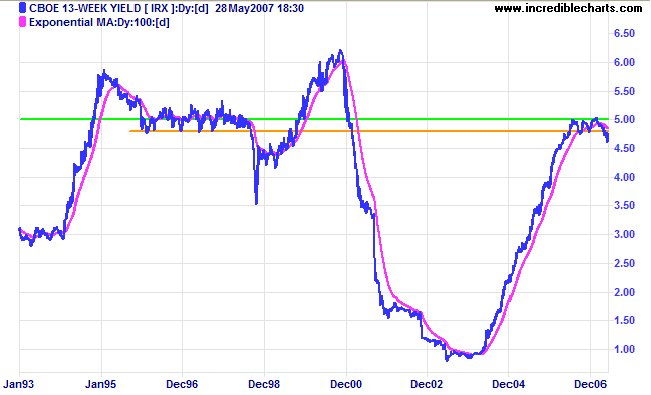

Short-term treasury yields respected the new resistance level at 4.80% on their (upward) retracement. Reversal below their recent low of 4.60% would confirm that the Fed is increasing liquidity in the economy (in the hope of engineering a soft landing); while a rise above 4.80% would indicate that the recent fall was a temporary aberration. Prospects of further rates hikes appear minimal and rates may remain constant for some time.

Stock Markets

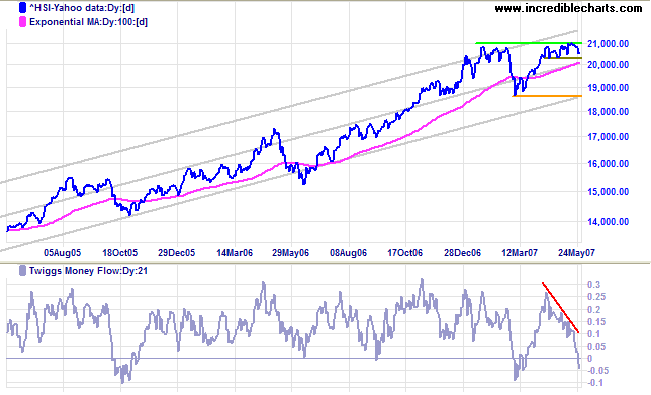

This week is dominated by China, with heavy distribution on the Hang Seng and Shanghai indices. A Hang Seng fall below 20000 would signal a secondary correction that would test support at the lower channel line. Reversal above 21000, though unlikely considering the signal on Twiggs Money Flow, would signal continuation of the primary advance.

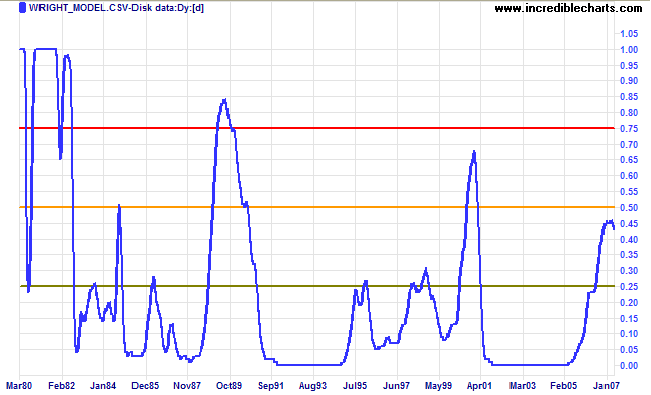

Wright Model

Probability of recession in the next four quarters retreated to 43 per cent according to the Wright Model.

Good tactics can save even the worst strategy.

Bad tactics will destroy even the best strategy.

~ General George S Patton Jr.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.