China Syndrome

By Colin Twiggs

May 26, 2007 2:00 a.m. EST (4:00 p.m. AEST)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

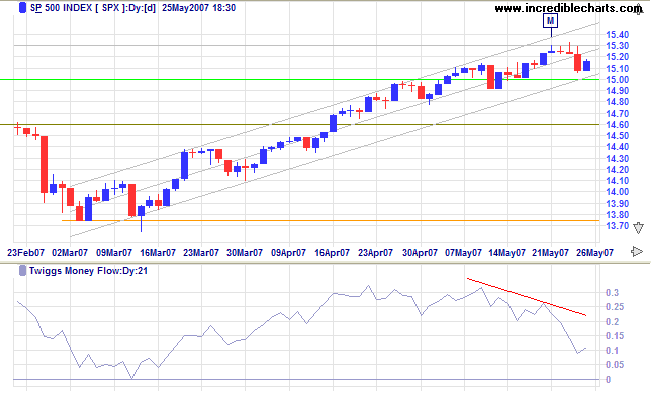

USA: Dow, Nasdaq and S&P500

I suspect that Ben Bernake would appreciate a gagging order on the former Fed Chairman, who is not averse to tossing the odd hand grenade over his shoulder. Alan Greenspan's comments on China appear likely to have precipitated a correction on the Hang Seng and Shanghai indexes. Many will wait to assess the extent of any domino effect on other exchanges, so the coming week is likely to be bearish.

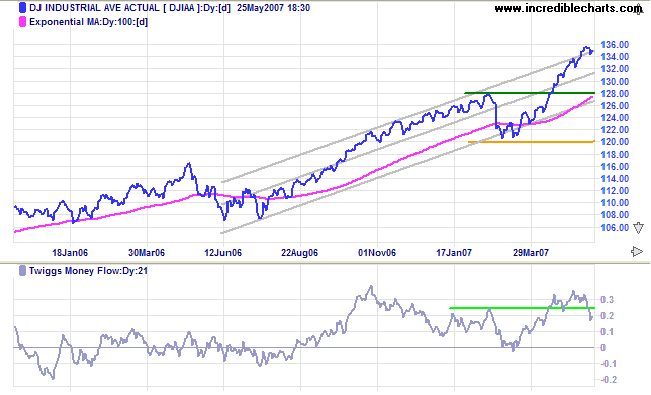

The Dow Jones Industrial Average broke through the upper

border of the trend channel, but

Twiggs Money Flow is now falling sharply, warning of a

possible correction that would test the first line of primary

support at 12800/13000.

Channel lines on the chart below are not symmetrical: I have

dragged the top channel line closer to the linear regression

line because in this case data is not evenly distributed around

the LR line.

Long Term: The primary up-trend continues, with primary support at 12000.

|

I repeat my note from last week on my review of the primary trend. Robert Rhea (The Dow Theory, 1932) defines a secondary reaction as "an important decline... usually lasting from three weeks to as many months, during which interval the price movement generally retraces from 33 per cent to 66 per cent of the primary price change since the termination of the last preceding secondary reaction." The key words are: an important decline. The duration and percentage retracement are merely guidelines. Rhea himself records secondary reactions as short as 7 days; and others where retracement is as low as 20 per cent. The recent February/March reaction endured less than 3 weeks and is borderline one-third retracement. Nevertheless I believe that it qualifies as an important decline and should be considered a secondary reaction. Primary support levels have been revised accordingly. |

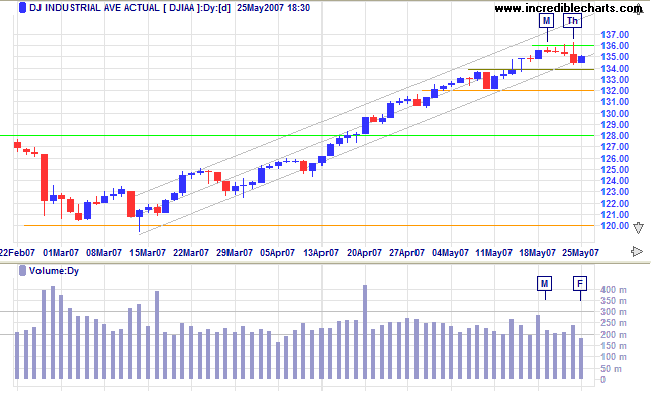

Short Term: Thursday's [Th] increased volume signals some profit-taking, but overall this has been a quiet week with low volumes typical of a narrow consolidation.

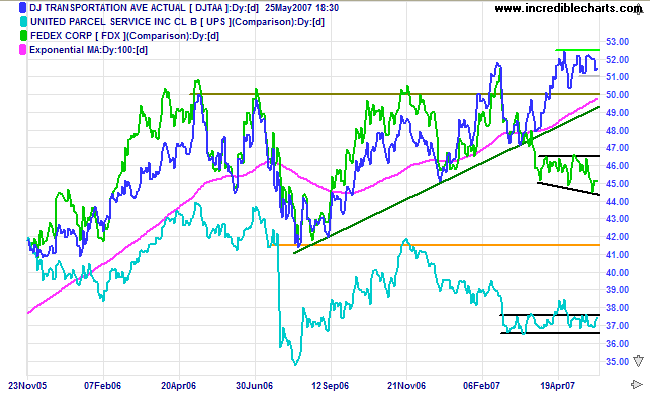

The Dow Jones Transportation Average shows a bullish narrow consolidation below 5250. Fedex has formed a right-angled broadening formation; a higher low or upside breakout would signal reversal of the secondary correction. UPS remains in a bearish narrow consolidation (during a down-trend).

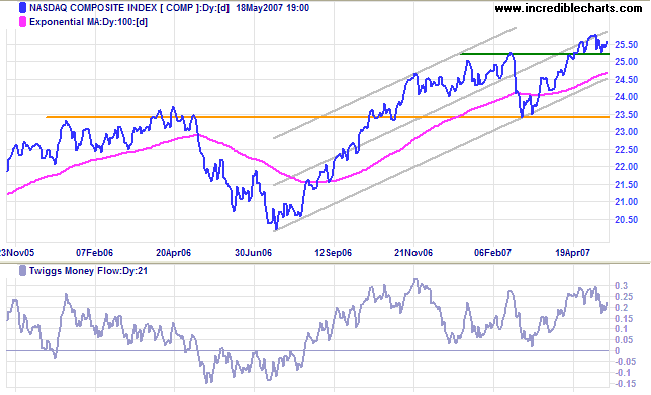

The Nasdaq Composite again respected support at 2525.

Upward breakout from the recent narrow consolidation would

signal a test of the upper trend channel, while a fall below

2500 would test the lower channel border and threaten primary

support at 2340.

Twiggs Money Flow (21-day) continues to signal long-term

accumulation, having respected the zero line for several

months.

Long Term: The primary trend is up.

The S&P 500 encountered significant profit-taking at

the all-time high of 1530 and

Twiggs Money Flow (21-day) is falling sharply. A fall below

1500 would be cause for concern, while break of support at 1490

would warn of a secondary correction. A rise above 1530, though

not expected in the coming week, would be a strong bull

signal.

Long Term: The primary trend is up, with support levels

at 1460 and 1375.

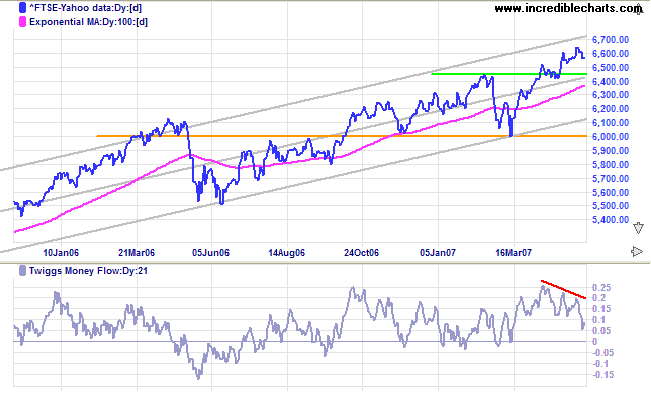

LSE: United Kingdom

The FTSE 100 also shows significant profit-taking, with

Twiggs Money Flow falling sharply. Reversal below 6450 would

warn of a secondary correction, while recovery above 6650 would

signal resumption of the up-trend.

Long Term: The primary up-trend continues, with primary

support at 6000.

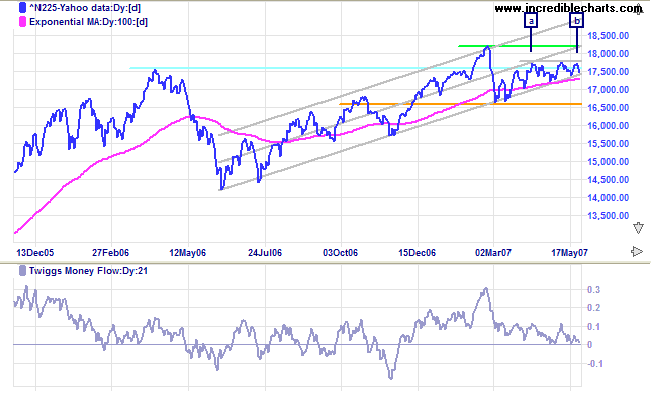

Japan: Nikkei

The Nikkei 225 is hugging the lower border of the trend

channel, but has formed a bullish ascending triangle between

[a] and [b]. Breakout above the upper border would signal a

test of the February high. Though less likely, downward

breakout below the trend channel (and moving

average) would warn of a test of primary support at 16600.

Twiggs Money Flow continues to hold above zero, signaling

an absence of major selling.

Long Term: The primary trend remains up.

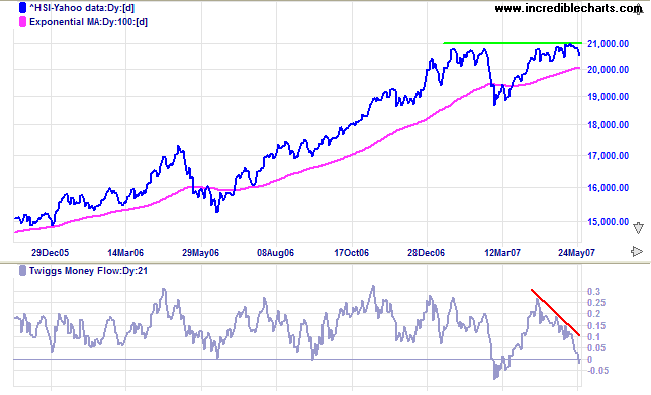

China: Hang Seng & Shanghai indexes

The Hang Seng is consolidating in a narrow range below

resistance at 21000, normally a bull signal. However,

Twiggs Money Flow is falling sharply, signaling major

profit-taking. A fall below 20000 and the 100-day moving

average would warn of a secondary correction to test

primary support at 18700. A rise above 21000, though unlikely,

would signal resumption of the primary advance.

Long Term: The primary trend remains up.

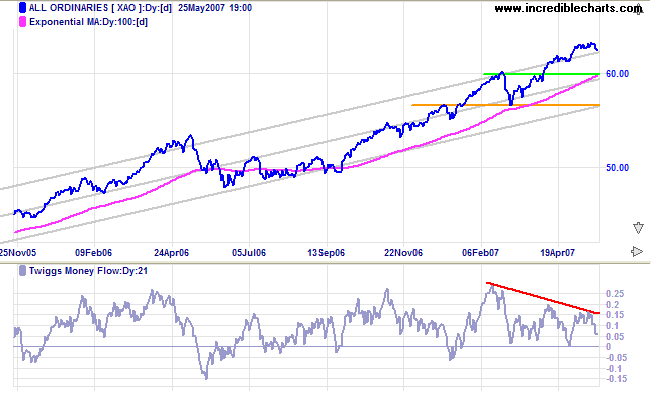

ASX: Australia

The All Ordinaries continues above the upper border of

the trend channel, but

Twiggs Money Flow (21-day) shows a large bearish

divergence, warning of profit-taking.

Long Term: The primary up-trend continues, with support

at 6000 and 5650.

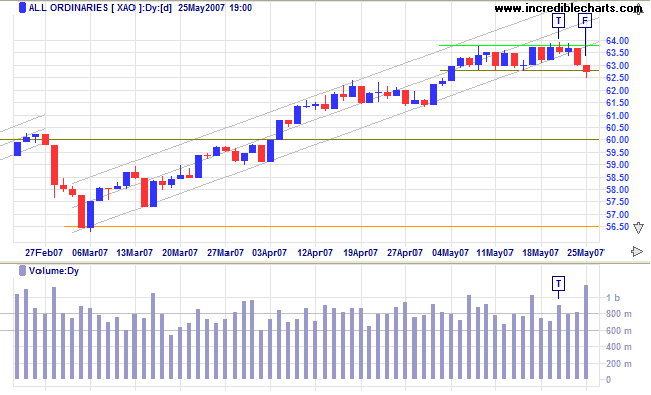

Short Term: The index is below the trend channel, signaling trend weakness, but continues in a narrow consolidation. Strong buying on Friday reversed a downward breakout, but support may be in for severe testing in the week ahead. A fall below 6250 would signal a secondary correction; while a close above 6375 would indicate that the primary advance has resumed.

By perseverance, study, and eternal desire, any man can become

great.

~ General George S Patton Jr.

(Colin: He should have said: "...any man or woman")

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.