S&P 500 Breaks Through 1500

By Colin Twiggs

May 5, 2007 1:00 a.m. ET (3:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

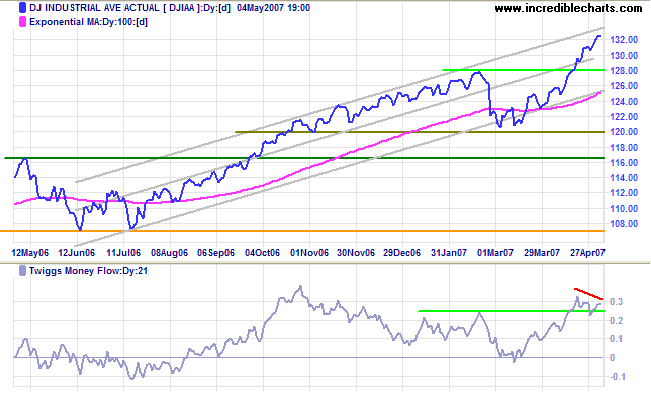

USA: Dow, Nasdaq and S&P500

The Dow Jones Industrial Average is headed for a test of

the upper border of the trend channel. Reversal below 13000

would signal a test of the lower channel border.

Twiggs Money Flow (21-day) displays short-term

profit-taking at 13000, but accumulation is expected to resume.

Reversal below 12000 is unlikely, but would warn of a secondary

correction.

Close observation will reveal that the channel lines are not

symmetrical: I have dragged the top channel line closer to the

linear regression line because in this case data is not evenly

distributed around the LR line.

Long Term: The primary up-trend continues, with the first line of support at the May 2006 peak of 11600 and primary support at the June 2006 low of 10700. Expect strong primary trend moves in the next few months: we are in phase 3 of a bull market. Just don't be blinded by the euphoria.

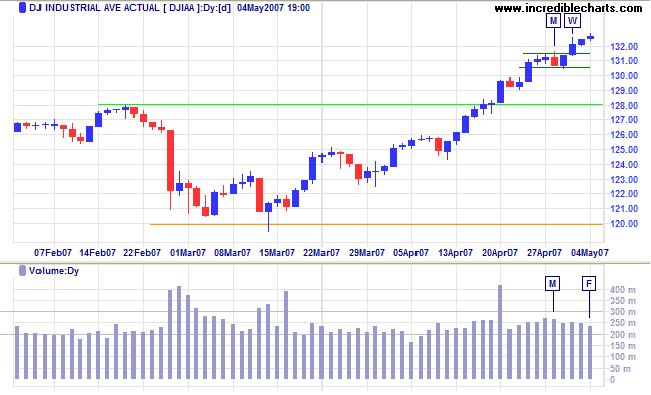

Short Term: A weak close at [W] and a doji candlestick at [F] signal some hesitation, but the up-trend is expected to continue.

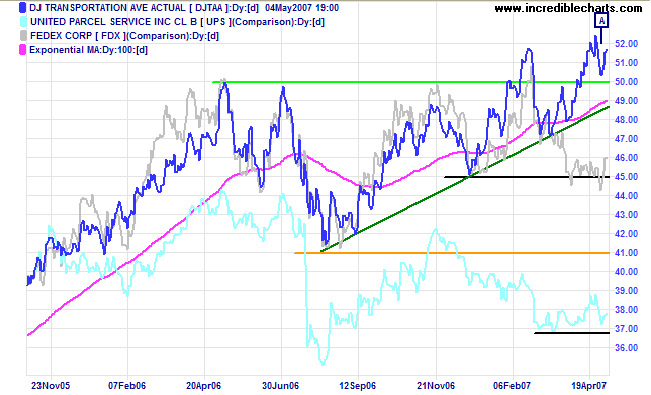

The Dow Jones Transportation Average respected the new support level of 5000 at [A]: a strong bull signal.

Fedex recovered after two false breaks below support, while UPS displays a bearish consolidation while undergoing a secondary correction.

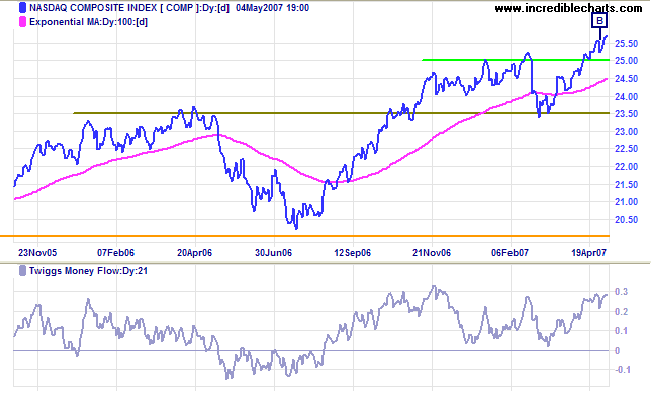

The Nasdaq Composite completed a second retracement [B]

that respected the new support level of 2500: another bullish

sign.

Twiggs Money Flow (21-day) signals long-term accumulation

having respected the zero line for several months.

Long Term: The primary up-trend continues, with support

at 2350 and 2000.

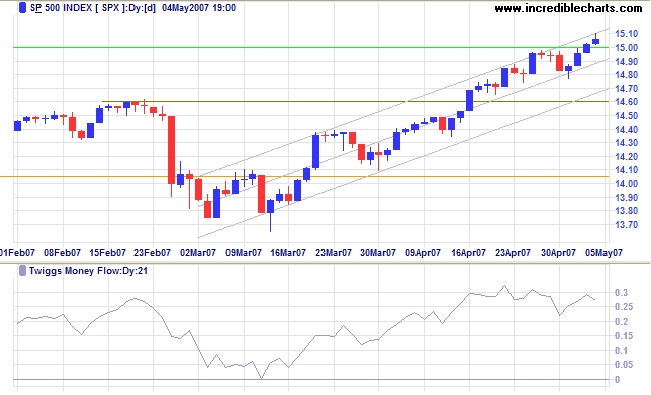

The S&P 500 broke through key resistance at 1500

after a bullish narrow consolidation. Friday's weak close warns

of further resistance; a short retracement that respects the

new support level would be another bullish sign, while reversal

below 1500 would warn of a test of the lower channel border.

Twiggs Money Flow (21-day) is well above zero, signaling

strong accumulation. The target for the primary trend move is

1545 (1460 + [1460-1375]).

Long Term: The primary trend is up, with support levels

at 1325 and 1220.

LSE: United Kingdom

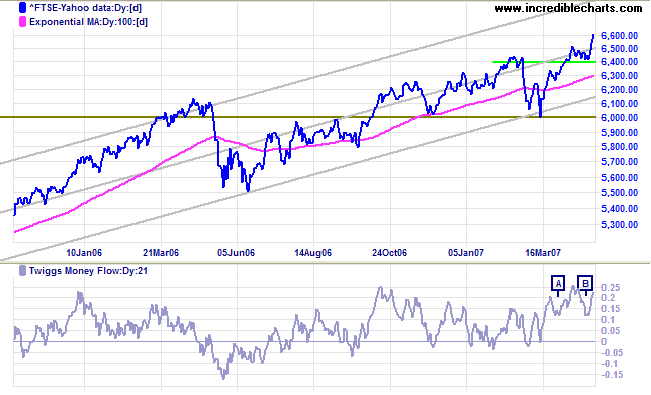

The FTSE 100

flag respected support at 6400 and the breakout is expected

to test the upper border of the trend channel (coinciding with

the 1999 all-time high of 6950). Reversal below 6400 is

unlikely, but would signal a test of the lower channel

border.

Long Term: The primary up-trend continues. A fall below

6000 is not expected, but would warn of a test of primary

support at 5500.

Nikkei: Japan

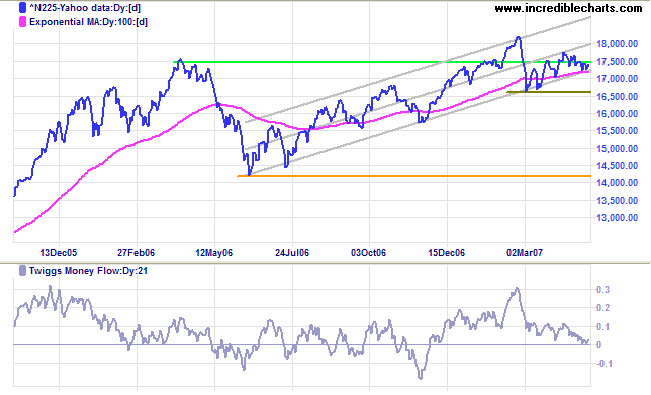

Not much has happened on the Nikkei 225 because of the

short (3 day) trading week. The index is edging towards the

lower channel border, rather than retracing sharply: an

encouraging sign. Recovery above 17500 would signal

continuation of the up-trend; while a break below the lower

border would warn of a test of the March low of 16600; and a

fall below 16600 would warn of a test of primary support at

14200. A

Twiggs Money Flow (21-day) fall below zero would also warn

of further distribution.

Long Term: The primary trend remains up.

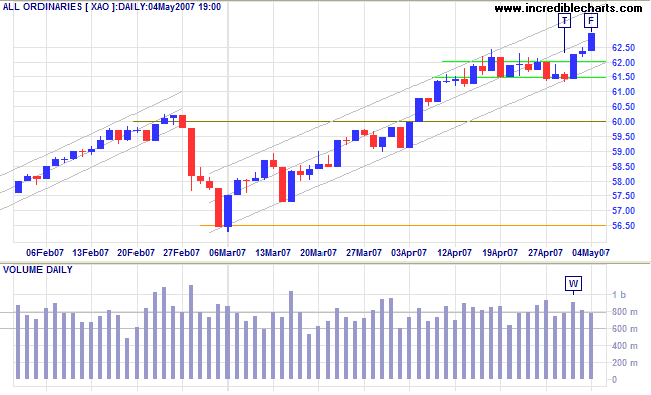

ASX: Australia

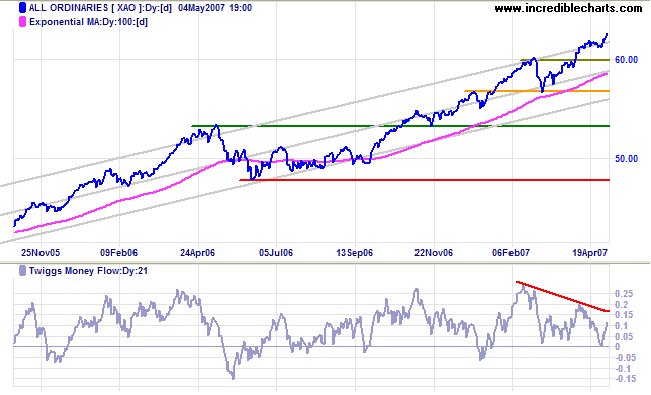

The All Ordinaries is rising steeply above the upper

border of the trend channel (drawn at 2 standard deviations

around a linear regression line), indicating that the up-trend

is accelerating. Typical of

phase 3 in a bull market. Bearish divergence on

Twiggs Money Flow (21-day) warns of long-term

profit-taking, while a sharp rise in the last week reflects

short-term accumulation. Accelerating trends rise swiftly, but

inevitably spike into a blow-off and sharp reversal.

Long Term: The primary up-trend continues, with the

first line of support at the May 2006 high of 5300 and primary

support at the June 2006 low of 4800.

Short Term: Support held at 6150, the lower border of the narrow consolidation, and Wednesday's strong blue candle overcame resistance to start another rally. Expect a test of the upper border of the trend channel. Reversal below 6150 is unlikely, but would warn of a test of 6000.

People's human rights have to work in a way in which they can

resolve conflicts — day to day conflicts — where

the rights of the individual have to be balanced against the

rights of the community.

In the vast majority of those cases, of conflict between

rights, common sense tells us the answer. Common sense tells us

how to resolve the conflicts which may arise.

Take the recent example of the row over a decision by

Derbyshire police not to release — supposedly on human

rights grounds — photographs of two convicted murderers

who had been imprisoned in both cases for over a decade and who

had escaped from prison. The crimes involved were serious:

brutal murder. The idea that the human rights of people

convicted of such crimes would, should or could prevent the

legitimate use of photographic material in the course of trying

to reapprehend them is utter nonsense. Not human rights. Not

the law. Most certainly not common sense.

~ UK Lord Chancellor and Secretary of State for Constitutional

Affairs Lord Falconer of Thoroton in his address to

the Manchester School of Law.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.