Key Resistance Levels Ahead

By Colin Twiggs

April 14, 2007 1.00 p.m. AET (11:00 p.m. ET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA: Dow, Nasdaq and S&P500

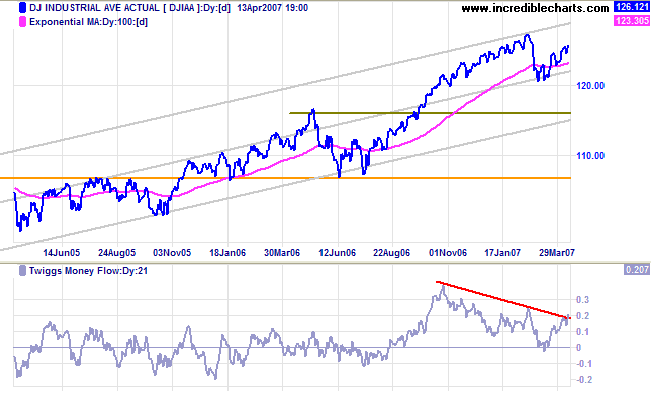

The Dow Jones Industrial Average is trending upwards, headed for a test of the upper border of the trend channel (drawn at 2 standard deviations around a linear regression line). A fall below 12000, though not expected, would signal a secondary correction. The bearish divergence on Twiggs Money Flow (21-day) is easing; a rise above the May 2006 high would signal long-term accumulation.

Long Term: The primary up-trend continues. The first line of support is at the May 2006 peak of 11600, with primary support at the June 2006 low of 10700.

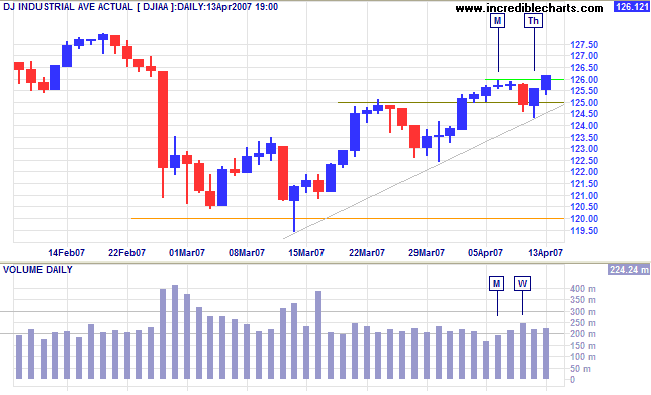

Short Term: The Dow successfully tested support at 12500, with increased volume on Wednesday and a long tail on Thursday indicating support. The break above 12600 signals a test of 12800. Though not expected, reversal below 12450 or the medium-term trendline would warn of trend weakness. Low volumes are expected to continue until resistance at the previous high of 12800 is tested.

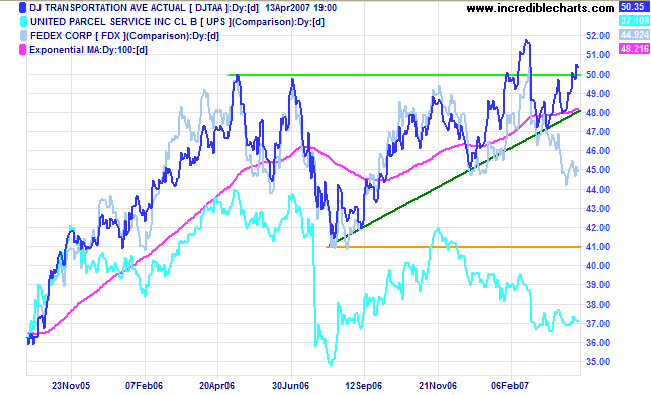

The Dow Jones Transportation Average broke through resistance at 5000, signaling continuation of the primary up-trend (and the bull market).

Fedex and UPS appear bearish, however, and reversal to a primary down-trend would warn of an economic slow-down.

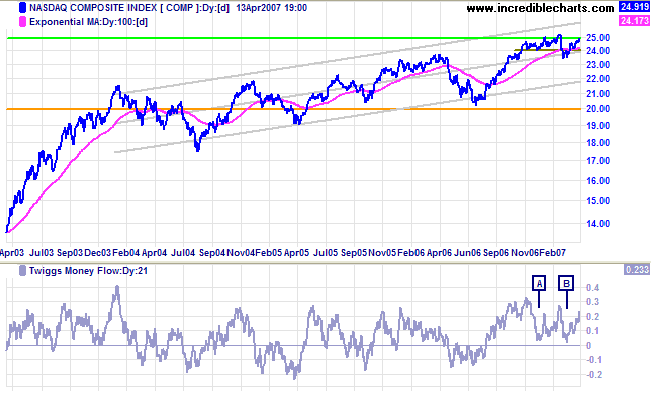

The Nasdaq Composite is testing resistance at 2500; the

primary significance being that it is 50 per cent of the March

2000 high. Several previous swings have failed to reach the

upper border of the trend channel, so it would be premature to

assert that an upward breakout is likely. If, however, a

breakout occurs, expect a test of the upper channel line; while

a fall below 2350 would warn of a secondary correction.

Twiggs Money Flow (21-day) signals long-term accumulation,

having twice respected the zero line in recent months.

Long Term: The primary up-trend continues.

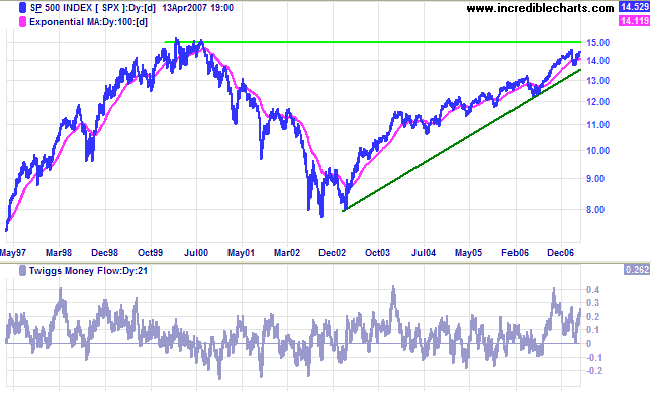

If the S&P 500 rises above 1460, expect a test of

the key 1500 resistance level. Divergence on

Twiggs Money Flow (21-day) has eased, respect of the zero

line signaling long-term accumulation.

Long Term: The primary trend is up, with support levels

at 1325 and 1220.

LSE: United Kingdom

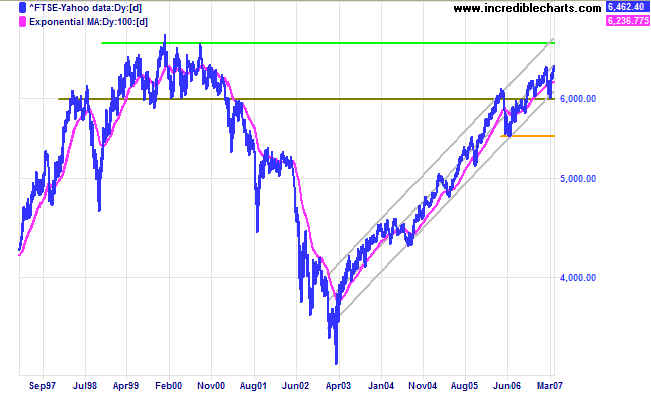

The FTSE 100 is headed for a test of key resistance at

6800/6900 after breaking above its February 2007 high. The

calculated target is 6900 ( 6450 + [6450 - 6000] ).

Twiggs Money Flow (21-day) is rising steeply, signaling

strong accumulation. A fall below 6000 is unlikely, but would

warn of a test of primary support at 5500.

Long Term: The primary up-trend continues.

Nikkei: Japan

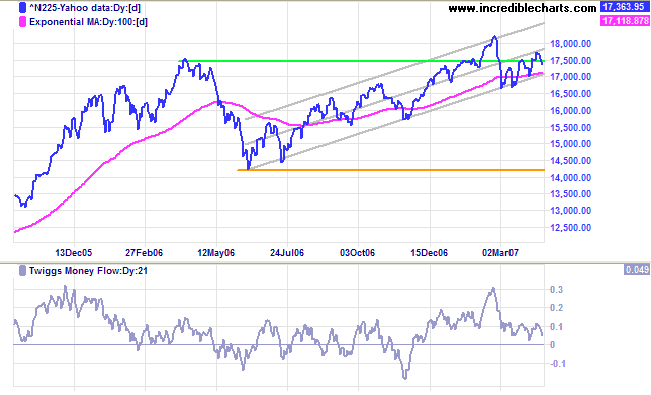

The Nikkei 225 signals uncertainty, with the index

whipsawing around resistance at 17500/17600. The long-term

target of 21000 [ 17600 + ( 17600 - 14200 )] remains in doubt

until a retracement clearly respects support at the 2006 high.

A

Twiggs Money Flow (21-day) break below zero or the index

falling below 17000 would warn of a secondary correction.

Long Term: The primary trend remains up, with support at

the June 2006 low of 14200.

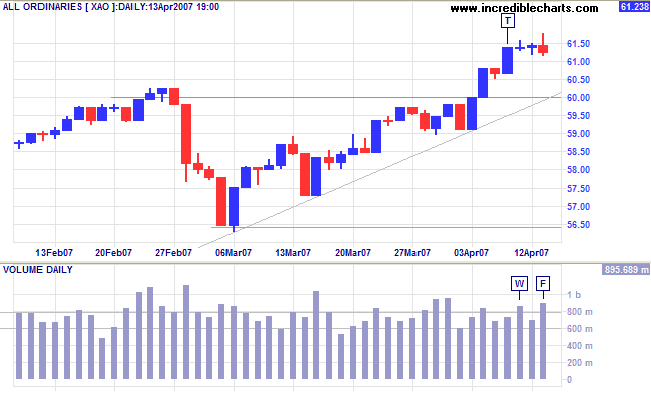

ASX: Australia

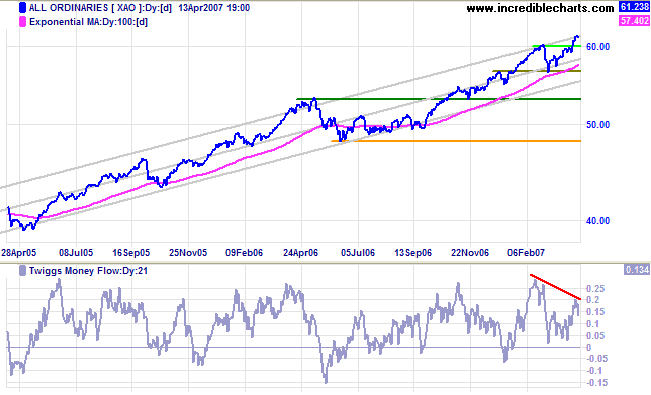

The All Ordinaries is testing the upper border of the

trend channel drawn at 2 standard deviations around a linear

regression line. The calculated target is 6350 ( 6000 + [6000 -

5650] ).

Twiggs Money Flow (21-day) displays another bearish

divergence, warning of further profit-taking. Reversal below

5650 is unlikely, but would be a strong bear signal.

Long Term: The primary up-trend continues, with the

first line of support at the May 2006 high of 5300 and primary

support at the June 2006 low of 4800.

Short Term: Profit-taking is evident, with strong volume and weak closes at [W] and [F], but the up-trend remains intact. A retracement that respects support at 6000 would be a bullish sign, while a fall below 5900, though unlikely, would warn of a test of 5650.

One day we must come to see that peace is not merely a distant

goal we seek, but that it is a means by which we arrive at that

goal. We must pursue peaceful ends through peaceful

means.

~ Martin Luther King Jr. (1929 - 1968)

To understand my approach to technical analysis, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.