The Big Picture

By Colin Twiggs

April 3, 2007 7:00 p.m. ET (9:00 a.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

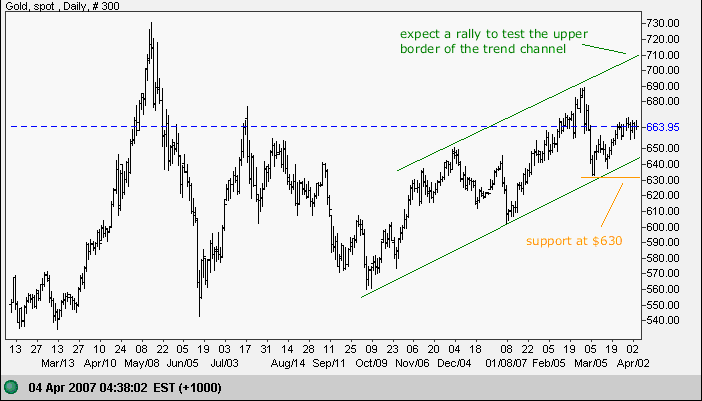

Gold

Spot gold is trending upwards in a long-term trend channel.

Expect a swing to test the upper border of the trend channel

after overcoming resistance at $690. The target is $750 ( 690 +

[ 690 - 630 ] ). Though unlikely at this stage, a fall below

the lower channel line would signal weakness; and a fall below

support at $630 would signal reversal.

Rising crude oil prices strengthen demand for gold.

Source: Netdania

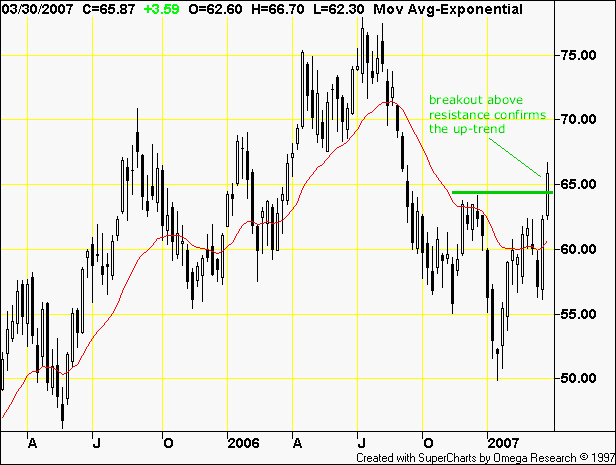

Crude Oil

May Light Crude broke through resistance at $64. A retracement that respects the new support level would confirm the up-trend. Failure of $64 is not expected, but would indicate further consolidation between $55 and $64.

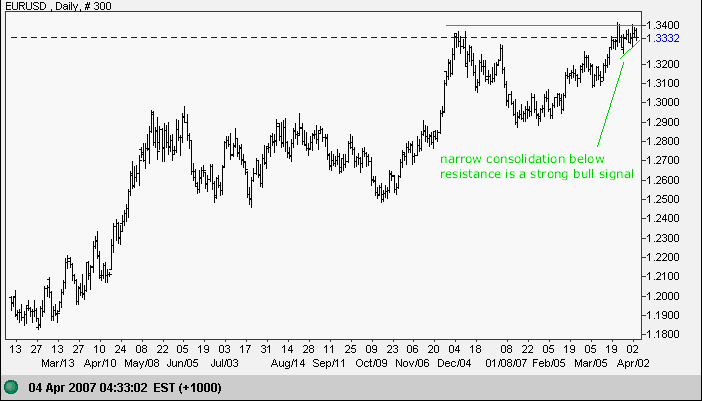

Currencies

The euro formed a bullish narrow consolidation below the December 2006 high of $1.34. Expect a breakout to test the 2005 high of $1.37. The target for a breakout above $1.37 would be $1.57 ( 1.37 + [ 1.37 - 1.17 ] ). Reversal below $1.29, though unlikely, would signal reversal of the up-trend.

Source: Netdania

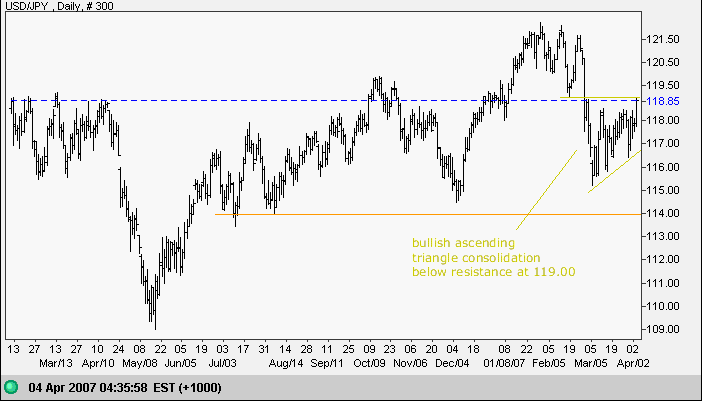

The dollar formed a bullish ascending (triangle) consolidation below resistance at 119 against the yen. This favors a rise above 119, signaling another test of resistance at 122. A break through the lower border of the pattern, on the other hand, would signal another test of support at 114.00/114.50 (failure of which would signal reversal to a down-trend).

Source: Netdania

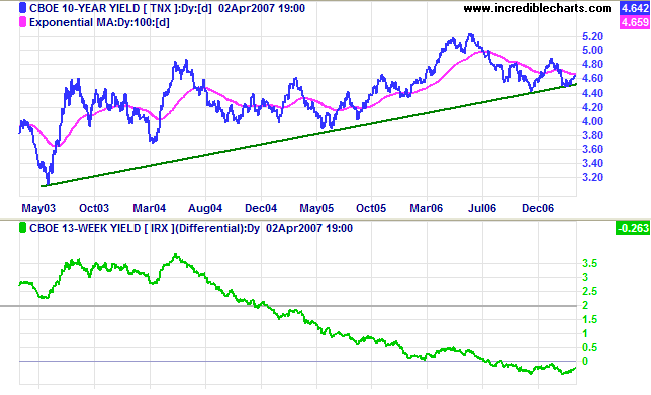

Treasury Yields

Ten-year treasury yields respected the long-term (green) trendline and the up-trend remains intact. Probability of another rally to test 5.25% has increased. The signal will be confirmed if there is a rise above the recent peak of 4.90%. Low (long-term) treasury yields encourage higher valuations in the stock market, offsetting to some extent the negative impact of an inverted yield curve.

The negative yield differential (10-year minus 13-week treasury yields) continues to warn of pressure on banking margins and contraction of bank credit.

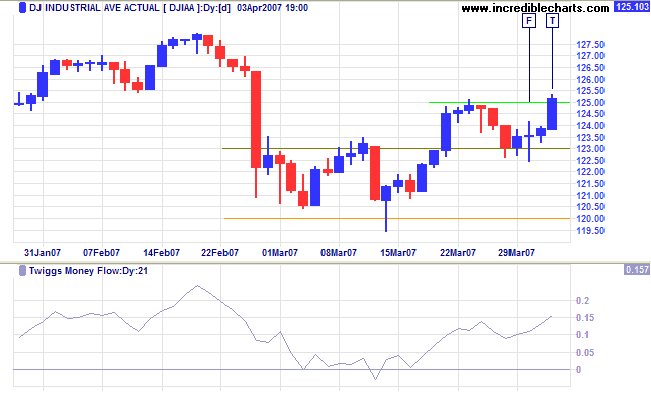

Dow Jones Industrial Average

The Dow Jones Industrial Average close above 12500 signals an up-trend. Twiggs Money Flow is rising strongly above zero, signaling short-term accumulation. Expect a test of resistance at 12800. Reversal below 12300 is unlikely, but would warn of another test of support at 12000.

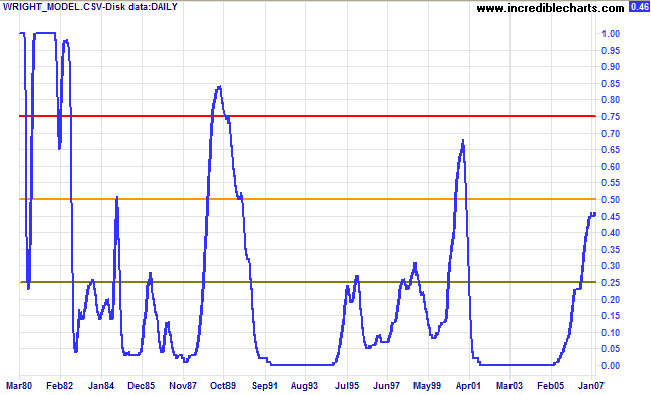

Wright Model

Probability of recession in the next four quarters remains at 46 per cent according to the Wright Model.

There is some evidence that the Wright model may understate probability of recession in a low interest rate environment (as at present).

Joy is not in things; it is in us.

~ Richard Wagner (1813 - 1883)

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.