The Big Picture

By Colin Twiggs

March 06, 2007 6:00 p.m. ET (10:00 a.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

The Big Picture

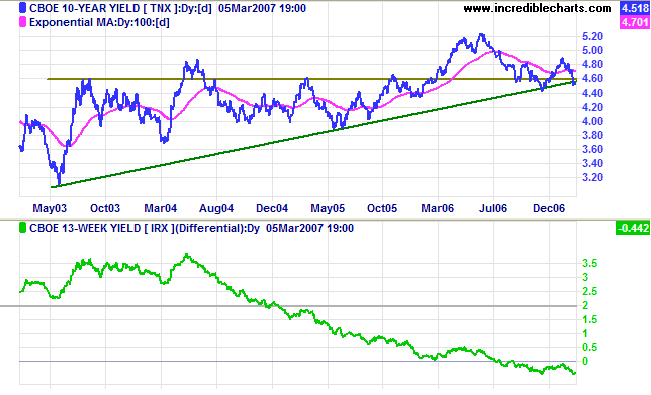

Ten-year treasury yields are testing the 3-year trendline. Respect of the trendline would signal another rally to test resistance at 5.25%, while failure would warn of reversal to a down-trend. Low long-term treasury yields to some extent offset the negative impact of an inverted yield curve, encouraging higher valuations in the stock market; while high yields have the opposite effect.

The negative yield differential (10-year minus 13-week treasury yields) is increasing, warning of pressure on banking margins and a possible contraction of bank credit, restricting new investment.

Equity Markets

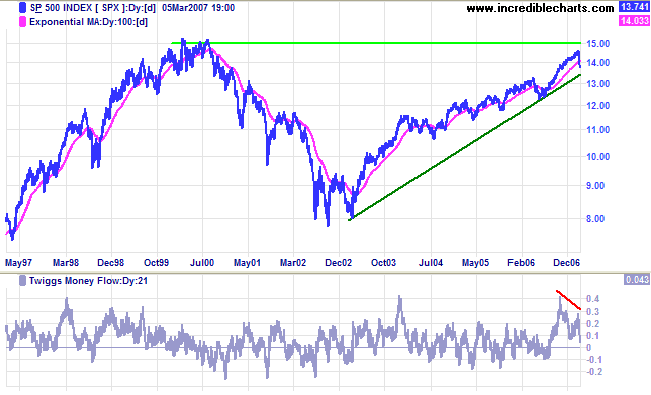

The S&P500 has retraced after testing its 1999/2000 high of 1500. Respect of the long-term trendline would signal another test of resistance at 1500; failure would indicate a loss of upward momentum. Twiggs Money Flow shows a strong bearish divergence, warning of distribution, and there are no signs yet of a short-term base -- still too early for swing traders to go bargain-hunting.

Gold

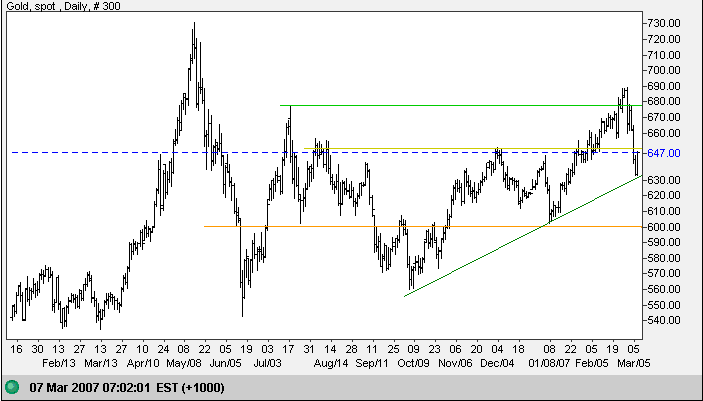

Spot gold reversed $10 short of its target of $700, falling

sharply through the first line of support at $650 before

halting at the long-term trendline. These are typical signs of

a healthy up-trend: slow, steady rallies followed by short,

sharp reactions as traders cover their positions. The up-trend

remains intact unless there is a fall below $630, warning of a

loss of momentum. A fall below $600 would signal reversal to a

down-trend, while a rise above $650 would signal another rally

with a target of $750 ( 690 + [ 690 - 630 ] ).

Rising crude oil prices continue to support demand for gold:

(a) as an inflation hedge; and (b) as OPEC producers tend to

buy gold with surplus funds. A weaker dollar would also boost

gold prices, but there is no strong trend as yet.

Source: Netdania

Crude Oil

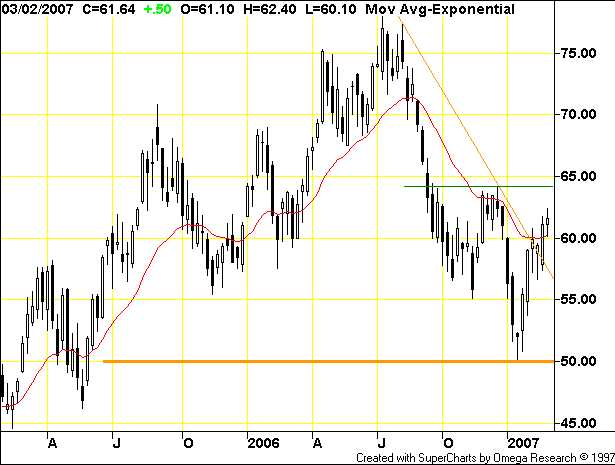

Crude oil is holding above the new support level of $60/barrel. A rise above $64 would signal reversal of the down-trend. I am wary of V-bottoms, however, they have a strong tendency to become W-bottoms or inverted head and shoulders.

Currencies

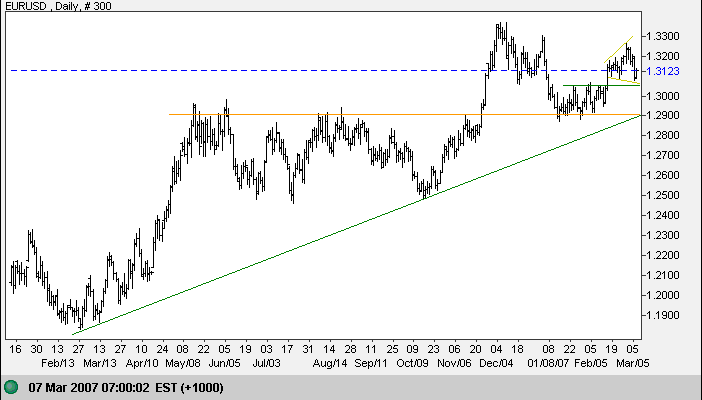

The euro formed a bullish broadening formation above intermediate support. A partial decline would signal an upward breakout, while a partial up-swing, though less likely, would warn of a downward breakout. If resistance at $1.34 is penetrated, expect further substantial resistance at the 2005 high of $1.37.

Source: Netdania

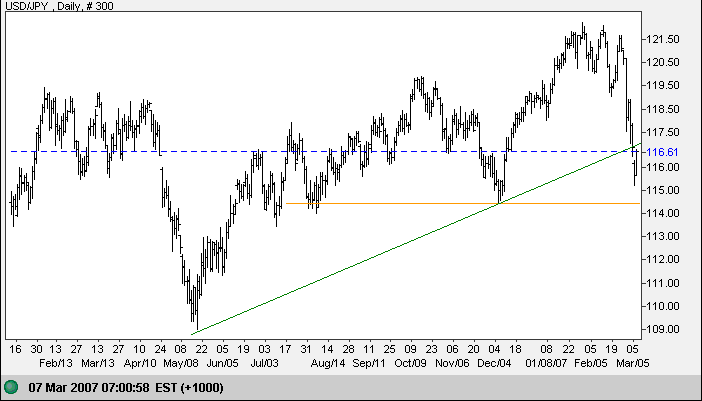

The dollar reversed sharply and appears headed for a test of support at 114.50 against the yen after penetrating the upward trendline. A fall below support would signal reversal to a down-trend and possible test of long-term support at 100. Respect of support, on the other hand, would signal further consolidation between there and 121.50.

Source: Netdania

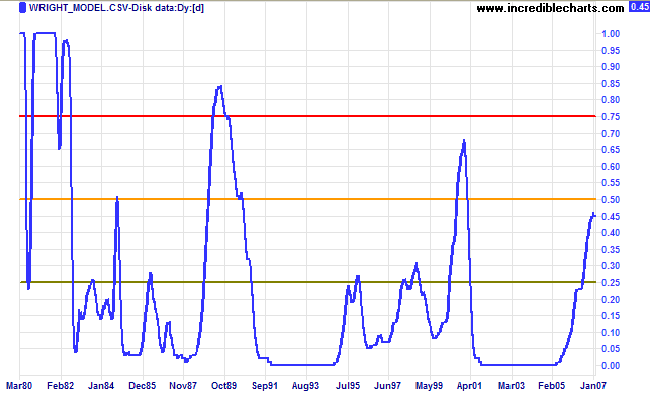

Wright Model

Probability of recession in the next four quarters has leveled off at 45 per cent according to the Wright Model.

There is some evidence that the Wright model may understate the probability of recession in a low interest rate environment (as at present).

In centuries past, people hearing the rooster crow as the sun

came up decided that the crowing caused the sunrise. It sounds

silly now, but every day the experts confuse cause and effect

on Wall Street...

~ Peter Lynch: One Up on Wall Street

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.