The Big Picture

By Colin Twiggs

February 14, 2007 7:00 a.m. ET (11:00 p.m. AEDT)

These extracts from my daily trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

The Big Picture

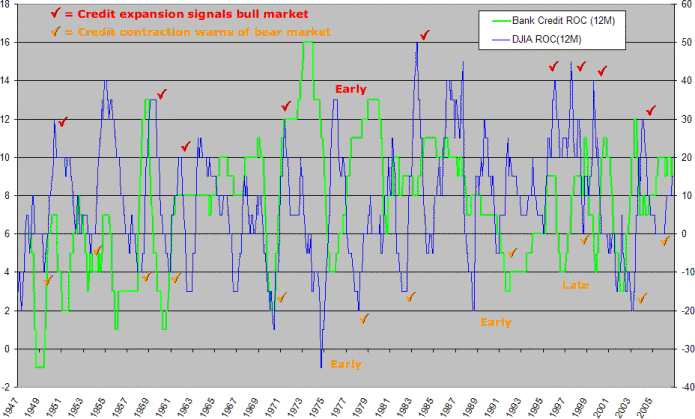

Growth in commercial bank credit bears a close relationship to major reversals in the stock market and recessions recorded by NBER. The chart below plots the 12-month Rate Of Change in bank credit to the 12-month ROC in the Dow Jones Industrial Average.

Not all bull and bear markets are caused by credit expansion or contraction, but almost all major expansions or contractions of bank credit are accompanied by a bull or bear market respectively. There are times when the market anticipates a contraction or expansion, normally during extreme swings as in the 1970s, and in 1987, but there has only been one false signal in the last 60 years. In 1998 annual credit growth fell to 4%, but the Dow only peaked 2 years later.

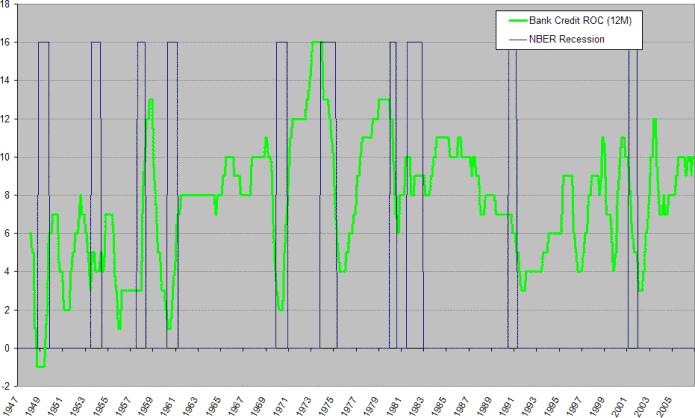

The chart below compares the 12-month Rate Of Change in bank credit to recessions recorded by the NBER rather than the Dow. The relationship is clear.

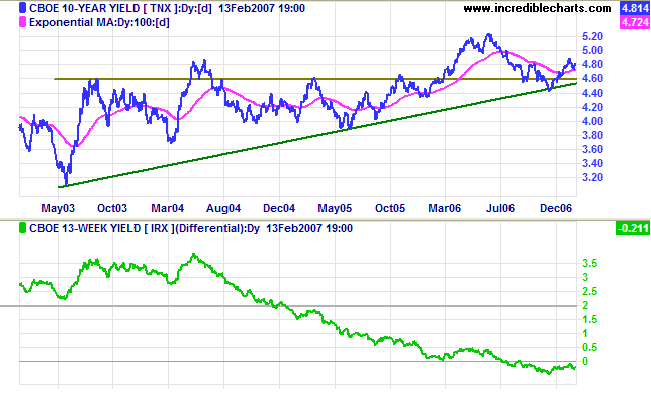

Treasury Yields

The yield differential (10-year minus 13-week treasury yields) remains negative, warning of long-term pressure on banking margins and a possible down-turn. The up-trend on 10-year yields remains intact.

Equity Markets

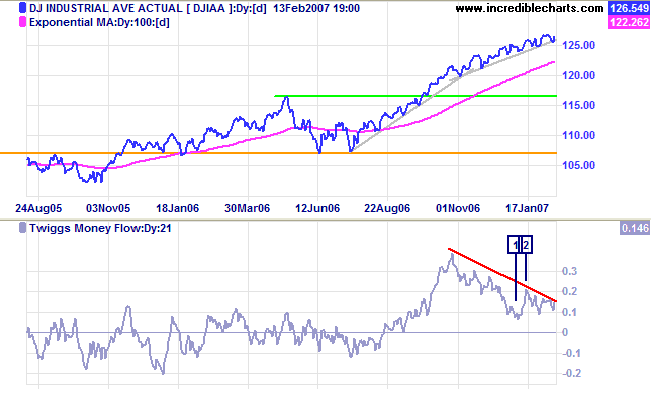

The primary trend on the Dow Jones Industrial average continues, but a bearish divergence on Twiggs Money Flow warns of a secondary correction.

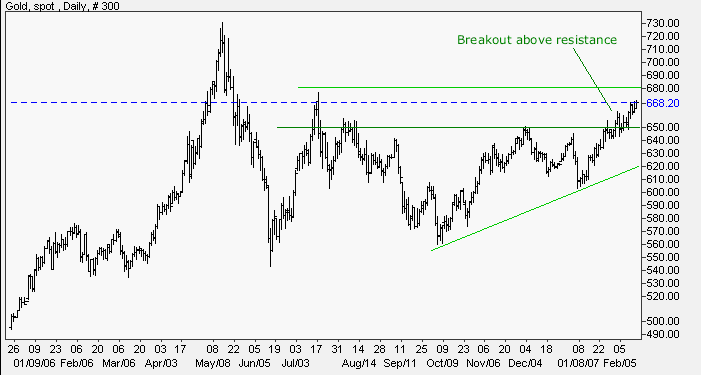

Gold

Spot gold broke through resistance at $650, signaling a test of

the May 2006 high of $730. The calculated target is $740 [ 650

+ ( 650 - 560) ]. Expect some resistance at $680; and a

retracement that respects support at $650 would strengthen the

bull signal.

Rising crude oil prices will support demand for gold. A weaker

dollar would also boost gold prices, but this is not yet

evident.

Source: Netdania

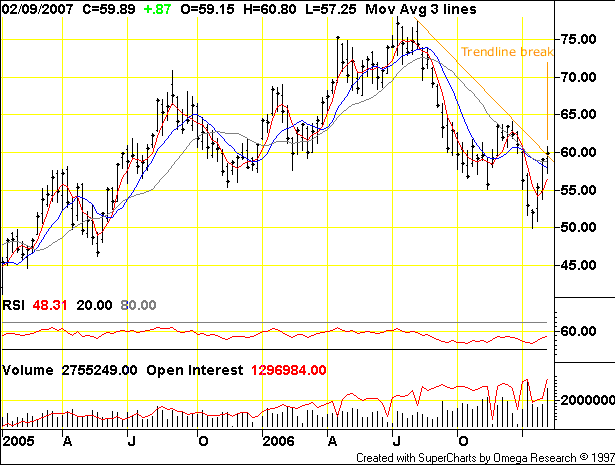

Crude Oil

Crude oil prices have broken the downward trendline at $60, signaling that the trend is slowing. At present this remains a bear market rally -- unless there is a rise above $65.

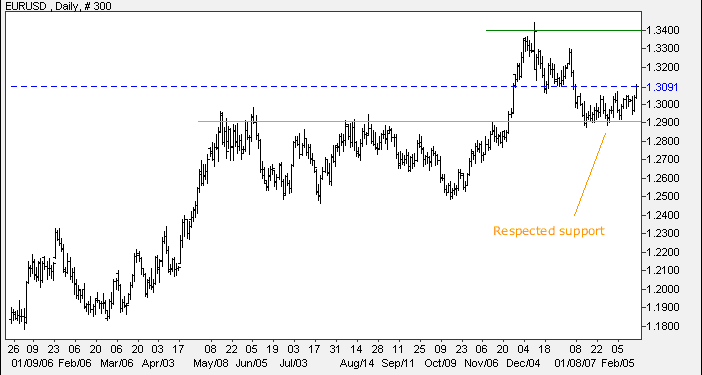

Currencies

The euro respected support at $1.29 and now appears headed for a test of $1.34, having broken out above the recent narrow consolidation.

Source: Netdania

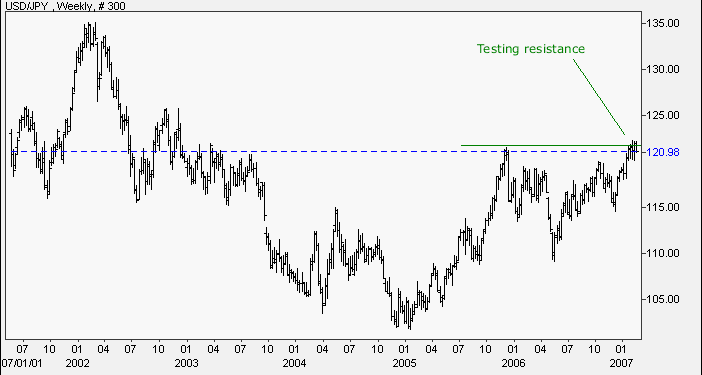

The dollar continues to test resistance at 121 against the yen. Breakout above the December 2005 high would be a long-term bull signal. Narrow consolidation below 121 is starting to look bullish. A downward breakout should not be ruled out as the Nikkei 225 has completed a long-term bull signal -- and would signal a test of long-term support at 100.

Source: Netdania

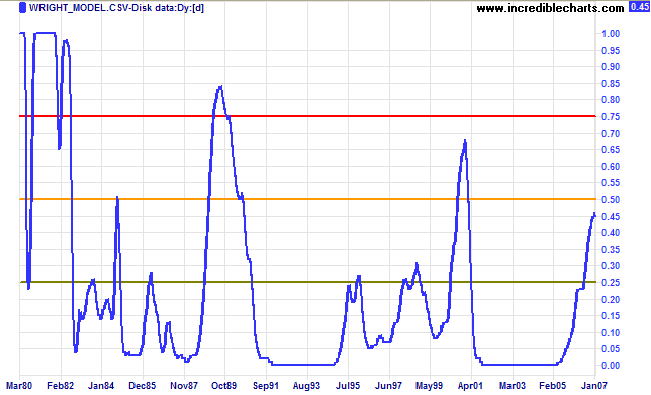

Wright Model

Probability of recession in the next four quarters has leveled off at 45 per cent according to the Wright Model.

There is some evidence that the Wright model may understate the probability of recession in a low interest rate environment (as at present). The model emphasizes the nominal level of short-term interest rates and ignores whether these rates are rising or falling. It also does not adequately explain the behavior of the market during the 1966 and 2001 recessions, when interest rates were low.

The tragedy of life doesn't lie in not reaching your

goal.

The tragedy lies in having no goal to reach.

~ Benjamin Mays

Technical Analysis and PredictionsI believe that Technical Analysis should not be used to make predictions because we never know the outcome of a particular pattern or series of events with 100 per cent certainty. The best that we can hope to achieve is a probability of around 80 per cent for any particular outcome: something unexpected will occur at least one in five times.My approach is to assign probabilities to each possible outcome. Assigning actual percentages would imply a degree of precision which, most of the time, is unachievable. Terms used are more general: "this is a strong signal"; "this is likely"; "expect this to follow"; "this is less likely to occur"; "this is unlikely"; and so on. Bear in mind that there are times, especially when the market is in equilibrium, when we may face several scenarios with fairly even probabilities. Analysis is also separated into three time frames: short, medium and long-term. While one time frame may be clear, another could be uncertain. Obviously, we have the greatest chance of success when all three time frames are clear. The market is a dynamic system. I often compare trading to a military operation, not because of its' oppositional nature, but because of the complexity, the continual uncertainty created by conflicting intelligence and the element of chance that can disrupt even the best made plans. Prepare thoroughly, but allow for the unexpected. The formula is simple: trade when probabilities are in your favor; apply proper risk (money) management; and you will succeed. For further background, please read About The Trading Diary. |

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.