Slow Progress

By Colin Twiggs

January 27, 2007 1.00 a.m. ET (5:00 p.m. AET)

These extracts from my daily trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA: Dow, Nasdaq and S&P500

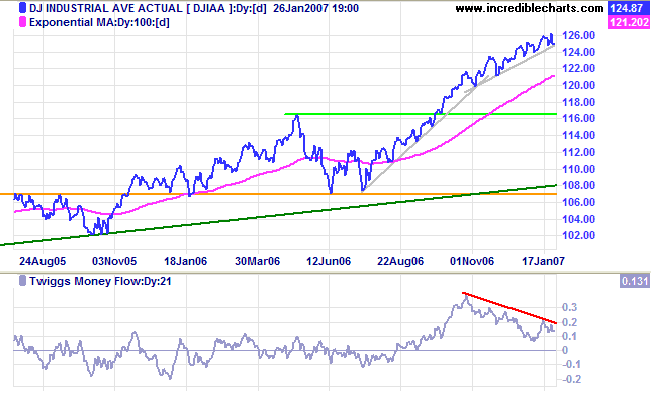

The Dow Jones Industrial Average is above its target of

12500 (11600+[11600-10700]) and momentum has slowed, with the

index failing to respect support at the earlier high of 12500.

The Dow may be entering a rounding top, highlighted by the

decelerating trendlines on the chart below. The bearish

divergence on

Twiggs Money Flow (21-day) warns of distribution and

possibly a secondary correction.

The primary trend is up with support at 11600/11650 (the

preceding high) and 10700 (the preceding low).

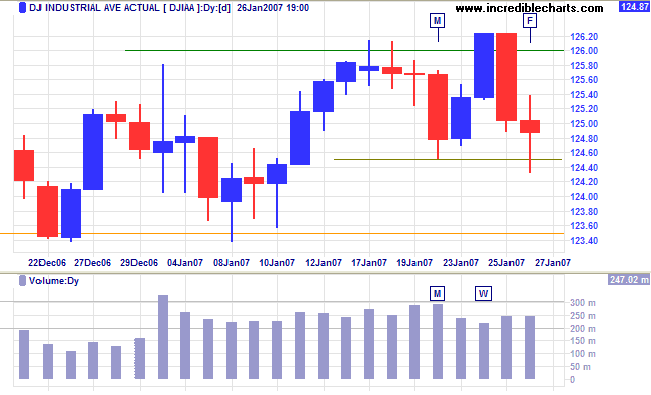

Short Term: The index is consolidating between 12450 and 12600, with low volume on Wednesday's blue candle indicating a lack of interest from buyers. Friday's weak close signals buying support.

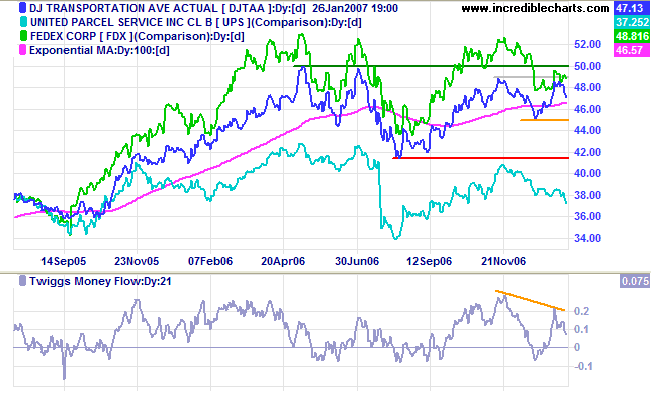

The Dow Jones Transportation Average faltered at the first hurdle, retreating from intermediate resistance at 4900. Breakout above 5000 would confirm the existence of a bull market, but this will be unlikely if the index falls below 4500.

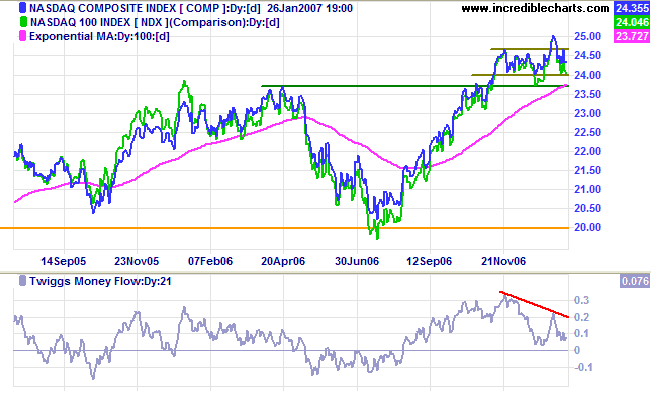

The Nasdaq Composite is consolidating in a narrow range

between 2400 and 2470. The position of the consolidation is

bullish, being above the April 2006 high of 2370. A break above

2500 (the high of the previous marginal break) would be a

strong bull signal.

Twiggs Money Flow displays a bearish

divergence but has so far respected zero. Completion of the

current trough will help to clarify future direction: above the

previous trough would be bullish, while a fall below zero would

signal weakness.

The index remains in a primary up-trend with support at

2350/2370 (preceding high) and at 2000 (preceding low).

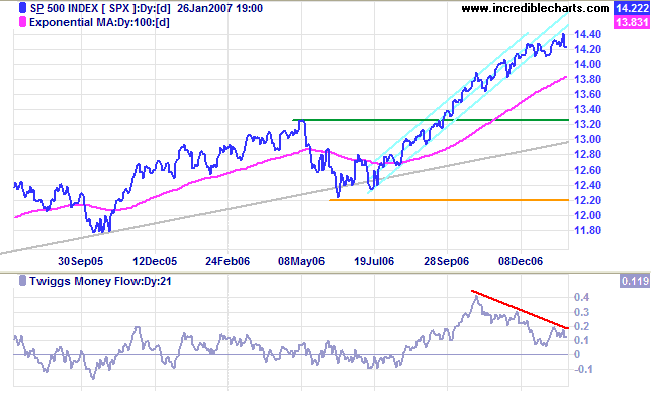

The S&P 500 shows a similar Twiggs Money Flow (21-day) bearish divergence to the Dow. Momentum is slowing as indicated by the fall below the trend channel (drawn at 2 standard deviations around a linear regression line). The index has reached its target of 1430 (1325+[1325-1220]) and risk of a secondary correction (or large consolidation) is increasing.

LSE: United Kingdom

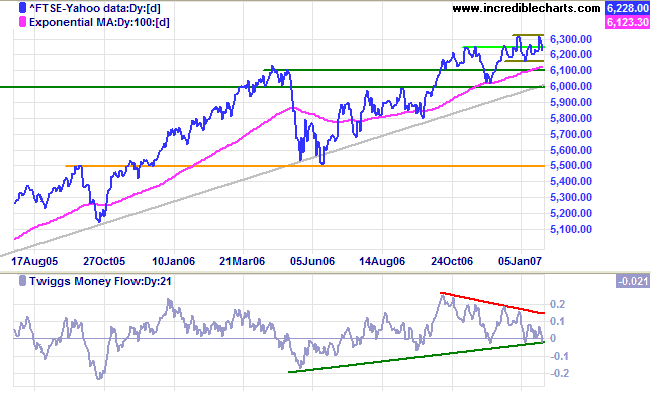

Profit-taking continues on the FTSE 100, with short-term

consolidation between 6160 and 6320. A fall below 6160 would

warn of a secondary correction -- confirmed if the index falls

below 6000 (breaking the 100-day moving

average). We need to heed

Twiggs Money Flow (21-day), which displays a large bearish

divergence, indicating distribution. The indicator appears

to be weakening and a peak below the zero line would be a

strong bear signal.

Long Term: The primary up-trend continues, with support

at 6000/6100 (preceding high) and at 5500 (preceding low).

Nikkei: Japan

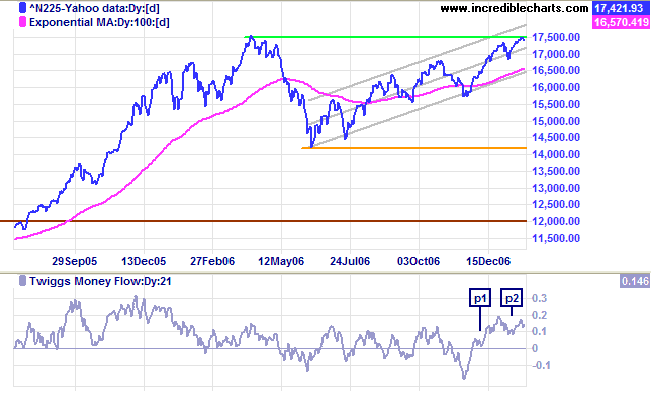

The Nikkei 225 is the only index showing real progress,

testing resistance at the April high of 17500/17600.

Twiggs Money Flow (21-day) troughs above the zero line (at

p1 and p2) signal strong accumulation and

breakout above 17600 is likely.

Long Term: The primary up-trend continues, with support

at 14200 (preceding low) and resistance at 17500 (preceding

high). The target for the breakout is close to the next major

resistance level of 21000: 17500 + (17500 - 14200) = 20800.

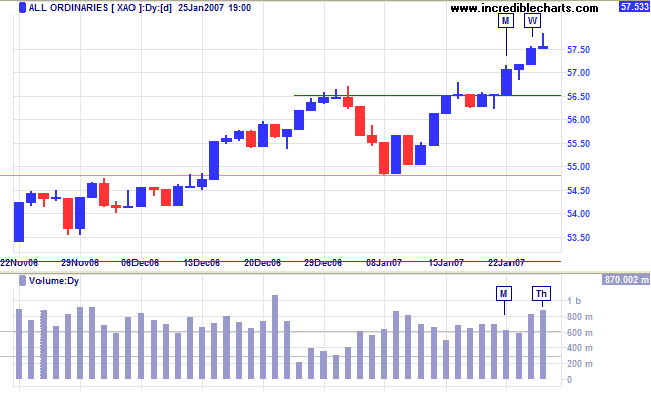

ASX: Australia

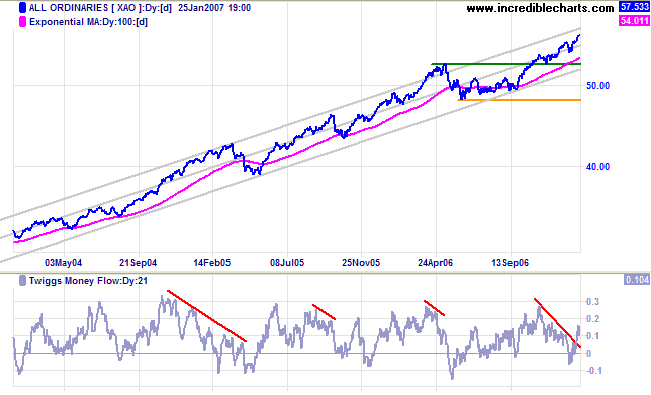

The All Ordinaries rallied towards the upper border of

the trend channel (drawn at 2 standard deviations around a

linear regression line), approaching its target of 5800: 5300 +

(5300-4800).

Twiggs Money Flow (21-day) has broken the trendline from

the recent down-trend, but continues to display a bearish

divergence. TMF signals are sometimes early, as in

2004/2005.

Long Term: The primary trend is upwards, with support at

5300 (the preceding high) and 4800 (preceding low).

Short Term: Thursday's gravestone candlestick and strong volume over the last two days signal resistance and a short-term reversal. The target for the current rally coincides with the long-term target of 5800: 5650 + (5650 - 5500). A fall below the first line of support at 5650 would indicate that upward momentum is slowing, while a fall below support at 5480 would warn of a secondary correction.

We read that the traveller asked the boy if the swamp before

him had a hard bottom. The boy replied that it had. But

presently the traveller's horse sank in up to the girths, and

he observed to the boy, "I thought you said that this bog had a

hard bottom." "So it has," answered the latter, "but you have

not got half way to it yet."

~ Henry David Thoreau: Walden (1854)

|

Technical Analysis and Predictions I believe that Technical Analysis should not be used to make predictions because we never know the outcome of a particular pattern or series of events with 100 per cent certainty. The best that we can hope to achieve is a probability of around 80 per cent for any particular outcome: something unexpected will occur at least one in five times. My approach is to assign probabilities to each possible outcome. Assigning actual percentages would imply a degree of precision which, most of the time, is unachievable. Terms used are more general: "this is a strong signal"; "this is likely"; "expect this to follow"; "this is less likely to occur"; "this is unlikely"; and so on. Bear in mind that there are times, especially when the market is in equilibrium, when we may face several scenarios with fairly even probabilities. Analysis is also separated into three time frames: short, medium and long-term. While one time frame may be clear, another could be uncertain. Obviously, we have the greatest chance of success when all three time frames are clear. The market is a dynamic system. I often compare trading to a military operation, not because of its' oppositional nature, but because of the complexity, the continual uncertainty created by conflicting intelligence and the element of chance that can disrupt even the best made plans. Prepare thoroughly, but allow for the unexpected. The formula is simple: trade when probabilities are in your favor; apply proper risk (money) management; and you will succeed. For further background, please read About The Trading Diary. |

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.