and prosperity in the year ahead.

Bearish Divergences Continue

December 16, 2006 12.00 a.m. ET (4:00 p.m. AET)

This will be the last newsletter for the year. The service will resume on January 9th.

The Big Picture

January light crude, is rallied to $63.43/barrel, but the base above $55 is not yet solidly established (it could just be a bear market rally). The euro is headed for a test of $1.30 against the dollar, but as long as it respects this level the up-trend against the dollar is intact. Gold retreated to $614.60, but as long as it holds near $615.00 the secondary rally is also intact.

Probability of recession in the next four quarters remains at 44 per cent according to the Wright model. A rise above 50% would be cause for concern.

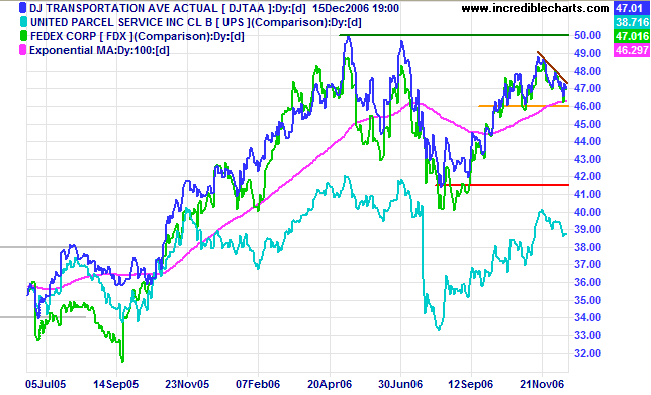

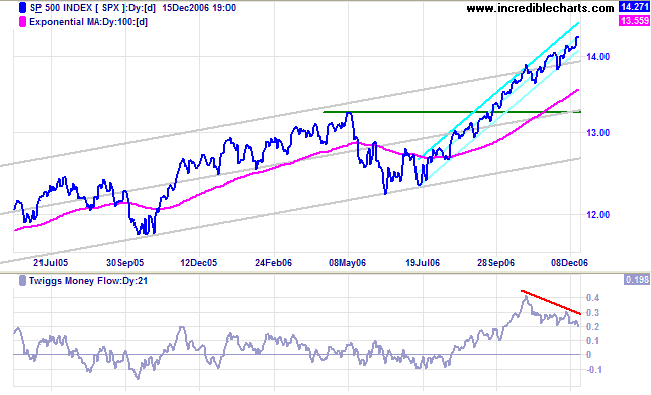

USA: Dow, Nasdaq and S&P500

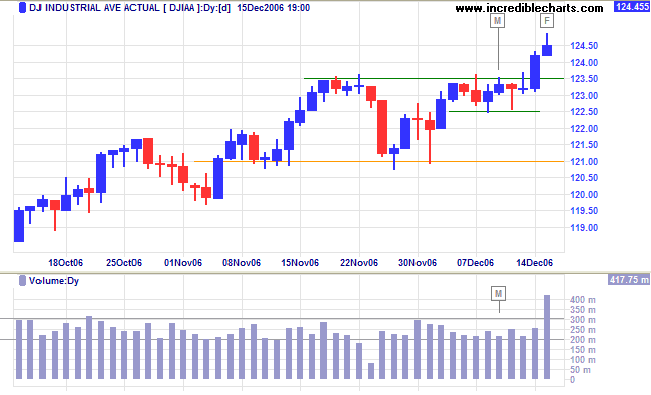

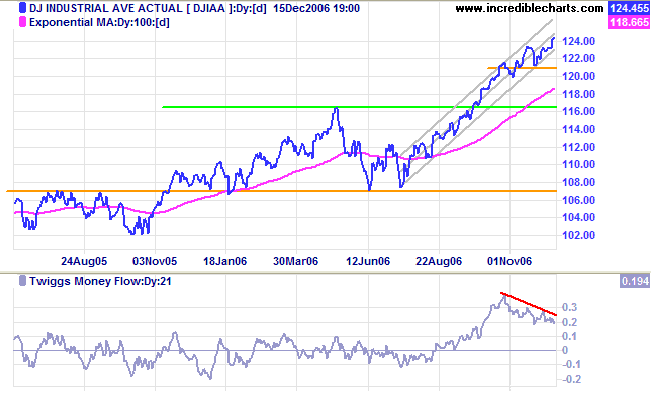

Long Term: The Dow continues in a primary up-trend, with initial support at 11600/11650 and primary support at 10700.

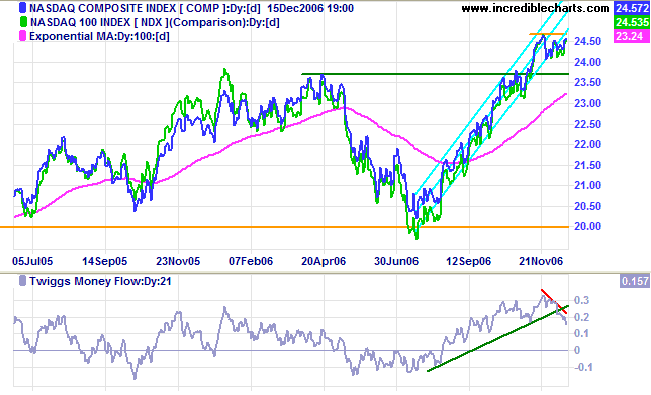

The index remains in a primary up-trend with initial support at 2350/2370 and primary support at 2000.

Long Term: The S&P 500 continues in a primary up-trend, with initial support at 1320 and primary support at 1220.

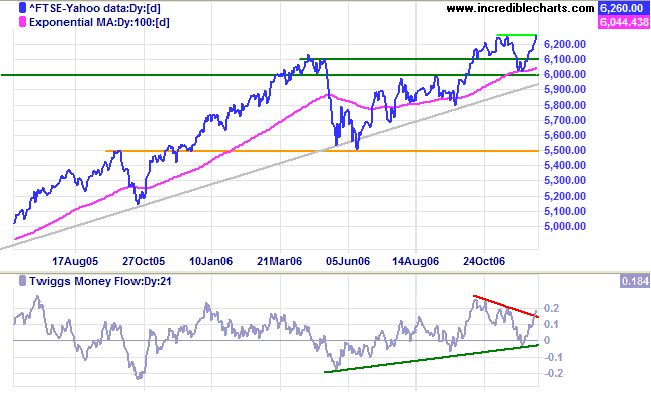

LSE: United Kingdom

Medium Term: The target for a breakout would be 6500 (6260 + [6260 - 6020]). Failure to break through resistance would signal another test of support at 6000. Twiggs Money Flow (21-day) is not yet bullish, but has recovered most of its recent losses.

Long Term: The primary up-trend continues, with initial support at 6000/6100 and primary support at 5500.

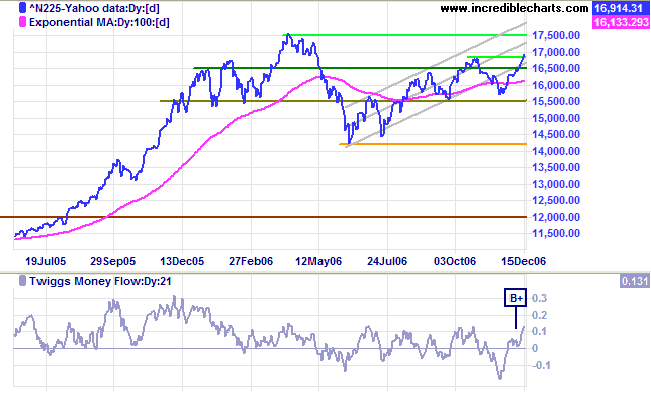

Nikkei: Japan

Medium Term: The trend channel may have to be re-drawn after the recent downward breakout, so a test of the upper trend channel is fairly ambitious, but expect a test of the April 2006 high of 17500. Reversal below 16800, on the other hand, would signal trend weakness.

Long Term: The index continues in a primary up-trend with support at 14200 and resistance at 17500.

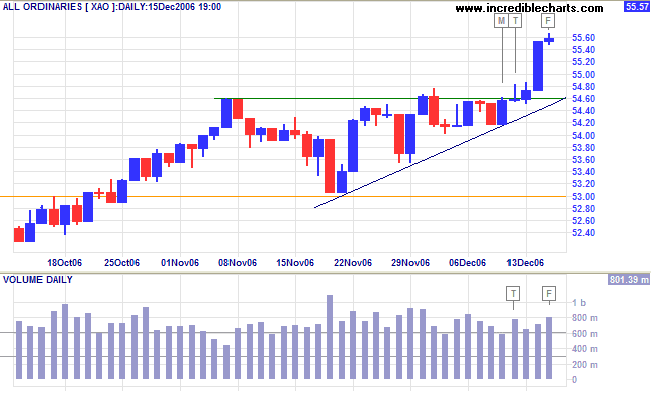

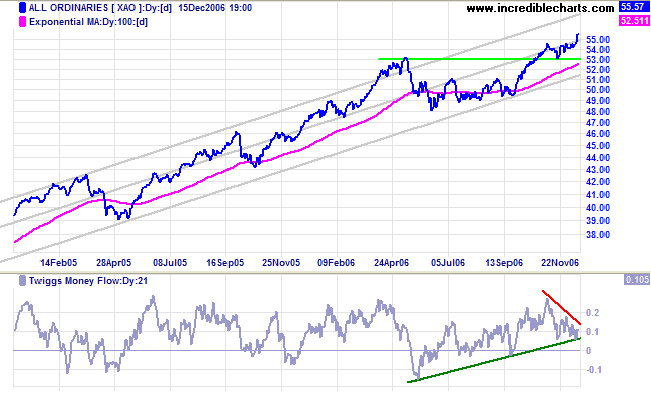

ASX: Australia

Long Term: The All Ordinaries remains in a primary up-trend with support at 4800.

that if one advances confidently in the direction of his dreams,

and endeavors to live the life which he has imagined,

he will meet with a success unexpected in common hours.

~ Henry David Thoreau: Walden

|

Technical Analysis and Predictions I believe that Technical Analysis should not be used to make predictions because we never know the outcome of a particular pattern or series of events with 100 per cent certainty. The best that we can hope to achieve is a probability of around 80 per cent for any particular outcome: something unexpected will occur at least one in five times. My approach is to assign probabilities to each possible outcome. Assigning actual percentages would imply a degree of precision which, most of the time, is unachievable. Terms used are more general: "this is a strong signal"; "this is likely"; "expect this to follow"; "this is less likely to occur"; "this is unlikely"; and so on. Bear in mind that there are times, especially when the market is in equilibrium, when we may face several scenarios with fairly even probabilities. Analysis is also separated into three time frames: short, medium and long-term. While one time frame may be clear, another could be uncertain. Obviously, we have the greatest chance of success when all three time frames are clear. The market is a dynamic system. I often compare trading to a military operation, not because of its' oppositional nature, but because of the complexity, the continual uncertainty created by conflicting intelligence and the element of chance that can disrupt even the best made plans. Prepare thoroughly, but allow for the unexpected. The formula is simple: trade when probabilities are in your favor; apply proper risk (money) management; and you will succeed. For further background, please read About The Trading Diary. |

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.