Nikkei Weakens

November 18, 2006 2:30 p.m. AET (10:30 p.m. ET)

The Big Picture

Crude oil is testing major support at $55/barrel. Failure of this level would signal a long-term down-trend. The dollar is at $1.28 against the euro, testing the high of the last 6 month's consolidation. Gold recovered to $621.75 after testing short-term support at $615, continuing the intermediate rally. However, if oil falls and the dollar continues to consolidate against the euro, gold is likely to weaken.

Probability of recession in the next four quarters increased to 42 per cent according to the Wright model. A climb above 50% would be cause for concern.

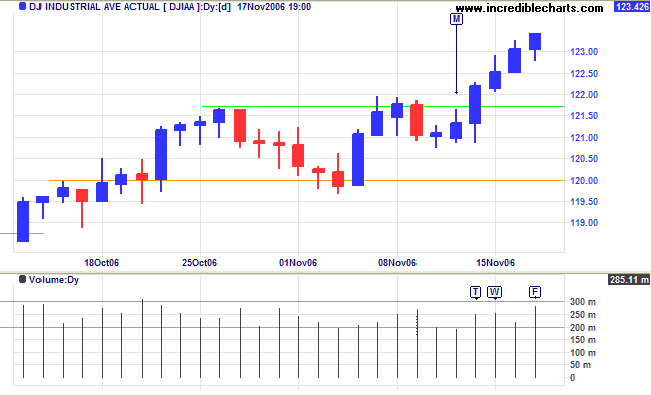

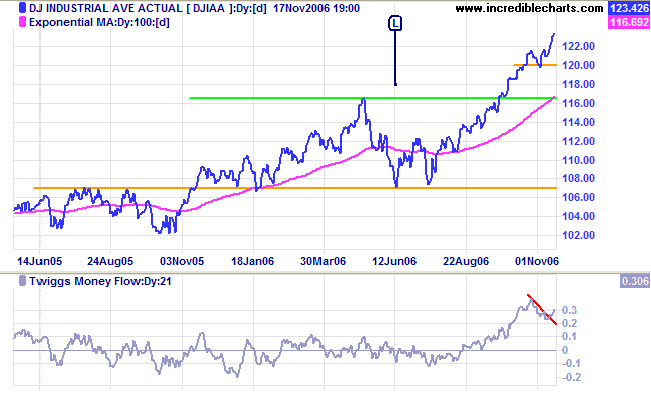

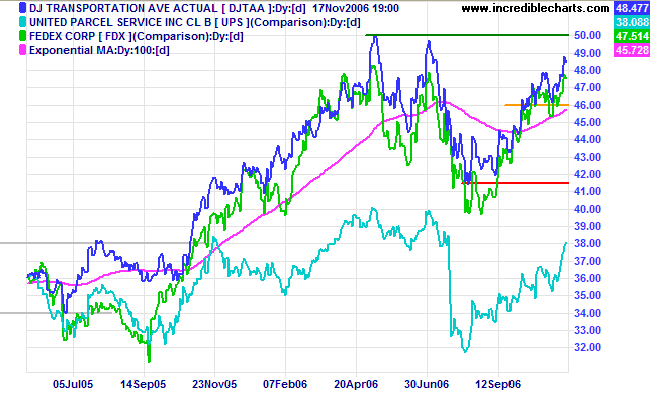

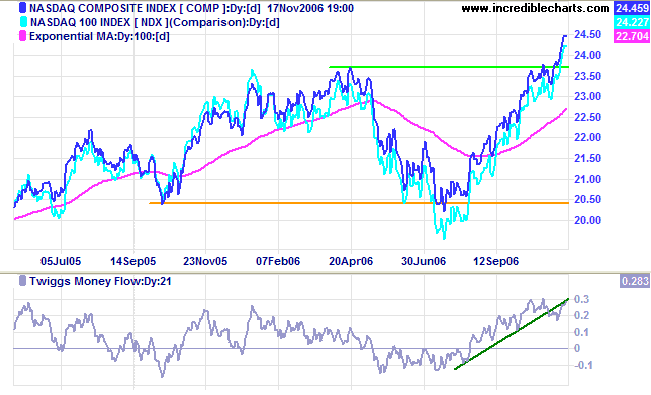

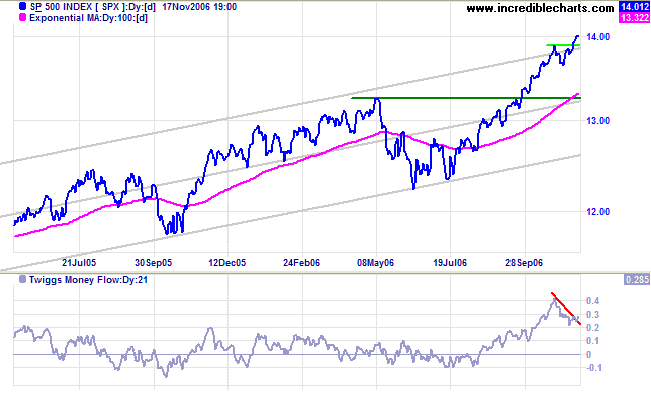

USA: Dow, NASDAQ & SP500

Long Term: The Dow is in a primary up-trend with support at 10700 [L].

Long Term: The S&P 500 continues in a primary up-trend with support at 1220.

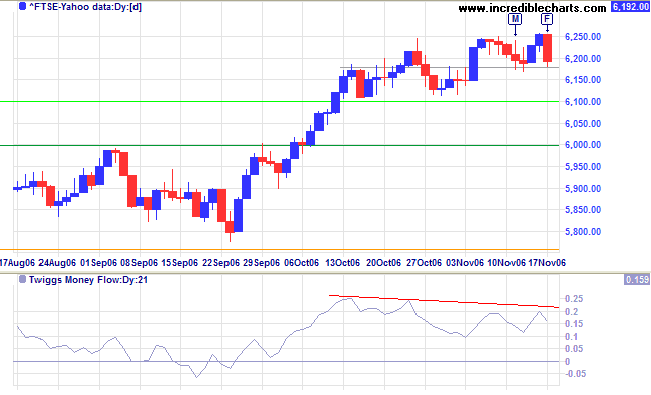

LSE: United Kingdom

Medium Term: Twiggs Money Flow (21-day) bearish triple divergence warns that another test of 6100 is likely. Consolidation in a narrow band above the new support level is a bullish sign: while buyers may not be strong enough to overcome further resistance they have sufficient strength to prevent a correction, maintaining the support level at 6100. Failure of support at 6000/6100, though not expected at this stage, would warn of a correction, possibly testing primary support at 5500.

Long Term: The primary up-trend continues.

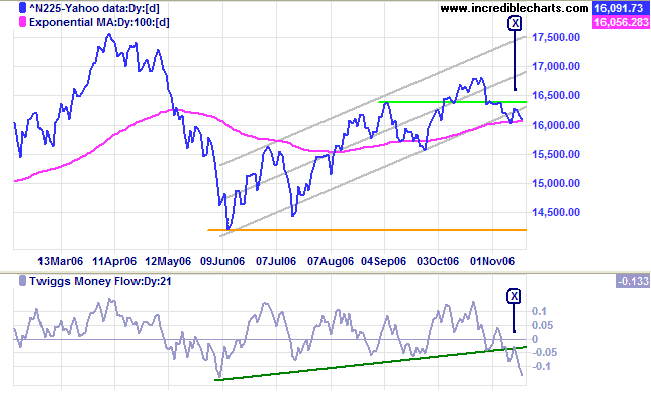

Nikkei: Japan

Medium Term: A break below the 100-day moving average would be a further bear signal, warning of a test of primary support at 14200. Failure to test the previous high of 17500 would be a further negative, weakening primary support.

Long Term: The index is in a primary up-trend.

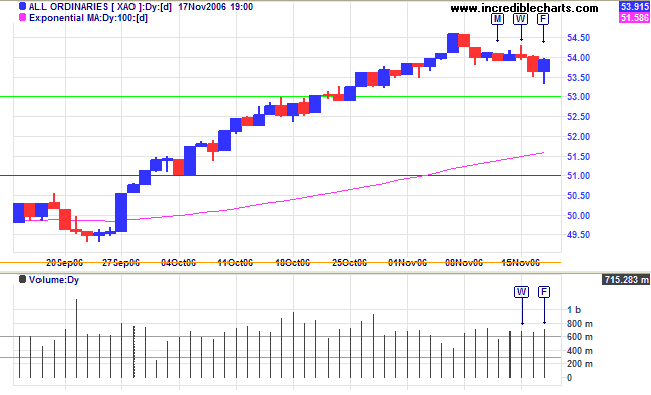

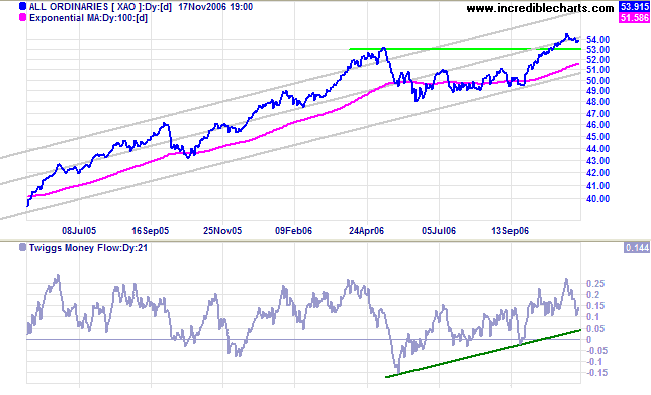

ASX: Australia

Long Term: The All Ordinaries continues in a primary up-trend with support at 4800.

~ Oprah Winfrey

|

Technical Analysis and Predictions I believe that Technical Analysis should not be used to make predictions because we never know the outcome of a particular pattern or series of events with 100 per cent certainty. The best that we can hope to achieve is a probability of around 80 per cent for any particular outcome: something unexpected will occur at least one in five times. My approach is to assign probabilities to each possible outcome. Assigning actual percentages would imply a degree of precision which, most of the time, is unachievable. Terms used are more general: "this is a strong signal"; "this is likely"; "expect this to follow"; "this is less likely to occur"; "this is unlikely"; and so on. Bear in mind that there are times, especially when the market is in equilibrium, when we may face several scenarios with fairly even probabilities. Analysis is also separated into three time frames: short, medium and long-term. While one time frame may be clear, another could be uncertain. Obviously, we have the greatest chance of success when all three time frames are clear. The market is a dynamic system. I often compare trading to a military operation, not because of its' oppositional nature, but because of the complexity, the continual uncertainty created by conflicting intelligence and the element of chance that can disrupt even the best made plans. Prepare thoroughly, but allow for the unexpected. The formula is simple: trade when probabilities are in your favor; apply proper risk (money) management; and you will succeed. For further background, please read About The Trading Diary. |

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.