Gold , Oil & The Dollar

October 17, 2006 2:30 a.m. ET (4:30 p.m. AET)

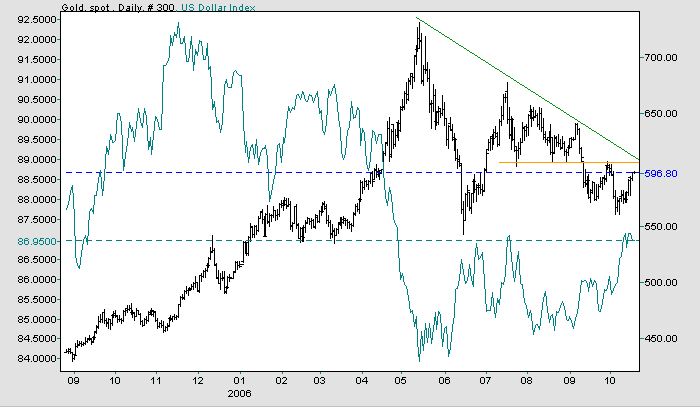

Spot gold is headed for another test of resistance at $600/$607. Respect of the new resistance level would confirm the down-trend, while failure of resistance and penetration of the downward trendline would be a bullish sign. The latter scenario is less likely given the recent strength of the dollar and lower crude oil prices.

Medium Term: Falling oil prices have eased inflationary expectations, causing a drop in demand for gold. Expect a test of primary support at $540.

Long Term: Gold is a political barometer and an inflation hedge. Nuclear tests by North Korea and Iran may increase political instability in the next few years and peak oil is likely to place continual upward pressure on prices. Given that scenario, gold appears to have more upside than downside potential.

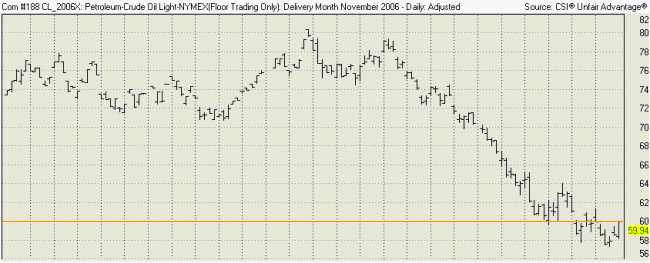

Light Crude encountered support at $58/barrel and retraced to test resistance at $60. Respect of the $60 level would signal the start of a further intermediate down-swing -- confirmed if price falls below the recent low. Failure of resistance, on the other hand, would signal that buyers have sufficient strength to stave off another down-trend. The probability of either scenario is about even.

Medium Term: If price falls below the recent low it is likely to encounter support at $55.

Long Term: Peak oil is still a major consideration: oil producers are not discovering new resources as fast as existing fields are being depleted. Retracement from $80 to $55 may merely be a mid-point consolidation in a larger up-trend, but this could take some time to emerge.

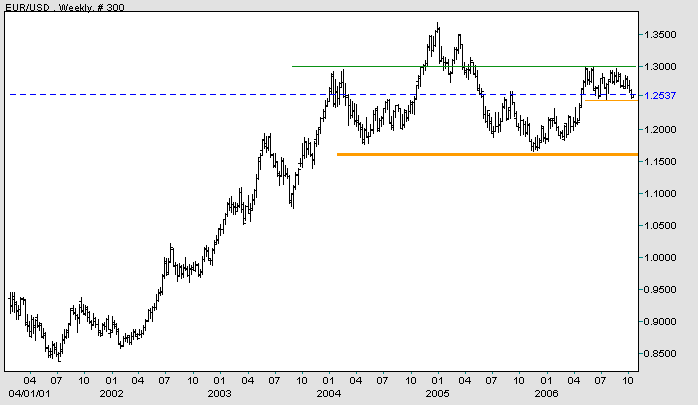

The euro is testing support at $1.245. Failure of this level would be likely to test primary support at $1.165.

Long Term: A fall below primary support would complete a large head and shoulders pattern, but breakout above $1.30 remains a possibility.

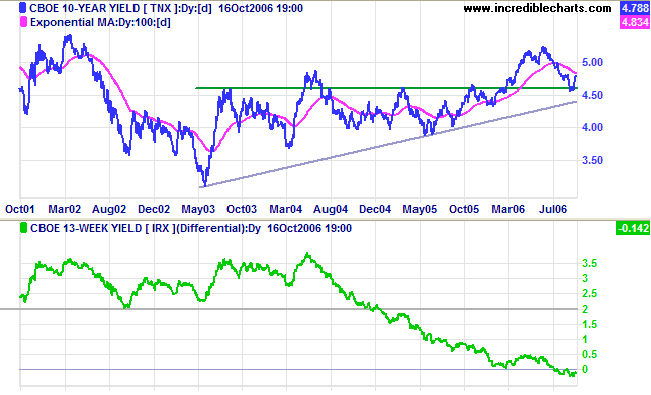

Falling long-term rates reflect lower inflation expectations and growing confidence that the Fed will achieve a soft landing. Lower rates have failed to weaken the dollar while offering some respite to the beleaguered housing market.

Medium Term: Ten-year Treasury note yields have so far respected support at 4.60%, but be prepared for another test. Continued respect of support would confirm that the up-trend is intact, while failure would signal a test of primary support at 4.00%.

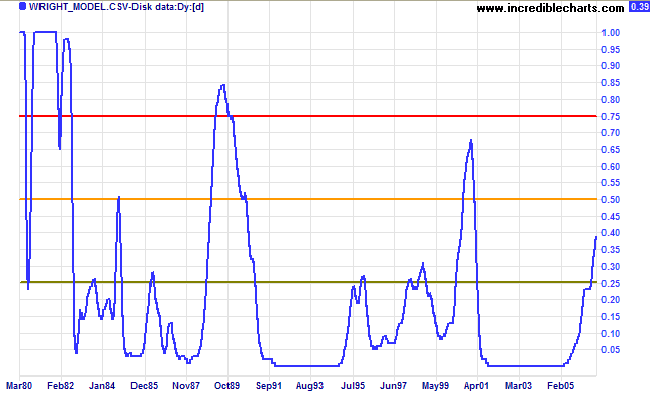

The yield differential (10-year T-notes minus 13-week T-bills) remains below zero, warning of further weakness in the economy.

are in harmony.

~ Mahatma Gandhi

|

Predictions I believe that Technical Analysis should not be used to make predictions because we never know the outcome of a particular pattern or series of events with 100 per cent certainty. The best that we can hope to achieve is a probability of around 80 per cent for any particular outcome: something unexpected will occur at least one in five times. My approach is to assign probabilities to each possible outcome. Assigning actual percentages would imply a degree of precision which, most of the time, is unachievable. Terms used are more general: "this is a strong signal"; "this is likely"; "expect this to follow"; "this is less likely to occur"; "this is unlikely"; and so on. Bear in mind that there are times, especially when the market is in equilibrium, when we may face several scenarios with fairly even probabilities. Analysis is also separated into three time frames: short, intermediate and long-term. While one time frame may be clear, another could be uncertain. Obviously, we have the greatest chance of success when all three time frames are clear. The market is a dynamic system. I often compare trading to a military operation, not because of its' oppositional nature, but because of the complexity, the continual uncertainty created by conflicting intelligence reports and the element of chance that can disrupt even the best made plans. Prepare thoroughly, but allow for the unexpected. The formula is simple: trade when probabilities are in your favor; apply proper risk (money) management; and you will succeed. For further background, please read About The Trading Diary. |

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.