Gold , Oil & the Dollar

October 10, 2006 4:30 a.m. ET (6:30 p.m. AET)

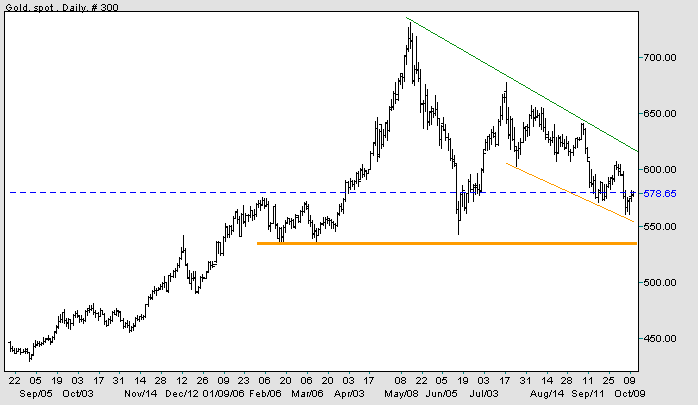

Spot gold rallied slightly off its recent low of $560.

Medium Term: Gold is trending downwards, headed towards a test of primary support at $540.

Long Term: Gold is a political barometer and I suspect that nuclear tests by North Korea and Iran are going to increase political instability in the next few years. Given that scenario, gold appears to have more upside potential than downside.

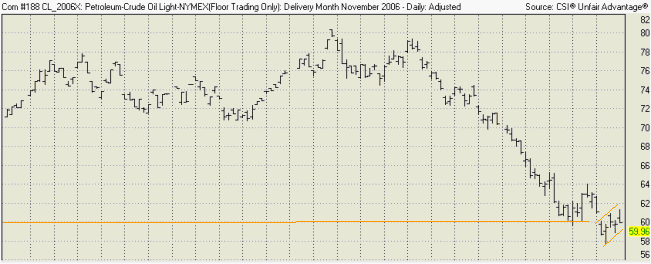

Light Crude penetrated support at $60/barrel in the last week before recovering to $59.96/barrel. The flag pattern is a continuation signal warning us to expect further downside. A fall below the recent low of $58 would be likely to encounter further support at $55. Recovery above $64, though unlikely in the near term, would be a bullish sign.

Falling crude prices have eased inflationary expectations, resulting in lower gold prices.

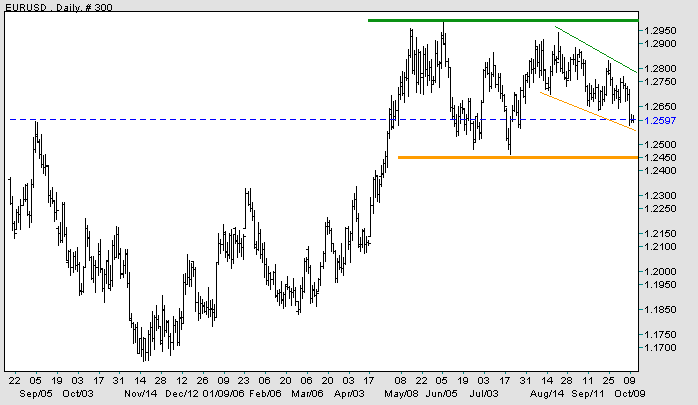

The euro is trending downwards against the dollar, headed for a test of support at $1.245 The trend appears slow and an upside breakout from the trend channel should not be discounted.

In the longer term the currency is consolidating between support at $1.245 and resistance at $1.30. The position in an up-trend favors an upside breakout -- which would strengthen gold.

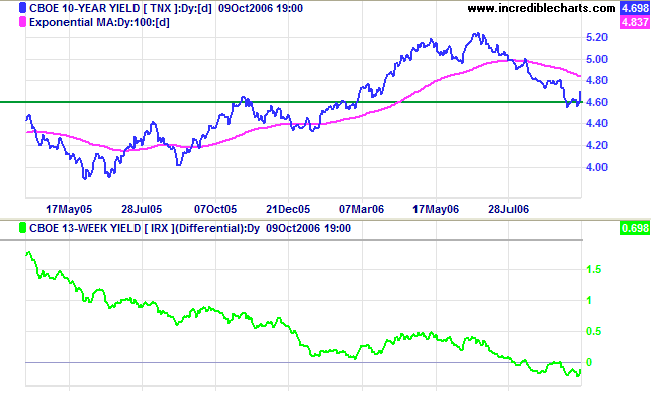

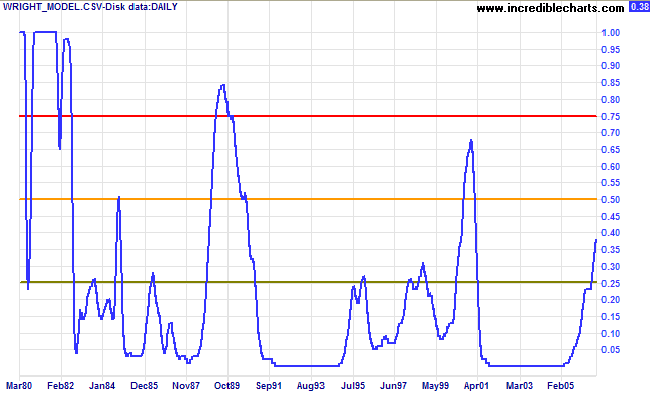

Falling long-term rates tend to weaken the dollar, though may offer some respite to the slumping property market. Ten-year Treasury note yields have so far respected support at 4.60%, but be prepared for another test. Failure of support would signal a test primary support at 4.00%. Respect of support, on the other hand, would signal that the up-trend is intact.

Medium Term: The yield differential (10-year T-notes minus 13-week T-bills) below zero warns of further weakness in the economy. A gentle easing of economic activity will probably suit the Fed, while a resurgence would force them to resume interest rate hikes.

Behind the black portent of the new atomic age lies a hope which, seized upon with faith, can work out a salvation.

If we fail, then we have damned every man to be the slave of fear.

Let us not deceive ourselves: we must elect world peace or world destruction.

- Bernard Baruch at the inaugural meeting of the United Nations Atomic Energy Commission, June 14, 1946.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.