Gold , Oil & the Dollar

October 3, 2006 2:30 a.m. ET (4:30 p.m. AET)

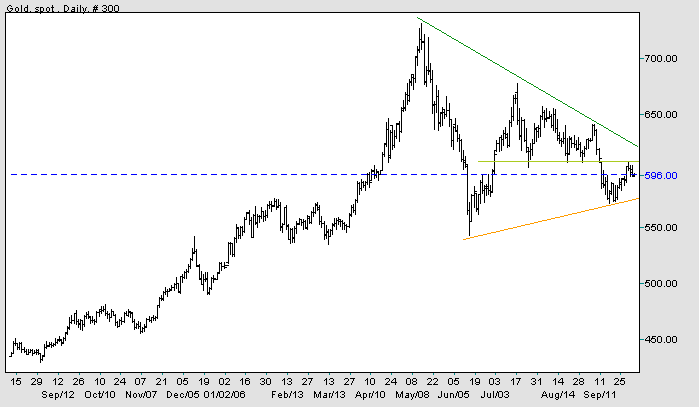

Spot gold is testing resistance at $600/$610. Narrow consolidation below the resistance level (or a breakout) would be a bullish sign.

Medium Term: The large symmetrical triangle (May - September) is approaching its apex. The target of $190, calculated from the high of $730 to the low of $540, would be projected from the breakout point, whether up or down.

Long Term: The dollar appears likely to weaken, which should help strengthen gold.

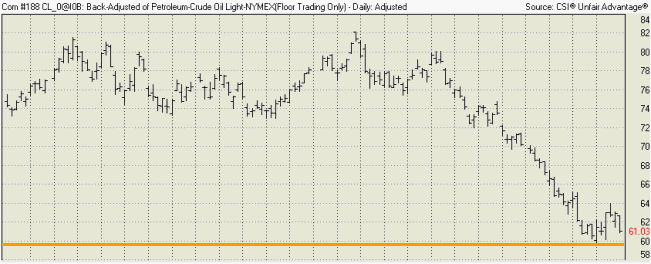

Light Crude is testing support at $60/barrel. Expect strong support between $60 and $55.

Falling crude prices have eased inflationary expectations, resulting in lower gold prices. Recovery would have the opposite effect.

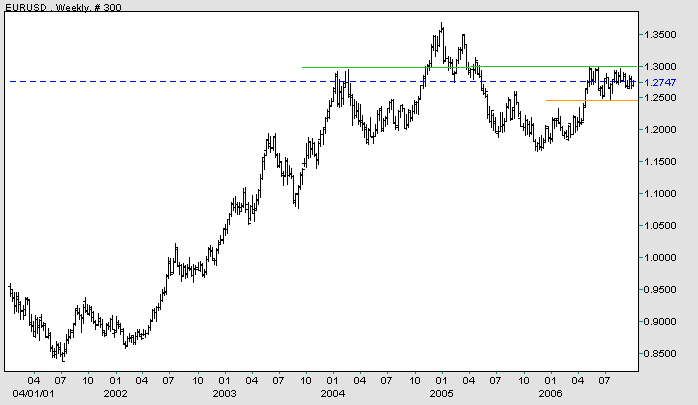

The euro is consolidating below resistance at $1.30. Consolidations are continuation signals, normally resolving in the direction of the trend -- in this case up. If the euro breaks out above $1.30, expect gold to strengthen.

A fall below support at $1.245, though unlikely at present, would mean a test support at 1.16/1.17 -- and a possible head and shoulders reversal (2004 - 2006).

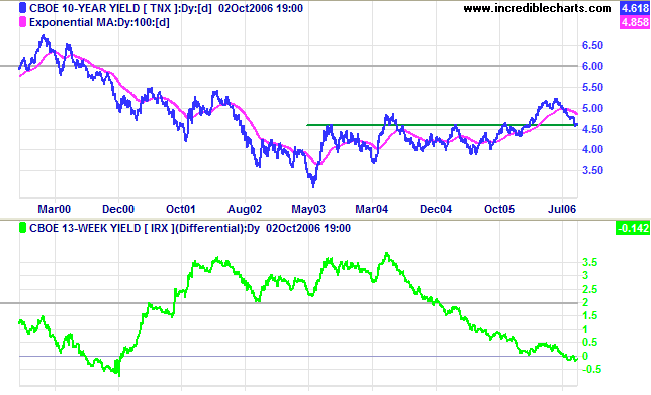

Falling long-term rates tend to weaken the dollar. Ten-year Treasury note yields are testing the first line of long-term support at 4.60%. A break below this level would test primary support at 4.00%. On the other hand, respect of support at 4.60%, though less likely, would signal that the up-trend is intact.

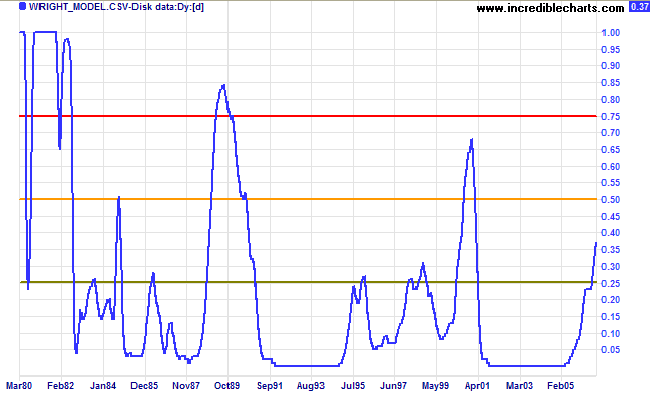

Medium Term: The yield differential (10-year T-notes minus 13-week T-bills) is well below zero, warning of further weakness in the economy. The Fed cannot afford to raise interest rates much further without harming the economy (short-term yields peaked at 6.20% before the last recession -- compared to current levels of just below 5.0%). A gentle easing of economic activity will probably suit them, while signs of an up-turn may force them to use more of their meager remaining ammunition.

~ Samuel Goldwyn

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.