Gold Falls

September 15, 2006 6:15 a.m. ET (8:15 p.m. AET)

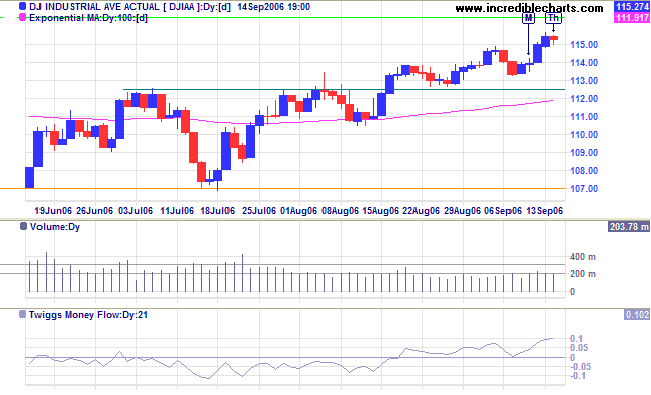

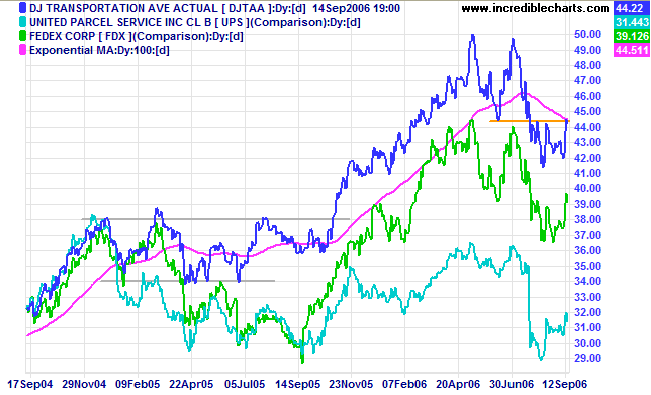

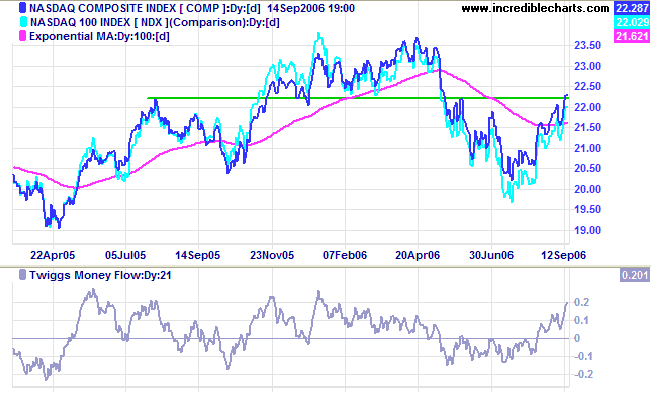

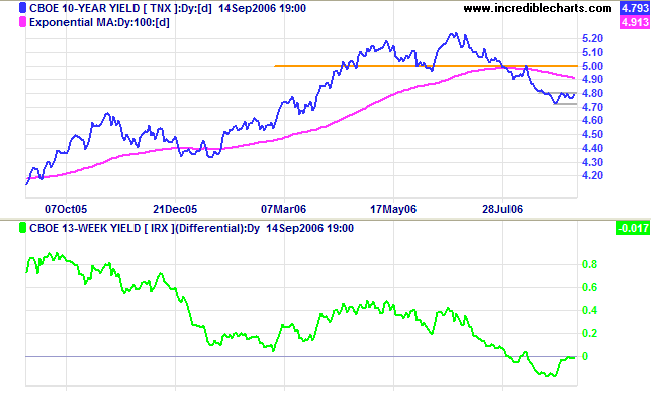

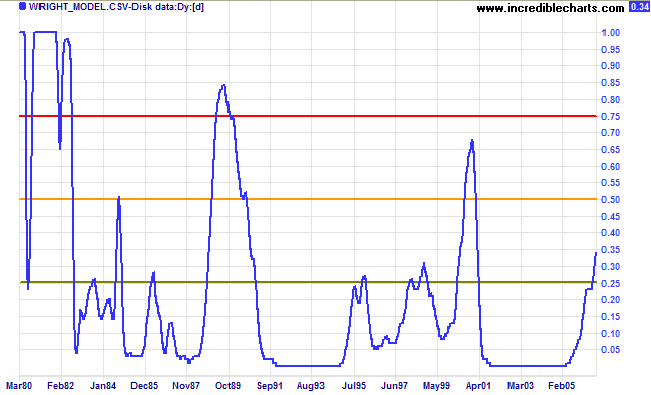

Falling crude oil prices and a declining Dow Transport Index signal reduced inflationary pressures -- resulting in falling bond yields. The yield differential remains negative but probability of recession in the next four quarters is still a modest 34 per cent according to the Wright model.

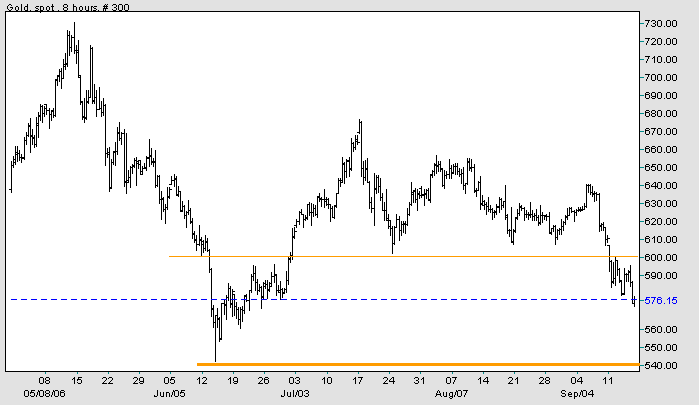

Gold weakened on the back of falling crude prices/inflation fears. Despite this and a stronger bond market the dollar has failed to appreciably strengthen.

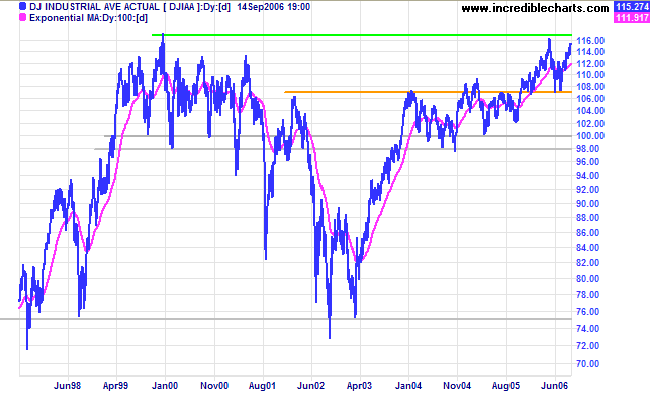

Long Term: The Dow continues in a primary up-trend, with resistance from the all-time high at 11750 and support at 10700.

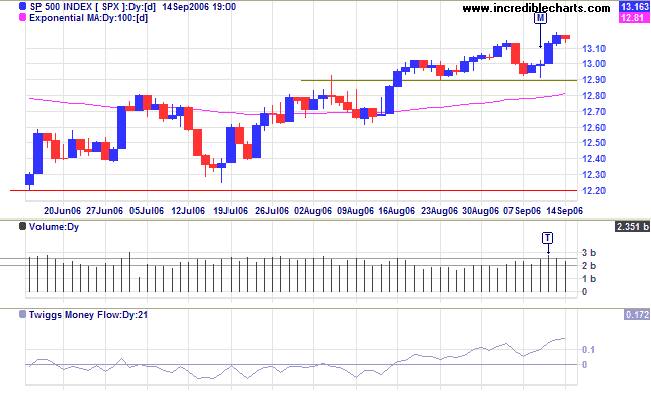

Long Term: The S&P 500 remains in a slow primary up-trend, with support at 1220.

Ten-year Treasury note yields consolidated below 4.80% as inflation fears resurfaced.

Medium Term: The yield differential (10-year T-notes minus 13-week T-bills) is close to zero. The primary cause has been the fall in long-term yields rather than rising short-term yields, reducing the significance.

Spot gold formed a brief consolidation below $600 before breaking through support.

Medium Term: Falling crude oil prices should weaken gold and strengthen the dollar. Expect gold to test primary support at $540.

Long Term: The primary trend remains upward until there is a fall below $540.

Light Crude has fallen to $64.11 per barrel. The down-trend should encounter a strong band of support between $55 and $60, possibly triggering a short recovery.

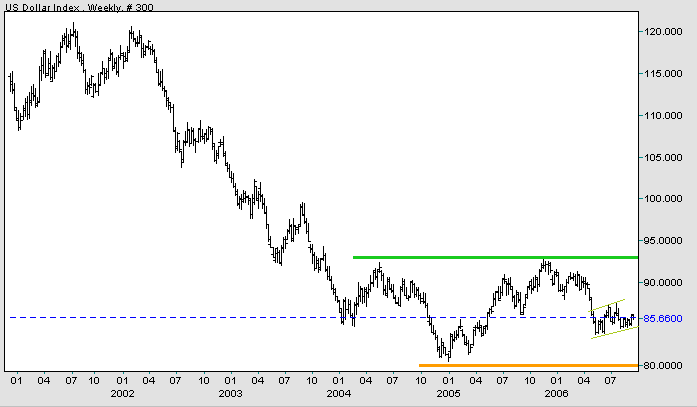

The US Dollar Index has consolidated in a fairly narrow range over the last few months. Remember this is a weekly chart, so the consolidation pattern is not a flag, however the longer-term down-trend is likely to continue. Any breakout below the support level will signal a test of the extreme low of 80.00, last reached in early 2005. A weakening dollar would provide support for the gold price.

An upward breakout, though less likely, is likely to test resistance at 93.00; and a breakout above that level, though not very promising at this stage, would complete an inverted head and shoulders.

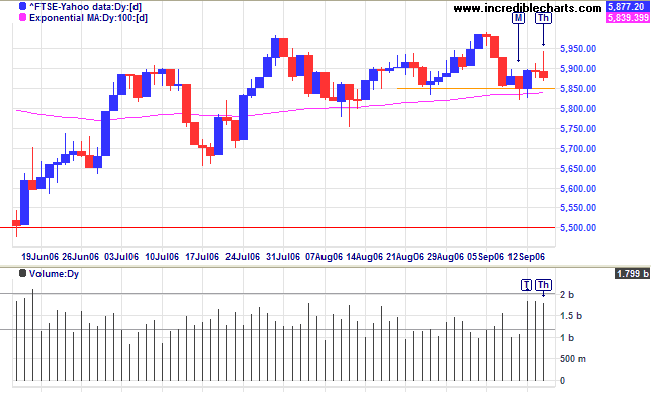

The FTSE 100 has seen a surge in volumes in the last 3 days, accompanied by signs of distribution: a doji candle on Wednesday followed by a gravestone [Th]. Intermediate support at 5850 may be under threat.

Medium Term: Activity levels have been low throughout July and August, and I suspect that this rally is going to struggle to break through the April high of 6130. Twiggs Money Flow (21-day) has retreated to zero, signaling uncertainty.

Long Term: The primary up-trend remains until primary support at 5500 is penetrated.

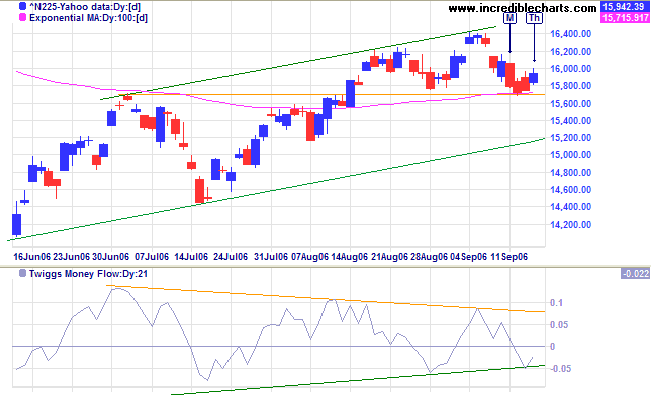

The Nikkei 225 has so far respected support at 15700. Failure of this level would signal a slowing of the intermediate up-trend, but as long as the index remains within the channel the longer-term trend remains positive.

Medium Term: Twiggs Money Flow (21-day) continues in a narrowing triangle around the zero line, signaling uncertainty. The next target for the up-trend is the April high of 17500, but we would need to see an improvement in TMF for this to be achieved.

Long Term: The primary up-trend remains up, with support at 14200.

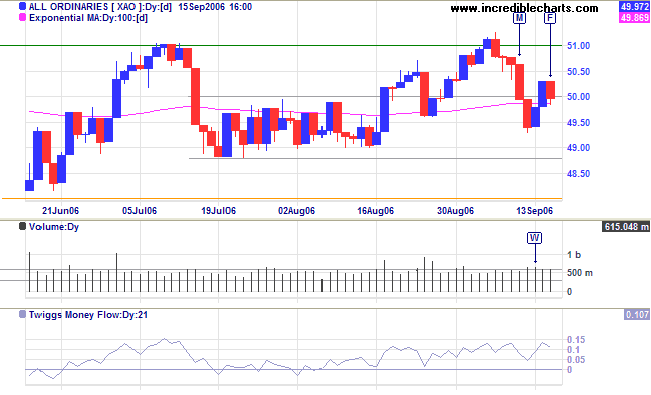

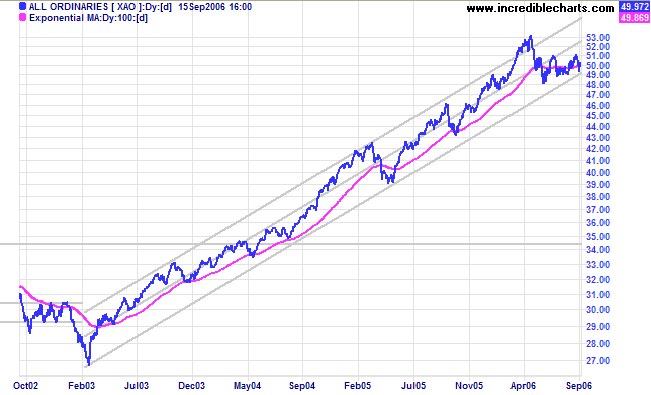

The All Ordinaries retraced for 5 days before rallying on Wednesday, stronger volumes signaling the presence of buying support. The rally only lasted 2 days, however, before a red candle [F] warns of further weakness. A fall below Tuesday's low would signal that a test of support at 4800 is likely, while a rise above Thursday's high would signal another test of resistance at 5100.

Long Term: The All Ordinaries continues in a primary up-trend.

to win the respect of intelligent people

and the affection of children;

to earn the appreciation of honest critics

and endure the betrayal of false friends.

To appreciate beauty;

to find the best in others;

to leave the world a bit better

whether by a healthy child, a garden patch

or a redeemed social condition;

to know that even one life has breathed easier

because you have lived.

This is to have succeeded.

~ Ralph Waldo Emerson (1803 - 1882)

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.