Crude Oil Falls

September 8, 2006 3:27 a.m. ET (5:27 p.m. AET)

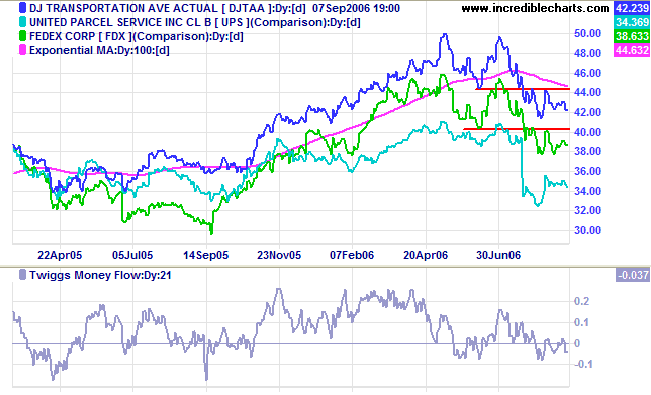

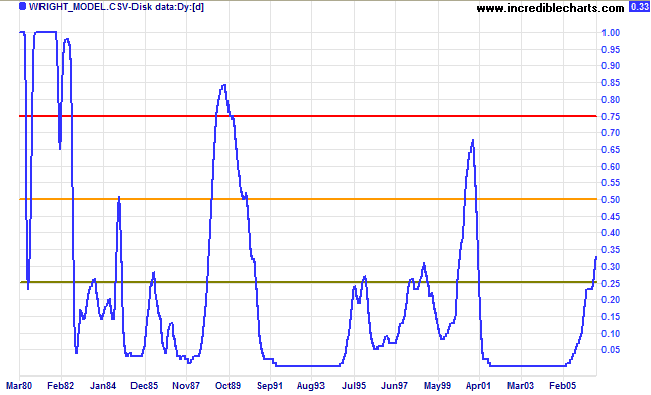

The Dow Transport Index confirms general economic activity is declining, but strong increases in hourly wage data have raised fears of further rate hikes. The yield differential remains negative and is likely to cause problems in the months ahead.

Crude oil is falling sharply. Gold is likely to weaken and the dollar to strengthen.

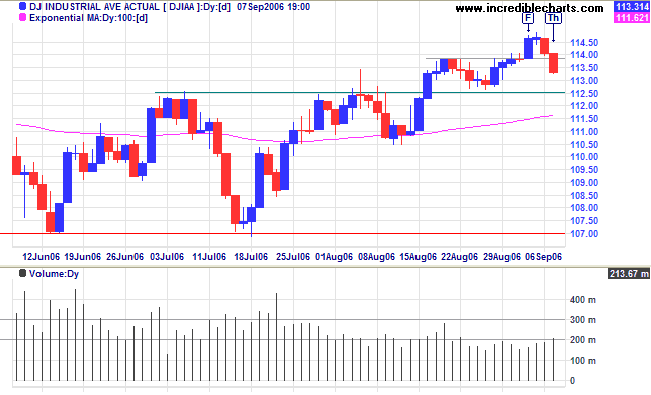

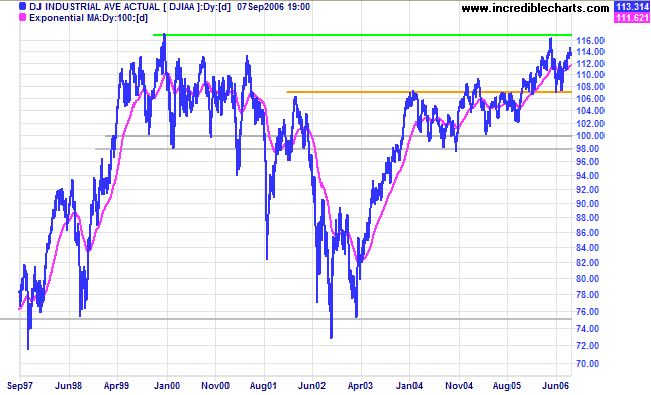

Long Term: The Dow continues in a primary up-trend, with resistance from the all-time high at 11650 and support at 10700.

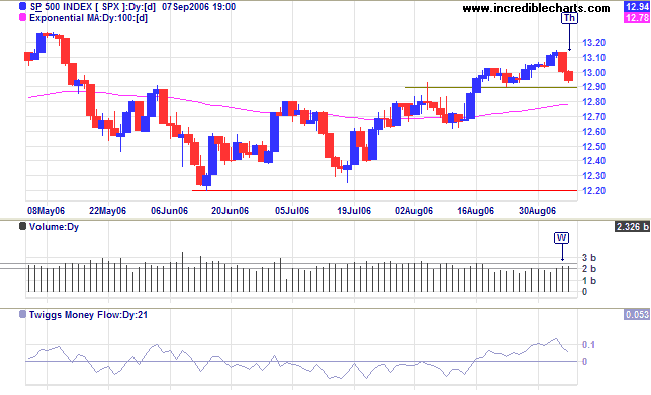

Long Term: The S&P 500 remains in a slow primary up-trend.

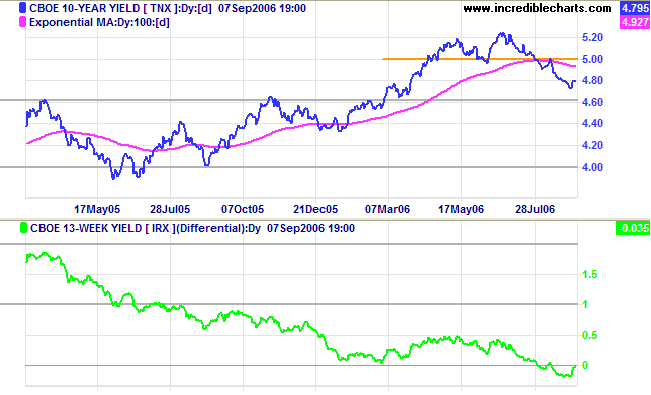

Strong rises in hourly wage data rekindled fears of further rate hikes, causing a retracement in the recent down-trend in 10-year Treasury note yields.

Medium Term: The yield differential (10-year T-notes minus 13-week T-bills) reversed towards zero (as short-term yields fell). The trend has not reversed and we can expect further weakness.

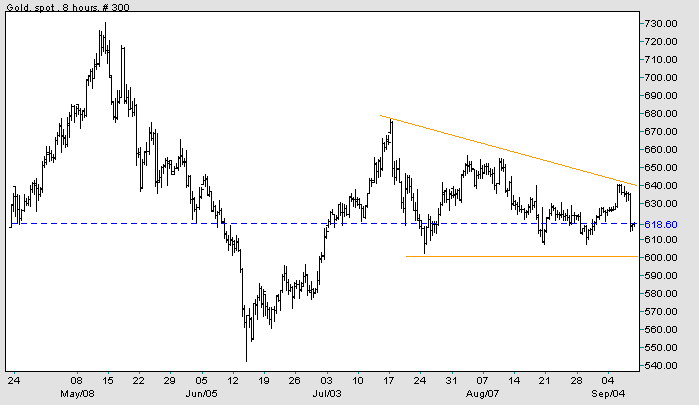

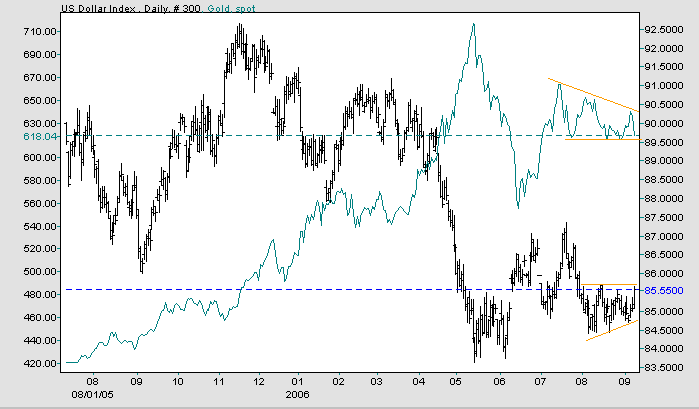

Spot gold formed a bearish descending triangle with support at $600. A downward breakout would signal a test of primary support at $540.

Medium Term: Falling crude oil prices should weaken gold and strengthen the dollar.

Long Term: The primary trend is upward, but remains weak.

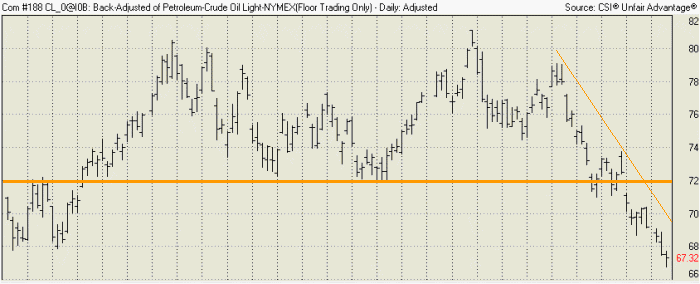

Light Crude is in a strong down-trend after breaking through support at $72. The next major support level is at $59/$60, but do not rule out a retracement to test the new resistance level (at $72).

The US Dollar Index formed an ascending triangle in the last few weeks, mirroring the descending triangle on the gold chart. An upward breakout would signal an attempt at 87.00. Though less likely, a fall below 84.50 would warn of a test of major support at 83.50 (and a bullish sign for gold).

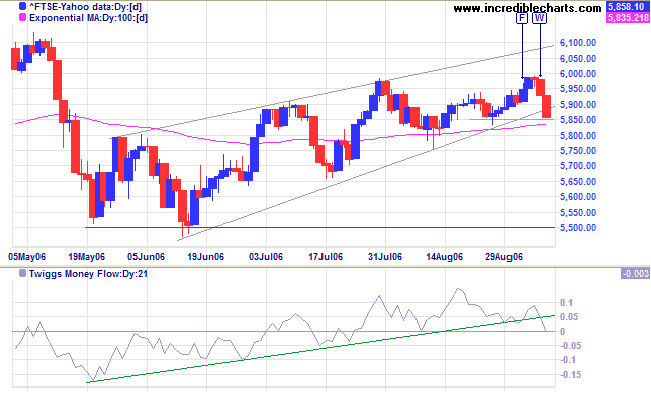

The FTSE 100 made a downward breakout from a bearish rising wedge -- confirmed if intermediate support at 5850 fails. Watch for a test of primary support at 5500.

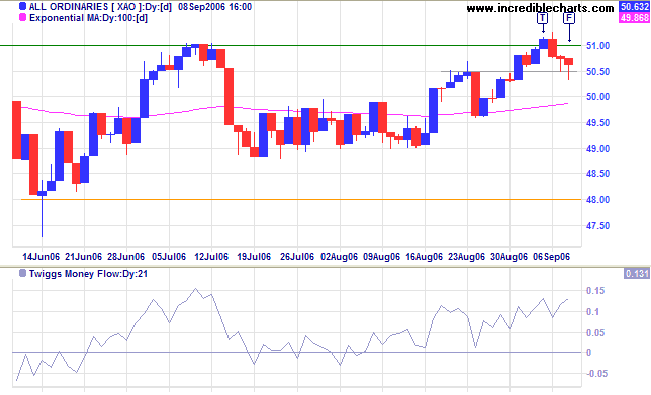

Medium Term: Twiggs Money Flow (21-day) is bearish after a sharp fall.

Long Term: The primary up-trend continues until primary support at 5500 is penetrated.

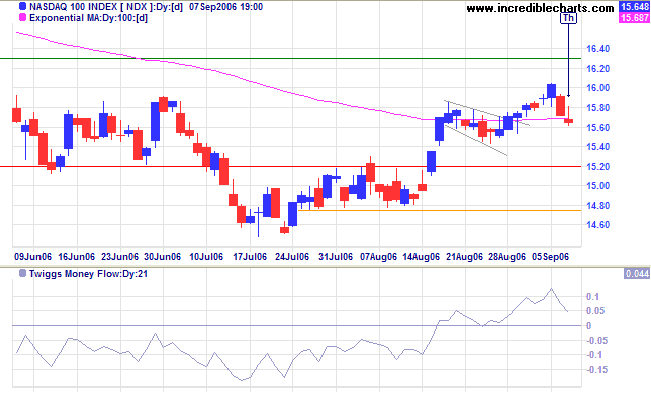

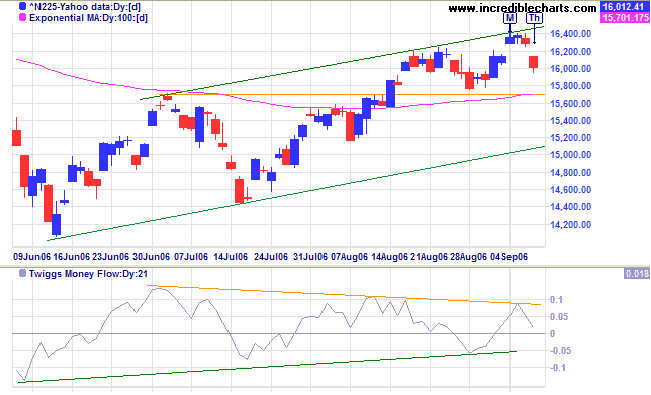

The Nikkei 225 is headed for a second test of the new support level at 15700.

Medium Term: The intermediate rally is likely to test resistance at the April high of 17500. Twiggs Money Flow (21-day) formed a narrow triangle around the zero line, indicating continued uncertainty.

Long Term: The primary up-trend is up.

The All Ordinaries made a false break through resistance at 5100, reversing on the day following the breakout. Long tails in the last two days indicate buying at the first line of support -- a bullish sign. If support at 5050 holds, expect another breakout.

Long Term: The All Ordinaries continues in a primary up-trend.

are skewed toward moving in a given direction more times than not,

there are times when they are not going to move.

~ Don Miller

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.