Tuesday Update

September 5, 2006 5:30 p.m. AET

These extracts from my daily trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

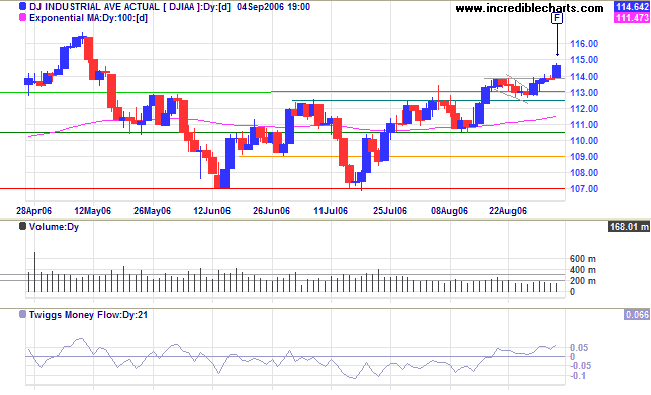

The Dow Jones Industrial Average appears unaffected by the low volume, posting a strong blue candle on Friday [F], while Twiggs Money Flow (21-day) trends above zero, signaling accumulation. Expect a test of the all-time high at 11650, but low volume indicates a lack of enthusiasm from buyers and places a question-mark over the index's ability to break through this major resistance level.

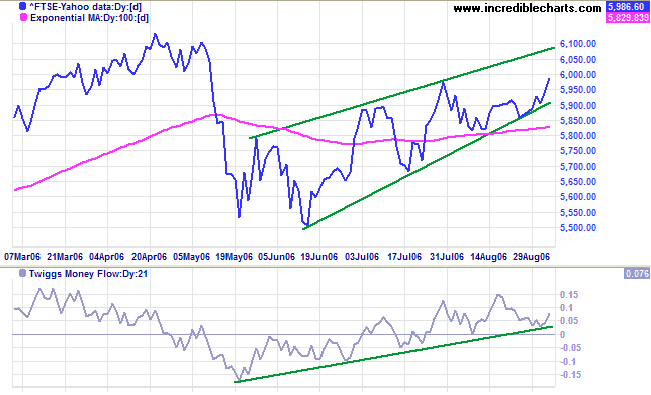

The FTSE 100 is trending upwards, with Twiggs Money Flow (21-day) forming troughs above zero -- a sign of strong accumulation. One word of caution: There is insufficient evidence to conclude that the index has formed a rising wedge, but if the current rally respects the upper border of the pattern, that would be a bearish sign.

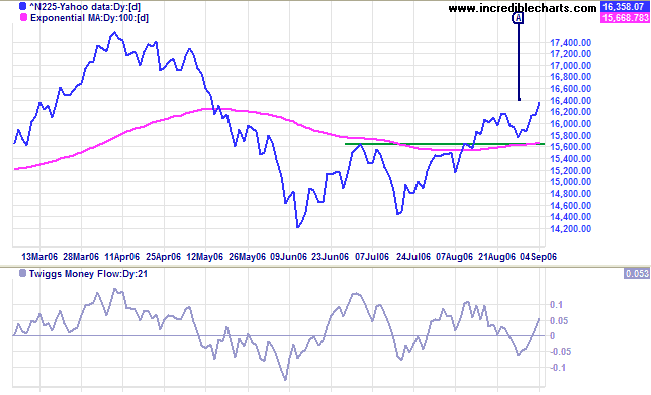

The Nikkei 225 pull-back respected the new support level at 15700, confirming the up-trend, and has started a new upward spike. The rally is likely to test resistance at 17500. Twiggs Money Flow (21-day) is whipsawing around the zero line, indicating continued uncertainty.

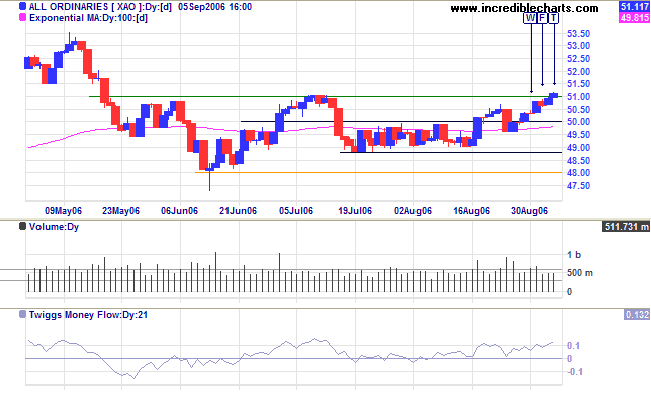

The All Ordinaries broke through resistance at 5100 and appears likely to test the May high of 5350. A pull-back that respects the new support level would confirm the breakout. Twiggs Money Flow (21-day) is above zero and rising, signaling accumulation.

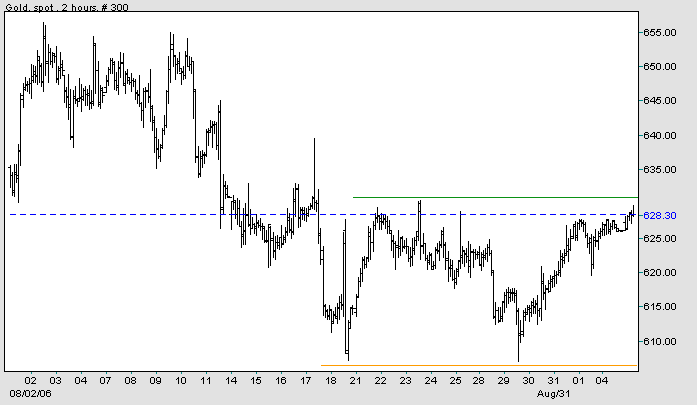

Gold is testing resistance at $628/$630. A breakout above this level would signal a test of $655. If the level is respected, we should see a test of support at $600.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.