Low Volumes Hinder Trend

September 1, 2006 3:27 a.m. ET (5:27 p.m. AET)

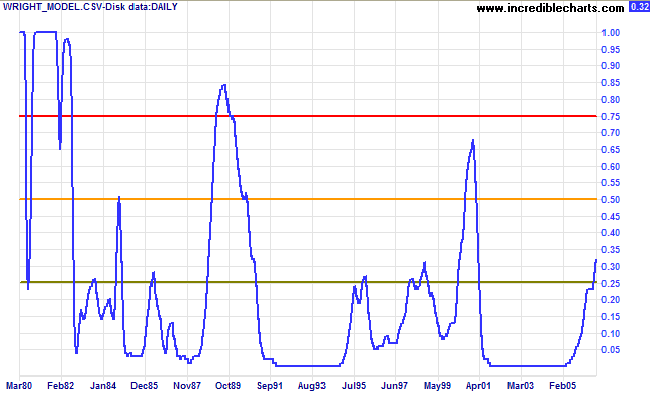

The negative yield differential is likely to cause problems in the months ahead, but falling long-term yields may revive the housing market.

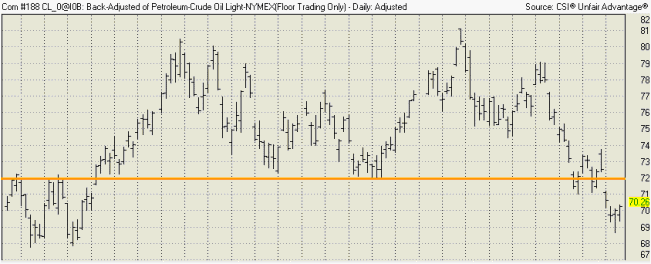

Crude oil fell through support at $71/$72, starting a primary down-trend. If this continues, expect gold to weaken.

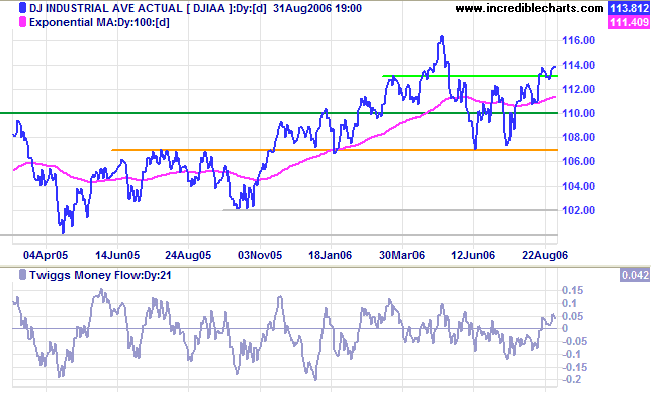

Long Term: The Dow continues in a primary up-trend, with support at 10700.

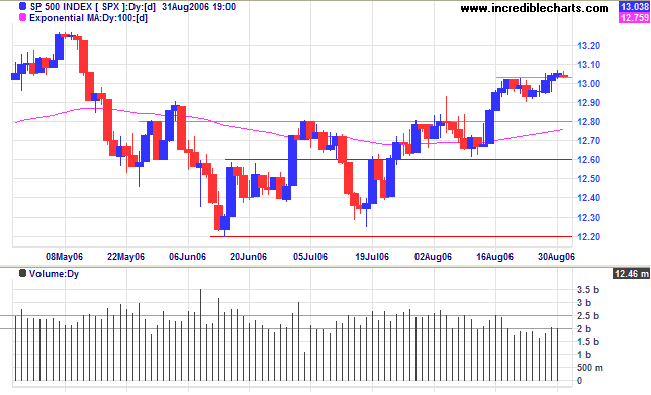

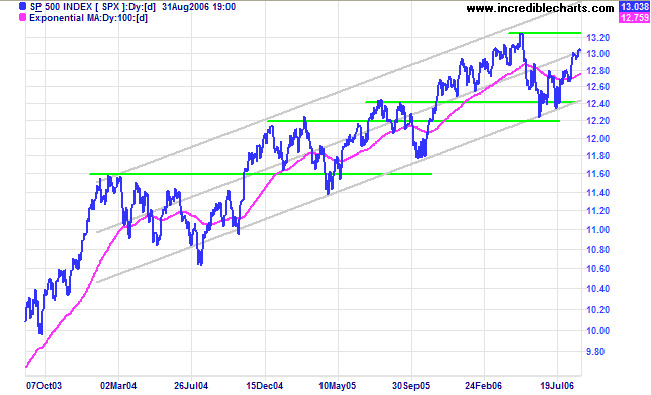

Long Term: The S&P 500 is in a slow primary up-trend, with primary support at 1220. The index is oscillating in a channel around the linear regression line, with stubborn resistance at earlier highs and initial support levels often penetrated. The pattern appears set to continue.

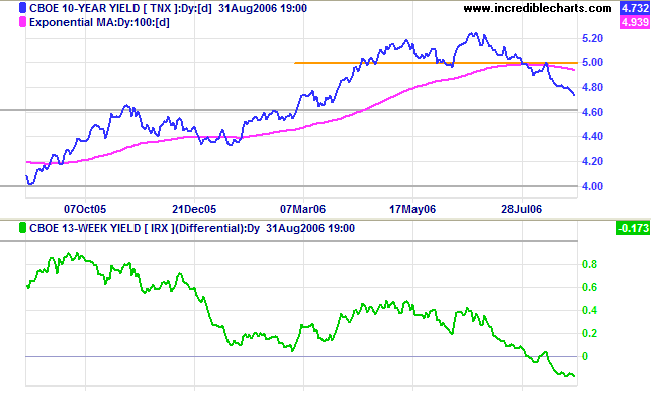

The yield on 10-year Treasury notes is falling steeply as inflation expectations are lowered.

Medium Term: Core consumer prices rose a low 0.1% in July, according to the Department of Commerce, confirming the Fed's view that the economy is slowing. However, the overall price index rose 0.3%, reflecting higher energy costs and the continuing threat of a resurgence in core inflation.

Long Term: The yield differential (10-year T-notes minus 13-week T-bills) is in negative territory, increasing the risk of a down-turn.

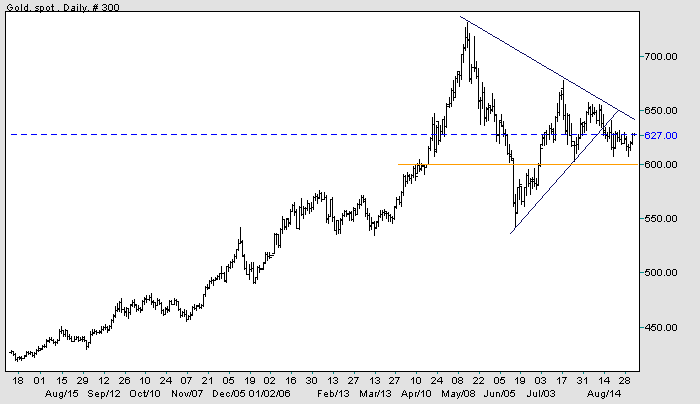

Spot gold continues to test support at $600. Falling crude oil prices should weaken gold and strengthen the dollar.

Medium Term: A reader correctly pointed out that the breakout from the recent large symmetrical triangle was close to the apex. The strongest signals are taken from breakouts two-thirds to three-quarters along the length of the triangle, though any breakout before the apex is still a valid signal. Penetration of support at $600 would be a strong bear signal. The target for the triangle breakout is $450: (630 - (730 - 550)), well below primary support at $540/$550.

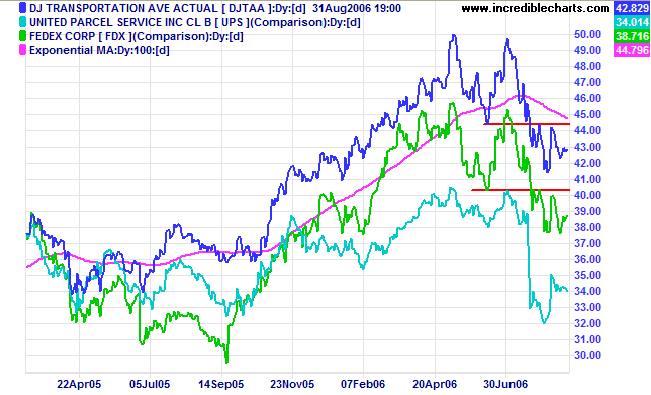

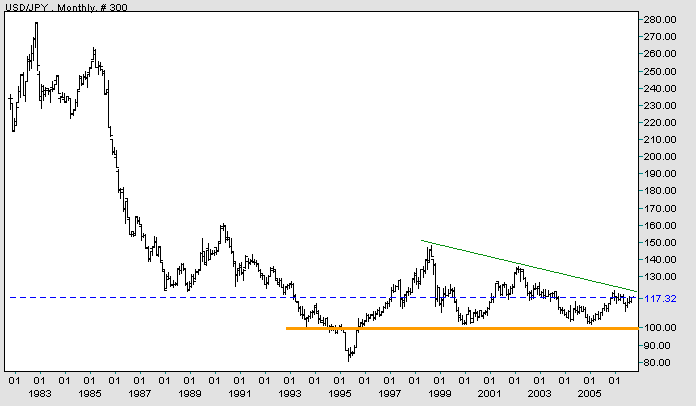

Long Term: The primary trend remains up, but surrounded by uncertainty.

Light Crude gapped below support to commence a primary down-trend, Friday's open-close reversal day giving early warning. Another pull-back may test the new resistance level; if it respects resistance at $71/$72 that will confirm the down-trend.

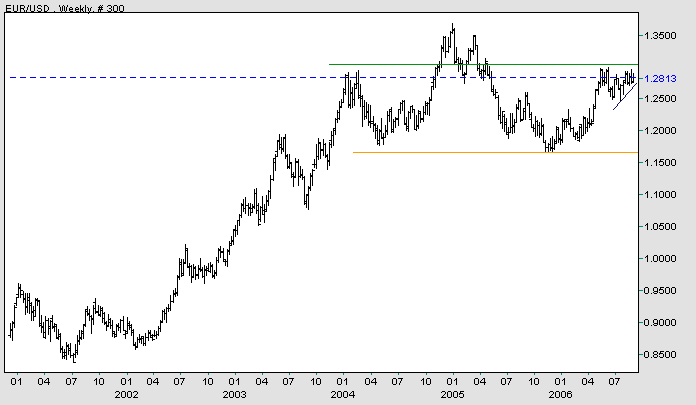

The Euro is trending upwards, headed for another test of resistance at 1.30 dollars. The recent pattern does not qualify as an ascending triangle because the lower border has not been respected by two clear down-swings. However an upward breakout above 1.30 would signal a test of the all-time high at 1.35/1.36 (and a bullish sign for gold).

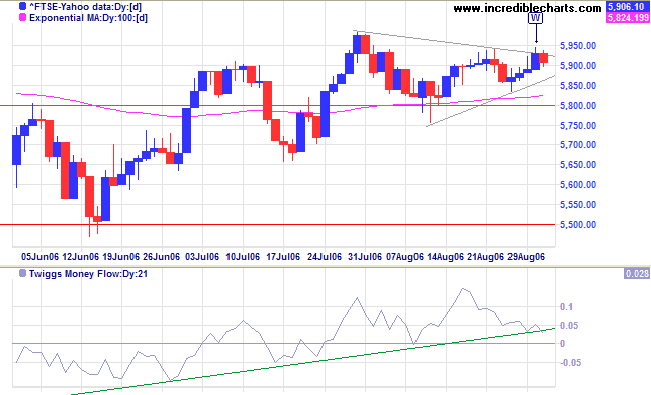

The FTSE 100 tested the upper border of the symmetrical triangle on Wednesday [W], but failed to breakout. Triangles are normally continuation patterns when found in an up-trend, the signal weakening as we approach the apex of the triangle. Watch for a breakout above 5950 or below 5850.

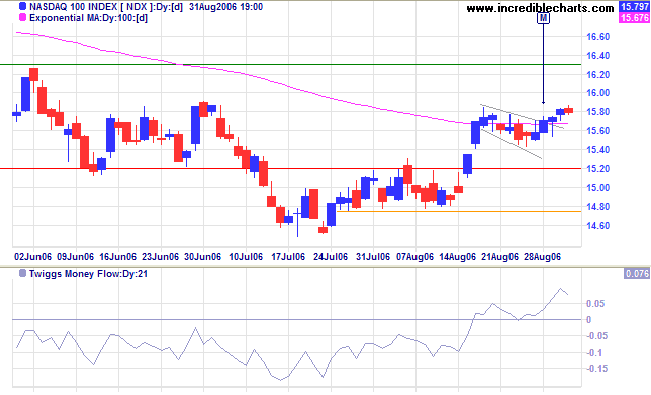

Medium Term: The intermediate trend is upwards. If Twiggs Money Flow (21-day) respects zero, that would be a bullish sign.

Long Term: The primary up-trend continues.

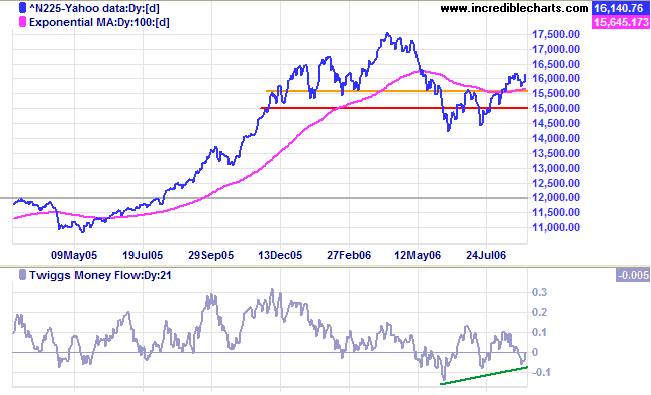

The Nikkei 225 pull-back respected the new support level at 15700, confirming the up-trend.

Medium Term: The index is in an intermediate up-trend and likely to test resistance at 17500. Twiggs Money Flow (21-day) is rising slowly, however, indicating continued uncertainty.

Long Term: The primary up-trend is up.

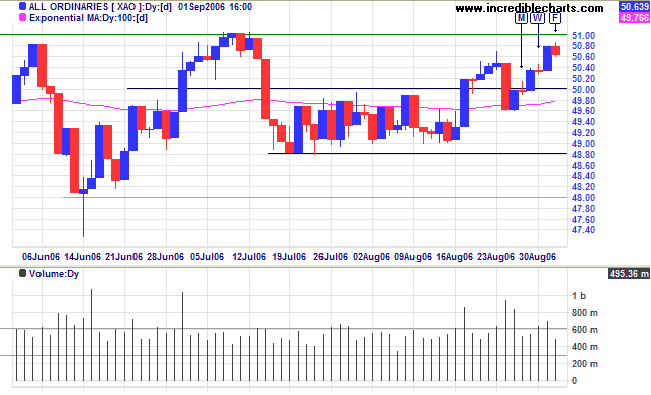

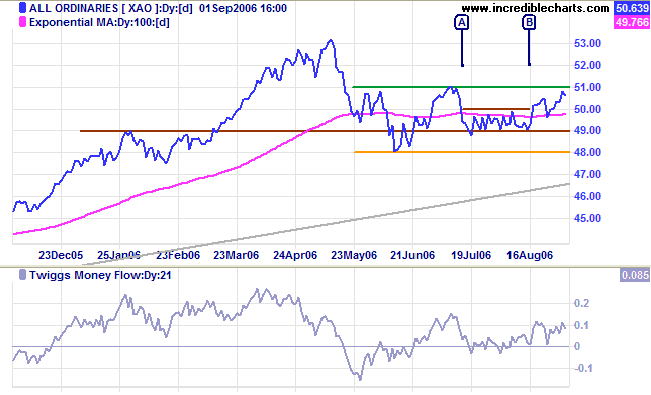

The All Ordinaries is headed for a test of resistance at 5100 after Thursday's strong blue candle and big volume. Friday's short red candle and lower volume reveals some hesitancy, but should not change the direction of the trend.

I hesitate to call the pattern of the last 3 months an ascending triangle because the rectangle from [A] to [B] is not a regular down-swing. What is clear, however, is that 5100 is shaping up as a key resistance level and a breakout above this would be a bull signal. Twiggs Money Flow (21-day) is rising, signaling accumulation.

~ John Kord Lagemann

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.