Markets Slow As Crude Finds Support

August 24, 2006 22:37 p.m. ET

The negative yield differential may cause problems in the months ahead.

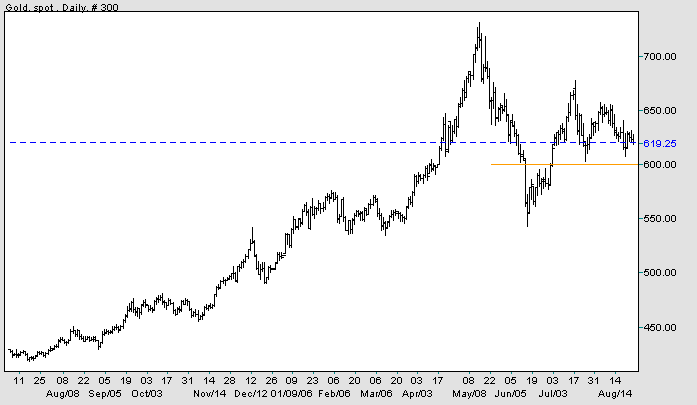

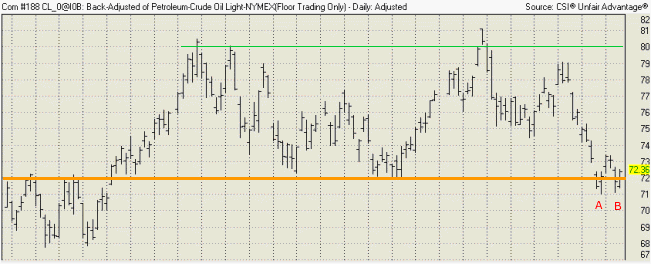

Crude oil prices are finding support at $71/$72. Along with a weaker dollar, this may spur gold prices.

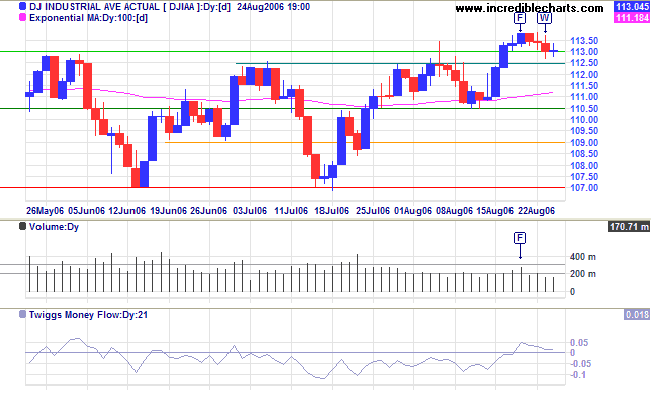

Long Term: The Dow continues in a primary up-trend, with support at 10700.

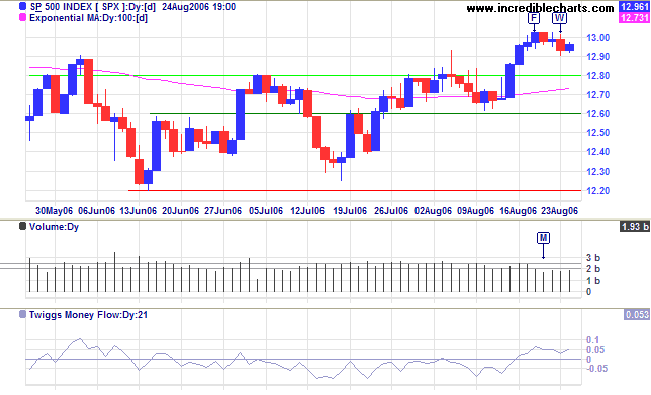

Long Term: The S&P 500 is in a slow up-trend, with primary support at 1220.

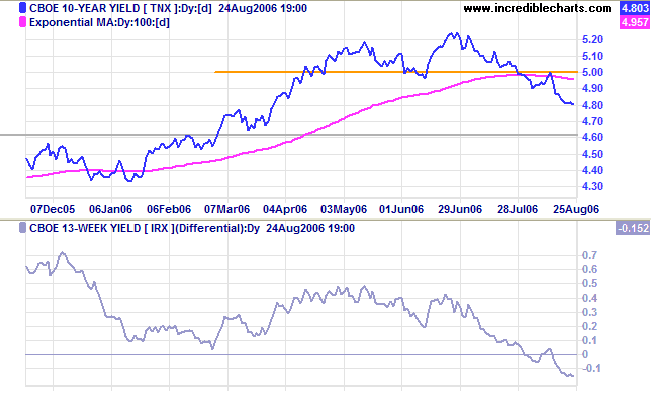

The yield on 10-year Treasury notes is trending lower after respecting resistance at 5.0%.

Medium Term: There is still some concern over annual inflation, but July figures indicate that pressures may be easing -- relieving upward pressure on long-term yields.

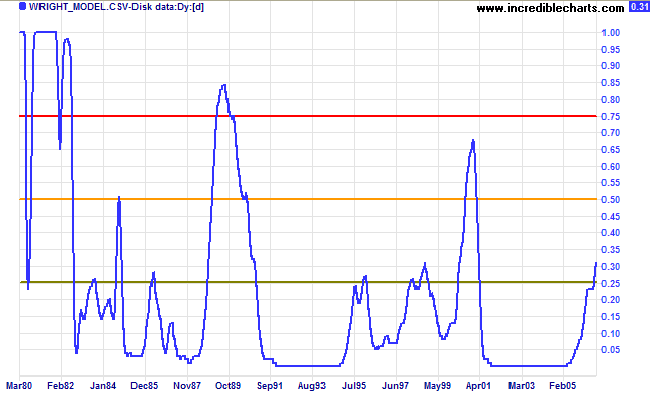

Long Term: The yield differential (10-year T-notes minus 13-week T-bills) is negative and falling, increasing the risk of a down-turn.

Spot gold is testing support at $600. A rally on the crude oil chart would strengthen gold prices.

Medium Term: The metal has broken out below a large symmetrical triangle. Penetration of support at $600 would signal another down-trend, with a target of $450: (630 - (730 - 550)), below primary support at $540/$550.

Long Term: The primary up-trend appears uncertain.

After two false breaks below primary support at $72.00, Light Crude could rally if it completes a double bottom with a rise above $73.50. A fall below $71, however, would confirm the down-trend.

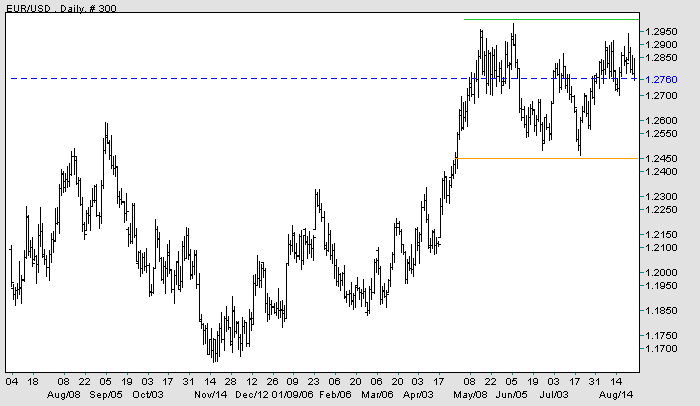

Slower growth and falling long-term bond yields should weaken the dollar.

The Euro is trending upwards, headed for another test of resistance at 1.30 dollars. A rise above this level would mean a test of the high at 1.35/1.36 (and a bullish sign for gold).

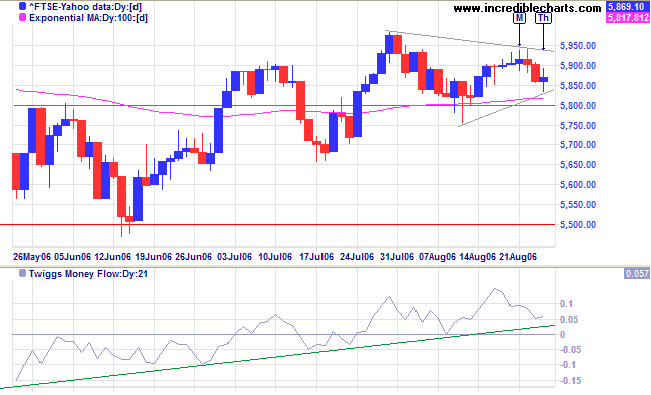

The FTSE 100 formed a small triangle, with future direction signaled by the breakout: either above 5950 or below 5850.

Medium Term: The intermediate trend is upwards, indicating that a test of resistance at 6130 is more likely than another test of primary support at 5500. Twiggs Money Flow (21-day) is trending upwards, signaling accumulation.

Long Term: The primary up-trend continues.

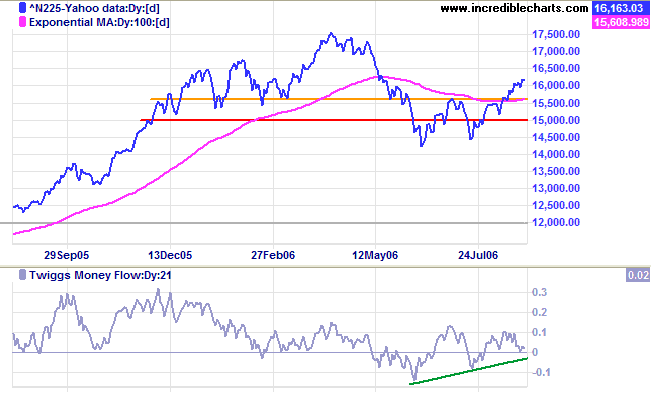

The Nikkei 225 is consolidating between 15900 and 16200, a bullish sign, after breaking out above an ascending triangle.

Medium Term: We may see a pull-back to test the new support level at 15700. Twiggs Money Flow (21-day) is rising, signaling accumulation.

Long Term: The index has reversed to a primary up-trend.

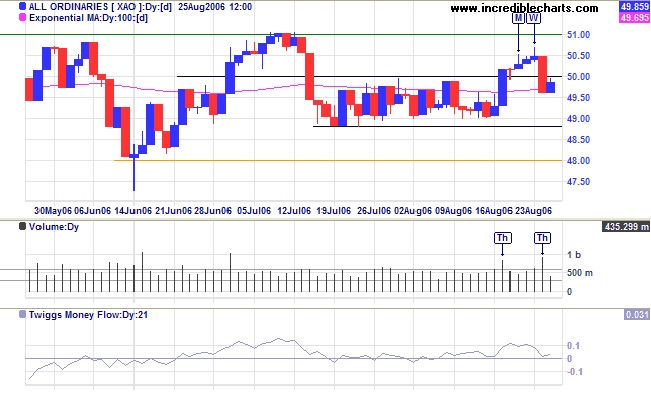

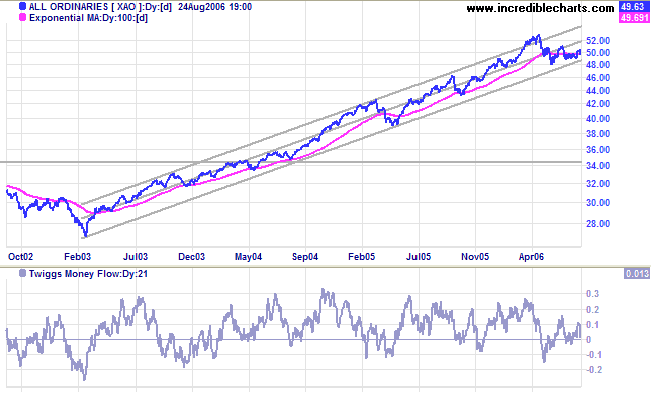

The All Ordinaries fell back sharply through the new support level at 5000 on strong volume, with weak closes on Monday [M] and Wednesday [W] warning of resistance. Expect some support at 4900, but the breakout reversal is likely to elicit a strong bear reaction -- and a test of primary support at 4800. Twiggs Money Flow (21-day) is close to zero, signaling uncertainty.

but we often look so long and so regretfully upon the closed door

that we do not see the one which has opened for us.

~ Alexander Graham Bell

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.