Markets Bullish After Crude Falls

August 17, 2006 21:30 p.m. ET

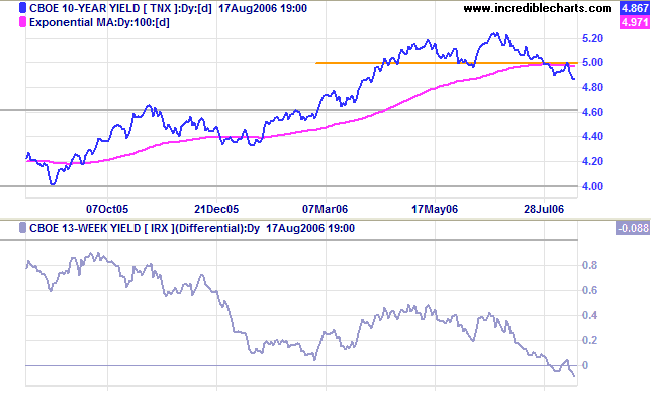

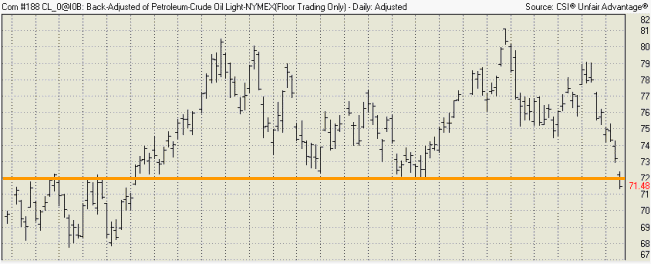

The Fed appears to have called the pause in interest rates correctly, with latest data signaling a slow-down in manufacturing and an easing of inflationary pressure. A fall in crude oil prices has also helped. The yield differential remains cause for concern: it has fallen well below zero and may cause problems in the months ahead.

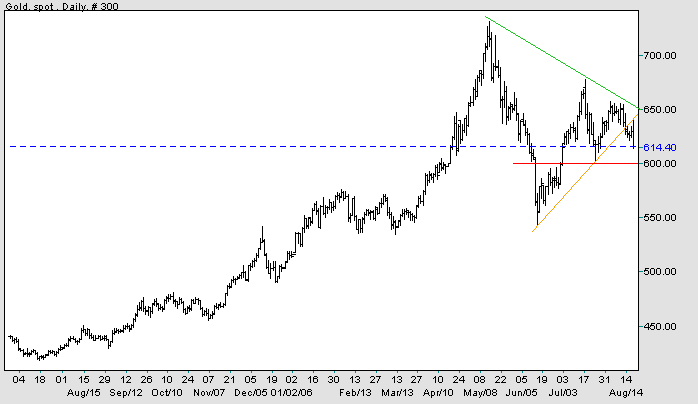

Gold is weakening, accompanying the fall in crude oil, but the dollar has yet to show any real gains. This may be a prospect in the weeks ahead.

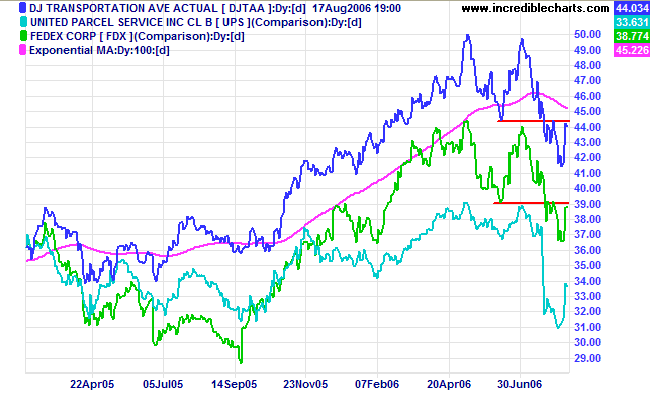

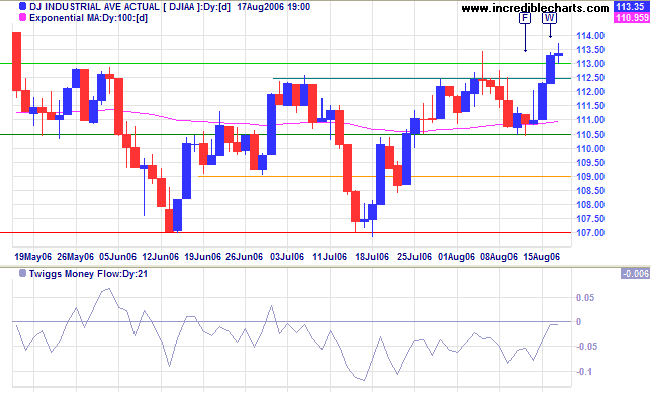

Long Term: The Dow continues in a primary up-trend, with support at 10700.

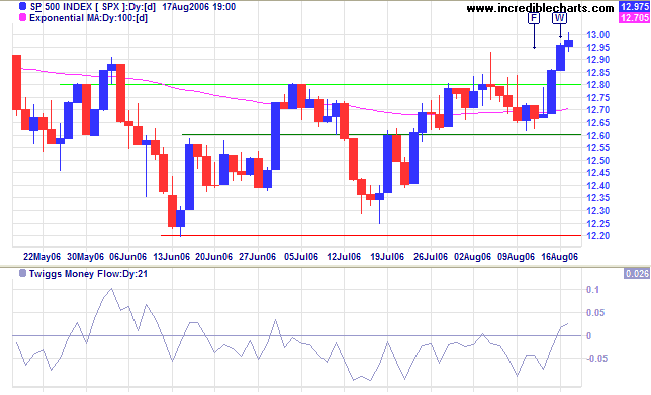

Long Term: The S&P 500 is in a slow up-trend, with primary support at 1220.

The yield on 10-year Treasury notes respected resistance at 5.0% and is now trending downwards.

Medium Term: Mild recent inflation figures have eased upward pressure on yields.

Long Term: The yield differential (10-year T-notes minus 13-week T-bills) fell sharply, making the economy extremely vulnerable.

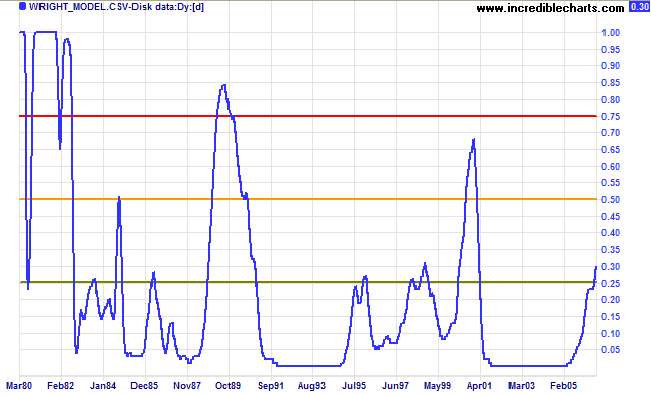

- probability rises above 25%: while not yet cause for concern, watch the indicator regularly for signs of further deterioration;

- above 50%: the situation is becoming volatile -- so exercise caution;

- above 75% means dire risk of an economic downturn.

Spot gold is likely to weaken if crude oil establishes a primary down-trend.

Medium Term: The metal has broken out below a large symmetrical triangle. Penetration of support at $600 would signal another down-trend. The target for the triangle breakout is $450: (630 - (730 - 550)).

Long Term: The primary up-trend appears uncertain. Primary support is at $540/$550.

Light Crude has fallen through primary support at $72.00, signaling the start of a primary down-trend. A pull-back that respects the new resistance level would confirm the down-trend.

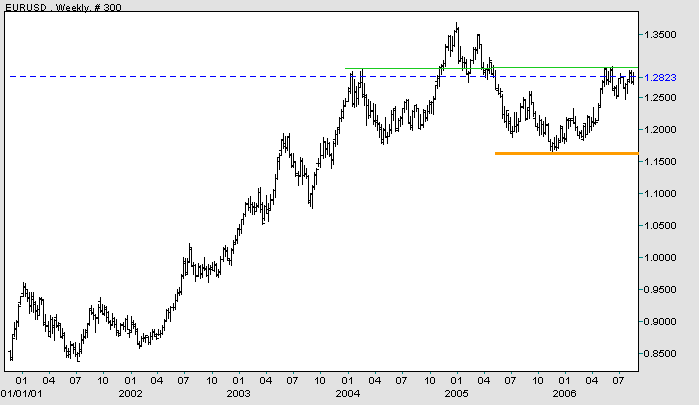

Mild inflation figures and falling crude and gold prices should boost the dollar, but this is not yet evident on the charts.

The Euro is consolidating below resistance at 1.30 dollars. A rise above this level would mean a test of the high at 1.35/1.36 (and a bullish sign for gold).

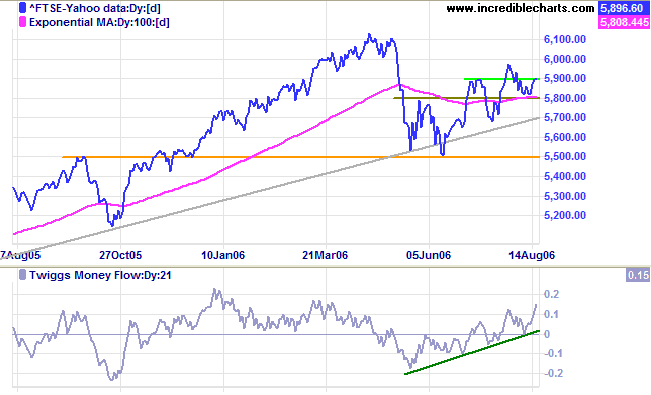

The FTSE 100 is trending slowly upwards. Having respected initial support at 5800 (from the first peak), and overcome resistance at 5900, we should see a rally test 6130.

Medium Term: A rise above 6000 would add further confirmation, while reversal below 5800 would signal another test of primary support at 5500. Twiggs Money Flow (21-day) is trending upwards, signaling accumulation.

Long Term: The index is in a primary up-trend.

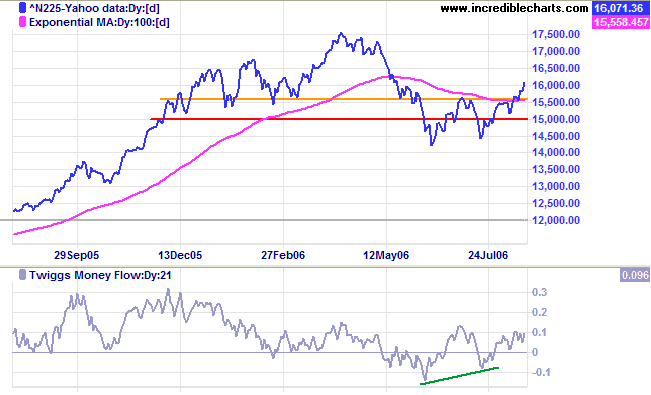

The Nikkei 225 broke out from a bullish ascending triangle.

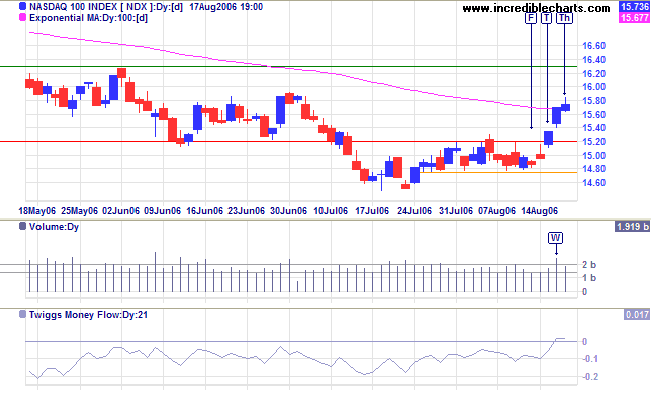

Medium Term: We may see a pull-back to test the new support level at 15700. The target for the breakout is close to the previous high of 17500: (15700 + (15700 -14200)) = 17200. Twiggs Money Flow (21-day) is rising, signaling accumulation.

Long Term: The index has reversed to a primary up-trend.

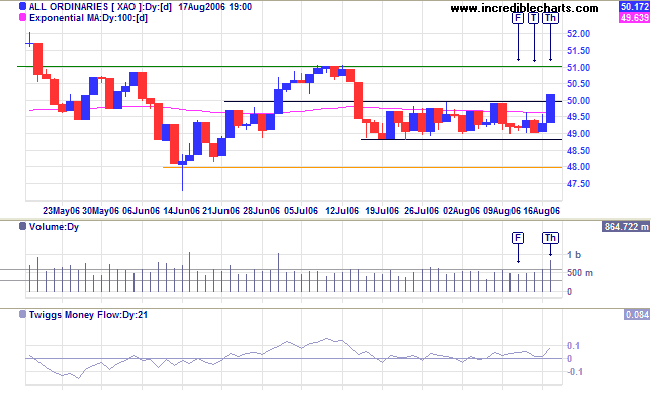

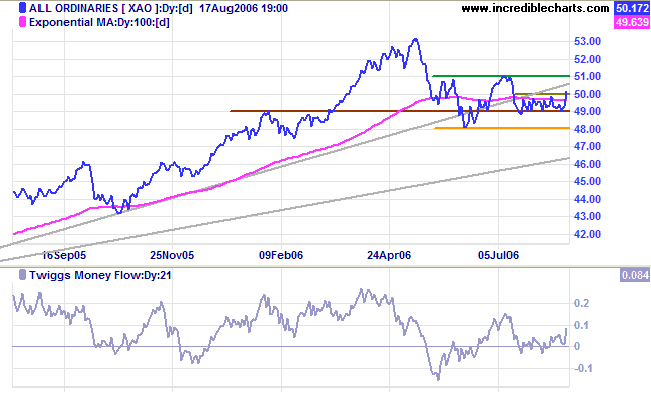

The All Ordinaries broke through the top of the recent consolidation at 5000. This is a bullish sign and we can expect a test of 5100 shortly. A breakout above 5100 would confirm that the intermediate up-trend has resumed.

~ Theodore Roosevelt (1895).

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.