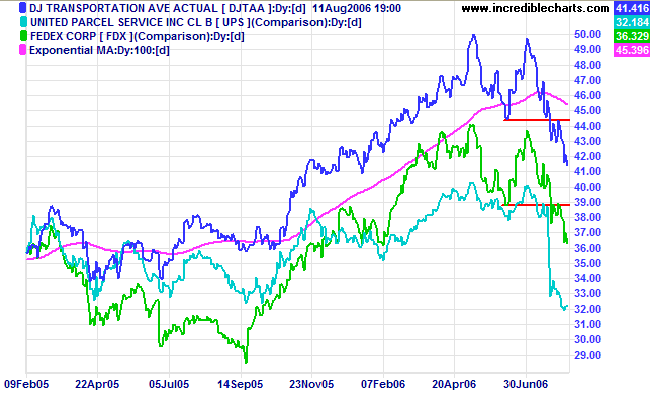

Markets Uncertain, Transport Falls

August 12, 2006 1:00 a.m. ET

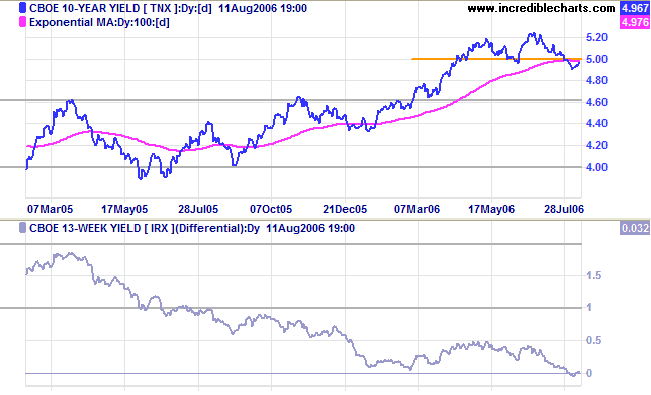

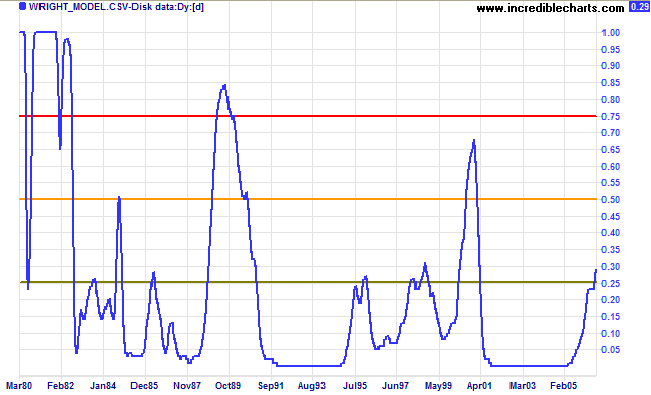

The Fed missed an opportunity to establish its credentials as an inflation hawk, pausing in the cycle of interest rate hikes. Inflation concerns are pushing long-term yields higher and may require the Fed to later make more substantive hikes. The yield differential is close to zero and the risk of an economic down-turn in the next four quarters is 29% and rising steeply, according to the Wright model.

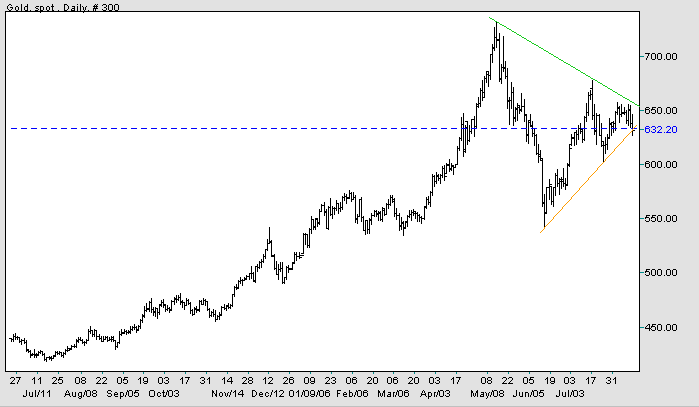

Gold has formed a large symmetrical triangle. Expect an upward breakout if crude oil continues to strengthen and the dollar weaken.

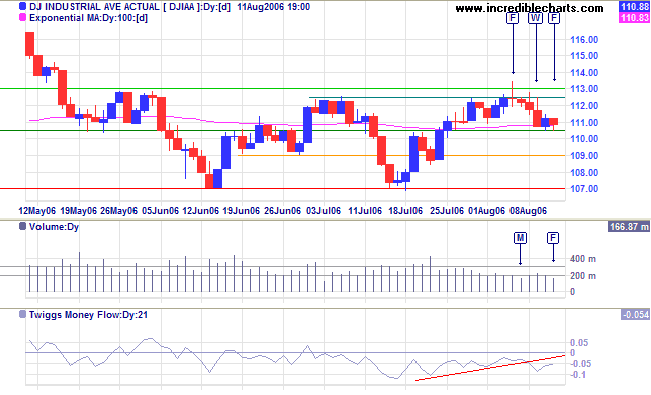

Long Term: The Dow is in a primary up-trend, but a fall below 10700 would mean reversal.

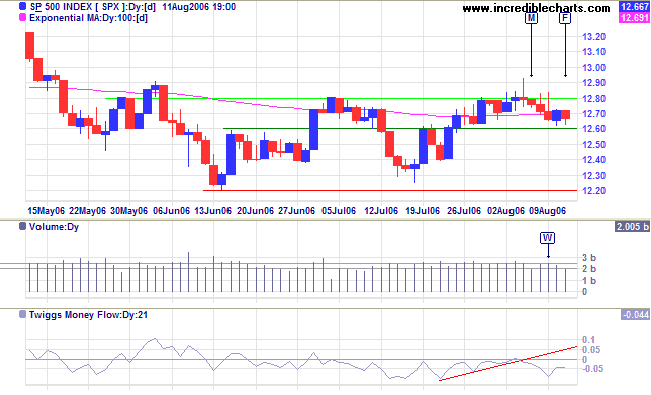

Long Term: The S&P 500 is in a slow up-trend, with primary support at 1220.

The yield on 10-year Treasury notes is rising as fears of inflation surface after the pause in interest rates.

Medium Term: Long-bond yields are likely to continue in an up-trend.

Long Term: The yield differential (10-year T-notes minus 13-week T-bills) is close to zero, making the economy vulnerable.

- probability rises above 25%: while not yet cause for concern, watch the indicator regularly for signs of further deterioration;

- above 50%: the situation is becoming volatile -- so exercise caution;

- above 75% means dire risk of an economic downturn.

Spot gold is testing the lower border of a large symmetrical triangle.

Medium Term: A downward breakout would be bearish, confirmed if there is a close below support at $600. On the other hand, an upward breakout would be confirmed if there is a close above $675

Long Term: The primary up-trend continues, with primary support at $540/$550.

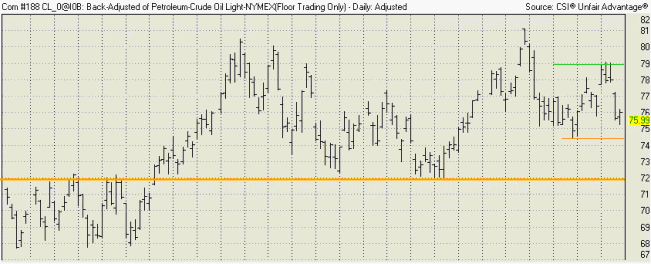

After a lower high at $79, Light Crude appears headed for a test of intermediate support at $74.50. A close below this level would signal a test of primary support at $72, while a close above $79 would mean another test of resistance at $81.

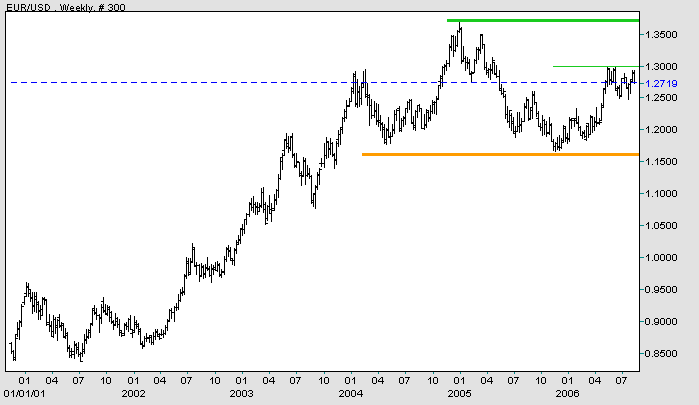

The dollar is weakening against major trading partners.

The Euro is testing resistance at 1.30 dollars. A rise above this level would mean a test of the high at 1.36 (and a bullish sign for gold).

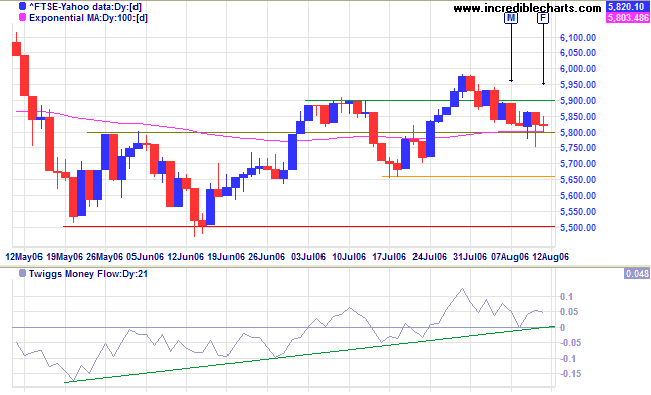

The FTSE 100 is trending slowly upwards. Having earlier penetrated initial support at 5800, if the trend now respects this level (and the 100-day exponential moving average) we should see a rally test 6130. Long tails on Wednesday/Thursday suggest that this is likely.

Medium Term: Twiggs Money Flow (21-day) is trending upwards, signaling accumulation. A rise above 6000 would confirm the up-trend, while reversal below 5650 would signal another test of primary support at 5500.

Long Term: The primary up-trend is intact, unless there is a fall below 5500.

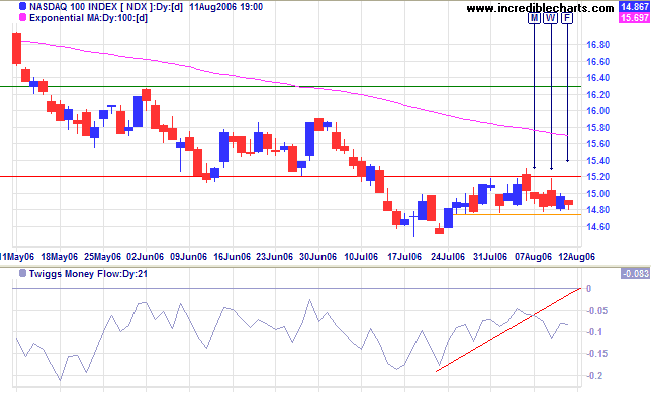

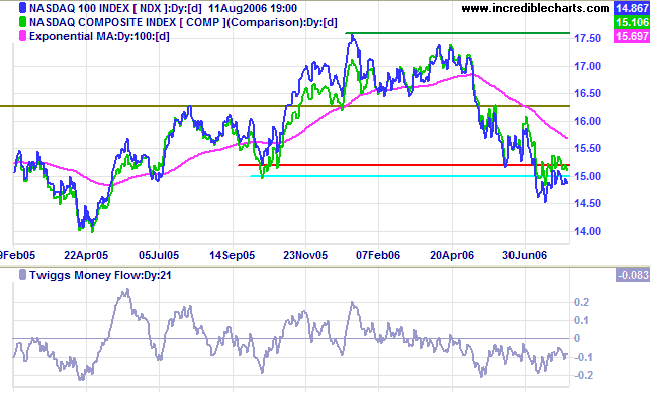

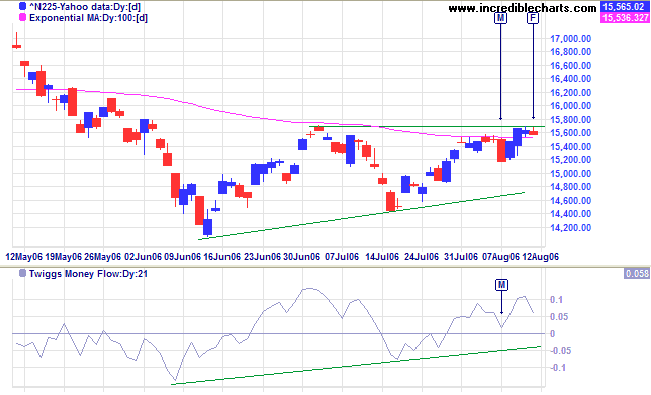

The Nikkei 225 has formed a bullish ascending triangle below resistance at 15700.

Medium Term: Twiggs Money Flow (21-day) signals accumulation. A breakout above 15700 would signal reversal to a primary up-trend, while a fall below 14400 would confirm the primary down-trend.

Long Term: The index is consolidating with no clear trend as yet.

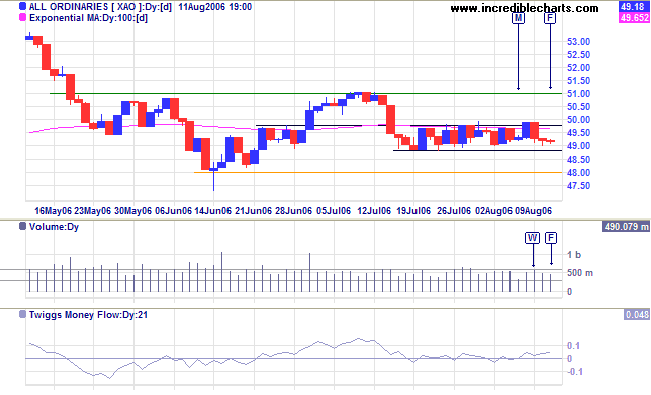

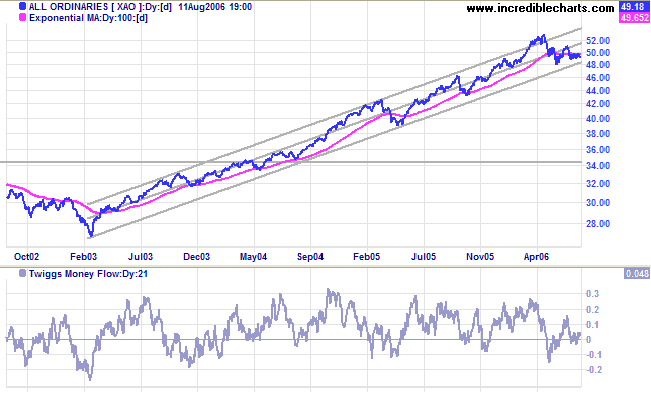

The All Ordinaries continues to consolidate in a narrow band between 4880 and 4980, unusually positioned half way between the high and low, indicating market uncertainty. A rise above 4980 would be bullish, signaling an up-trend if the index is able to break through resistance at 5100. However, a fall below 4880 would mean another test of primary support at 4800.

and the ability of households to spend more than they earn because the value of their house is rising.

~ George Soros.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.