Monday Update

August 7, 2006

These extracts from my daily trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

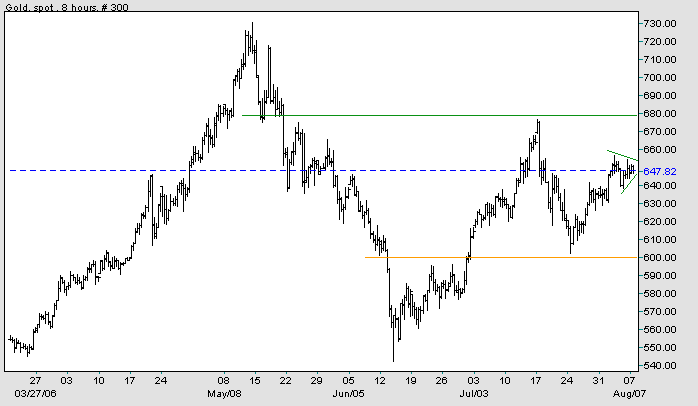

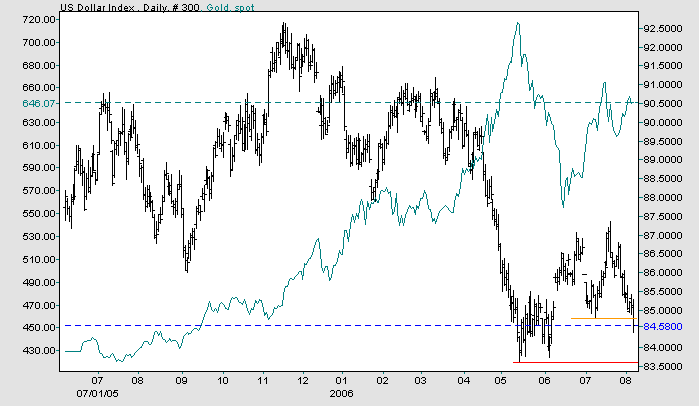

Spot gold has formed a small pennant at $640 to $660, normally a continuation pattern. An upward breakout would signal a test of resistance at $680. A (less likely) downward breakout would test primary support at $600.

The US Dollar Index is weakening ahead of the Fed's Tuesday meeting, with the market anticipating a pause in rate hikes. In my opinion a rate hike is in the balance: the Fed may still be concerned with recent inflation figures and opt for one last hike before the much-anticipated pause. The dollar is weakening, along with long-term yields.

The index completed a double top and is now headed for a test of major support at 83.50. Expect gold to rally.

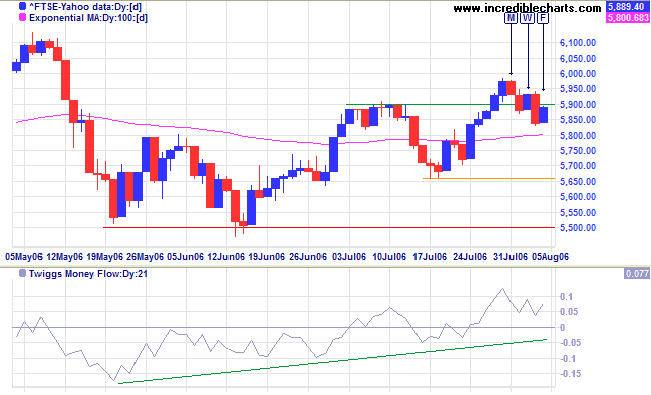

The FTSE 100 dipped below initial support at 5900. Twiggs Money Flow (21-day) is trending upwards, signaling accumulation, so watch for a close back above 5900 to complete a bullish false break. A fall below 5650, on the other hand, would signal a test of primary support at 5500.

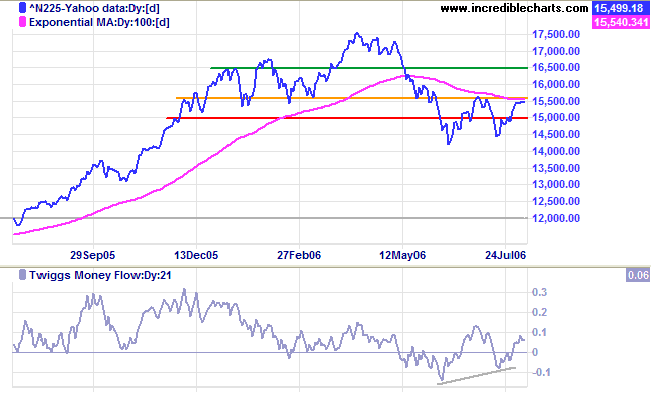

The Nikkei 225 encountered strong resistance at 15500. A down-turn that respects the 100-day exponential moving average would be bearish, but a fall below the recent low of 14500 would confirm the primary down-trend. A rise above 15500, on the other hand, would be a strong bull signal.

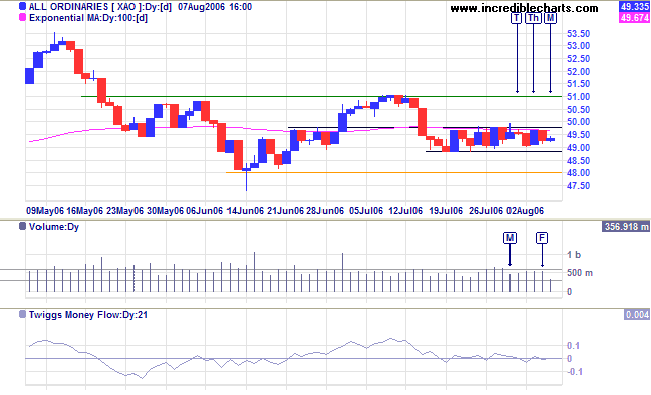

The All Ordinaries continues to show uncertainty, consolidating mid-way between the recent high and low, with Twiggs Money Flow (21-day) whipsawing around the zero line. A close above 4980 would be bullish, while a close below 4880 would mean a test of primary support at 4800.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.