Markets Strengthen Despite Negative Yield Curve

August 4, 2006 2:23 a.m. ET

These extracts from my daily trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

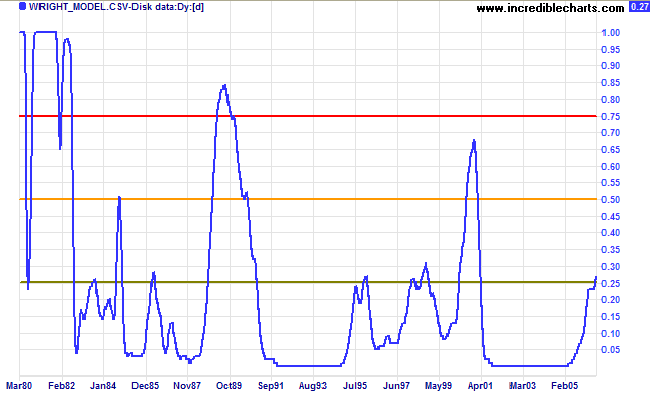

The markets still have to cope with the yield differential which has turned negative and the possibility of another rate rise on August 8. Annual core consumer price index figures of 2.4% mean that the Fed is unlikely to pause yet in its cycle of rate hikes. This further increases the risk of an economic down-turn according to the Wright model. The probability of recession in the next four quarters is currently 27% and rising.

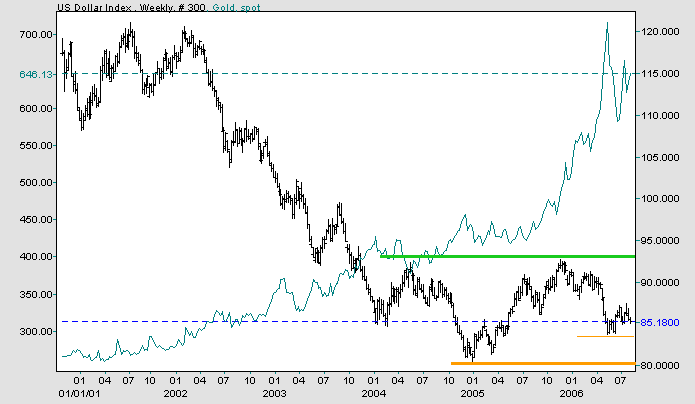

Gold is strengthening, along with crude oil, as the dollar weakens.

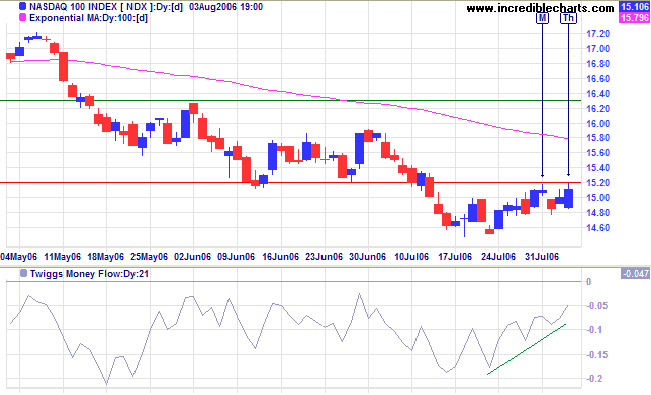

The Nasdaq 100 again tested resistance at 1520 after breaking below the primary support level. A close below 1450 would confirm the primary down-trend, but consolidation below the resistance level signals trend weakness -- and a close above this level would be a bullish sign. Twiggs Money Flow (21-day) is below zero but rising: early signs of accumulation.

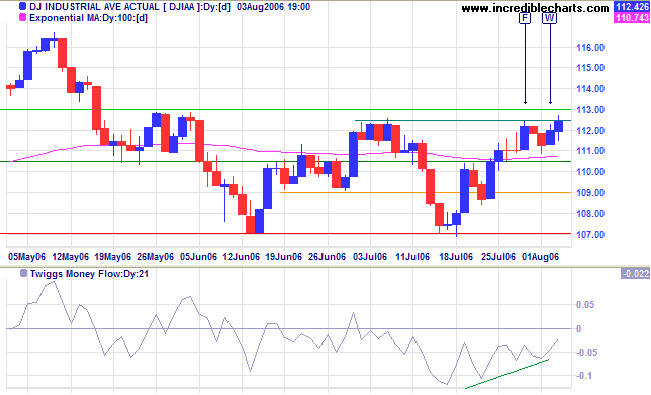

Long Term: The Dow is in a primary up-trend, but a fall below 10700 would mean reversal.

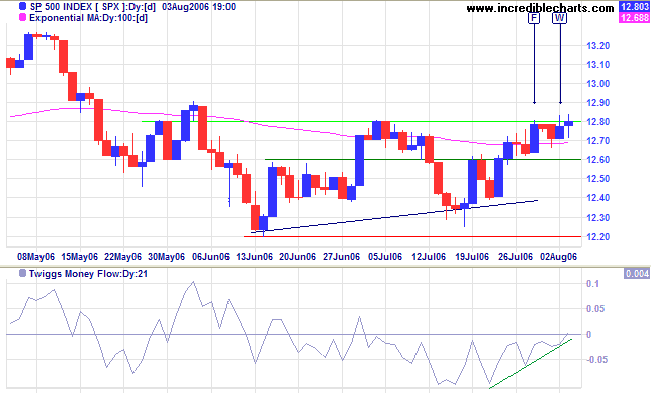

Long Term: The S&P 500 is in a slow up-trend, with primary support at 1220.

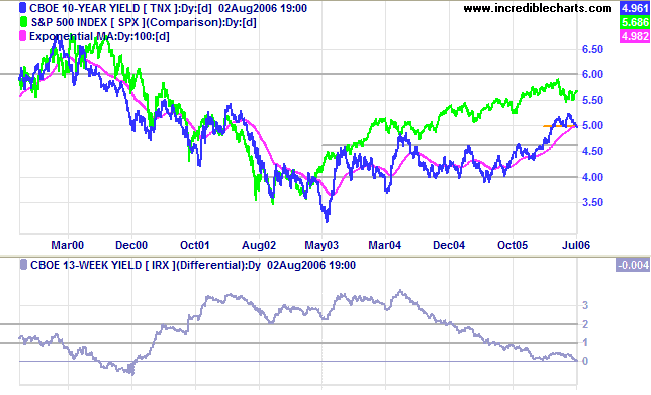

The yield on 10-year Treasury notes is testing support at 5.0%.

Medium Term: Long-bond yields are likely to continue in an up-trend.

Long Term: The yield differential (10-year T-notes minus 13-week T-bills) has fallen below zero, making the economy extremely vulnerable.

- probability rises above 25%: while not yet cause for concern, watch the indicator regularly for signs of further deterioration;

- above 50%: the situation is becoming volatile -- so exercise caution;

- above 75% means dire risk of an economic downturn.

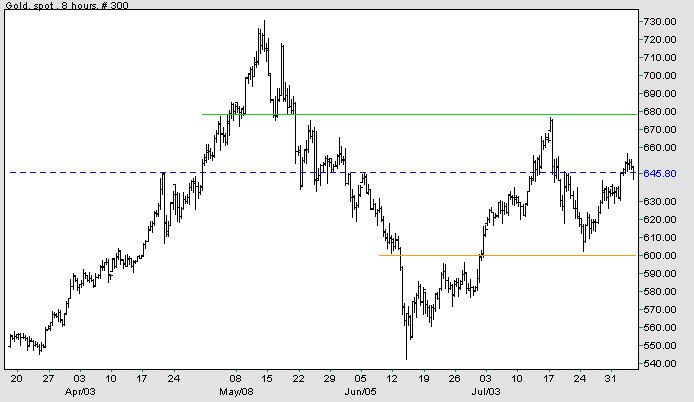

Spot gold is rallying to test resistance at $680.

Medium Term: Failure to break out above $680 would be a bear signal (two lower highs after the May peak), placing support at $600 under threat. A fall below $600 would be an even stronger bear signal.

Long Term: The primary up-trend continues, with primary support at $540/$550.

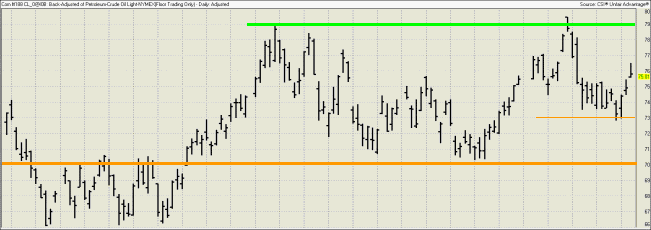

Light Crude appears headed for another test of resistance at $80 after forming a bullish higher low at $73/barrel. Breakout above $80 would signal another up-trend, while reversal below $73 would mean a test of primary support at $70.

The dollar is weakening against major trading partners in the short-term.

The US Dollar Index is likely to test support at 83/84 in the weeks ahead. A close below this level would mean a test of the 5-year low at 80 (and a bullish sign for gold).

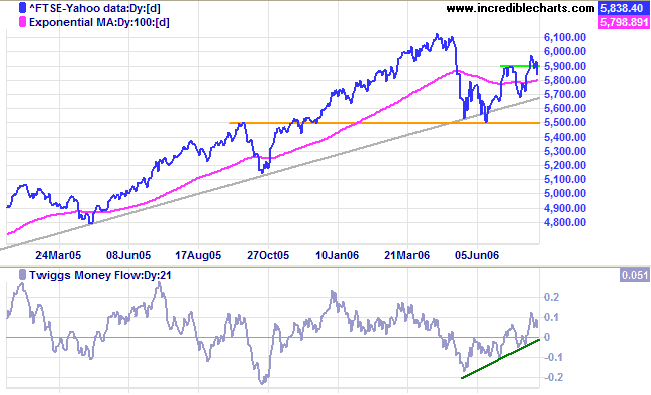

The FTSE 100 is trending slowly upwards, whipsawing around the 100-day exponential moving average, and appears headed for another test of 6130.

Medium Term: Reversal below 5700 would signal another test of primary support at 5500. Twiggs Money Flow (21-day) is trending upwards, signaling accumulation.

Long Term: The primary up-trend is intact.

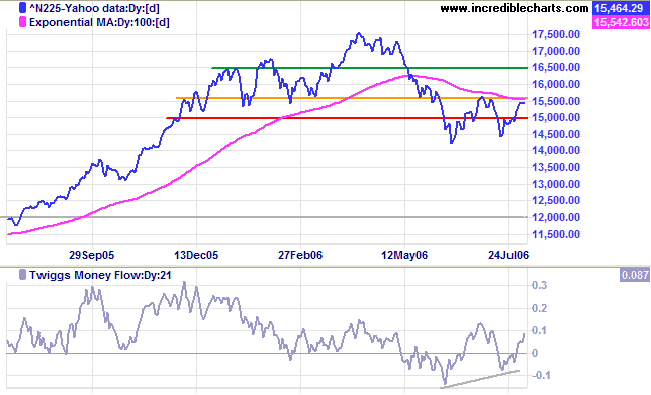

The Nikkei 225 is testing resistance at 15500/15600.

Medium Term: A higher trough on Twiggs Money Flow (21-day) signals accumulation. A fall below 14200 would confirm the primary down-trend.

Long Term: The index is consolidating with no clear trend as yet. A close above 15600 would signal reversal to a primary up-trend.

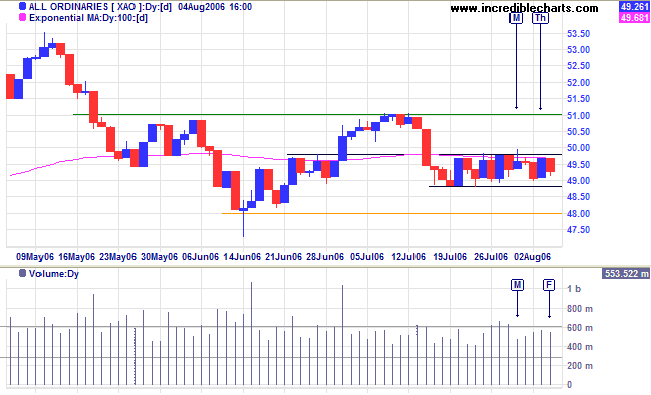

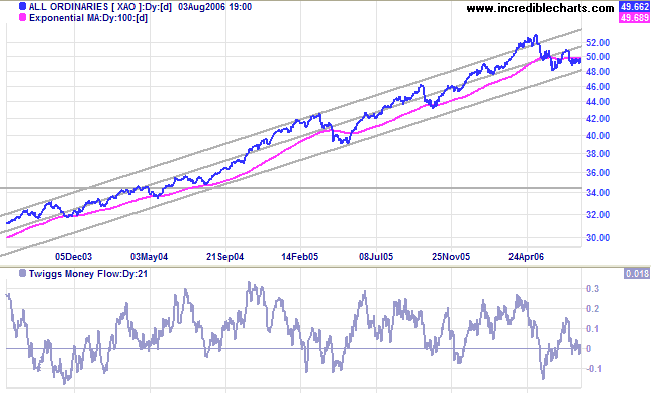

The All Ordinaries is consolidating in a narrow band between 4880 and 4980. The consolidation is unusually positioned half way between the high and low, indicating market uncertainty. A rise above 4980 would be bullish, signaling an up-trend if the index is able to break through resistance at 5100. However, a fall below 4880 would mean another test of primary support at 4800.

Unless we solve that problem it will avail us little to solve all others.

~ Theodore Roosevelt, October 1907.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.